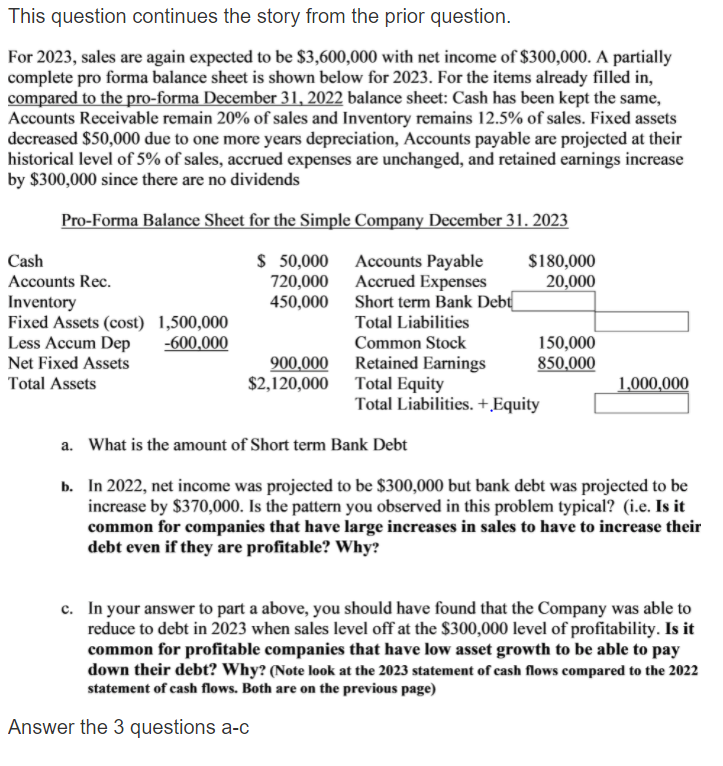

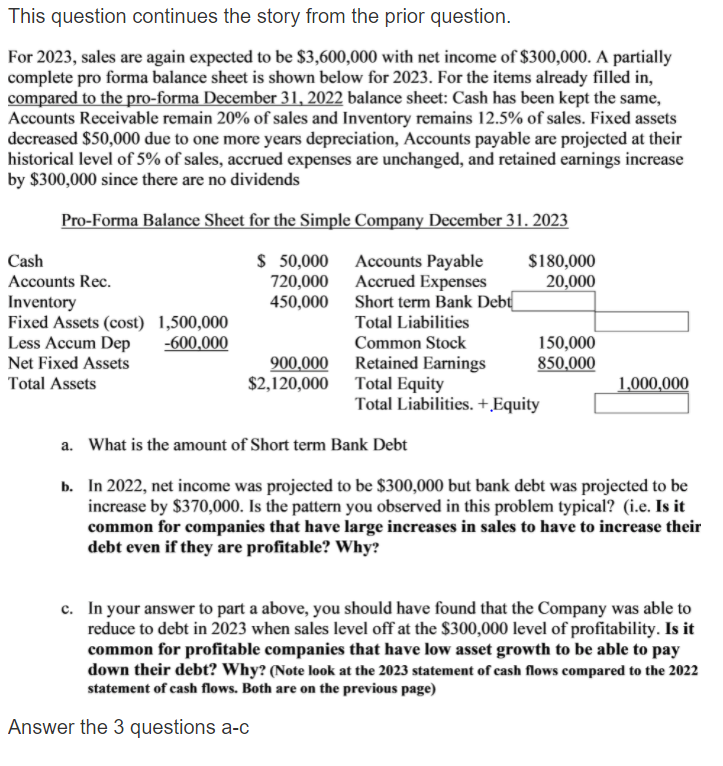

This question continues the story from the prior question. For 2023, sales are again expected to be $3,600,000 with net income of $300,000. A partially complete pro forma balance sheet is shown below for 2023. For the items already filled in, compared to the pro-forma December 31, 2022 balance sheet: Cash has been kept the same, Accounts Receivable remain 20% of sales and Inventory remains 12.5% of sales. Fixed assets decreased $50,000 due to one more years depreciation, Accounts payable are projected at their historical level of 5% of sales, accrued expenses are unchanged, and retained earnings increase by $300,000 since there are no dividends Pro-Forma Balance Sheet for the Simple Company December 31, 2023 Cash $ 50,000 Accounts Payable $180,000 Accounts Rec. 720,000 Accrued Expenses 20,000 Inventory 450,000 Short term Bank Debt_ Fixed Assets (cost) 1,500,000 Total Liabilities Less Accum Dep -600,000 Common Stock 150,000 Net Fixed Assets 900,000 Retained Earnings 850,000 Total Assets $2,120,000 Total Equity Total Liabilities. +. Equity a. What is the amount of Short term Bank Debt 1,000,000 b. In 2022, net income was projected to be $300,000 but bank debt was projected to be increase by $370,000. Is the pattern you observed in this problem typical? (i.e. Is it common for companies that have large increases in sales to have to increase their debt even if they are profitable? Why? c. In your answer to part a above, you should have found that the Company was able to reduce to debt in 2023 when sales level off at the $300,000 level of profitability. Is it common for profitable companies that have low asset growth to be able to pay down their debt? Why? (Note look at the 2023 statement of cash flows compared to the 2022 statement of cash flows. Both are on the previous page) Answer the 3 questions a-c This question continues the story from the prior question. For 2023, sales are again expected to be $3,600,000 with net income of $300,000. A partially complete pro forma balance sheet is shown below for 2023. For the items already filled in, compared to the pro-forma December 31, 2022 balance sheet: Cash has been kept the same, Accounts Receivable remain 20% of sales and Inventory remains 12.5% of sales. Fixed assets decreased $50,000 due to one more years depreciation, Accounts payable are projected at their historical level of 5% of sales, accrued expenses are unchanged, and retained earnings increase by $300,000 since there are no dividends Pro-Forma Balance Sheet for the Simple Company December 31, 2023 Cash $ 50,000 Accounts Payable $180,000 Accounts Rec. 720,000 Accrued Expenses 20,000 Inventory 450,000 Short term Bank Debt_ Fixed Assets (cost) 1,500,000 Total Liabilities Less Accum Dep -600,000 Common Stock 150,000 Net Fixed Assets 900,000 Retained Earnings 850,000 Total Assets $2,120,000 Total Equity Total Liabilities. +. Equity a. What is the amount of Short term Bank Debt 1,000,000 b. In 2022, net income was projected to be $300,000 but bank debt was projected to be increase by $370,000. Is the pattern you observed in this problem typical? (i.e. Is it common for companies that have large increases in sales to have to increase their debt even if they are profitable? Why? c. In your answer to part a above, you should have found that the Company was able to reduce to debt in 2023 when sales level off at the $300,000 level of profitability. Is it common for profitable companies that have low asset growth to be able to pay down their debt? Why? (Note look at the 2023 statement of cash flows compared to the 2022 statement of cash flows. Both are on the previous page) Answer the 3 questions a-c