This question is about firms and cost functions,

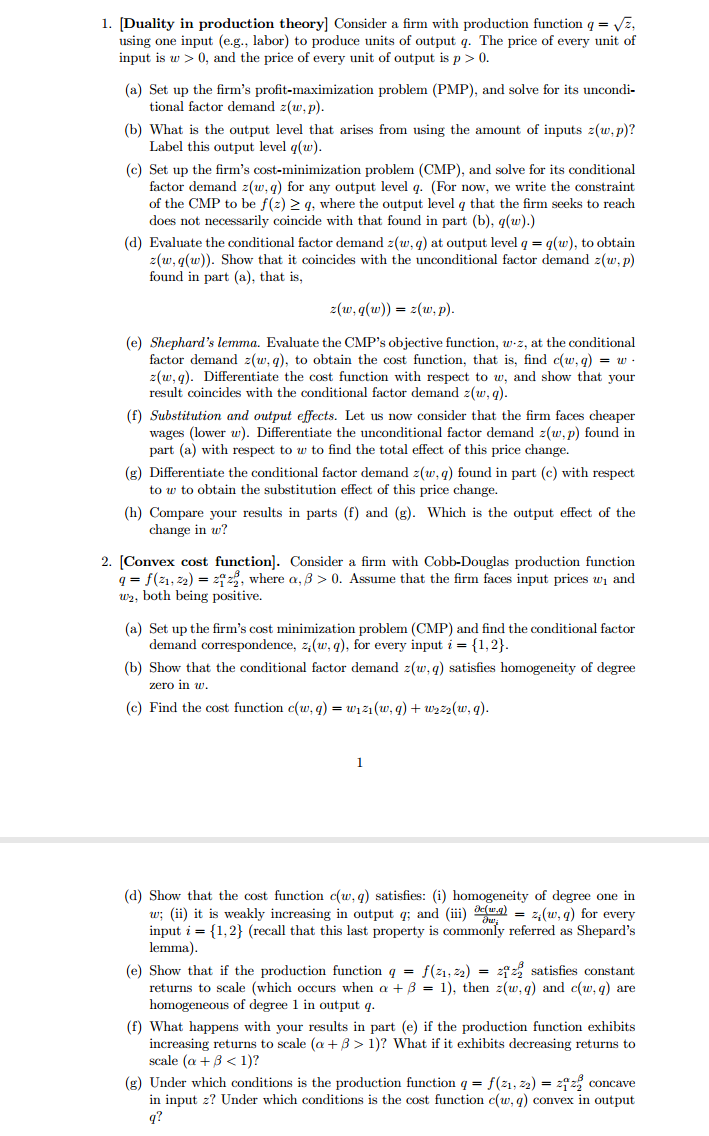

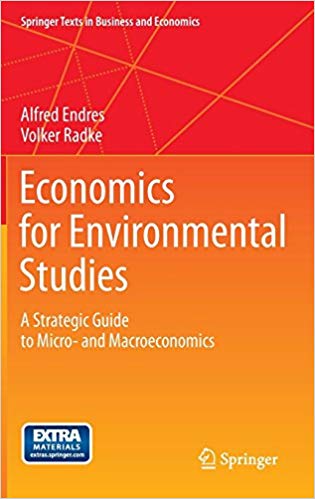

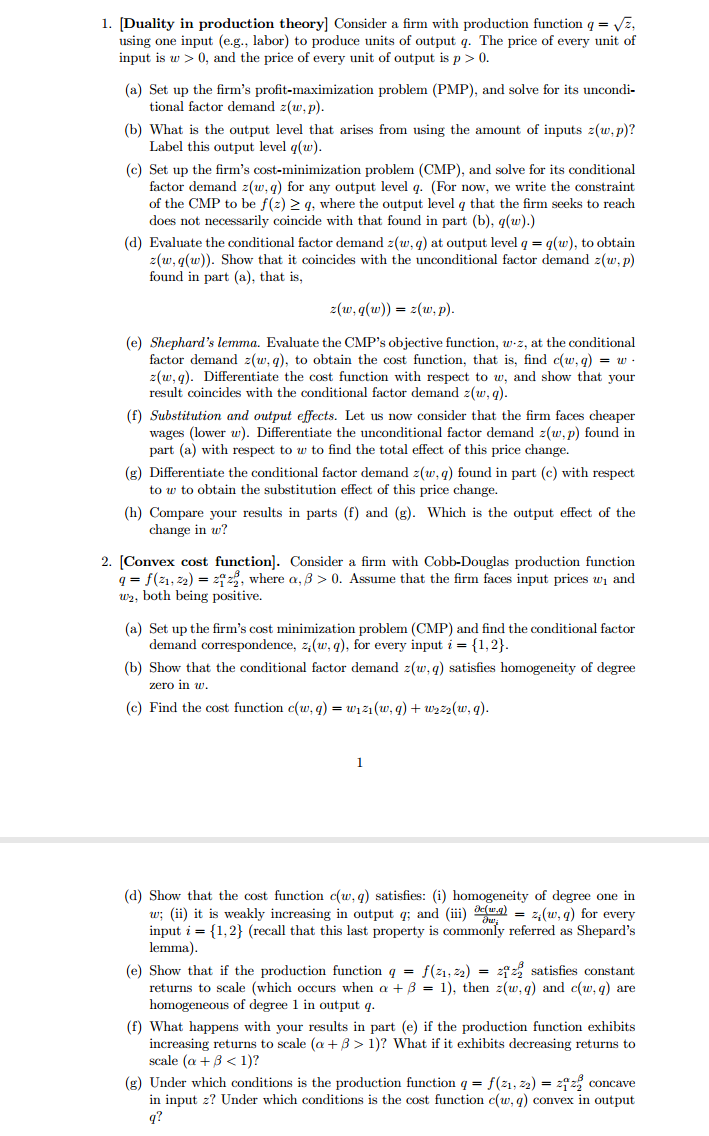

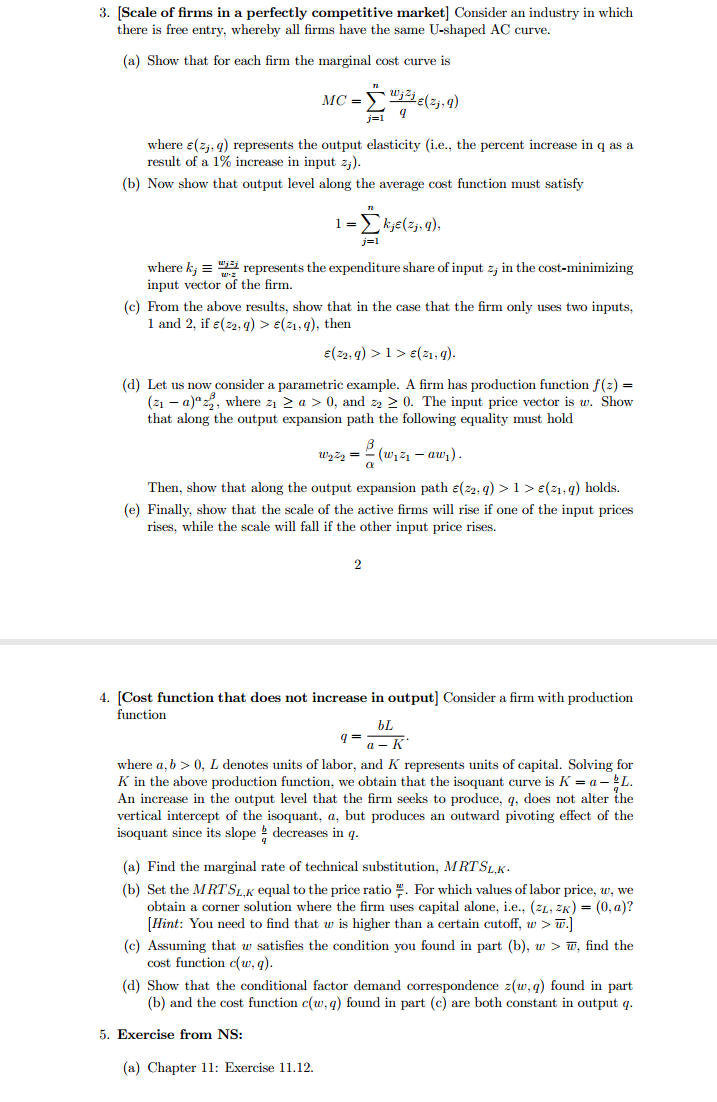

1. [Duality in production theory] Consider a firm with production function q = VE, using one input (e.g., labor) to produce units of output q. The price of every unit of input is w > 0, and the price of every unit of output is p > 0. (a) Set up the firm's profit-maximization problem (PMP), and solve for its uncondi- tional factor demand z(w, p). (b) What is the output level that arises from using the amount of inputs z(w,p)? Label this output level q(w). (c) Set up the firm's cost-minimization problem (CMP), and solve for its conditional factor demand z(w, q) for any output level q. (For now, we write the constraint of the CMP to be f(2) 2 q, where the output level q that the firm seeks to reach does not necessarily coincide with that found in part (b), q(w).) (d) Evaluate the conditional factor demand z(w, q) at output level q = q(w), to obtain z(w, q(w)). Show that it coincides with the unconditional factor demand z(w, p) found in part (a), that is, z( w, q(w)) = z(w, p)- (e) Shephard's lemma. Evaluate the CMP's objective function, w-z, at the conditional factor demand z(w, q), to obtain the cost function, that is, find c(w, q) = w . z(w, q). Differentiate the cost function with respect to w, and show that your result coincides with the conditional factor demand z(w, q). (f) Substitution and output effects. Let us now consider that the firm faces cheaper wages (lower w). Differentiate the unconditional factor demand z(w, p) found in part (a) with respect to w to find the total effect of this price change. (g) Differentiate the conditional factor demand z(w, q) found in part (c) with respect to w to obtain the substitution effect of this price change. (h) Compare your results in parts (f) and (g). Which is the output effect of the change in w? 2. [Convex cost function]. Consider a firm with Cobb-Douglas production function q = f(21, 22) = zizz, where a, B > 0. Assume that the firm faces input prices wn and w/2, both being positive. (a) Set up the firm's cost minimization problem (CMP) and find the conditional factor demand correspondence, z;(w, q), for every input i = {1, 2}. (b) Show that the conditional factor demand z(w, q) satisfies homogeneity of degree zero in w. (c) Find the cost function c(w, q) = wiz (w, q) + wazz(w, q). (d) Show that the cost function c(w, q) satisfies: (i) homogeneity of degree one in w; (ii) it is weakly increasing in output q; and (iii) down = z,(w, q) for every input i = {1,2} (recall that this last property is commonly referred as Shepard's lemma). (e) Show that if the production function q = f(21, 22) = zizz satisfies constant returns to scale (which occurs when o + 8 = 1), then z(w, q) and c(w, q) are homogeneous of degree 1 in output q. (f) What happens with your results in part (e) if the production function exhibits increasing returns to scale (a + 3 > 1)? What if it exhibits decreasing returns to scale (a + 8 E(21, q), then E(22, q) > 1 > =(21, q). (d) Let us now consider a parametric example. A firm has production function f ( z) = (21 - a)"22, where z1 2 a > 0, and z2 2 0. The input price vector is w. Show that along the output expansion path the following equality must hold Then, show that along the output expansion path z(22, q) > 1 > =(21, q) holds. (e) Finally, show that the scale of the active firms will rise if one of the input prices rises, while the scale will fall if the other input price rises. 2 4. [Cost function that does not increase in output] Consider a firm with production function bL 9= a - K' where a, b > 0, L denotes units of labor, and K represents units of capital. Solving for K in the above production function, we obtain that the isoquant curve is K = a - 2L. An increase in the output level that the firm seeks to produce, q, does not alter the vertical intercept of the isoquant, a, but produces an outward pivoting effect of the isoquant since its slope = decreases in q. (a) Find the marginal rate of technical substitution, MRTSL,K. (b) Set the MRTSL,x equal to the price ratio ". For which values of labor price, w, we obtain a corner solution where the firm uses capital alone, i.e., (zL, zK) = (0, a)? [Hint: You need to find that w is higher than a certain cutoff, w > w.] (c) Assuming that w satisfies the