Answered step by step

Verified Expert Solution

Question

1 Approved Answer

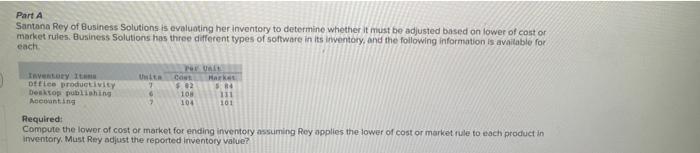

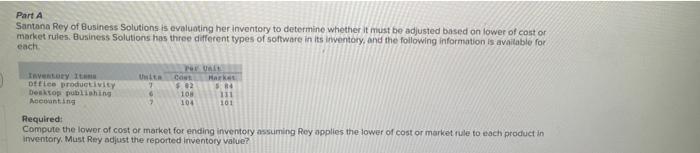

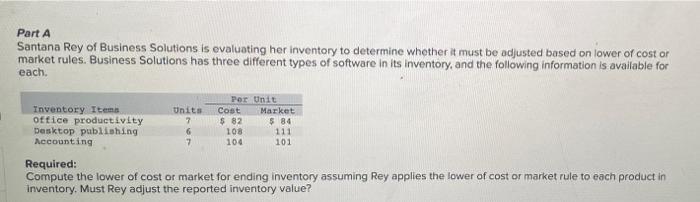

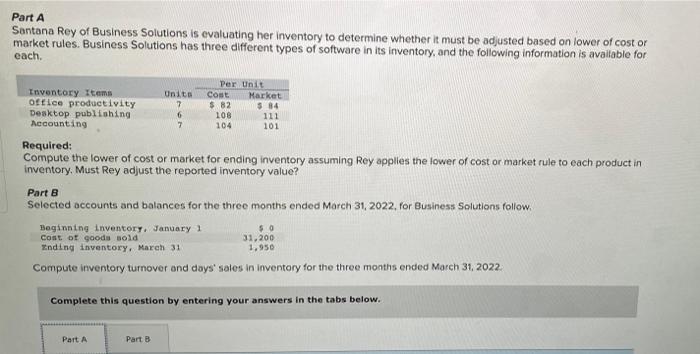

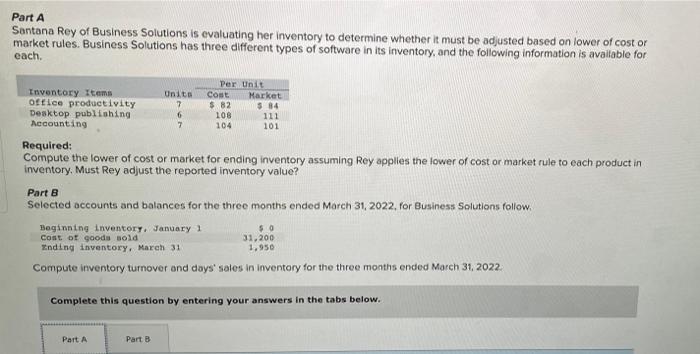

This question has TWO parts TWO part question Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be

