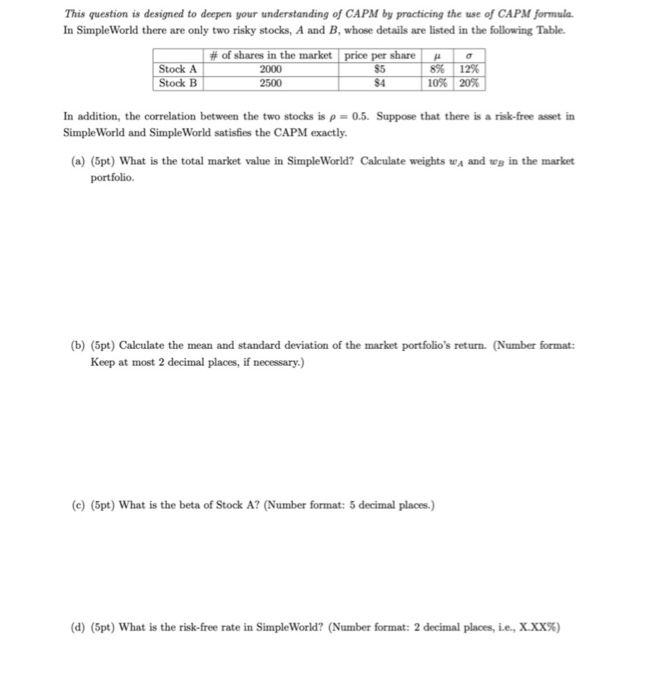

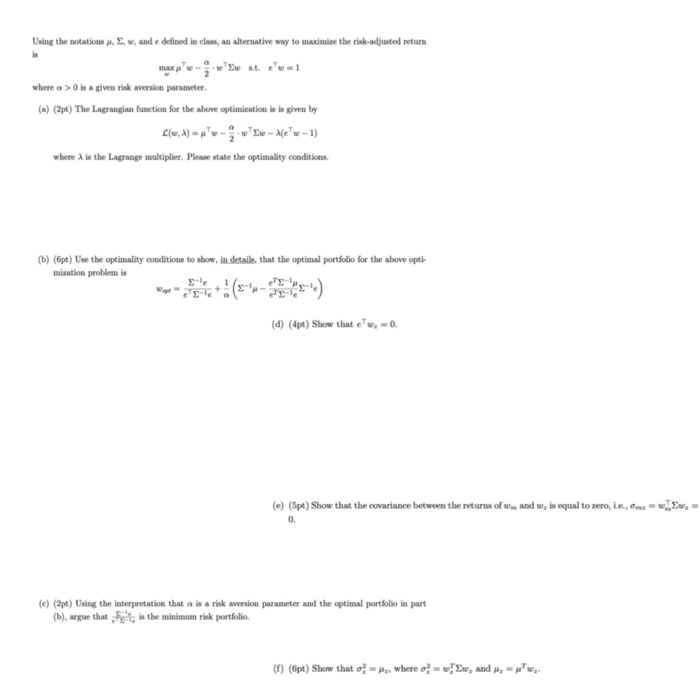

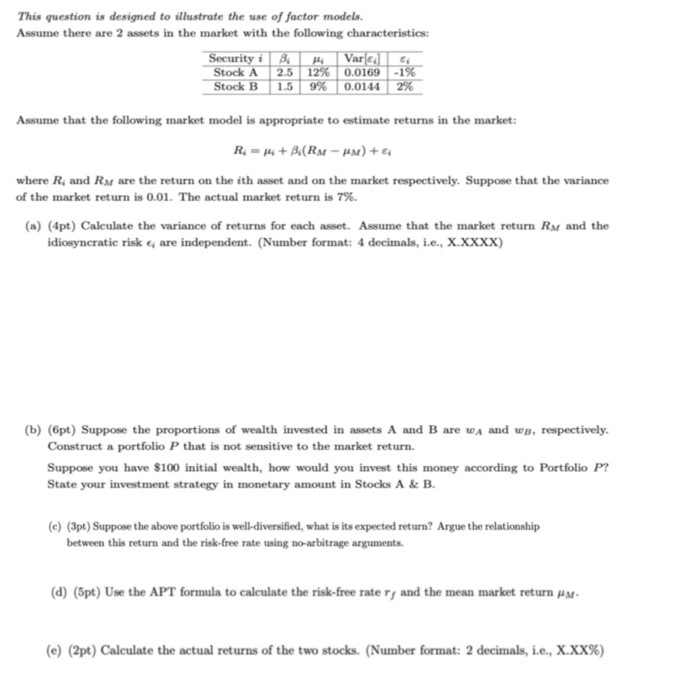

This question is designed to deepen your understanding of CAPM by practicing the use of CAPM formula. In Simple World there are only two risky stocks, A and B, whose details are listed in the following Table. # of shares in the market price per share Stock A $5 8% 12% Stock B 2500 $4 10% 20% 2000 In addition, the correlation between the two stocks is p = 0.5. Suppose that there is a risk-free asset in Simple World and Simple World satisfies the CAPM exactly. (a) (5pt) What is the total market value in Simple World? Calculate weights wA and wg in the market portfolio (b) (5pt) Calculate the mean and standard deviation of the market portfolio's return. (Number format: Keep at most 2 decimal places, if necessary.) (c) (5pt) What is the beta of Stock A? (Number format: 5 decimal places.) (d) (5pt) What is the risk-free rate in Simple World? (Number format: 2 decimal places, i.e., X.XX%) This exercise considers the solar panel enample discussed in class and provides further erplanations to various risk analysis methods MathSoe is considering a project to install solar panels on the MC roof. Information about costs and revenues are as follows: Initial cost - $1 mil. Annual operating costs = $10K Panels last 15 years, after which will be sold for scrap at $100K. As a pilot project, no more solar panel will be installed after 15 years. Upon successful installation, each sunny hour can generate $100 revenue. . Based on the weather forecasts, 1,500 sunny hours/yt is expected for the next 15 years. Assume that the appropriate discount rate is 10%. Ignore taxes. In class, we have calculated that, if the installation has zero cost and is successful, the NPV for this project NPV = -Simil+ (100H -S10K) 1-(1.1)-45 $100K based on the expected number of sunny hour 1 - 1,500hrs/year. Please answer the following questions based on the above information. (a) (9pt) Decision Tree: Suppose the installation may fail and the project terminates upon this failure. There are two installation options: A student intern can install the solar panel for free, but has a 50% chance of failure. . An experienced technician installs the solar panel for a fee, but has a 90% success rate. The installation n fee is paid up front and is non-refundable. What is the maximum installation fee that MathSoc is willing to pay to hire the technician? 0.1 (1.1)* = $88,790 (b) (pt) Monte Carlo Simulation: Suppose the number of sunny hours per year follows a normal distribution with mean y = 1,500 and variance o2 = 500. Use the following method to calculate the expected NPV of the solar panel project: (a) (3pt) Recall that the NPV of the project is NPV --$lmil+ (100H - $10K) * 1-(1.1)-15 $100K (1.1)15 which has become a random variable because the number of sunny hour per year, i.e., H, is now random. Please calculate the expected value of the NPV exactly. (Hint: If X is a random variable and a & b are constants, then ElaX + b] = E[X] + b.) 0.1 (b) (3pt) Please calculate the variance of the NPV exactly. (Hint: If X is a random variable and a & b are constants, then VaraX+b] = 'Var[x].) Using the notations , , w, and e defined in class, an alternative way to maximize the