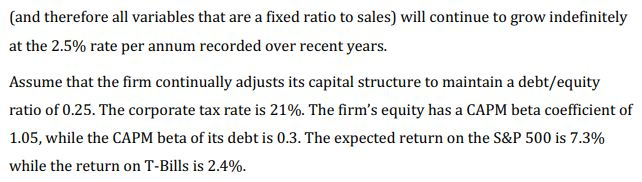

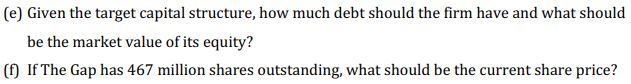

This question is inspired by" Problem 1 on the final Accepi Practice Problem set (the problem has been simplified a little and some details changed). The question relates to the retail store The Gap. Employees, store space, inventories and costs of goods sold scale with sales in many retail businesses. In this problem, the variables are all assumed to be fixed ratios to sales. Also, we assume that all components of the cash flow have the same risk as sales, and therefore are all discounted at the same risk-adjusted rate. Specifically, assume that operating costs are 67% of sales, fixed assets (primarily stores) are 20% of sales, annual depreciation allowances are 3% of sales, and net working capital (predominantly inventory) is 15% of sales. Assume that the annual growth rate of sales and therefore all variables that are a fixed ratio to sales) will continue to grow indefinitely at the 2.5% rate per annum recorded over recent years. Assume that the firm continually adjusts its capital structure to maintain a debt/equity ratio of 0.25. The corporate tax rate is 21%. The firm's equity has a CAPM beta coefficient of 1.05, while the CAPM beta of its debt is 0.3. The expected return on the S&P 500 is 7.3% while the return on T-Bills is 2.4%. (e) Given the target capital structure, how much debt should the firm have and what should be the market value of its equity? (1) If The Gap has 467 million shares outstanding, what should be the current share price? This question is inspired by" Problem 1 on the final Accepi Practice Problem set (the problem has been simplified a little and some details changed). The question relates to the retail store The Gap. Employees, store space, inventories and costs of goods sold scale with sales in many retail businesses. In this problem, the variables are all assumed to be fixed ratios to sales. Also, we assume that all components of the cash flow have the same risk as sales, and therefore are all discounted at the same risk-adjusted rate. Specifically, assume that operating costs are 67% of sales, fixed assets (primarily stores) are 20% of sales, annual depreciation allowances are 3% of sales, and net working capital (predominantly inventory) is 15% of sales. Assume that the annual growth rate of sales and therefore all variables that are a fixed ratio to sales) will continue to grow indefinitely at the 2.5% rate per annum recorded over recent years. Assume that the firm continually adjusts its capital structure to maintain a debt/equity ratio of 0.25. The corporate tax rate is 21%. The firm's equity has a CAPM beta coefficient of 1.05, while the CAPM beta of its debt is 0.3. The expected return on the S&P 500 is 7.3% while the return on T-Bills is 2.4%. (e) Given the target capital structure, how much debt should the firm have and what should be the market value of its equity? (1) If The Gap has 467 million shares outstanding, what should be the current share price