Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this question is from investment and portfolio analysis. plz mention the formulas while solving this math so that i can understand the procedure to solve

this question is from investment and portfolio analysis. plz mention the formulas while solving this math so that i can understand the procedure to solve it.

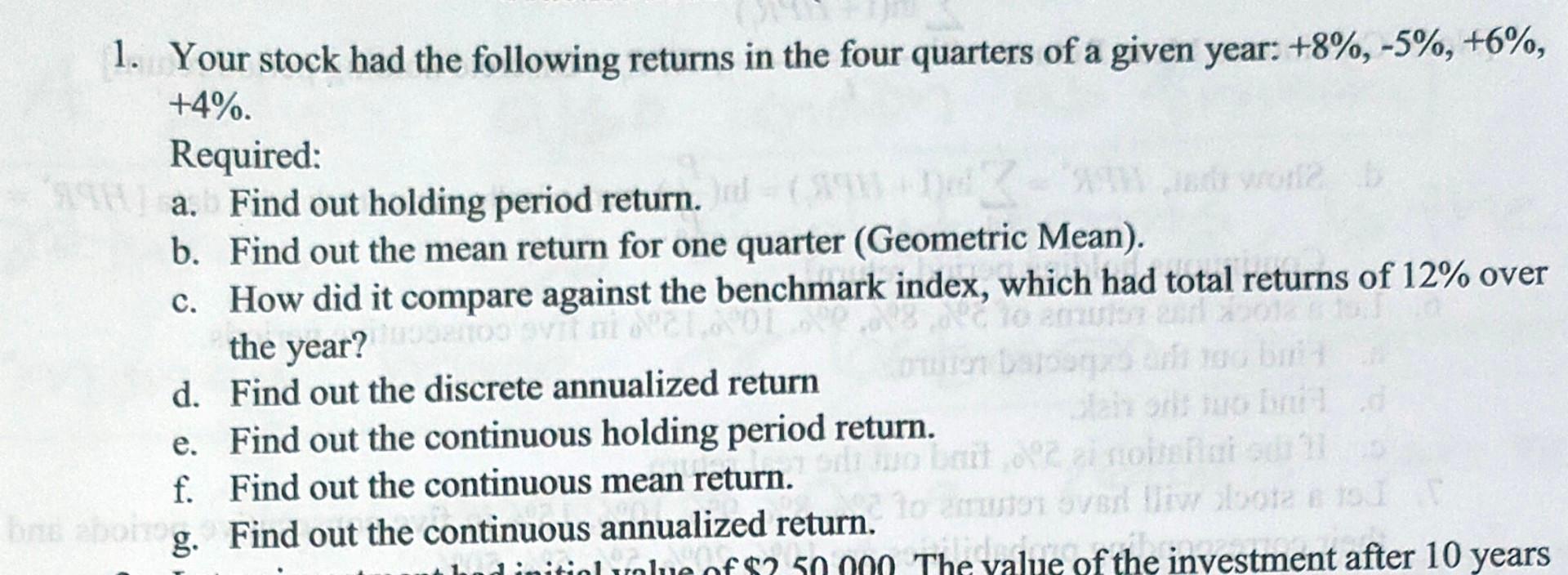

1. Your stock had the following returns in the four quarters of a given year: +8%, -5%, +6%, +4%. Required: a. Find out holding period return. var b. Find out the mean return for one quarter (Geometric Mean). c. How did it compare against the benchmark index, which had total returns of 12% over the year? CY d. Find out the discrete annualized return ollut e. Find out the continuous holding period return. f. Find out the continuous mean return. Laitoa noite tomutot SA w latau g. Find out the continuous annualized return. mlue of $ 50 000 The value of the investment after 10 years against the ben 1. Your stock had the following returns in the four quarters of a given year: +8%, -5%, +6%, +4%. Required: a. Find out holding period return. var b. Find out the mean return for one quarter (Geometric Mean). c. How did it compare against the benchmark index, which had total returns of 12% over the year? CY d. Find out the discrete annualized return ollut e. Find out the continuous holding period return. f. Find out the continuous mean return. Laitoa noite tomutot SA w latau g. Find out the continuous annualized return. mlue of $ 50 000 The value of the investment after 10 years against the benStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started