risk-adjusted return v'w ste'w? where a > 0 is a given risk version parameter (a) (?pt) The Lagrangian function for the above optimization is is given by C(0, 1) = w- "Eu - Me'w - 1) where A is the Lagrange multiplier. Please state the optimality conditions. (b) (pt) Use the optimality conditions to show, in details, that the optimal portfolio for the above opti- mization problem is (d) (dpt) Show that e'w,-0. () (5pt) Show that the covariance between the returns of wm and w, is equal to zero, ie., O. 0. (e) (2pt) Using the interpretation that a is a risk version parameter and the optimal portfolio in part (b), argue that is the minimum risk portfolio (E) (pt) Show that o - , where ow! Ew, and With only 2 risky assets, we derived the following minimum-risk portfolio: o - PO MOB o - 2po foto wj = 1 - w We also used the Lagrangian method to solve the mean-variance portfolio optimization problem and arrive at the following solution: Wapt =Wm+w, where wm-se and w, = 9-14 (a) (8pt) Consider two risky assets with the following risk/return parameters A B 8% 10% 20% 25% For each of the following values of the correlation coefficient p, calculate The minimum risk portfolio characterized by weights w; & wj; The expected return and standard deviation of the minimum risk portfolio If you have $100 cash, how much should you invest in each of the two assets? (1) (dpt) p= -1 (ii) (4pt) p = 1 In subsequent questions, assume p = 0.5. Keep 4 decimal places for all calculations & answers. (b) (5pt) State the expected return vector and the variance-covariance matrix E, then calculate its inverse - Keep all decimals for and E. Keep 5 decimals for S-1 (e) (Spt) Use the - in part (b) and the solution of the Markowitz's optimization problem to calculate the minimum risk portfolio w.. Keep 5 decimals in all calculations and final answer. (d) (2pt) Use the two-asset formulas for w; & wg to calculate the minimum-risk portfolio. (Hint: The answer for this part should match that of part (c).) This question is designed to illustrate the use of factor models. Assume there are 2 assets in the market with the following characteristics: Security i BiH Varle.lt Stock A 2.5 12% 0.0169 -1% Stock B 1.5 9% 0.0144 2% Assume that the following market model is appropriate to estimate returns in the market: R: =Hi+B(RM-M) + where R. and Rm are the return on the ith asset and on the market respectively. Suppose that the variance of the market return is 0.01. The actual market return is 7%. (a) (4pt) Calculate the variance of returns for each asset. Assume that the market return RM and the idiosyncratic risk are independent. (Number format: 4 decimals, i.e., X.XXXX) (b) (pt) Suppose the proportions of wealth invested in assets A and B are wA and wB, respectively. Construct a portfolio P that is not sensitive to the market return. Suppose you have $100 initial wealth, how would you invest this money according to Portfolio P? State your investment strategy in monetary amount in Stocks A & B. () (3pt) Suppose the above portfolio is well-diversified, what is its expected return? Argue the relationship between this return and the risk-free rate using no-arbitrage arguments. (d) (5pt) Use the APT formula to calculate the risk-free rate ry and the mean market return M. (e) (2pt) Calculate the actual returns