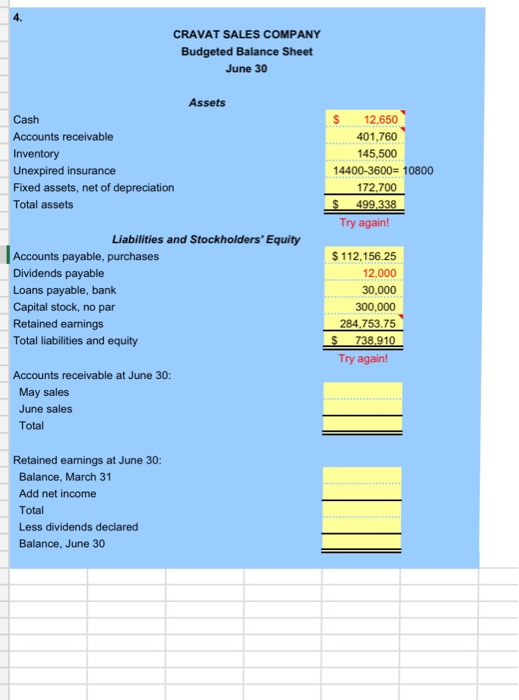

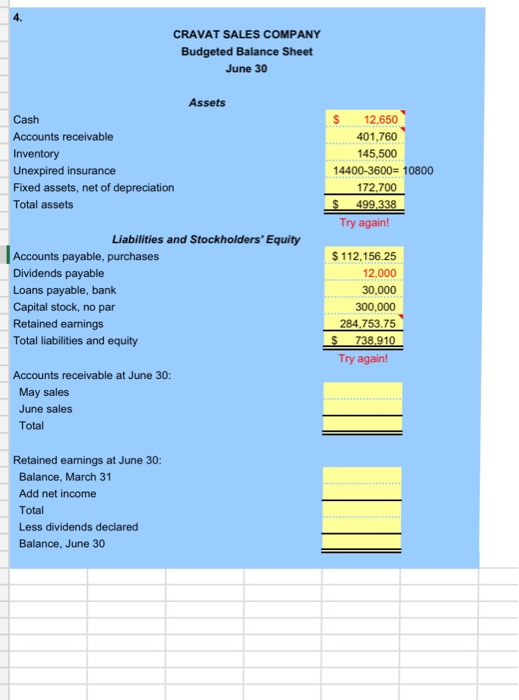

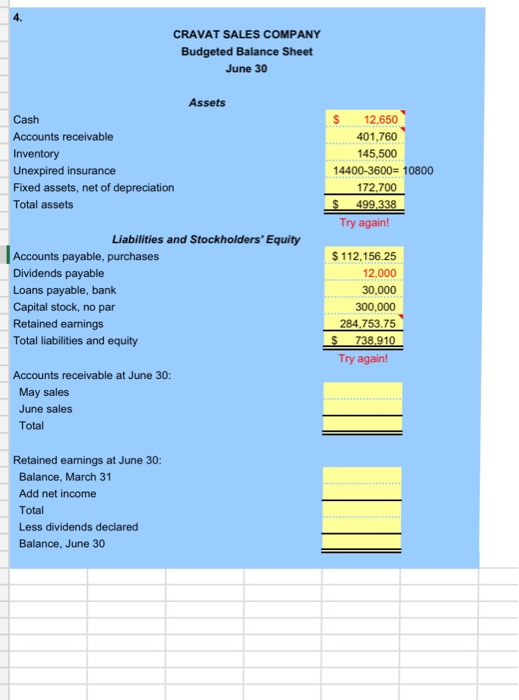

This part requires you to create a budgeted balance sheet from the previous parts and additional information given in the case. Use formulas wherever possible, including any derived numbers (i.e. unexpired insurance, fixed assets, net of depreciation, retained earnings, dividends payable, inventory). Use formulas whenever you calculate numbers!! Show work & include formulas for credit on Excel.

