Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This problem is a complex financial problem that requires several skills, perhaps some from previous sections. During four years of college, Nolan MacGregor's student loans

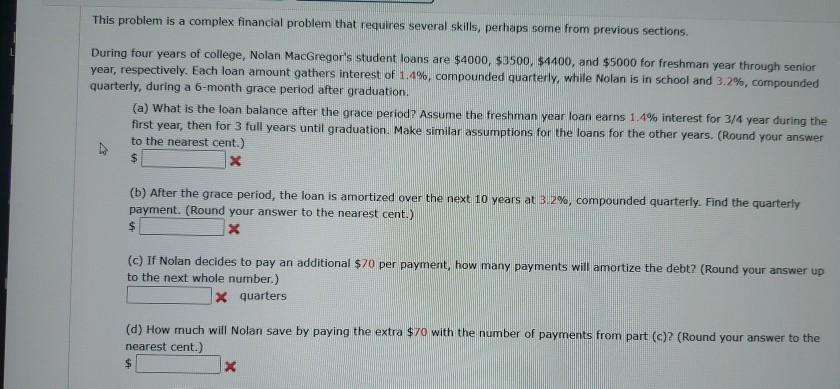

This problem is a complex financial problem that requires several skills, perhaps some from previous sections. During four years of college, Nolan MacGregor's student loans are $4000, $8500, $4400, and $5000 for freshman year through senior year, respectively. Each loan amount gathers interest of 1.4%, compounded quarterly, while Nolan is in school and 3.2%, compounded quarterly, during a 6-month grace period after graduation. (a) What is the loan balance after the grace period? Assume the freshman year loan earns 1.4% interest for 3/4 year during the first year, then for 3 full years until graduation. Make similar assumptions for the loans for the other years. (Round your answer to the nearest cent.) $ x (b) After the grace period, the loan is amortized over the next 10 years at 32%, compounded quarterly. Find the quarterly payment. (Round your answer to the nearest cent.) $ x (c) If Nolan decides to pay an additional $70 per payment, how many payments will amortize the debt? (Round your answer up to the next whole number.) x quarters (d) How much will Nolan save by paying the extra $70 with the number of payments from part (c)2 (Round your answer to the nearest cent.) X This problem is a complex financial problem that requires several skills, perhaps some from previous sections. During four years of college, Nolan MacGregor's student loans are $4000, $8500, $4400, and $5000 for freshman year through senior year, respectively. Each loan amount gathers interest of 1.4%, compounded quarterly, while Nolan is in school and 3.2%, compounded quarterly, during a 6-month grace period after graduation. (a) What is the loan balance after the grace period? Assume the freshman year loan earns 1.4% interest for 3/4 year during the first year, then for 3 full years until graduation. Make similar assumptions for the loans for the other years. (Round your answer to the nearest cent.) $ x (b) After the grace period, the loan is amortized over the next 10 years at 32%, compounded quarterly. Find the quarterly payment. (Round your answer to the nearest cent.) $ x (c) If Nolan decides to pay an additional $70 per payment, how many payments will amortize the debt? (Round your answer up to the next whole number.) x quarters (d) How much will Nolan save by paying the extra $70 with the number of payments from part (c)2 (Round your answer to the nearest cent.) X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started