Answered step by step

Verified Expert Solution

Question

1 Approved Answer

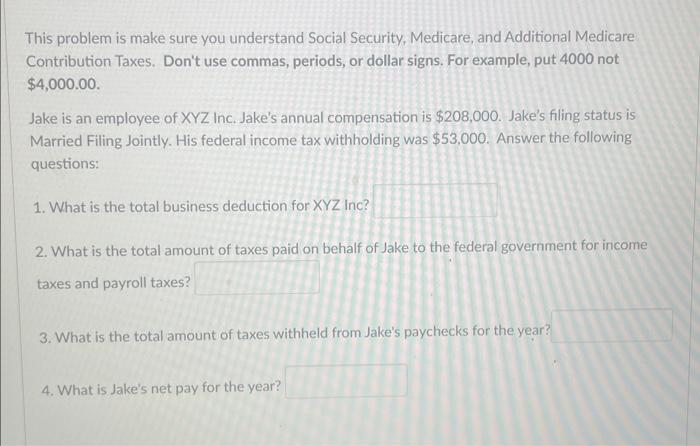

This problem is make sure you understand Social Security, Medicare, and Additional Medicare Contribution Taxes. Don't use commas, periods, or dollar signs. For example,

This problem is make sure you understand Social Security, Medicare, and Additional Medicare Contribution Taxes. Don't use commas, periods, or dollar signs. For example, put 4000 not $4,000.00. Jake is an employee of XYZ Inc. Jake's annual compensation is $208,000. Jake's filing status is Married Filing Jointly. His federal income tax withholding was $53,000. Answer the following questions: 1. What is the total business deduction for XYZ Inc? 2. What is the total amount of taxes paid on behalf of Jake to the federal government for income taxes and payroll taxes? 3. What is the total amount of taxes withheld from Jake's paychecks for the year? 4. What is Jake's net pay for the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started