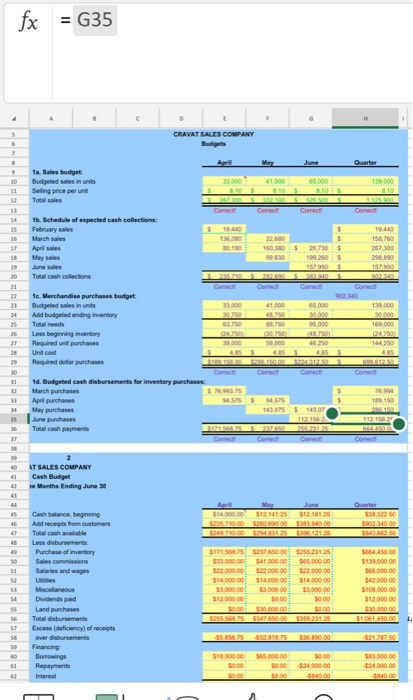

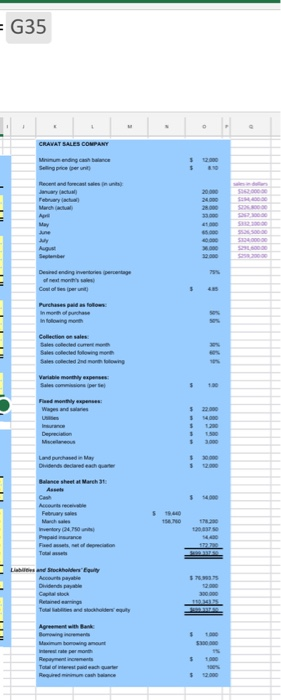

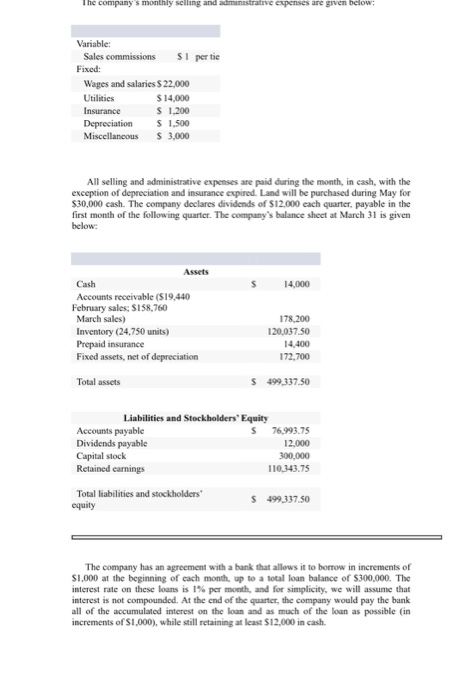

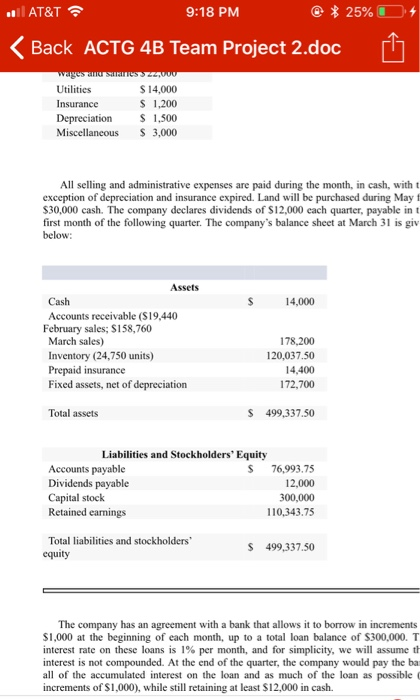

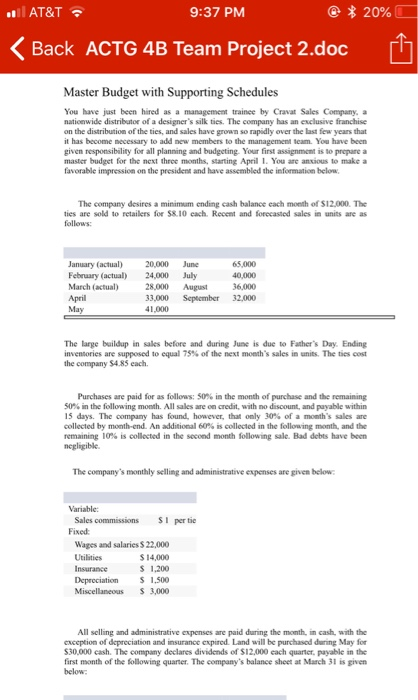

CRAVAT SALES COMPANY Budgeted Balance Sheet June 30 Cash S 12,650 Inventory 145,500 14400-3600 10800 Fixed assets, net of depreciation Total assets 172.700 Try again! Liabilities and Stockholders' Equity Accounts payable, purchases Dividends payable Loans payable, bank Capital stock, no par Retained earnings Total liabilities and equity $ 112,156.25 12,000 30,000 300,000 284,753.75 Try again! Accounts receivable at June 30: May sales June sales Total Retained earnings at June 30: Balance, March 31 Add net income Total Less dividends declared Balance, June 30 4 fx G35 CRAVAT SALES COMPANY Budgets a Sales budget Selling price per u Total sales 41b. Schedule of expected cash collections March saies April sales May sales June sales 267 300 1603.730 .63099 280 cash celections 1c Merchandise purchases budget Budgeted sales in units d budgeted ending inventory Required unt Required dollar purchases 1 1d. Budgeted cash disbursements for inventory purchases March purchases April purchases May purchases 76993 7S 43,075 143.0 4 Total cash pyments 40 ATSALES COMPANY 41 Cash Budget Months Ending June 30 45 Cash balance, beginning customens Less disbursements Punchase of inventory P $237 850 003 $255 23125 33000 004100000 565,000.00 64 450 00 $139,000.00 22 000 00 $14 000 00: $22 000.00 $22,000 $42.000 00 $108,000.00 $12.000 00 $14 000 0: 14,00000, 030000053,000.00 0.00 Miscelaneous 4 Dividends paid 5 Land purchaser Total disbursements Excess (deficiency) of receipts 18000 00565 000 00 61 Repayments 0.00424,000 00 Sales commissions Fixed: S1 per tie Wages and salaries $ 22,000 14,000 1,200 Depreciation 1,500 Miscellancous S 3,000 All selling and administrative expenses are paid during the month, in cash, with the exception of depreciation and insurance expired. Land will be purchased during May for S30,000 cash. The company declares dividends of $12.000 each