This post is for part b. Don't answer part a. Thank you

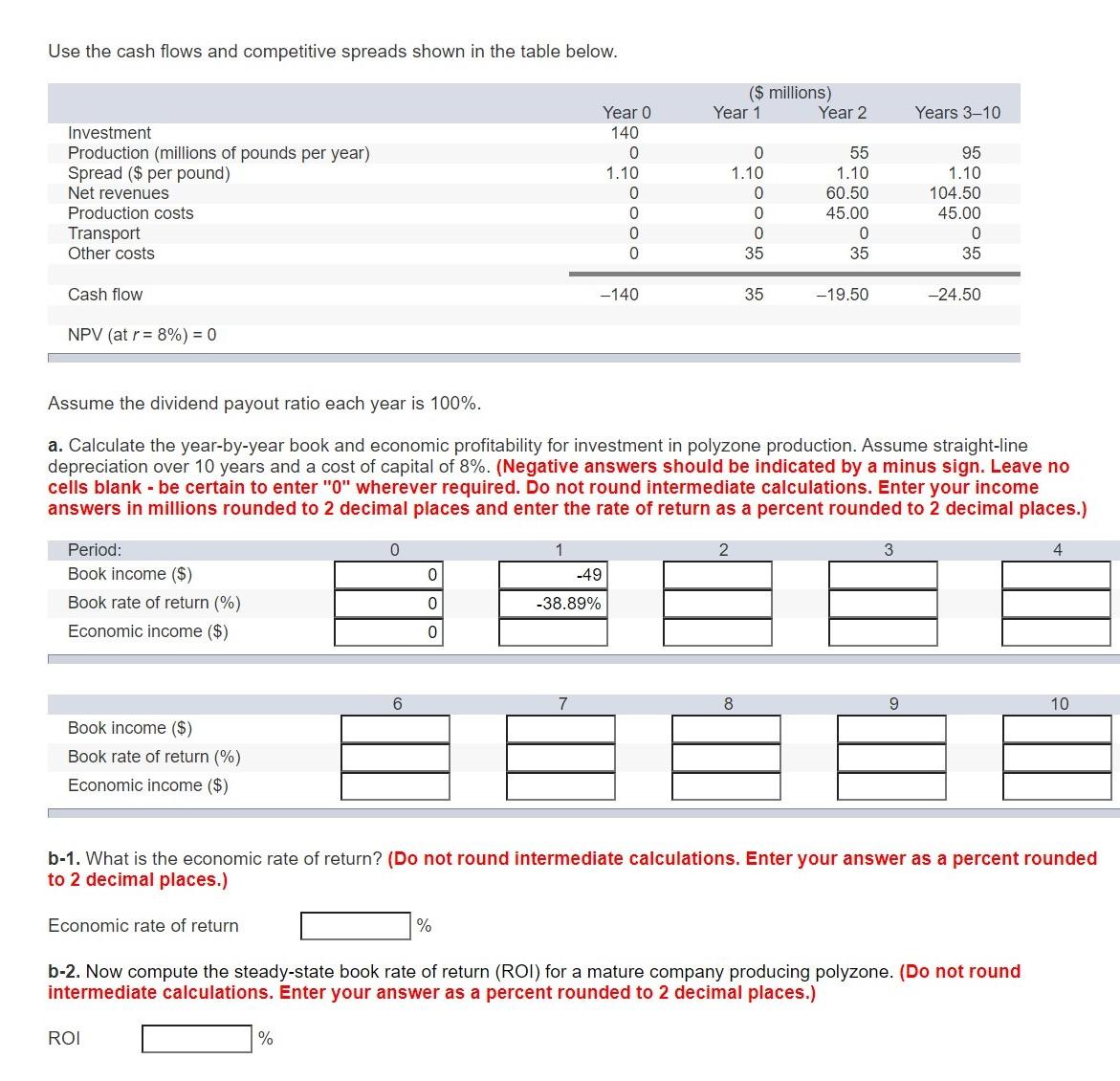

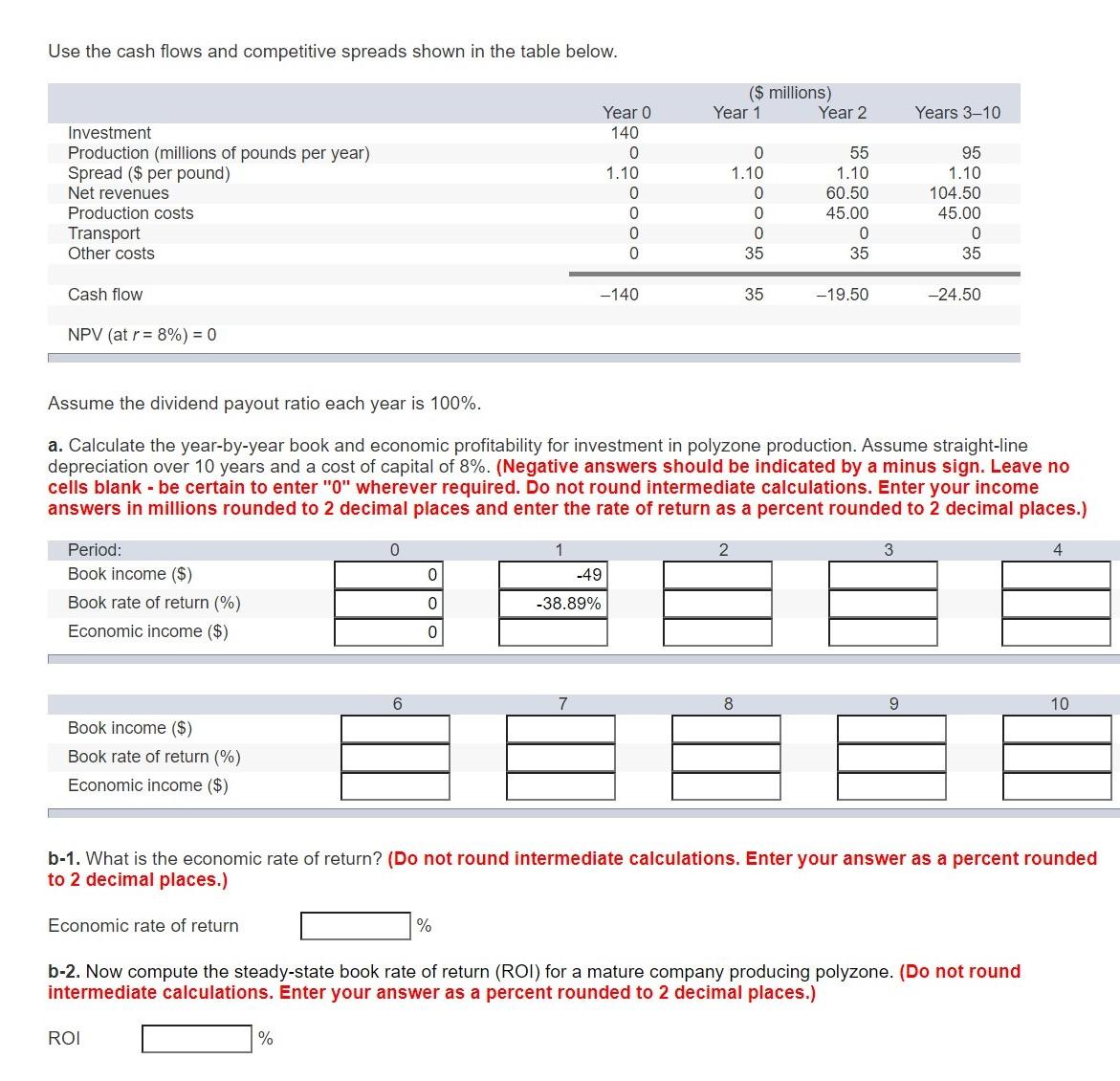

Use the cash flows and competitive spreads shown in the table below. ($ millions) Year 1 Year 2 Years 3-10 Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues Production costs Transport Other costs Year o 140 0 1.10 0 0 0 0 0 1.10 0 0 0 35 55 1.10 60.50 45.00 0 35 95 1.10 104.50 45.00 0 35 Cash flow -140 35 -19.50 -24.50 NPV (at r = 8%) = 0 Assume the dividend payout ratio each year is 100%. a. Calculate the year-by-year book and economic profitability for investment in polyzone production. Assume straight-line depreciation over 10 years and a cost of capital of 8%. (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter your income answers in millions rounded to 2 decimal places and enter the rate of return as a percent rounded to 2 decimal places.) 0 1 2 3 4 0 -49 Period: Book income ($) Book rate of return (%) Economic income ($) 0 -38.89% 0 6 8 9 10 Book income ($) Book rate of return (%) Economic income ($) b-1. What is the economic rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Economic rate of return % b-2. Now compute the steady-state book rate of return (ROI) for a mature company producing polyzone. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) ROI % Use the cash flows and competitive spreads shown in the table below. ($ millions) Year 1 Year 2 Years 3-10 Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues Production costs Transport Other costs Year o 140 0 1.10 0 0 0 0 0 1.10 0 0 0 35 55 1.10 60.50 45.00 0 35 95 1.10 104.50 45.00 0 35 Cash flow -140 35 -19.50 -24.50 NPV (at r = 8%) = 0 Assume the dividend payout ratio each year is 100%. a. Calculate the year-by-year book and economic profitability for investment in polyzone production. Assume straight-line depreciation over 10 years and a cost of capital of 8%. (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter your income answers in millions rounded to 2 decimal places and enter the rate of return as a percent rounded to 2 decimal places.) 0 1 2 3 4 0 -49 Period: Book income ($) Book rate of return (%) Economic income ($) 0 -38.89% 0 6 8 9 10 Book income ($) Book rate of return (%) Economic income ($) b-1. What is the economic rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Economic rate of return % b-2. Now compute the steady-state book rate of return (ROI) for a mature company producing polyzone. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) ROI %