This question has TWO parts

TWO part question

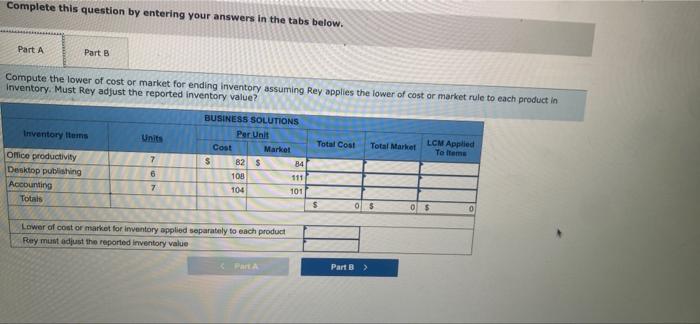

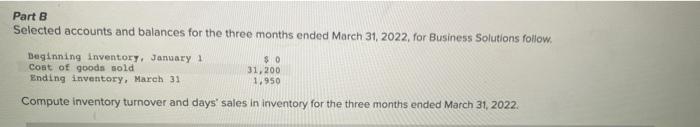

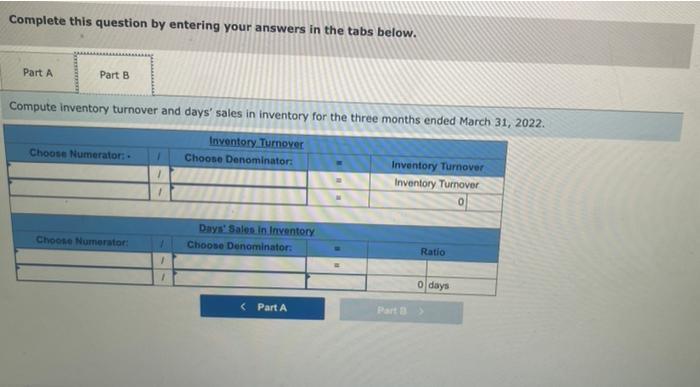

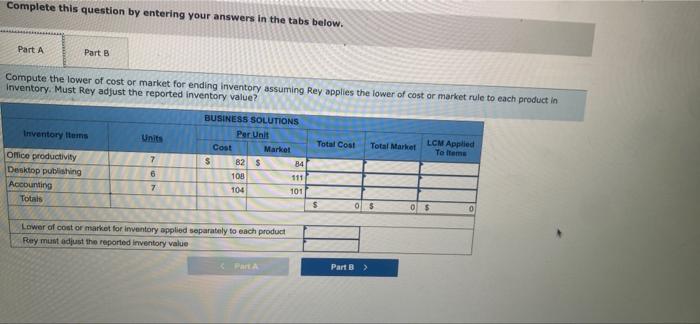

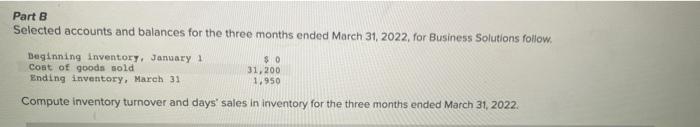

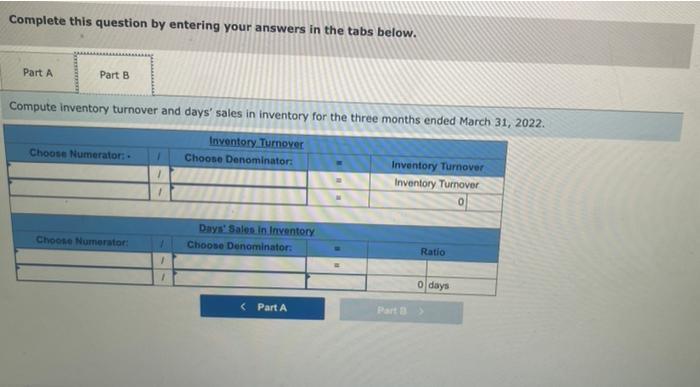

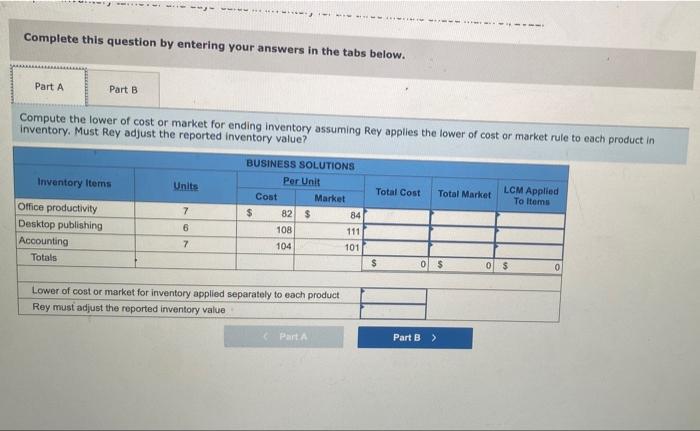

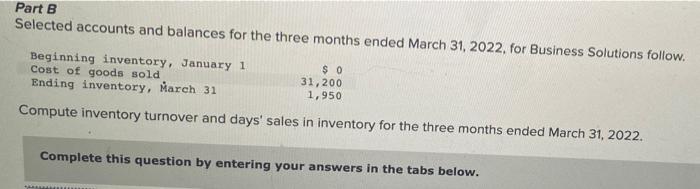

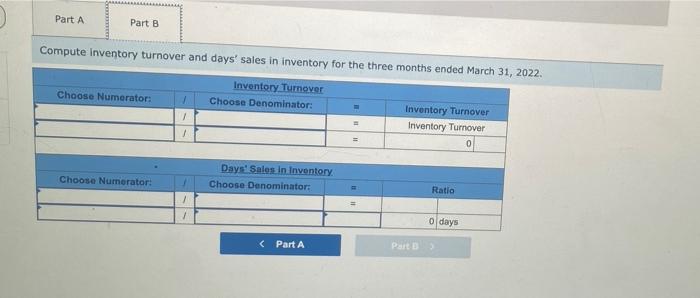

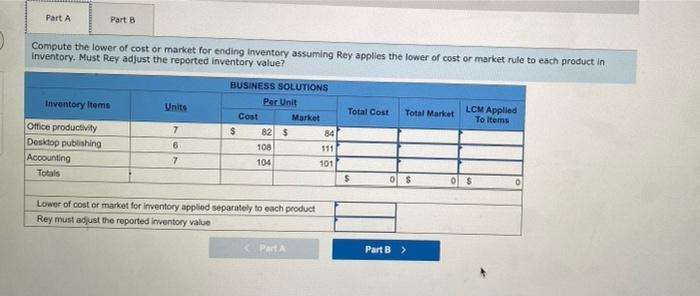

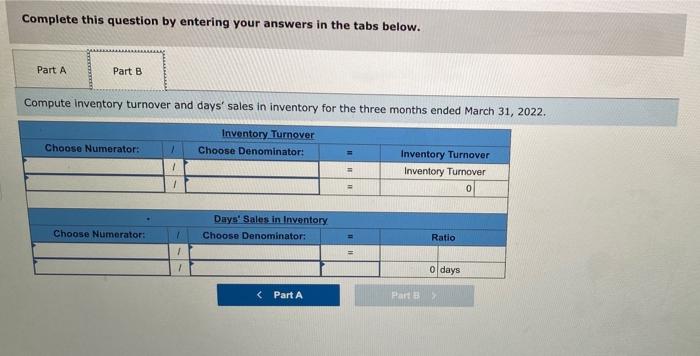

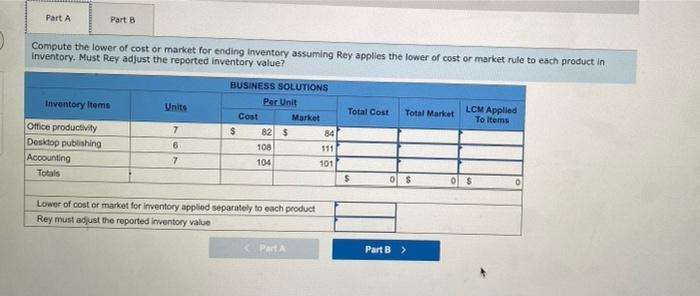

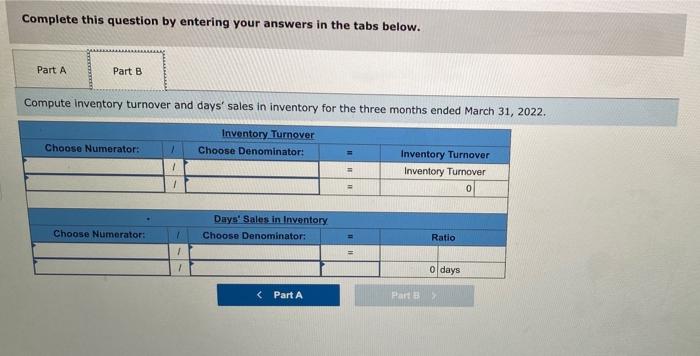

Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules, Business Solutions has three different types of software in its inventory, and the following information is available for each TAYLORY I ottico productivity Desktop publishing Accounting 2 PE $.02 108 104 Hark 5.4 111 101 7 Required: Compute the lower of cost or market for ending inventory assuming Rey applies the lower of cost or market rule to each product in Inventory. Must Rey adjust the reported inventory value? Complete this question by entering your answers in the tabs below. Part A Part B Compute the lower of cost or market for ending inventory assuming Rey applies the lower of cost or market rule to each product in Inventory. Must Rey adjust the reported inventory value? Inventory Items Units Total Cost Total Market LCM Applied BUSINESS SOLUTIONS Per Unit Cost Market $ 82 $ 84 108 111 104 101 Ta teme Office productivity Desktop publishing Accounting Totals 7 6 7 $ OS 05 0 Lower of cost or market for inventory applied separately to each product Rey