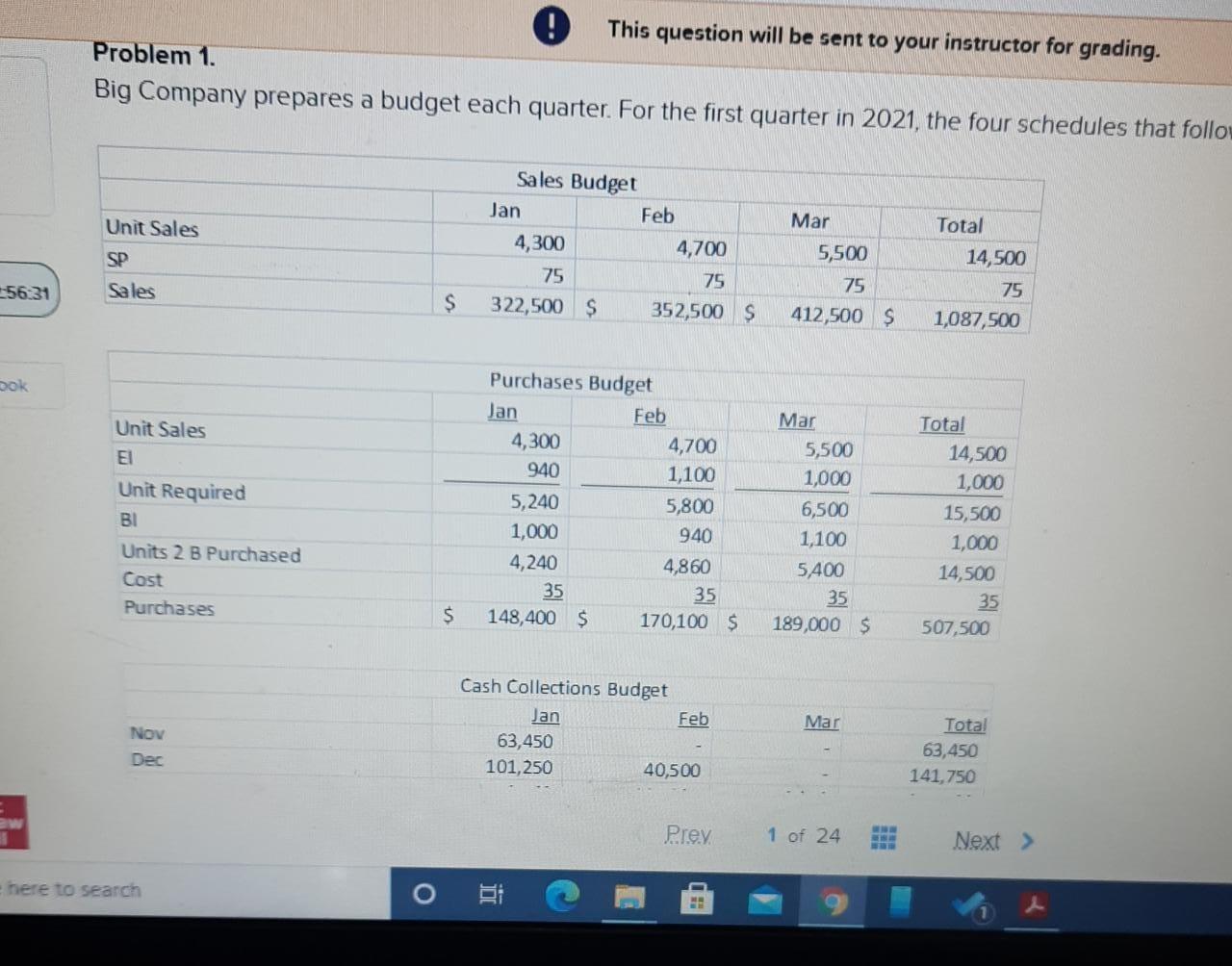

