Question

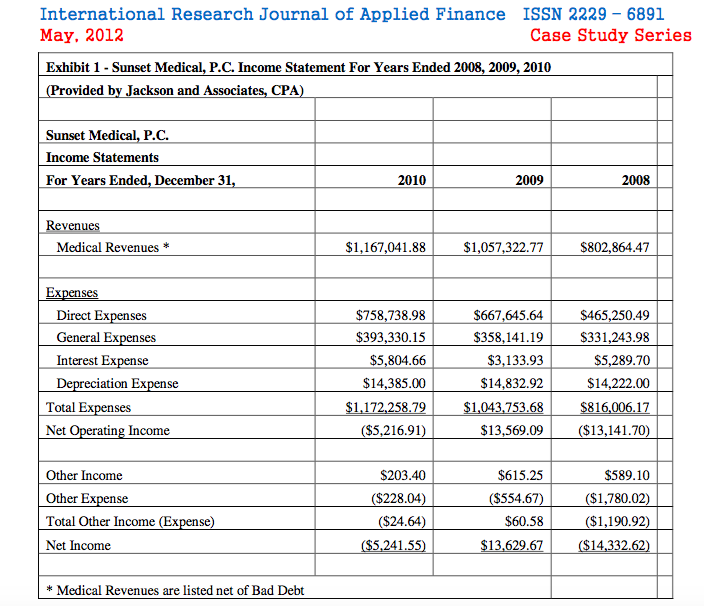

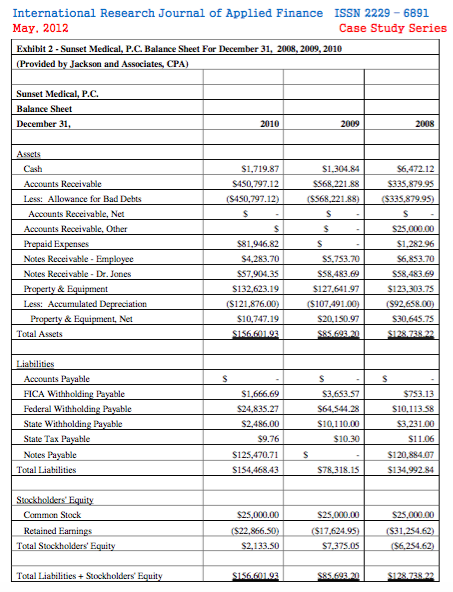

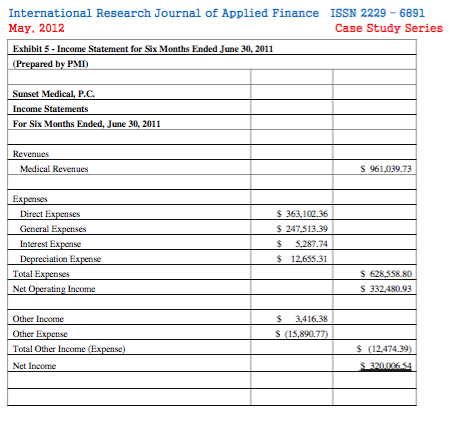

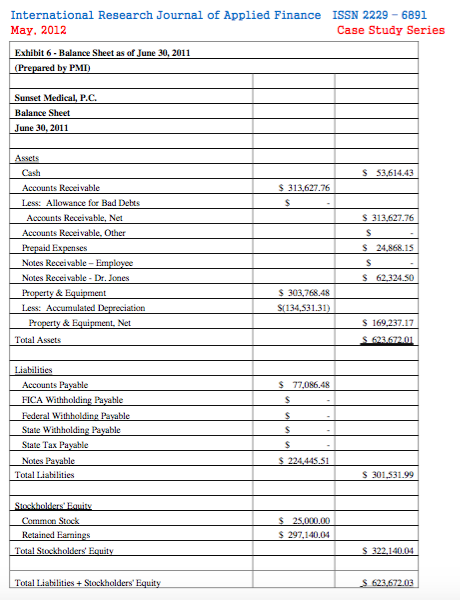

This question is anwered with the case found below. Examine the 2011 financial statements provided by PMI and the 2010 financial statements provided by Jackson

This question is anwered with the case found below.

Examine the 2011 financial statements provided by PMI and the 2010 financial statements provided by Jackson and Associates to answer the following.

A. Discuss the differences in the Financial Statements and the effect that these differences have on the Revenues and Receivables.

Abstract

Sunset Medical is based on a real situation occurring at an Orthopedic Medical practice in Colorado. While attending a trade show Dr. Jones, the managing partner at Sunset Medical, was approached by a medical consulting firm, Physicians Medical Inc. (PMI), to provide the practice billing and administrative services. Dr. Jones decided to hire PMI and signed a contract in February of 2011. Based on the interim financial statements that were released in June of 2011, Dr. Jones gave PMI control of the overall day to day operations of the practice. PMI immediately relieved the office manager of her duties and took over all operations of the practice. In early 2012, the 2011 financial statements were released and were not as impressive as the mid-year results. Dr. Jones is now worried that the increased power given to PMI may have been a mistake and has asked you to give a full assessment of the situation.

The case is suitable for an introductory Financial or Managerial Accounting class at the M.B.A. level once the students have a working knowledge of the financial statements. The students must critically evaluate contract language and financial statements to examine ethical dilemmas that face businesses.

International Research Journal of Applied Finance ISSN 2229-6891 Case Study Series May, 2012 Exhibit i-Sunset Medical, P.C. Income Statement For Years Ended 2008, 2009, 2010 ovided b Jackson and Associates, CPA Sunset Medical, P.C. Income Statements 2008 For Years Ended. December 31, 2010 2009 Revenues K 11670A1.88 $1,057,322.77 $802,864.47 Medical Revenues Expenses $758,738.98 $667,645.64 S465,250.49 Direct Expenses $358, 141.19 $393,330.15 S331,243.98 Interest Expense $14832.92 Depreciation Expense $14,385.00 $14,222.00 SI,043,753.68 $1.172,258.79 Total Expenses $816,006.17 ($521691 $13 569.00 ($13u 41.70 Net Operating Income $589.10 Other Income 22804) S554.61 1.780.02) Other Expense S60.58 1.190.92 Total other Income (Expense S24-642 LOSS 241,550 LS13 629,67 (S14,332.62 Net Income Medical Revenues are listed net of Bad Debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started