must adjust the reported Inventory value Part Part B > Part 8 Selected accounts and balances for the three months ended March 31, 2022, for Business Solutions follow, Beginning inventory, January 1 $0 Cont of goods sold 31,200 Ending inventory, March 31 1.950 Compute inventory turnover and days' sales in inventory for the three months ended March 31, 2022. Complete this question by entering your answers in the tabs below. Part A Part B Compute inventory turnover and days' sales in inventory for the three months ended March 31, 2022. Inventory Turnover Choose Numerator: Choose Denominator: Inventory Turnover Inventory Turnover 0 Choose Numerator Days Sales In Inventory Choose Denominator: Ratio 1 1 o days Part B Selected accounts and balances for the three months ended March 31, 2022. for Business Solutions follow. Beginning inventory, January 1 $ 0 Cost of goods sold 31,200 Ending inventory, March 31 1,950 Compute inventory turnover and days' sales in inventory for the three months ended March 31, 2022. Complete this question by entering your answers in the tabs below. Part A Part B Compute Inventory turnover and days' sales in inventory for the three months ended March 31, 2022. Choose Numerator: Inventory Turnover Choose Denominator: 1 1 Inventory Turnover Inventory Turnover Choose Numerator: Days Sales In Inventory Choose Denominator: Ratio 1 O days Part A Part Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules. Business Solutions has three different types of software in its inventory, and the following information is available for each. Inventory Items oftice productivity Desktop publishing