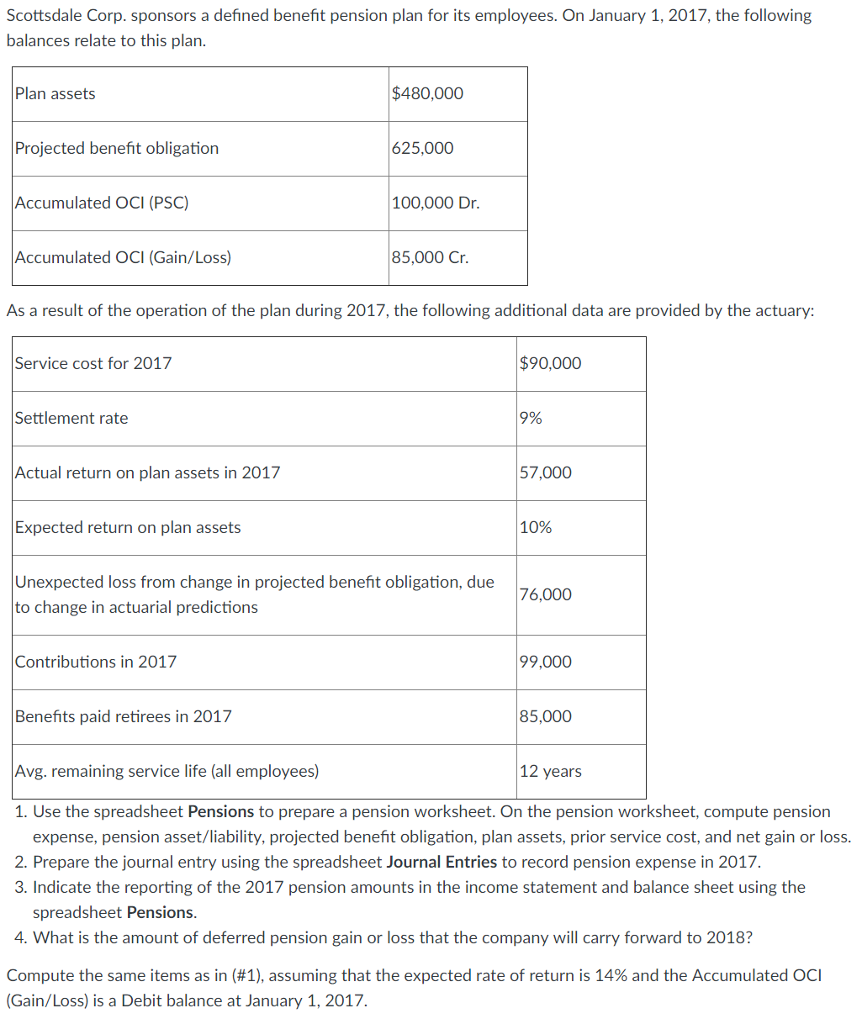

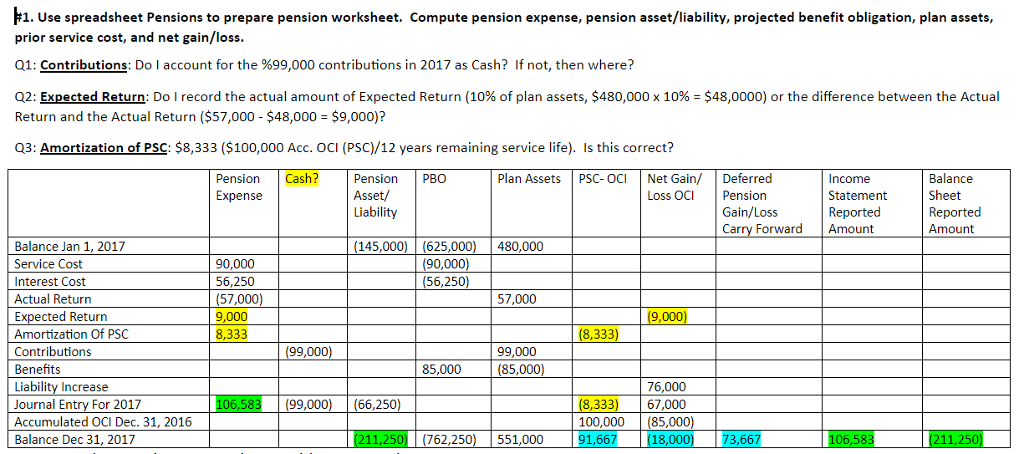

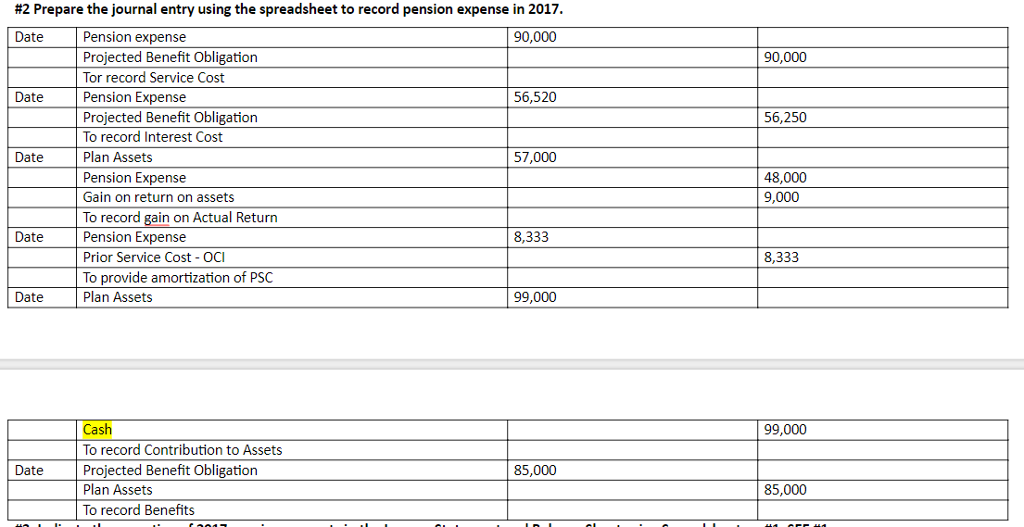

This question has been posted before with multiple answers provided. Please check my answers. Please see my questions on #1. If I have made any mistakes, please provide your working notes to show how you arrived at your answer. Thanks in advance!