of the two stocks. (Number format: 2 decimals, i.e., X.XX%) This question is designed to deepen your understanding of CAPM by practicing the use of CAPM formula. In Simple World there are only two risky stocks, A and B, whose details are listed in the following Table. # of shares in the market price per share Stock A $5 8% 12% Stock B 2500 $4 10% 20% 2000 In addition, the correlation between the two stocks is p = 0.5. Suppose that there is a risk-free asset in Simple World and Simple World satisfies the CAPM exactly. (a) (5pt) What is the total market value in Simple World? Calculate weights wA and wg in the market portfolio (b) (5pt) Calculate the mean and standard deviation of the market portfolio's return. (Number format: Keep at most 2 decimal places, if necessary.) (c) (5pt) What is the beta of Stock A? (Number format: 5 decimal places.) (d) (5pt) What is the risk-free rate in Simple World? (Number format: 2 decimal places, i.e., X.XX%) This exercise considers the solar panel enample discussed in class and provides further erplanations to various risk analysis methods MathSoe is considering a project to install solar panels on the MC roof. Information about costs and revenues are as follows: Initial cost - $1 mil. Annual operating costs = $10K Panels last 15 years, after which will be sold for scrap at $100K. As a pilot project, no more solar panel will be installed after 15 years. Upon successful installation, each sunny hour can generate $100 revenue. . Based on the weather forecasts, 1,500 sunny hours/yt is expected for the next 15 years. Assume that the appropriate discount rate is 10%. Ignore taxes. In class, we have calculated that, if the installation has zero cost and is successful, the NPV for this project NPV = -Simil+ (100H -S10K) 1-(1.1)-45 $100K based on the expected number of sunny hour 1 - 1,500hrs/year. Please answer the following questions based on the above information. (a) (9pt) Decision Tree: Suppose the installation may fail and the project terminates upon this failure. There are two installation options: A student intern can install the solar panel for free, but has a 50% chance of failure. . An experienced technician installs the solar panel for a fee, but has a 90% success rate. The installation n fee is paid up front and is non-refundable. What is the maximum installation fee that MathSoc is willing to pay to hire the technician? 0.1 (1.1)* = $88,790 (b) (pt) Monte Carlo Simulation: Suppose the number of sunny hours per year follows a normal distribution with mean y = 1,500 and variance o2 = 500. Use the following method to calculate the expected NPV of the solar panel project: (a) (3pt) Recall that the NPV of the project is NPV --$lmil+ (100H - $10K) * 1-(1.1)-15 $100K (1.1)15 which has become a random variable because the number of sunny hour per year, i.e., H, is now random. Please calculate the expected value of the NPV exactly. (Hint: If X is a random variable and a & b are constants, then ElaX + b] = E[X] + b.) 0.1 (b) (3pt) Please calculate the variance of the NPV exactly. (Hint: If X is a random variable and a & b are constants, then VaraX+b] = 'Var[x].) Using the notations , , w, and e defined in class, an alternative way to maximize the risk-adjusted return v'w ste'w? where a > 0 is a given risk version