This question has two big part please answer both clearly becuase I do not have any other question left to post

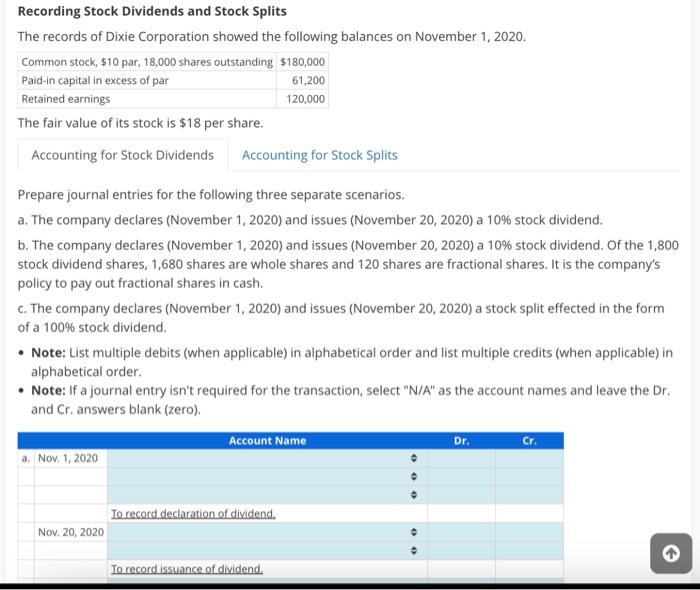

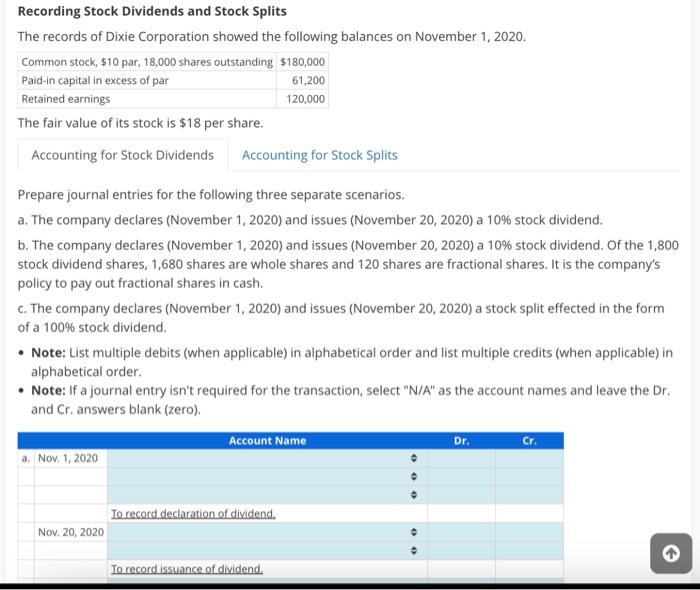

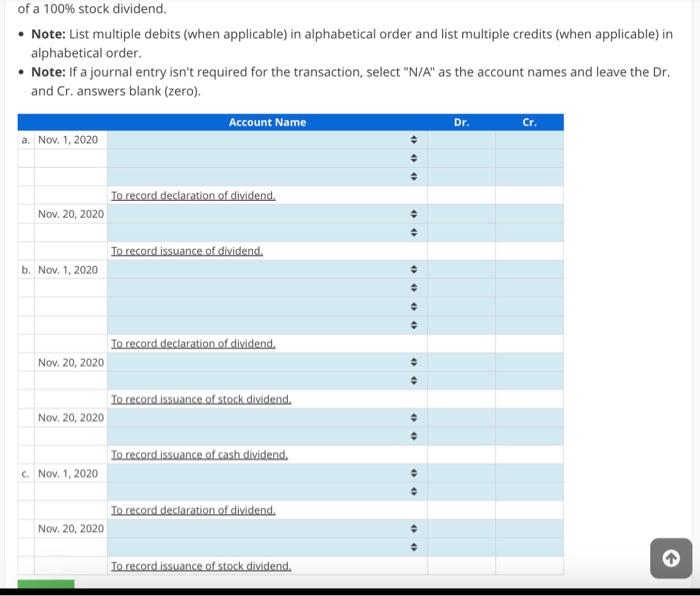

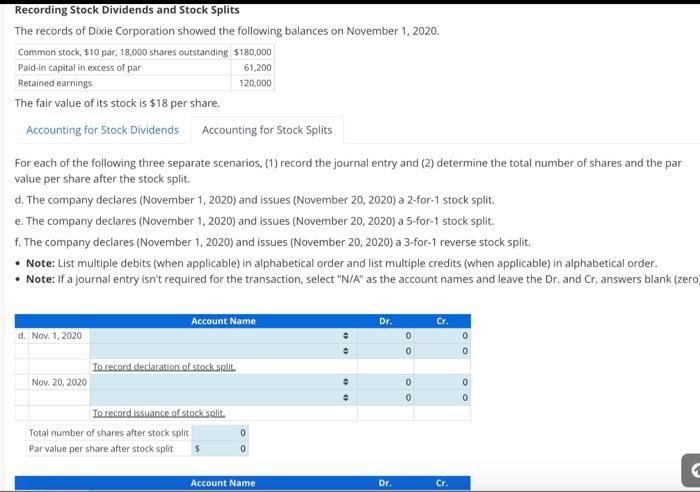

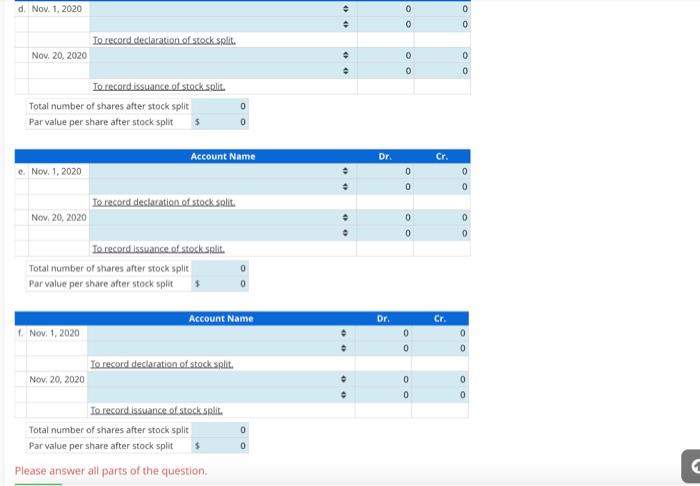

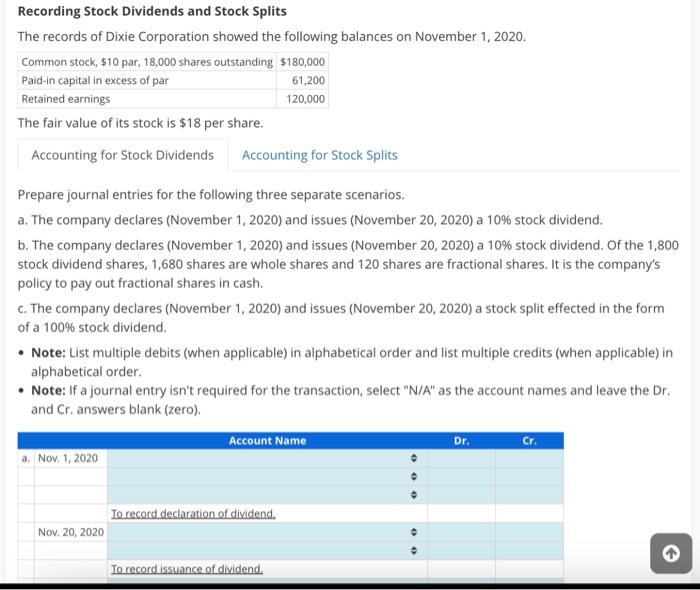

Recording Stock Dividends and Stock Splits The records of Dixie Corporation showed the following balances on November 1, 2020. The fair value of its stock is $18 per share. Prepare journal entries for the following three separate scenarios. a. The company declares (November 1, 2020) and issues (November 20, 2020) a 10\% stock dividend. b. The company declares (November 1,2020 ) and issues (November 20, 2020) a 10\% stock dividend. Of the 1,800 stock dividend shares, 1,680 shares are whole shares and 120 shares are fractional shares. It is the company's policy to pay out fractional shares in cash. c. The company declares (November 1, 2020) and issues (November 20, 2020) a stock split effected in the form of a 100% stock dividend. - Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. - Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). of a 100% stock dividend. - Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. - Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Recording Stock Dividends and Stock Splits The records of Dixie Corporation showed the following balances on November 1, 2020. The fair value of its stock is $18 per share. For each of the following three separate scenarios, (1) record the journal entry and (2) determine the total number of shares and the par value per share after the stock split. d. The company declares (November 1, 2020) and issues (November 20, 2020) a 2-for-1 stock split. e. The company declares (November 1, 2020) and issues (November 20, 2020) a 5-for-1 stock split. f. The company declares (November 1, 2020) and issues (November 20, 2020) a 3-for-1 reverse stock split. - Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. - Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr, and Cr, answers blank (zero FIEase dISVet an paris u we questium