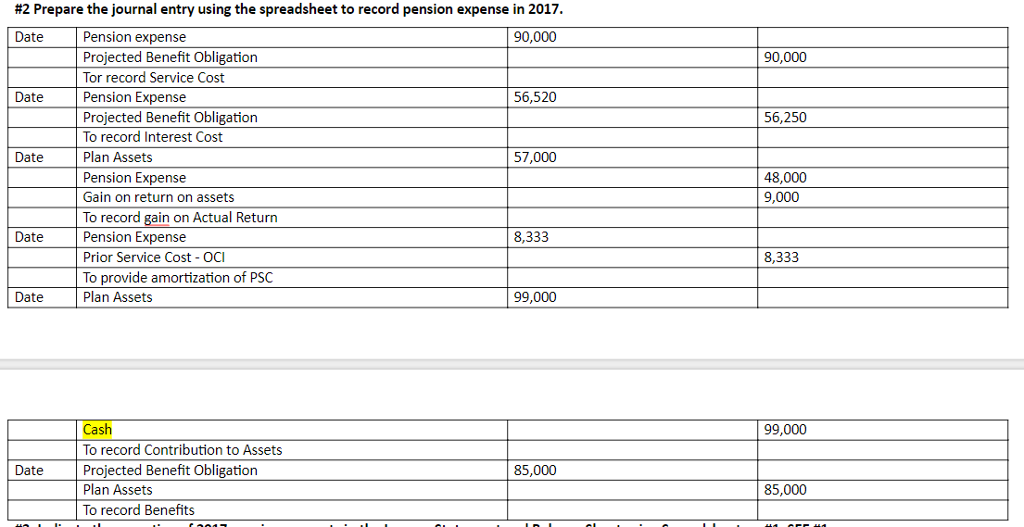

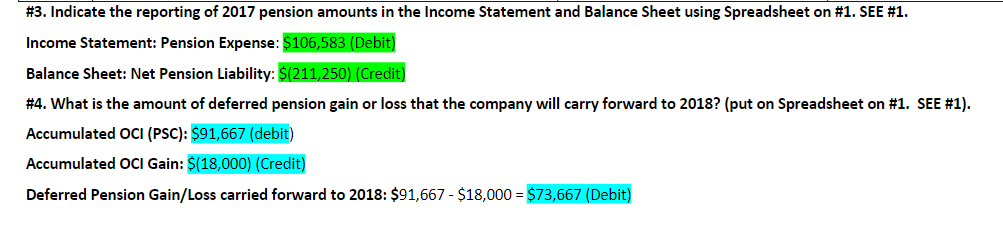

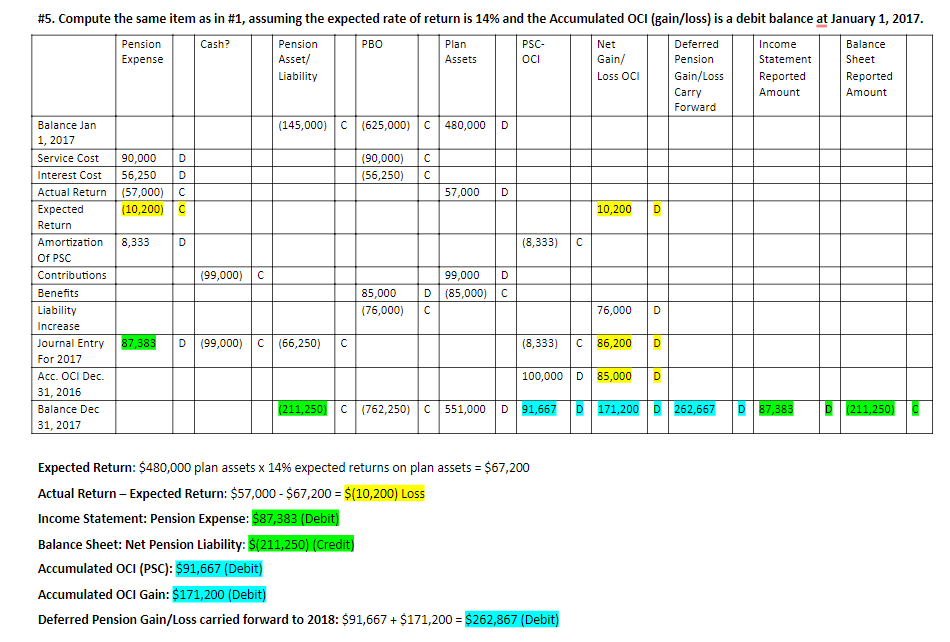

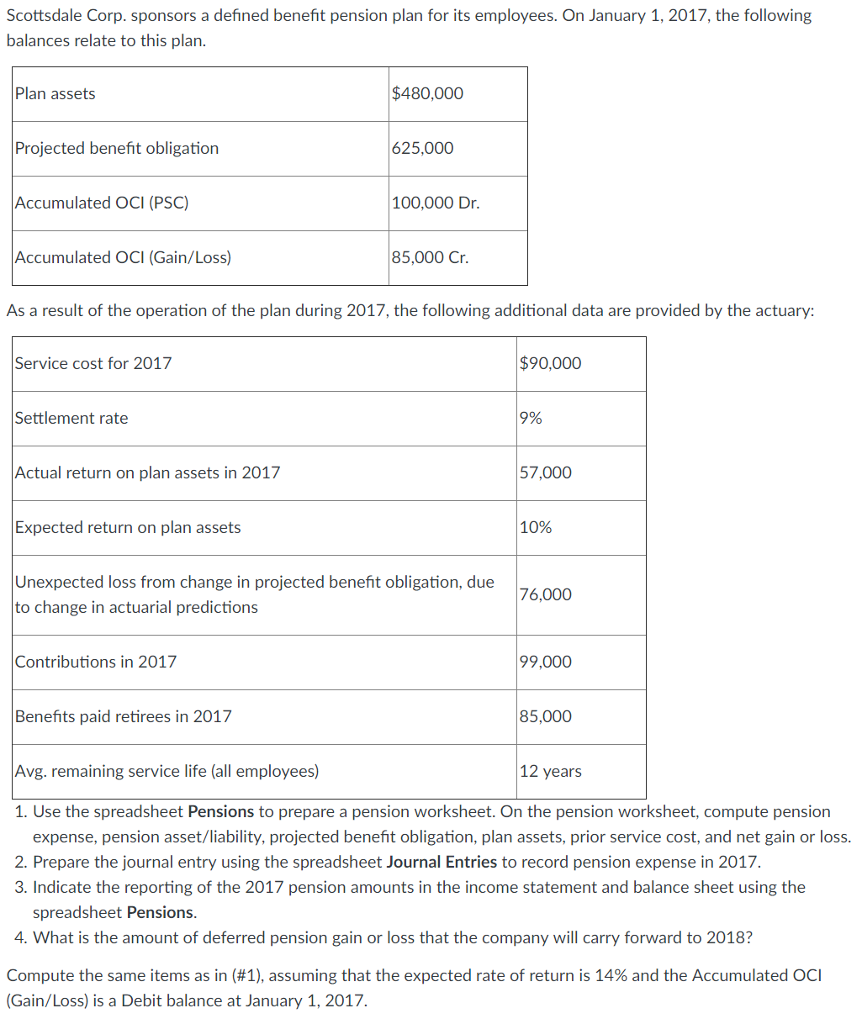

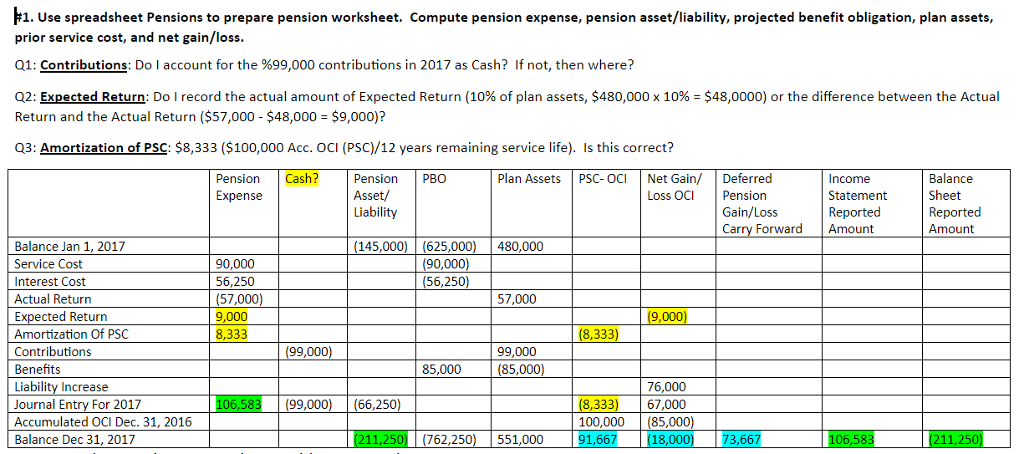

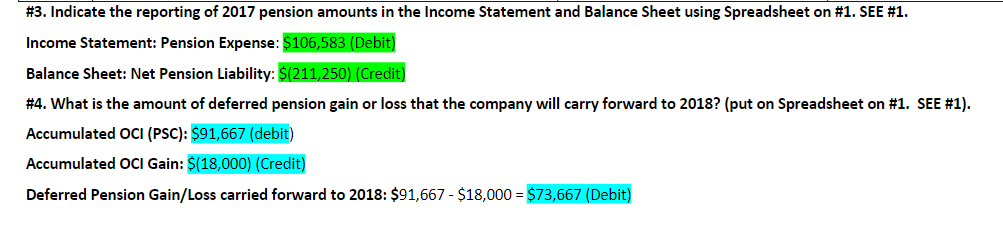

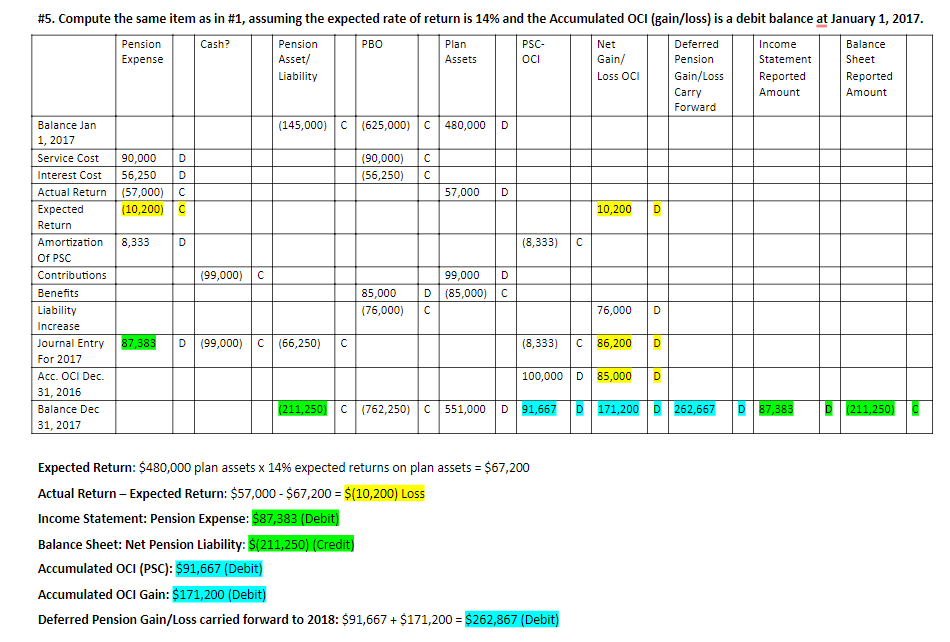

#2 Prepare the journal entry using the spreadsheet to record pension expense in 2017 Date Pension expense Projected Benefit Obligation Tor record Service Cost Pension Expense Projected Benefit Obligation To record Interest Cost Plan Assets Pension Expense Gain on return on assets To record gain on Actual Return Pension Expense Prior Service Cost OCi To provide amortization of PSO Plan Assets 90,000 90,000 Date 56,520 56,250 Date 57,000 48,000 9,000 Date 8,333 8,333 Date 99,000 Cash To record Contribution to Assets Projected Benefit Obligation Plan Assets To record Benefits 99,000 Date 85,000 85,000 #3. Indicate the reporting of 2017 pension amounts in the Income Statement and Balance Sheet using Spreadsheet on #l. SEE #1 Income Statement: Pension Expense: $106,583 (Debit) Balance Sheet: Net Pension Liability: $(211,250) (Credit) #4 what is the amount of deferred pension gain or loss that the company will carry forward to 2018? (put on spreadsheet on #1. SEE #1). Accumulated OCI (PSC): $91,667 (debit) Accumulated OCI Gain: $(18,000) (Credit) Deferred Pension Gain/Loss carried forward to 2018: $91,667 - $18,000 $73,667 (Debit) #5. Compute the same item as in #1, assuming the expected rate of return is 14% and the Accumulated OCI (gain/loss) is a debit balance at January 1, 2017 Pension Asset/ Liability PSC oCI Pension Cash? Plan Assets Net Deferred Pension Gain/Loss Carry Forward Income Statement Reported Amount Balance Sheet Reported Amount Expense Loss OCI Balance Jan 1, 2017 Service Cost90,000 D Interest Cost 56.250 D Actual Return (57,000)C Expected Return Amortization 8,333 Of PSC Contributions Benefit:s Liability Increase Journal Entry For 2017 Acc. OCI Dec. 31, 2016 Balance Dec 31, 2017 (145,000) C(625,000) C 480,000 D (90,000) |C (56,250 C 57,000 D (10,200) |c 10,200 D (8,333)C (99,000) C 99,000 D 85,000 D (85,000) C (76,000) C 76,000 D (8,333) C 86,200 D 100,000 D 85,000 D D (99,000) C(66,250) C C 762,250) C551,000 D 91,667 171,200 262,667 Expected Return: $480,000 plan assets x 14% expected returns on plan assets : $67,200 Actual Return- Expected Return: $57,000 $67,200 $(10,200) Loss Income Statement: Pension Expense: $87,383 (Debit) Balance Sheet: Net Pension Liability: $(211,250) (Credit) Accumulated OCI (PSC): $91,667 (Debit) Accumulated OCI Gain: $171,200 (Debit) Deferred Pension Gain/Loss carried forward to 2018: $91,667$171,200 $262,867 (Debit)