condition you found in part (b), w > w, find the cost function c(w, q). (d) Show that the conditional factor demand correspondence z(w, q) found in part (b) and the cost function c(w, q) found in part (c) are both constant in output q. 5. Exercise from NS: (a) Chapter 11: Exercise 11.12.2. Exercises from Rubinstein: (a) Lecture 7 (Expected utility): Exercises 4 and 5. (b) Lecture 8 (Risk): Exercise 6. 3. [Investment] An individual is an expected utility maximizer described by the in- tertemporally additive preference-scaling function u(co) + Bu(ci) where u(.) is a strictly concave function with u"(.). The individual has current income lo. The individual can buy bonds at unit price p = 8 which pay out in the next period one unit of consumption per unit of bond held. (a) Compare the individual's demand for bonds in the case where her future income is certain and equal to Jo, and the situation in which there is a 50% chance that her future income is Jo - and a 50% chance that her future income is Jo + z. (b) Show that the individual's demand for bonds (i.e., for "saving" ) is greater when she faces uncertain future income than when she faces certain future income. 4. [Hyperbolic Absolute Risk Aversion, HARA] Consider the family of utility func- tions with Hyperbolic Absolute Risk Aversion (HARA) as follows u(x) = 3-1 ( a + BI), where 8 0 and B # 1. Find the Arrow-Pratt coefficient of absolute risk-aversion, TA(r, u). Describe how it varies in parameters o and B. 5. [Non-constant coefficient of absolute risk aversion] Suppose that the utility function is given by u(w) = aw - biz, where a, b > 0, and w > 0 denotes income. (a) Find the coefficient of absolute risk-aversion, TA(w, u). Does it increase or decrease in wealth? Interpret. (b) Let us now consider that this decision maker is deciding how much to invest in a risky asset. This risky asset is a random variable R, with mean R > 0 and variance op. Assuming that his initial wealth is W, state the decision maker's expected utility maximization problem, and find first order conditions. (c) What is the optimal investment in risky assets? (d) Show that the optimal amount of investment in risky assets is a decreasing func- tion in wealth. Interpret