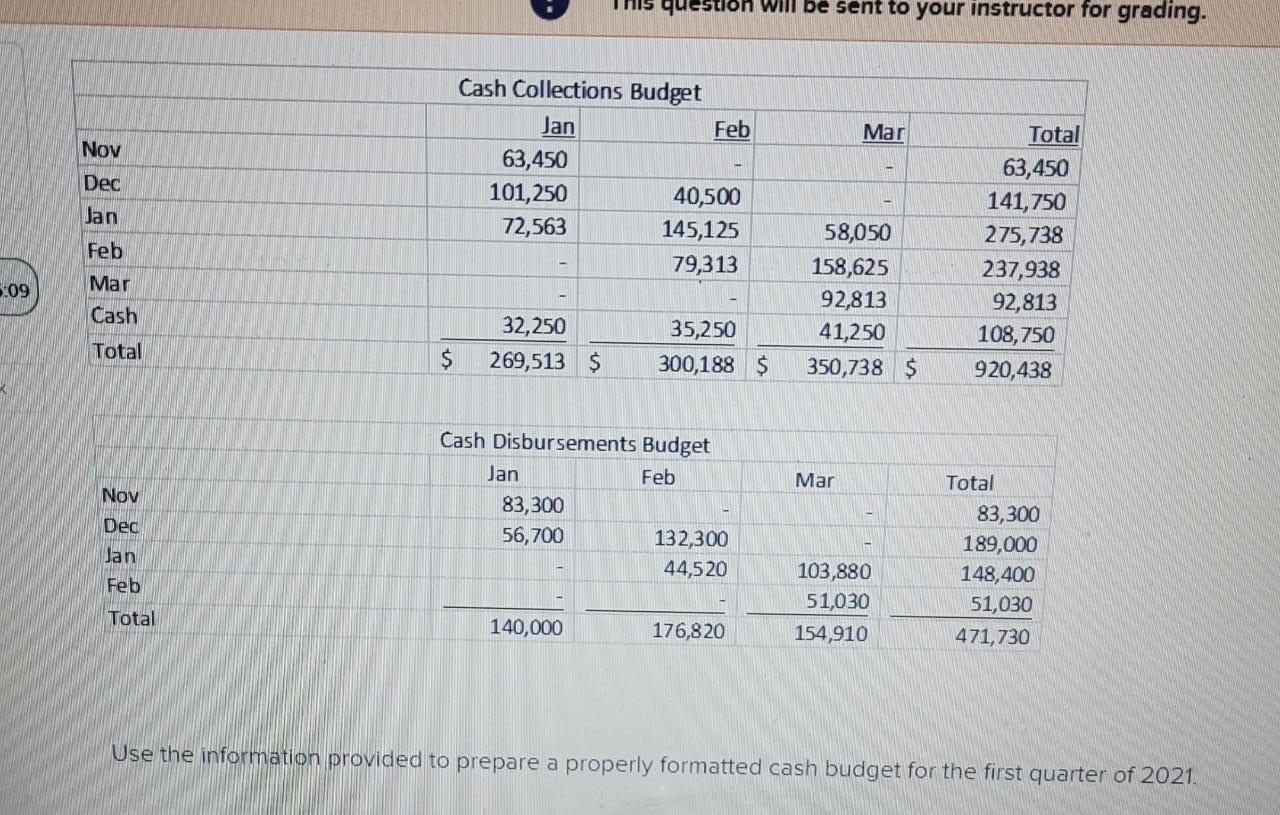

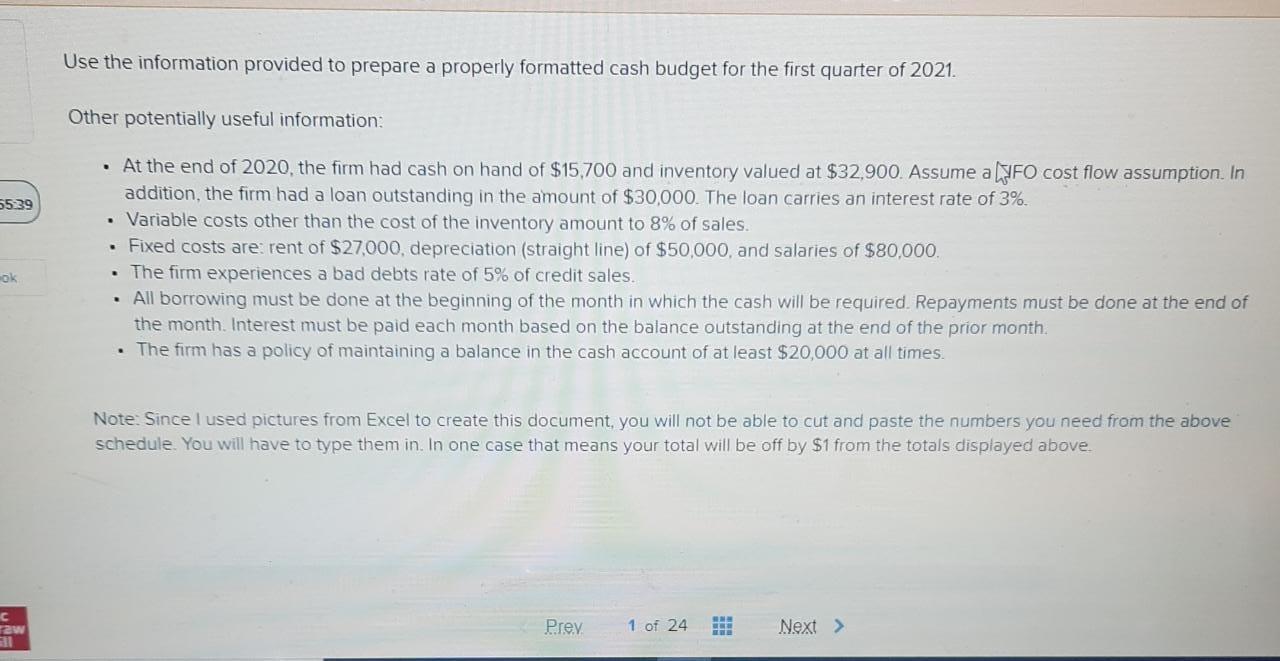

