Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is long and it has 2 parts, so I will upload 2 photos! Please solve all problems (A, B, C, D, as well

This question is long and it has 2 parts, so I will upload 2 photos! Please solve all problems (A, B, C, D, as well as the first question in part 1 and the last question in part 2) Please show work and not just the solution! Thanks

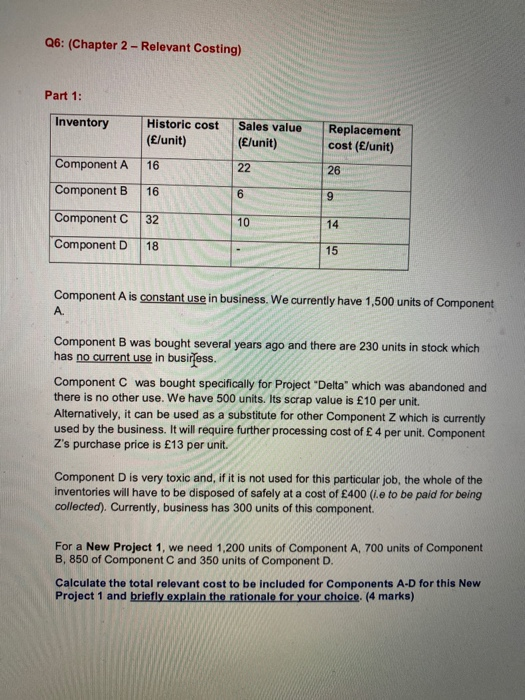

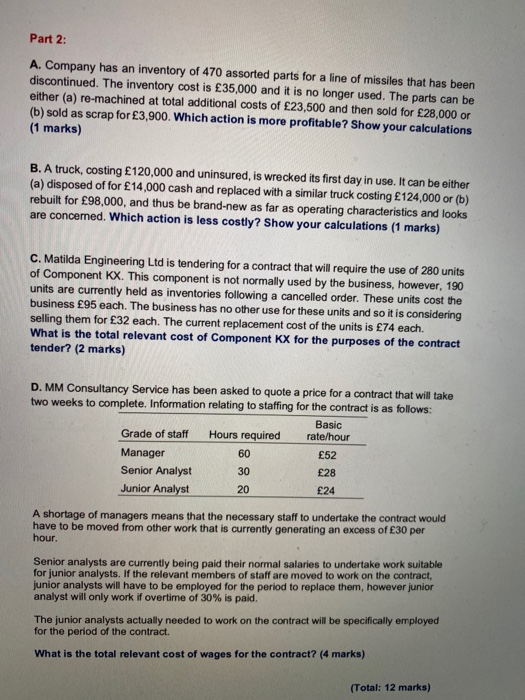

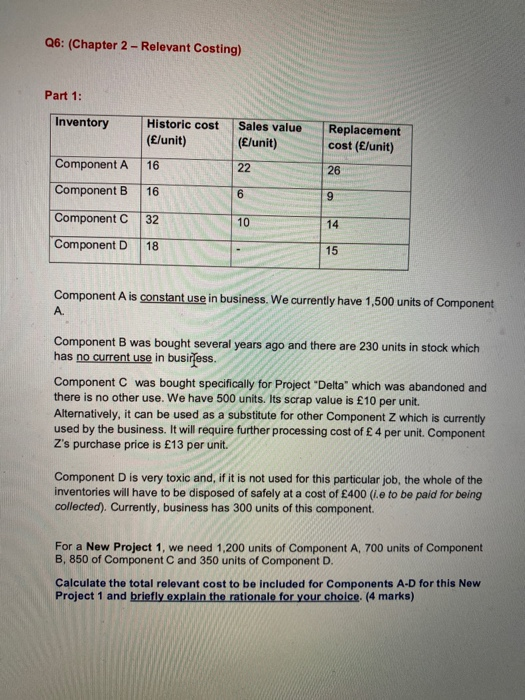

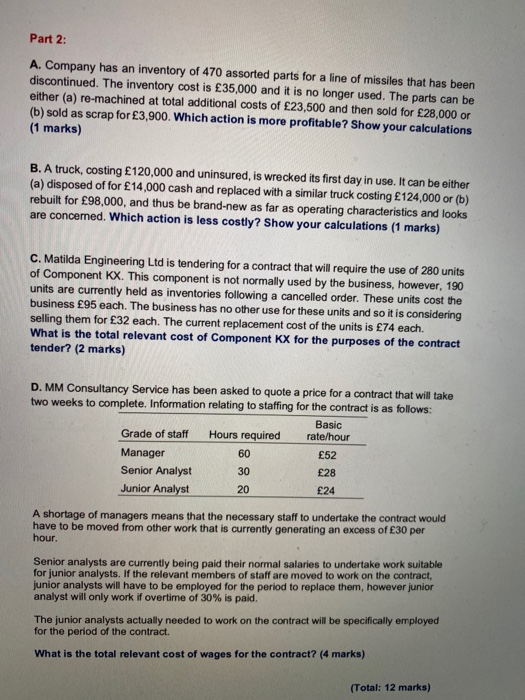

Q6: (Chapter 2 - Relevant Costing) Part 1: Inventory Historic cost (/unit) Sales value (/unit) Replacement cost (/unit) Component A 16 22 26 Component B 16 6 9 32 10 14 Component Component D 18 15 Component A is constant use in business. We currently have 1,500 units of Component A Component B was bought several years ago and there are 230 units in stock which has no current use in busiress. Component C was bought specifically for Project "Delta" which was abandoned and there is no other use. We have 500 units. Its scrap value is 10 per unit. Alternatively, it can be used as a substitute for other Component Z which is currently used by the business. It will require further processing cost of 4 per unit. Component Z's purchase price is 13 per unit. Component Dis very toxic and, if it is not used for this particular job, the whole of the inventories will have to be disposed of safely at a cost of 400 (i.e to be paid for being collected). Currently, business has 300 units of this component For a New Project 1, we need 1,200 units of Component A, 700 units of Component B, 850 of Component C and 350 units of Component D. Calculate the total relevant cost to be included for Components A-D for this New Project 1 and briefly explain the rationale for your choice. (4 marks) Part 2: A. Company has an inventory of 470 assorted parts for a line of missiles that has been discontinued. The inventory cost is 35,000 and it is no longer used. The parts can be either (a) re-machined