Question: This question is a continuation of the preceding question. Recall that on 1/1/X1, Big Company acquired 100% of Small company's common stock for $700,000. At

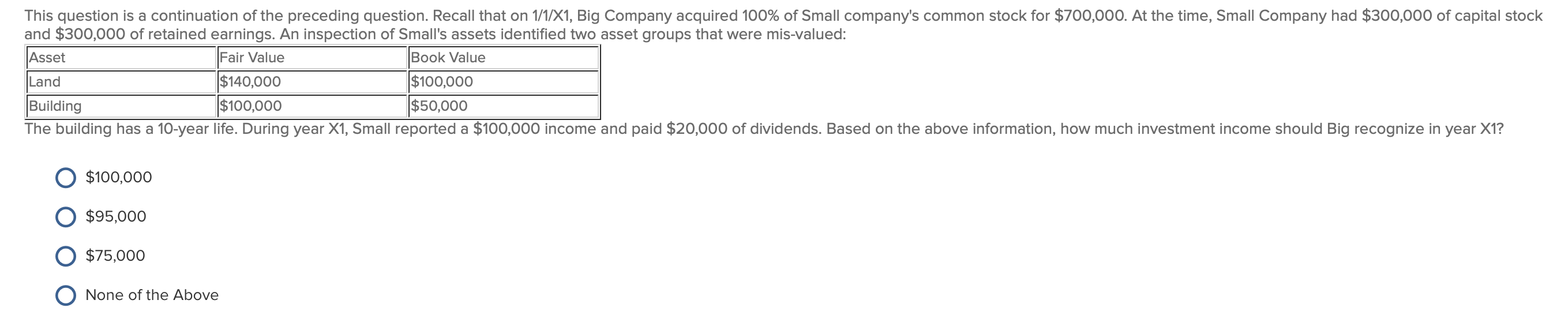

This question is a continuation of the preceding question. Recall that on 1/1/X1, Big Company acquired 100% of Small company's common stock for $700,000. At the time, Small Company had $300,000 of capital stock and $300,000 of retained earnings. An inspection of Small's assets identified two asset groups that were mis-valued: Asset Fair Value Book Value Land $140,000 $100,000 Building $100,000 $50,000 The building has a 10-year life. During year X1, Small reported a $100,000 income and paid $20,000 of dividends. Based on the above information, how much investment income should Big recognize in year X1? $100,000 $95,000 $75,000 None of the Above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts