Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is about Valuation where the question is a rather simple one as you can see below. You may draw a Time Line

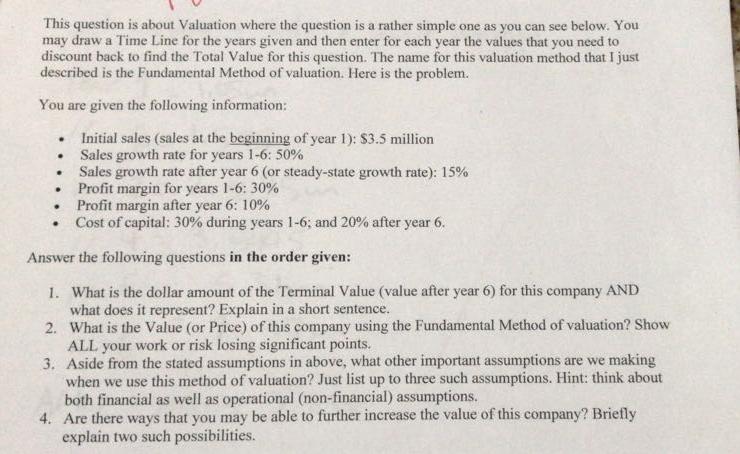

This question is about Valuation where the question is a rather simple one as you can see below. You may draw a Time Line for the years given and then enter for each year the values that you need to discount back to find the Total Value for this question. The name for this valuation method that I just described is the Fundamental Method of valuation. Here is the problem. You are given the following information: . . . . Initial sales (sales at the beginning of year 1): $3.5 million Sales growth rate for years 1-6: 50% Sales growth rate after year 6 (or steady-state growth rate): 15% Profit margin for years 1-6: 30% Profit margin after year 6: 10% Cost of capital: 30% during years 1-6; and 20% after year 6. Answer the following questions in the order given: 1. What is the dollar amount of the Terminal Value (value after year 6) for this company AND what does it represent? Explain in a short sentence. 2. What is the Value (or Price) of this company using the Fundamental Method of valuation? Show ALL your work or risk losing significant points. 3. Aside from the stated assumptions in above, what other important assumptions are we making when we use this method of valuation? Just list up to three such assumptions. Hint: think about both financial as well as operational (non-financial) assumptions. 4. Are there ways that you may be able to further increase the value of this company? Briefly explain two such possibilities.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 The dollar amount of the Terminal Value value after year 6 for this company is 500 million and it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started