Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This problem has been stressing me out any help would be greatly appreciated!! Presentation, Neatness, and Organization points (5 points) The recitation instructors will be

This problem has been stressing me out any help would be greatly appreciated!!

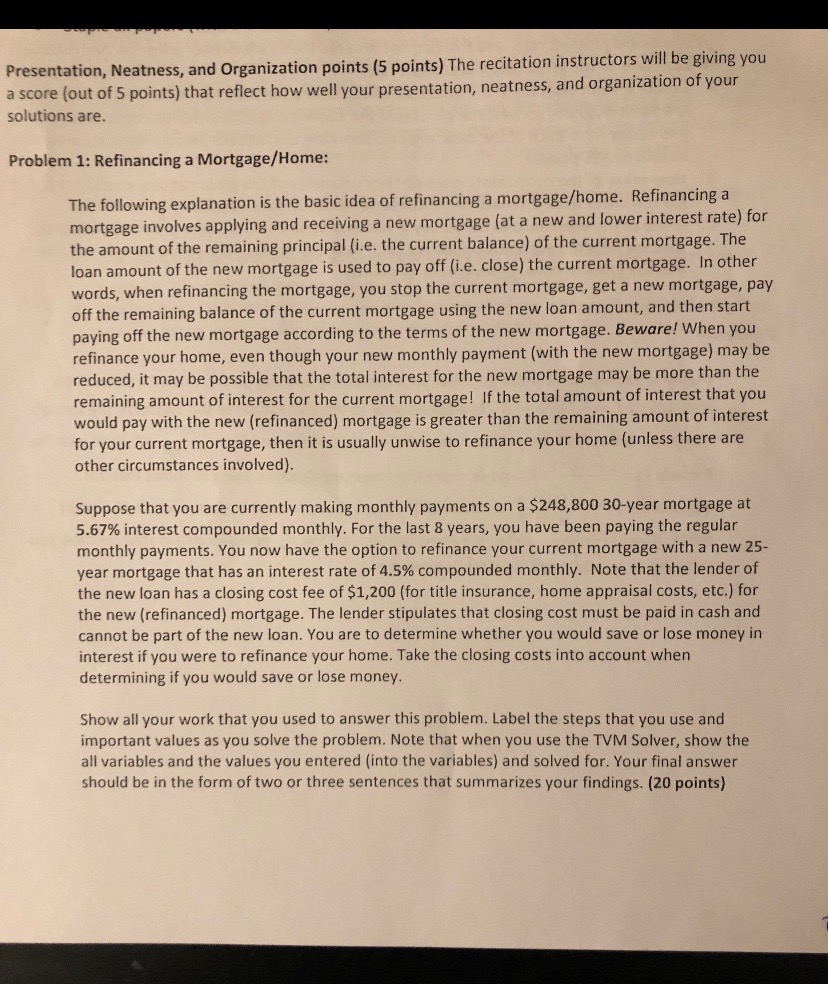

Presentation, Neatness, and Organization points (5 points) The recitation instructors will be giving you a score (out of 5 points) that reflect how well your presentation, neatness, and organization of your solutions are. Problem 1: Refinancing a Mortgage/Home: The following explanation is the basic idea of refinancing a mortgage/home. Refinancing a mortgage involves applying and receiving a new mortgage (at a new and lower interest rate) for the amount of the remaining principal (i.e. the current balance) of the current mortgage. The loan amount of the new mortgage is used to pay off (i.e. close) the current mortgage. In other words, when refinancing the mortgage, you stop the current mortgage, get a new mortgage, pay off the remaining balance of the current mortgage using the new loan amount, and then start paying off the new mortgage according to the terms of the new mortgage. Beware! When you refinance your home, even though your new monthly payment (with the new mortgage) may be reduced, it may be possible that the total interest for the new mortgage may be more than the remaining amount of interest for the current mortgage! If the total amount of interest that you would pay with the new (refinanced) mortgage is greater than the remaining amount of interest for your current mortgage, then it is usually unwise to refinance your home (unless there are other circumstances involved). Suppose that you are currently making monthly payments on a $248,800 30-year mortgage at 5.67% interest compounded monthly. For the last 8 years, you have been paying the regular monthly payments. You now have the option to refinance your current mortgage with a new 25- year mortgage that has an interest rate of 4.5% compounded monthly. Note that the lender of the new loan has a closing cost fee of $1,200 (for title insurance, home appraisal costs, etc.) for the new (refinanced) mortgage. The lender stipulates that closing cost must be paid in cash and cannot be part of the new loan. You are to determine whether you would save or lose money in interest if you were to refinance your home. Take the closing costs into account when determining if you would save or lose money. Show all your work that you used to answer this problem. Label the steps that you use and important values as you solve the problem. Note that when you use the TVM Solver, show the all variables and the values you entered into the variables) and solved for. Your final answer should be in the form of two or three sentences that summarizes your findings. (20 points) Presentation, Neatness, and Organization points (5 points) The recitation instructors will be giving you a score (out of 5 points) that reflect how well your presentation, neatness, and organization of your solutions are. Problem 1: Refinancing a Mortgage/Home: The following explanation is the basic idea of refinancing a mortgage/home. Refinancing a mortgage involves applying and receiving a new mortgage (at a new and lower interest rate) for the amount of the remaining principal (i.e. the current balance) of the current mortgage. The loan amount of the new mortgage is used to pay off (i.e. close) the current mortgage. In other words, when refinancing the mortgage, you stop the current mortgage, get a new mortgage, pay off the remaining balance of the current mortgage using the new loan amount, and then start paying off the new mortgage according to the terms of the new mortgage. Beware! When you refinance your home, even though your new monthly payment (with the new mortgage) may be reduced, it may be possible that the total interest for the new mortgage may be more than the remaining amount of interest for the current mortgage! If the total amount of interest that you would pay with the new (refinanced) mortgage is greater than the remaining amount of interest for your current mortgage, then it is usually unwise to refinance your home (unless there are other circumstances involved). Suppose that you are currently making monthly payments on a $248,800 30-year mortgage at 5.67% interest compounded monthly. For the last 8 years, you have been paying the regular monthly payments. You now have the option to refinance your current mortgage with a new 25- year mortgage that has an interest rate of 4.5% compounded monthly. Note that the lender of the new loan has a closing cost fee of $1,200 (for title insurance, home appraisal costs, etc.) for the new (refinanced) mortgage. The lender stipulates that closing cost must be paid in cash and cannot be part of the new loan. You are to determine whether you would save or lose money in interest if you were to refinance your home. Take the closing costs into account when determining if you would save or lose money. Show all your work that you used to answer this problem. Label the steps that you use and important values as you solve the problem. Note that when you use the TVM Solver, show the all variables and the values you entered into the variables) and solved for. Your final answer should be in the form of two or three sentences that summarizes your findings. (20 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started