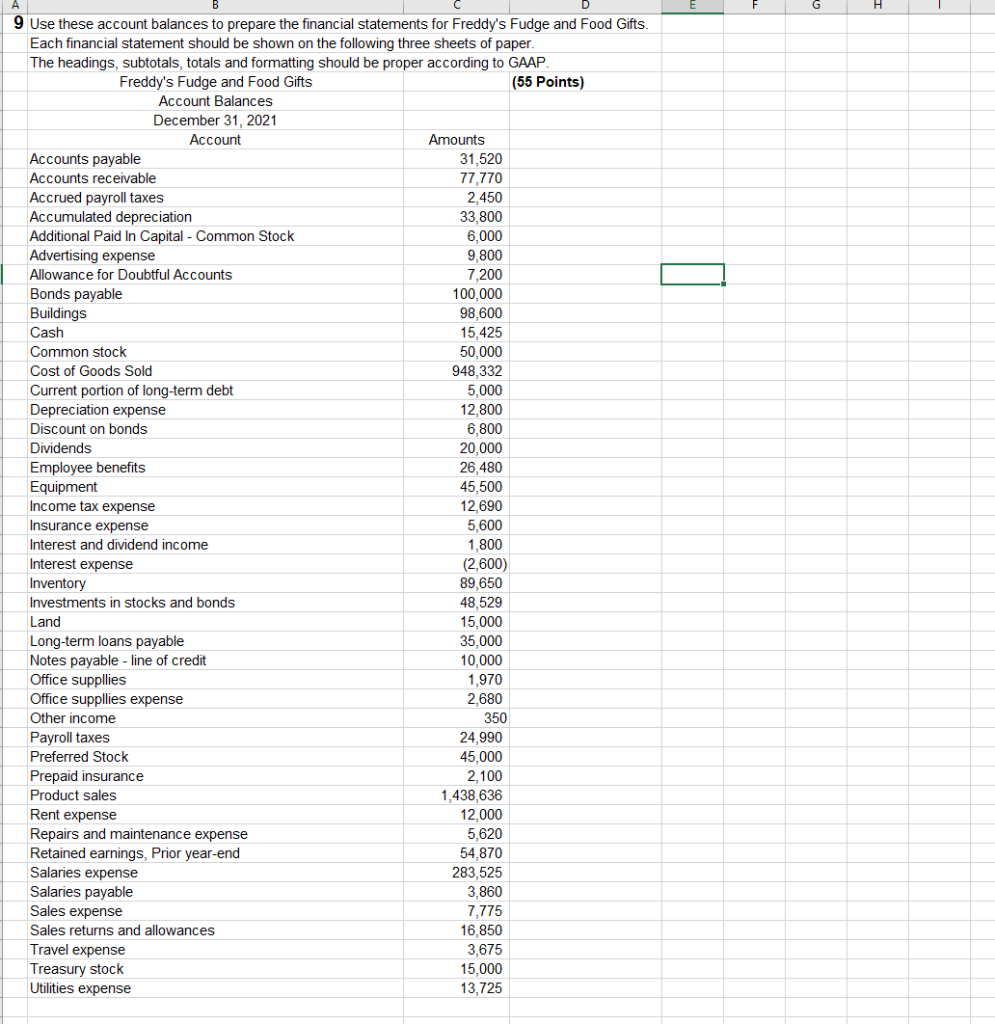

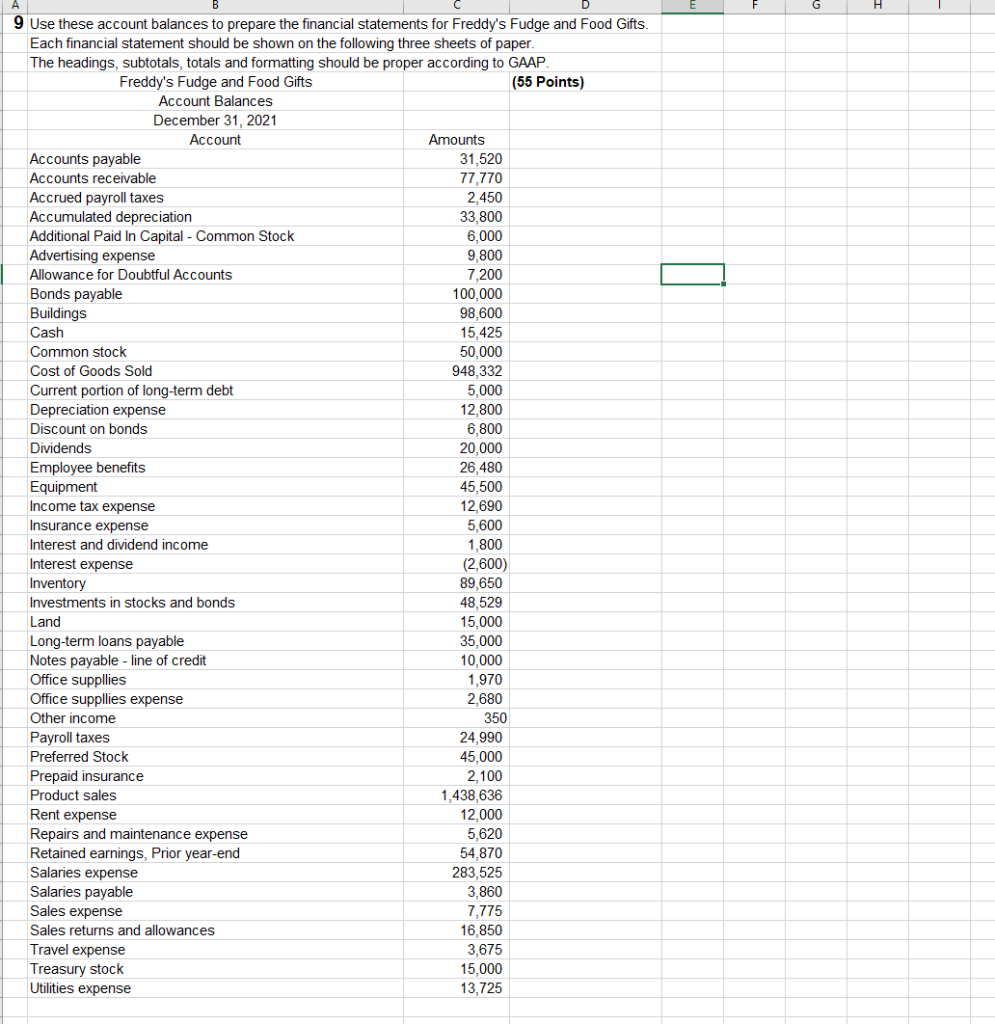

This project requires you to complete a full set of financial statements in proper form. Income statement, retained earnings, and balance sheet.

9 Use these account balances to prepare the financial statements for Freddy's Fudge and Food Gifts. Each financial statement should be shown on the following three sheets of paper. The headings, subtotals, totals and formatting should be proper according to GAAP. Freddy's Fudge and Food Gifts (55 Points) Account Balances December 31, 2021 Account Amounts Accounts payable 31,520 Accounts receivable Accrued payroll taxes Accumulated depreciation Additional Paid In Capital - Common Stock Advertising expense Allowance for Doubtful Accounts Bonds payable Buildings Cash Common stock Cost of Goods Sold Current portion of long-term debt Depreciation expense Discount on bonds Dividends Employee benefits Equipment Income tax expense Insurance expense Interest and dividend income Interest expense Inventory Investments in stocks and bonds Land Long-term loans payable Notes payable - line of credit Office suppllies Office suppllies expense Other income Payroll taxes Preferred Stock Prepaid insurance Product sales Rent expense Repairs and maintenance expense Retained earnings, Prior year-end Salaries expense Salaries payable Sales expense Sales returns and allowances Travel expense Treasury stock Utilities expense 9 Use these account balances to prepare the financial statements for Freddy's Fudge and Food Gifts. Each financial statement should be shown on the following three sheets of paper. The headings, subtotals, totals and formatting should be proper according to GAAP. Freddy's Fudge and Food Gifts (55 Points) Account Balances December 31, 2021 Account Amounts Accounts payable 31,520 Accounts receivable Accrued payroll taxes Accumulated depreciation Additional Paid In Capital - Common Stock Advertising expense Allowance for Doubtful Accounts Bonds payable Buildings Cash Common stock Cost of Goods Sold Current portion of long-term debt Depreciation expense Discount on bonds Dividends Employee benefits Equipment Income tax expense Insurance expense Interest and dividend income Interest expense Inventory Investments in stocks and bonds Land Long-term loans payable Notes payable - line of credit Office suppllies Office suppllies expense Other income Payroll taxes Preferred Stock Prepaid insurance Product sales Rent expense Repairs and maintenance expense Retained earnings, Prior year-end Salaries expense Salaries payable Sales expense Sales returns and allowances Travel expense Treasury stock Utilities expense