Answered step by step

Verified Expert Solution

Question

1 Approved Answer

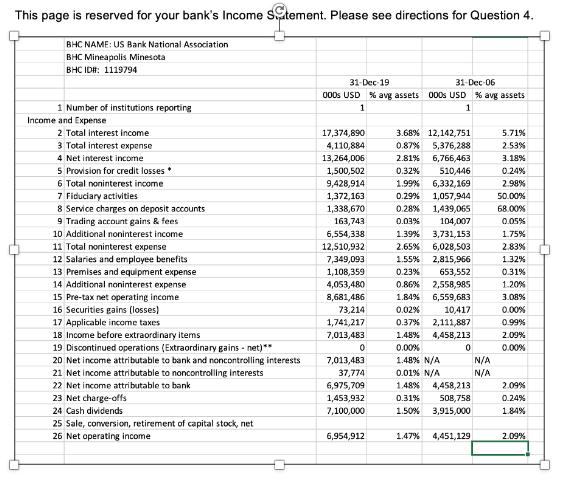

This page is reserved for your bank's Income Stement. Please see directions for Question 4. BHC NAME: US Bank National Association BHC Mineapolis Minesota

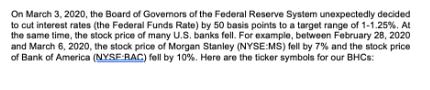

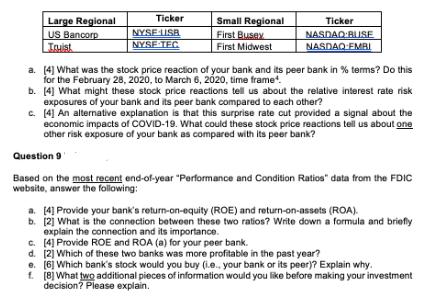

This page is reserved for your bank's Income Stement. Please see directions for Question 4. BHC NAME: US Bank National Association BHC Mineapolis Minesota BHC ID#: 1119794 1 Number of institutions reporting Income and Expense 2 Total interest income 3 Total interest expense 4 Net interest income 5 Provision for credit losses * 6 Total noninterest income 7 Fiduciary activities 8 Service charges on deposit accounts 9 Trading account gains & fees 10 Additional noninterest income 11 Total noninterest expense 12 Salaries and employee benefits 13 Premises and equipment expense 14 Additional noninterest expense 15 Pre-tax net operating income 16 Securities gains (losses) 17 Applicable income taxes 18 Income before extraordinary items 19 Discontinued operations (Extraordinary gains - net)** 20 Net income attributable to bank and noncontrolling interests 21 Net income attributable to noncontrolling interests 22 Net income attributable to bank 23 Net charge-offs 24 Cash dividends 25 Sale, conversion, retirement of capital stock, net 26 Net operating income 31-Dec-19 31-Dec-06 000s USD % avg assets 000s USD % avg assets 1 1 17,374,890 4,110,884 13,264,006 1,500,502 9,428,914 1,372,163 1,338,670 163,743 6,554,338 12,510,932 7,349,093 1,108,359 4,053,480 8,681,486 73,214 1,741,217 7,013,483 0 7,013,483 37,774 6,975,709 1,453,932 7,100,000 6,954,912 3.68 % 12,142,751 0.87% 5,376,288 6,766,463 2.81% 0.32% 510,446 1.99% 6,332,169 0.29% 1,057,944 1,439,065 0.28% 0.03% 104,007 1.39% 3,731,153 2.65% 6,028,503 1.55% 2,815,966 0.23% 653,552 0.86% 2,558,985 1.84% 6,559,683 0.02% 10,417 0.37% 2,111,887 1.48% 4,458,213 0.00% 1.48% N/A 0.01% N/A 1.48% 4,458,213 0.31% 508,758 1.50% 3,915,000 0 1.47% 4,451,129 N/A N/A 5.71% 2.53% 3.18% 0.24% 2.98% 50.00% 68.00% 0.05% 1.75% 2.83% 1.32% 0.31% 1.20% 3.08% 0.00% 0.99% 2.09% 0.00% 2.09% 0.24% 1.84% 2.09% On March 3, 2020, the Board of Governors of the Federal Reserve System unexpectedly decided to cut interest rates (the Federal Funds Rate) by 50 basis points to a target range of 1-1.25%. At the same time, the stock price of many U.S. banks fell. For example, between February 28, 2020 and March 6, 2020, the stock price of Morgan Stanley (NYSE:MS) fell by 7% and the stock price of Bank of America (NYSE RAC) fell by 10%. Here are the ticker symbols for our BHCs: Large Regional US Bancorp Truist Ticker NYSE-USB NYSE TEC Small Regional First Busey. First Midwest Ticker NASDAQ BUSE NASDAQ EMBI a. [4] What was the stock price reaction of your bank and its peer bank in % terms? Do this for the February 28, 2020, to March 6, 2020, time frame. b. [4] What might these stock price reactions tell us about the relative interest rate risk exposures of your bank and its peer bank compared to each other? c. [4] An alternative explanation is that this surprise rate cut provided a signal about the economic impacts of COVID-19. What could these stock price reactions tell us about one other risk exposure of your bank as compared with its peer bank? Question 9 Based on the most recent end-of-year "Performance and Condition Ratios" data from the FDIC website, answer the following: a. [4] Provide your bank's return-on-equity (ROE) and return-on-assets (ROA). b. [2] What is the connection between these two ratios? Write down a formula and briefly explain the connection and its importance. c. [4] Provide ROE and ROA (a) for your peer bank. d. [2] Which of these two banks was more profitable in the past year? e. [6] Which bank's stock would you buy (ie... your bank or its peer)? Explain why. f. [8] What two additional pieces of information would you like before making your investment decision? Please explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 4 Stock Price Reaction and Interest Rate Risk a Stock Price Reaction US Bancorp USB 288 from 5547 to 5382 Truist TFC 357 from 4734 to 4558 b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started