Question

This problem will provide you with practice in NPV, margin and markup, breakeven analysis, forecasting, and decision analysis, which are all important tools for managers

This problem will provide you with practice in NPV, margin and markup, breakeven analysis, forecasting, and decision analysis, which are all important tools for managers to know. The problem also combines material from two or more learning modules.

Scenario:

You are part of the management team for Schnauzer Security Systems, which manufactures building security systems. One of your products is a control panel that is used in a wide variety of applications. You have manufactured the product for the past 15 years, and you have enjoyed strong sales growth. Unfortunately, your design engineers have indicated that the current panel is rapidly becoming obsolete, and it will not be capable of interfacing with new sensor technology, which is rapidly taking over the market. So, you must discontinue the current product soon. The question is whether or not you can afford to change over to a new product given the high cost of redesign and retooling. Alternatively, you could outsource the technology to a Chinese manufacturer. But if you do so, you will not achieve significant profit from reselling the Chinese panel. If you choose to manufacture and sell the new panel, your engineers predict that the product life cycle will be about 10 years. So, it is important to recoup your initial investment before then.

Questions:

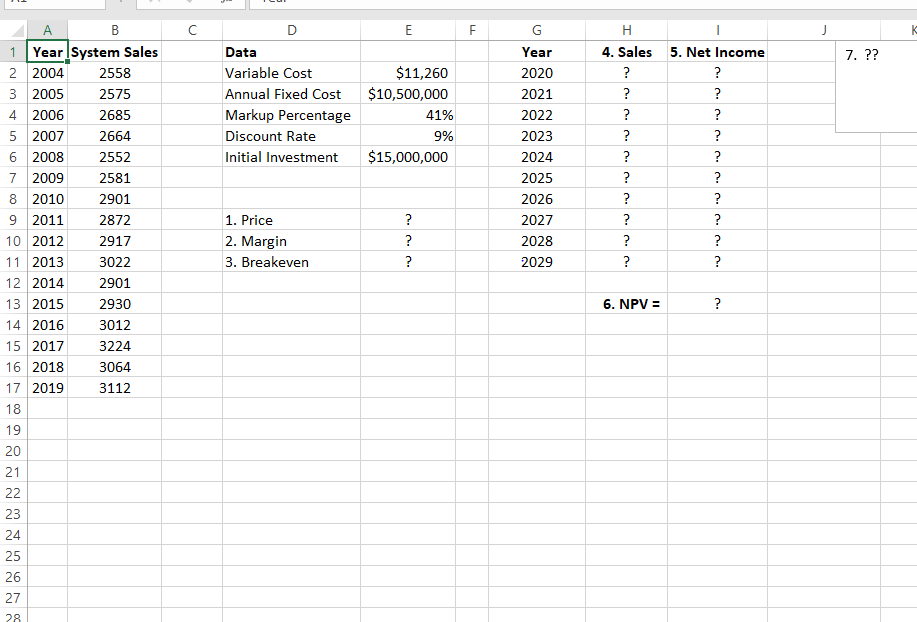

To answer the following questions, use the data in the accompanying Excel file.

- Using the markup percentage, what is the sales price?

- What is the margin given the price you calculated above?

- Based on your calculations in Question 1, how much must you sell to break even in the first year? Hint: Let your fixed cost be the sum of initial investment and one year of annual fixed cost.

- Since the sales are clearly trending upward, use the historical data to create a trend model, and then use that model to forecast sales for each of the next 10 years (2020-2029). Note: use TREND() for the forecasts. Set x and y to the history and the new x to the new dates.

- Assuming that sales will be very close to your forecasts, what is the expected net income for each of the next 10 years?

Hint: Let Net Income = Forecast Sales X Margin Annual Fixed Cost

- What is the net present value of the 10 years of profit computed in Question 4? Hint: Compute NPV of the 10 years of net income, and subtract the initial investment from this amount.

- Should Schnauzer Security Systems invest in the new product? Use all of the results of your analysis to justify your answer.

Deliverables:

Please place all of your analysis on the spreadsheet provided. When you have completed the assignment, post your Excel file on the HW 5 assignment dropbox.

Data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started