This question has multiple parts.

THANK YOU SO MUCH.

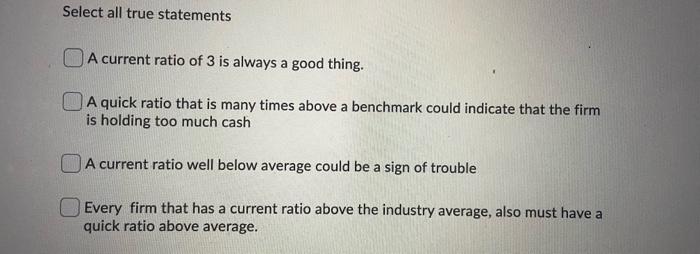

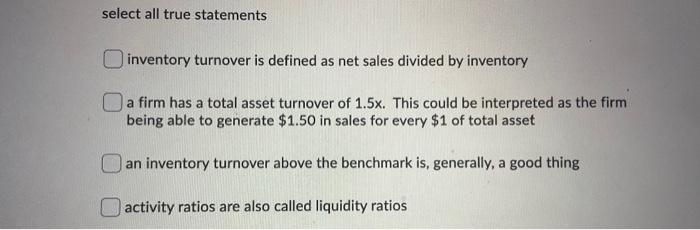

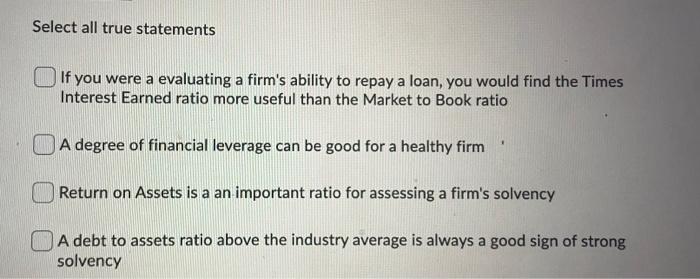

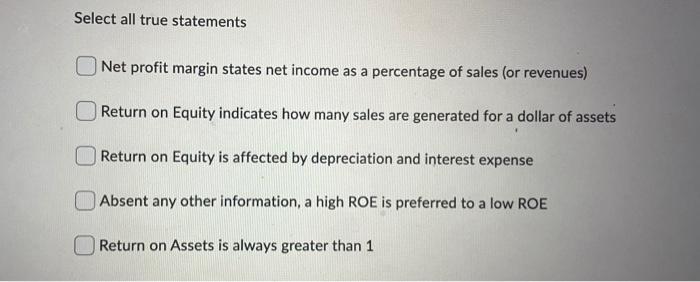

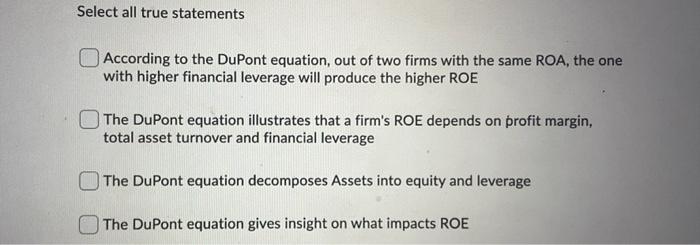

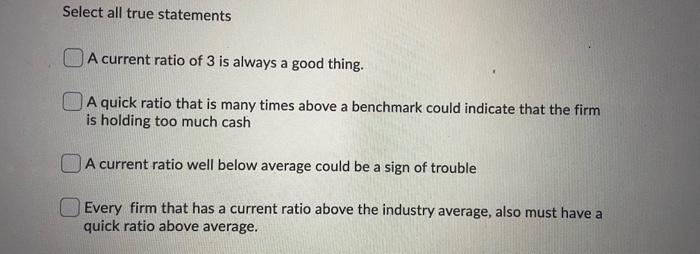

Select all true statements A current ratio of 3 is always a good thing. A quick ratio that is many times above a benchmark could indicate that the firm is holding too much cash A current ratio well below average could be a sign of trouble Every firm that has a current ratio above the industry average, also must have a quick ratio above average. select all true statements inventory turnover is defined as net sales divided by inventory a firm has a total asset turnover of 1.5x. This could be interpreted as the firm being able to generate $1.50 in sales for every $1 of total asset an inventory turnover above the benchmark is, generally, a good thing activity ratios are also called liquidity ratios Select all true statements If you were a evaluating a firm's ability to repay a loan, you would find the Times Interest Earned ratio more useful than the Market to Book ratio A degree of financial leverage can be good for a healthy firm Return on Assets is a an important ratio for assessing a firm's solvency A debt to assets ratio above the industry average is always a good sign of strong solvency Select all true statements Net profit margin states net income as a percentage of sales (or revenues) Return on Equity indicates how many sales are generated for a dollar of assets Return on Equity is affected by depreciation and interest expense Absent any other information, a high ROE is preferred to a low ROE Return on Assets is always greater than 1 Select all true statements According to the DuPont equation, out of two firms with the same ROA, the one with higher financial leverage will produce the higher ROE The DuPont equation illustrates that a firm's ROE depends on profit margin, total asset turnover and financial leverage The DuPont equation decomposes Assets into equity and leverage The DuPont equation gives insight on what impacts ROE Select all true statements A current ratio of 3 is always a good thing. A quick ratio that is many times above a benchmark could indicate that the firm is holding too much cash A current ratio well below average could be a sign of trouble Every firm that has a current ratio above the industry average, also must have a quick ratio above average