parameter (a) (?pt) The Lagrangian function for the above optimization is is given by C(0, 1) = w- "Eu - Me'w - 1) where A is the Lagrange multiplier. Please state the optimality conditions. (b) (pt) Use the optimality conditions to show, in details, that the optimal portfolio for the above opti- mization problem is (d) (dpt) Show that e'w,-0. () (5pt) Show that the covariance between the returns of wm and w, is equal to zero, ie., O. 0. (e) (2pt) Using the interpretation that a is a risk version parameter and the optimal portfolio in part (b), argue that is the minimum risk portfolio (E) (pt) Show that o - , where ow! Ew, and With only 2 risky assets, we derived the following minimum-risk portfolio: o - PO MOB o - 2po foto wj = 1 - w We also used the Lagrangian method to solve the mean-variance portfolio optimization problem and arrive at the following solution: Wapt =Wm+w, where wm-se and w, = 9-14 (a) (8pt) Consider two risky assets with the following risk/return parameters A B 8% 10% 20% 25% For each of the following values of the correlation coefficient p, calculate The minimum risk portfolio characterized by weights w; & wj; The expected return and standard deviation of the minimum risk portfolio If you have $100 cash, how much should you invest in each of the two assets? (1) (dpt) p= -1 (ii) (4pt) p = 1 In subsequent questions, assume p = 0.5. Keep 4 decimal places for all calculations & answers. (b) (5pt) State the expected return vector and the variance-covariance matrix E, then calculate its inverse - Keep all decimals for and E. Keep 5 decimals for S-1 (e) (Spt) Use the - in part (b) and the solution of the Markowitz's optimization problem to calculate the minimum risk portfolio w.. Keep 5 decimals in all calculations and final answer. (d) (2pt) Use the two-asset formulas for w; & wg to calculate the minimum-risk portfolio. (Hint: The answer for this part should match that of part (c).) This question is designed to illustrate the use of factor models. Assume there are 2 assets in the market with the following characteristics: Security i BiH Varle.lt Stock A 2.5 12% 0.0169 -1% Stock B 1.5 9% 0.0144 2% Assume that the following market model is appropriate to estimate returns in the market: R: =Hi+B(RM-M) + where R. and Rm are the return on the ith asset and on the market respectively. Suppose that the variance of the market return is 0.01. The actual market return is 7%. (a) (4pt) Calculate the variance of returns for each asset. Assume that the market return RM and the idiosyncratic risk are independent. (Number format: 4 decimals, i.e., X.XXXX) (b) (pt) Suppose the proportions of wealth invested in assets A and B are wA and wB, respectively. Construct a portfolio P that is not sensitive to the market return. Suppose you have $100 initial wealth, how would you invest this money according to Portfolio P? State your investment strategy in monetary amount in Stocks A & B. () (3pt) Suppose the above portfolio is well-diversified, what is its expected return? Argue the relationship between this return and the risk-free rate using no-arbitrage arguments. (d) (5pt) Use the APT formula to calculate the risk-free rate ry and the mean market return M. (e) (2pt) Calculate the actual returns of the two stocks. (Number format: 2 decimals, i.e., X.XX%)