quarter, payable in the first month of the following quarter. The company's balance sheet at March 31 is given below Assets S 14,000 Cash Accounts receivable ($19.440 February sales; $138,760 March sales) Inventory (24,750 units) Prepaid insurance Fixed assets, net of depreciation 178,200 120,037.50 14.400 172,700 Total assets 499337.50 Liabilities and Stockholders" Equity Accounts payable Dividends payable Capital stock Retained earnings S 76,993.75 110,343.75 Total liabilities and stockholders 499,337.50 The company has an agreement with a bank that allows it to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of S300,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $12,000 in cash. ..il AT&T 9:18 PM Back ACTG 4B Team Project 2.doc Utilities Insurance Depreciation 1,500 Miscellaneous 3,000 S 14,000 S 1,200 All selling and administrative expenses are paid during the month, in cash, with t exception of depreciation and insurance expired. Land will be purchased during May f S30,000 cash. The company declares dividends of S12,000 each quarter, payable in t first month of the following quarter. The company's balance sheet at March 31 is giv below Assets Cash Accounts receivable (S19.,440 14,000 February sales; $158,760 March sales) Inventory (24,750 units) Prepaid insurance Fixed assets, net of depreciation 178,200 120,037.50 14.400 172,700 Total assets S 499,337.50 Liabilities and Stockholders' Equity Accounts payable Dividends payable Capital stock Retained earnings S 76,993.75 12,000 300,000 110,343.75 Total liabilities and stockholders S 499,337.50 equity The company has an agreement with a bank that allows it to borrow in increments S1,000 at the beginning of each month, up to a total loan balance of S300,000. T interest rate on these loans is 1% per month, and for simplicity, we will assume th interest is not compounded. At the end of the quarter, the company would pay the ba all of the accumulated interest on the loan and as much of the loan as possible ( increments of $1,000), while still retaining at least $12,000 in cash. @ * 20% 9:37 PM [.