at total additional costs of 23,500 and then sold for 28,000 or (b) sold as scrap for 3,900. Which action is more profitable? Show your calculations (1 marks) B. A truck, costing 120,000 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for 14,000 cash and replaced with a similar truck costing 124,000 or (b) rebuilt for 98,000, and thus be brand-new as far as operating characteristics and looks are concerned. Which action is less costly? Show your calculations (1 marks) C. Matilda Engineering Ltd is tendering for a contract that will require the use of 280 units of Component KX. This component is not normally used by the business, however, 190 units are currently held as inventories following a cancelled order. These units cost the business 95 each. The business has no other use for these units and so it is considering selling them for 32 each. The current replacement cost of the units is 74 each. What is the total relevant cost of Component KX for the purposes of the contract tender? (2 marks) D. MM Consultancy Service has been asked to quote a price for a contract that will take two weeks to complete. Information relating to staffing for the contract is as follows: Basic Grade of staff Hours required rate/hour Manager 60 52 Senior Analyst 30 Junior Analyst 20 24 A shortage of managers means that the necessary staff to undertake the contract would have to be moved from other work that is currently generating an excess of 30 per hour. 28 Senior analysts are currently being paid their normal salaries to undertake work suitable for junior analysts. If the relevant members of staff are moved to work on the contract, junior analysts will have to be employed for the period to replace them, however junior analyst will only work if overtime of 30% is paid The junior analysts actually needed to work on the contract will be specifically employed for the period of the contract. What is the total relevant cost of wages for the contract? (4 marks) (Total: 12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started