Answered step by step

Verified Expert Solution

Question

1 Approved Answer

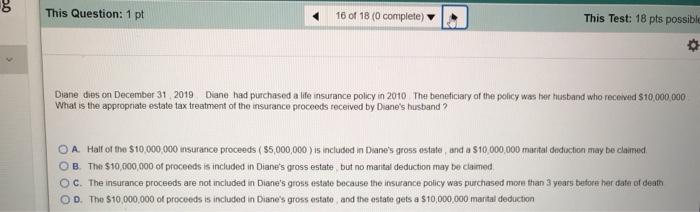

< This Question: 1 pt 16 of 18 (0 complete) This Test: 18 pts possible Diane dies on December 31, 2019 Diane had purchased

< This Question: 1 pt 16 of 18 (0 complete) " This Test: 18 pts possible Diane dies on December 31, 2019 Diane had purchased a life insurance policy in 2010 The beneficiary of the policy was her husband who received $10,000,000 What is the appropriate estate tax treatment of the insurance proceeds received by Diane's husband? OA. Half of the $10,000,000 insurance proceeds ($5,000,000) is included in Diane's gross estate, and a $10,000,000 marital deduction may be claimed OB. The $10,000,000 of proceeds is included in Diane's gross estate, but no marital deduction may be claimed OC. The insurance proceeds are not included in Diane's gross estate because the insurance policy was purchased more than 3 years before her date of death OD. The $10,000,000 of proceeds is included in Diane's gross estate, and the estate gets a $10,000,000 marital deduction *

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started