Accounting Units 7 6 7 Per Unit Cost Market $.82 $ 84 108 104 101 111 Required: Compute the lower of cost or market for ending inventory assuming Rey applies the lower of cost or market rule to each product in inventory, Must Rey adjust the reported inventory value? Part 8 Selected accounts and balances for the three months ended March 31, 2022, for Business Solutions follow, Beginning inventory, January 1 $. Cost of goods sold 31,200 Ending inventory, March 31 Compute inventory turnover ond days' sales in Inventory for the three months ended March 31, 2022 1.950 Complete this question by entering your answers in the tabs below. Part A Part B Part A Part 8 Compute the lower of cost or market for ending Inventory assuming Rey applies the lower of cost or market rule to each product in Inventory. Must Rey adjust the reported Inventory value? BUSINESS SOLUTIONS Inventory Items Per Unit Units Cost Total Cost LCM Applied Total Market Market To Items Office productivity 7 $ 82 $ 84 Desktop publishing 6 108 111 Accounting 7 104 101 Totals $ os 0 $ 0 Lower of cost or market for inventory applied separately to each product Rey must adjust the reported inventory value Part Part B > Complete this question by entering your answers in the tabs below. Part A Part B Compute Inventory turnover and days' sales in inventory for the three months ended March 31, 2022. Choose Numerator: Inventory. Turnover Choose Denominator: ! Inventory Turnover Inventory Turnover 0 1 Days' Sales In Inventory Choose Denominator: Choose Numerator: Ratio 1 1 O days Part A Part 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started