Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question was incorrectly answered the first time I sent it! Thank you for answering, answers are at the top! Raollearllt.LIquidation of a partnership L05

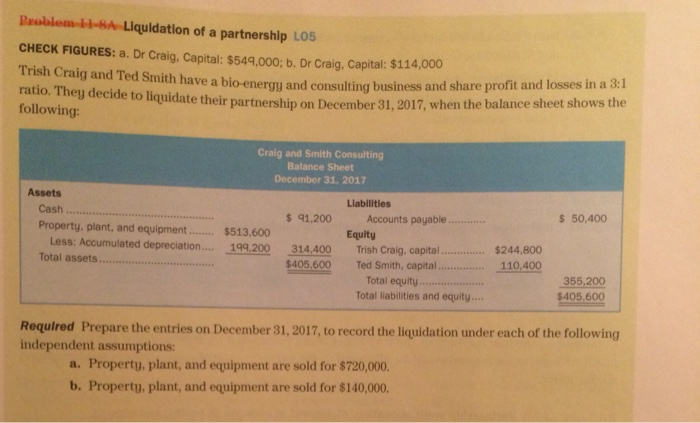

This question was incorrectly answered the first time I sent it! Thank you for answering, answers are at the top!  Raollearllt.LIquidation of a partnership L05 CHECK FIGURES: a. Dr Craig, Capital: $549,000; b. Dr Craig, Capital: $114,000 ratio. They decide to liquidate their partnership on December 31, 2017, when the t have a bio-energy and consulting business and share profit and losses in a 3:1 following Craig and Smith Consulting Balance Sheet December 31, 2017 Assets Cash Liabilities 50,400 1.200 Accounts payable... Equity ed depreciation.... 199.200 314.400 Trish Craig, capital...$244,800 $405.600 Ted Smith, capital. 110.400 Total assets Total equity. 355.200 Total liabilities and equity... $405,600 Required Prepare the entries on December 31, 2017, to record the liquidation under each of the following independent assumptions: a. Property, plant, and equipment are sold for $720,000. b. Property, plant, and equipment are sold for $140,000

Raollearllt.LIquidation of a partnership L05 CHECK FIGURES: a. Dr Craig, Capital: $549,000; b. Dr Craig, Capital: $114,000 ratio. They decide to liquidate their partnership on December 31, 2017, when the t have a bio-energy and consulting business and share profit and losses in a 3:1 following Craig and Smith Consulting Balance Sheet December 31, 2017 Assets Cash Liabilities 50,400 1.200 Accounts payable... Equity ed depreciation.... 199.200 314.400 Trish Craig, capital...$244,800 $405.600 Ted Smith, capital. 110.400 Total assets Total equity. 355.200 Total liabilities and equity... $405,600 Required Prepare the entries on December 31, 2017, to record the liquidation under each of the following independent assumptions: a. Property, plant, and equipment are sold for $720,000. b. Property, plant, and equipment are sold for $140,000

This question was incorrectly answered the first time I sent it! Thank you for answering, answers are at the top!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started