Question

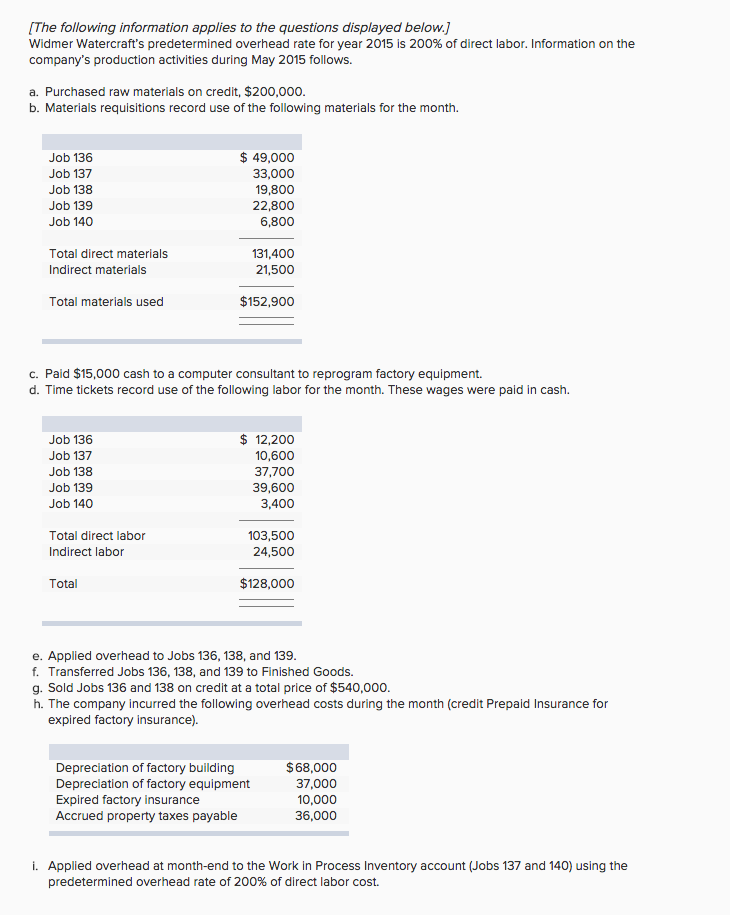

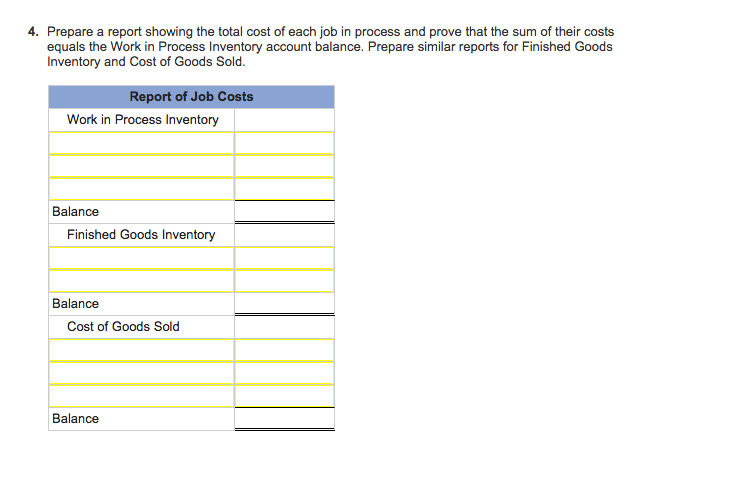

This question is hard for me, could someone help please. Journal entries a-i. 1. Already shown. (a) 2. Record the requisition of direct and indirect

This question is hard for me, could someone help please.

