Answered step by step

Verified Expert Solution

Question

1 Approved Answer

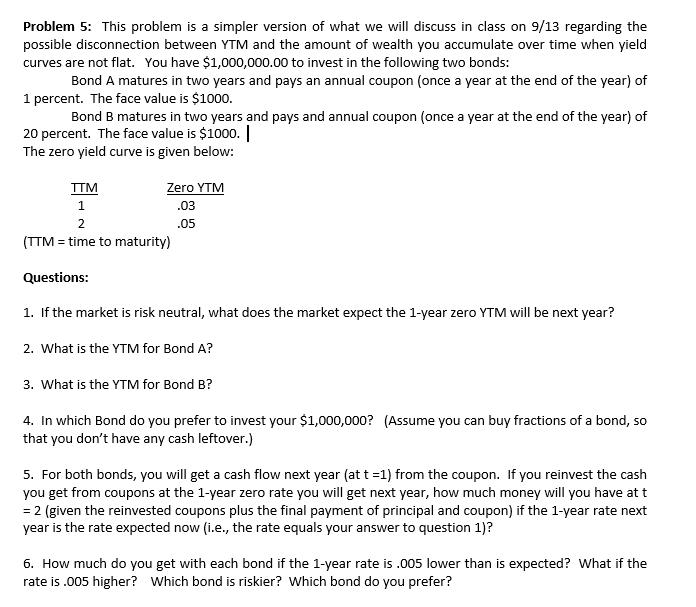

Problem 5: This problem is a simpler version of what we will discuss in class on 9/13 regarding the possible disconnection between YTM and

Problem 5: This problem is a simpler version of what we will discuss in class on 9/13 regarding the possible disconnection between YTM and the amount of wealth you accumulate over time when yield curves are not flat. You have $1,000,000.00 to invest in the following two bonds: Bond A matures in two years and pays an annual coupon (once a year at the end of the year) of 1 percent. The face value is $1000. Bond B matures in two years and pays and annual coupon (once a year at the end of the year) of 20 percent. The face value is $1000. | The zero yield curve is given below: TTM 1 2 (TTM = time to maturity) Questions: 1. If the market is risk neutral, what does the market expect the 1-year zero YTM will be next year? 2. What is the YTM for Bond A? Zero YTM .03 .05 3. What is the YTM for Bond B? 4. In which Bond do you prefer to invest your $1,000,000? (Assume you can buy fractions of a bond, so that you don't have any cash leftover.) 5. For both bonds, you will get a cash flow next year (at t =1) from the coupon. If you reinvest the cash you get from coupons at the 1-year zero rate you will get next year, how much money will you have at t = 2 (given the reinvested coupons plus the final payment of principal and coupon) if the 1-year rate next year is the rate expected now (i.e., the rate equals your answer to question 1)? 6. How much do you get with each bond if the 1-year rate is .005 lower than is expected? What if the rate is .005 higher? Which bond is riskier? Which bond do you prefer?

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 The expected 1year rate is 03 02 05 2 The YTM for Bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started