Answered step by step

Verified Expert Solution

Question

1 Approved Answer

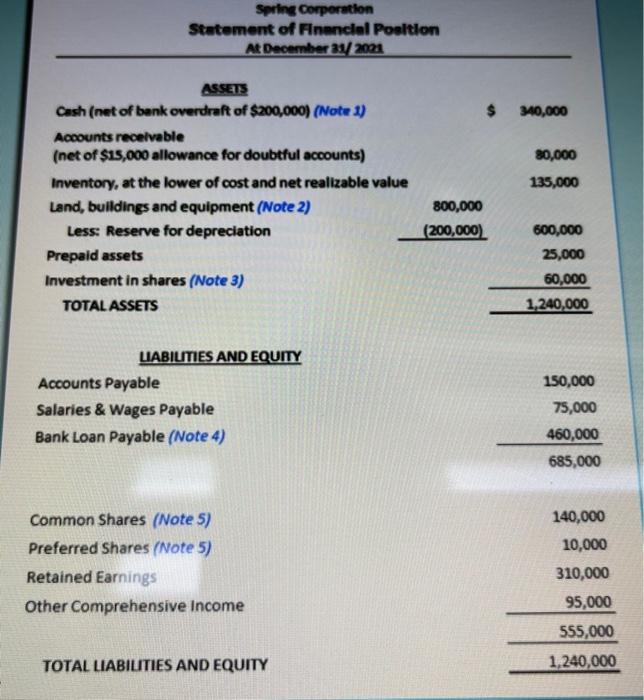

this question has 3 parts to it amd plz answer quick thank you The following Statement of Financial Position (also known as the Balance Sheet)

this question has 3 parts to it amd plz answer quick thank you

The following Statement of Financial Position (also known as the "Balance Sheet") was prepared by a junior

bookkeeper at Spring Corporation, a publicly traded company which follows International Financial Reporting

Standards (IFRS):

part 1. Based on the information provided, prepare what should have been shown in the current assets and current liabilities section of the Statement of Financial Position (Balance Sheet).

(Note: Preparation of a full financial statement is NOT required)

Part 2. How does classification of the bank overdraft impact working capital (in dollars $) and the current

ratio?

Briefly discuss the ethical issues surrounding the presentation of a bank overdraft assuming the Bank Loan Payable carries with it a debt covenant to maintain a working capital ratio of at least 2.0 or higher.Recall that..

Working capital ($) = Current Assets - Current Liabilities

Current Ratio = Current Assets/ Current Liabilities

Part 3. Identify FOUR other deficiencies in the financial statement prepared by the junior bookkeeper. What is wrong and how should the deficiency be fixed?

Note:

- Do NOT discuss Issues within current assets & current Mabides as this has already been examined in the first part of the

question.Please think critically & identify information that would be "useful" for decision-making.

No marks will be awarded for saying there is a lack of headings, subtotals, or totals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started