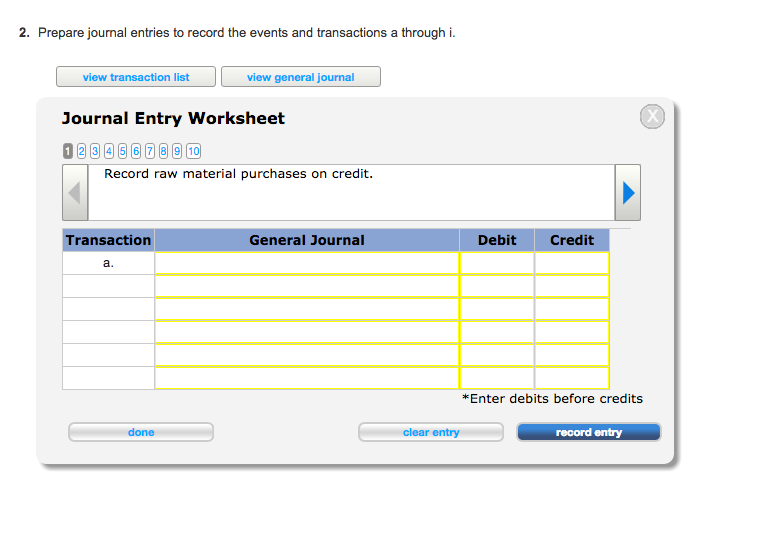

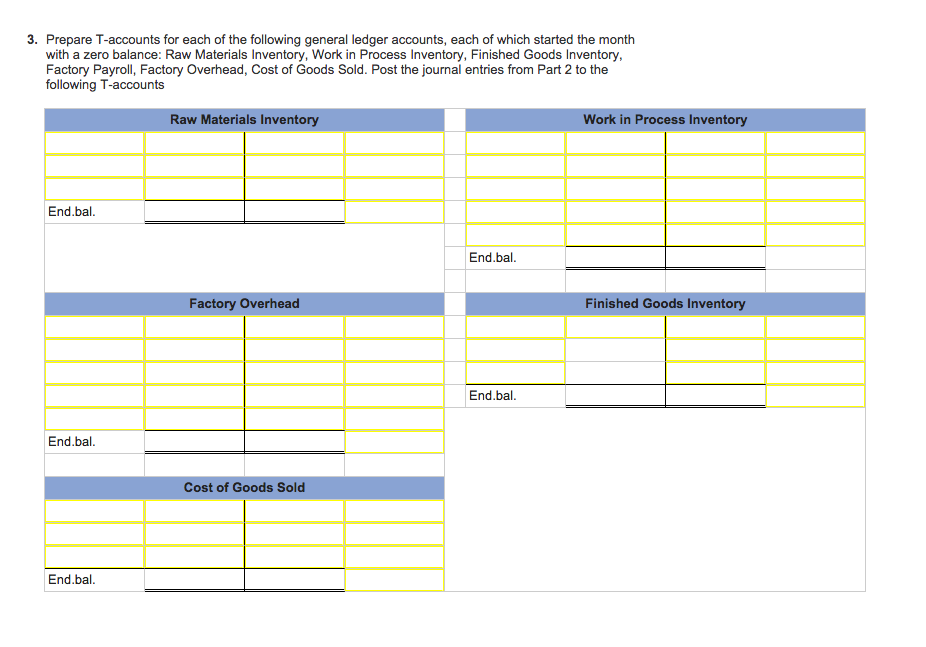

Journal entries a-i.

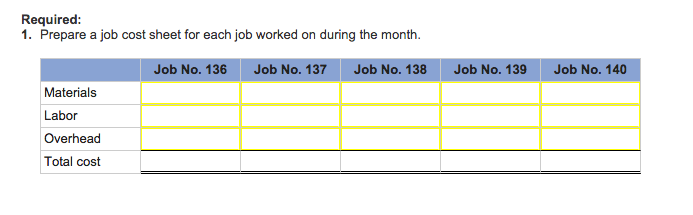

1. Already shown. (a)

2. Record the requisition of direct and indirect materials. (b)

3. Record payment to computer consultant to reprogram factory equipment. (c)

4. Record the entry for direct and indirect labor, paid in cash. (d)

5. Record the entry to apply overhead to jobs 136, 138 and 139. (e)

6. Record the transfer of completed jobs 136,138 and 139 to finished goods. (f)

7. Record the entry for sales on account for Jobs 136 and 138. (g1)

8. Record the entry for the cost of sales of Jobs 136 and 138. (g2)

9. Record other factory overhead (depreciation, insurance and property taxes). (h)

10. Record the entry to apply overhead to Jobs 137 and 140 (Work in Process). (i)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started