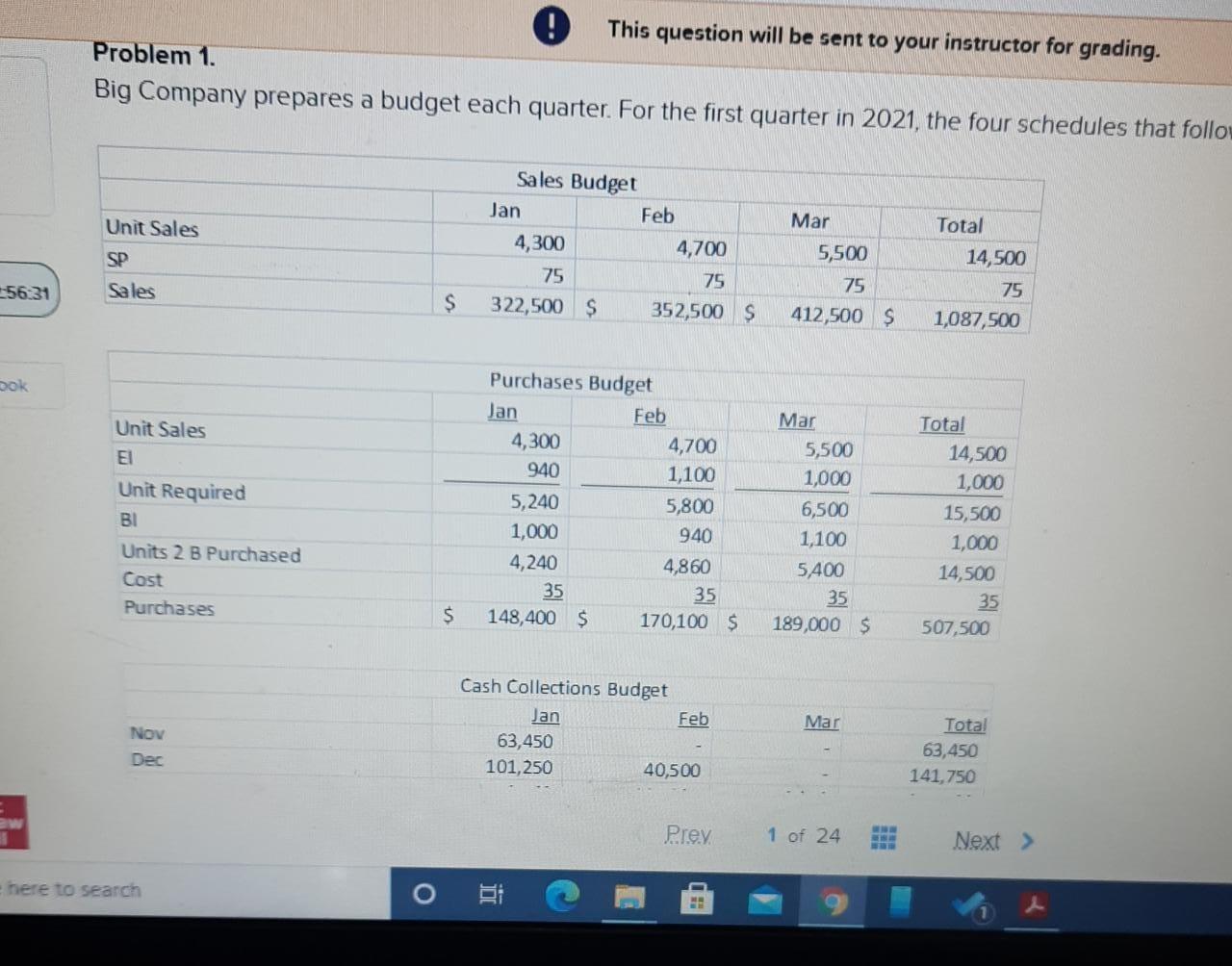

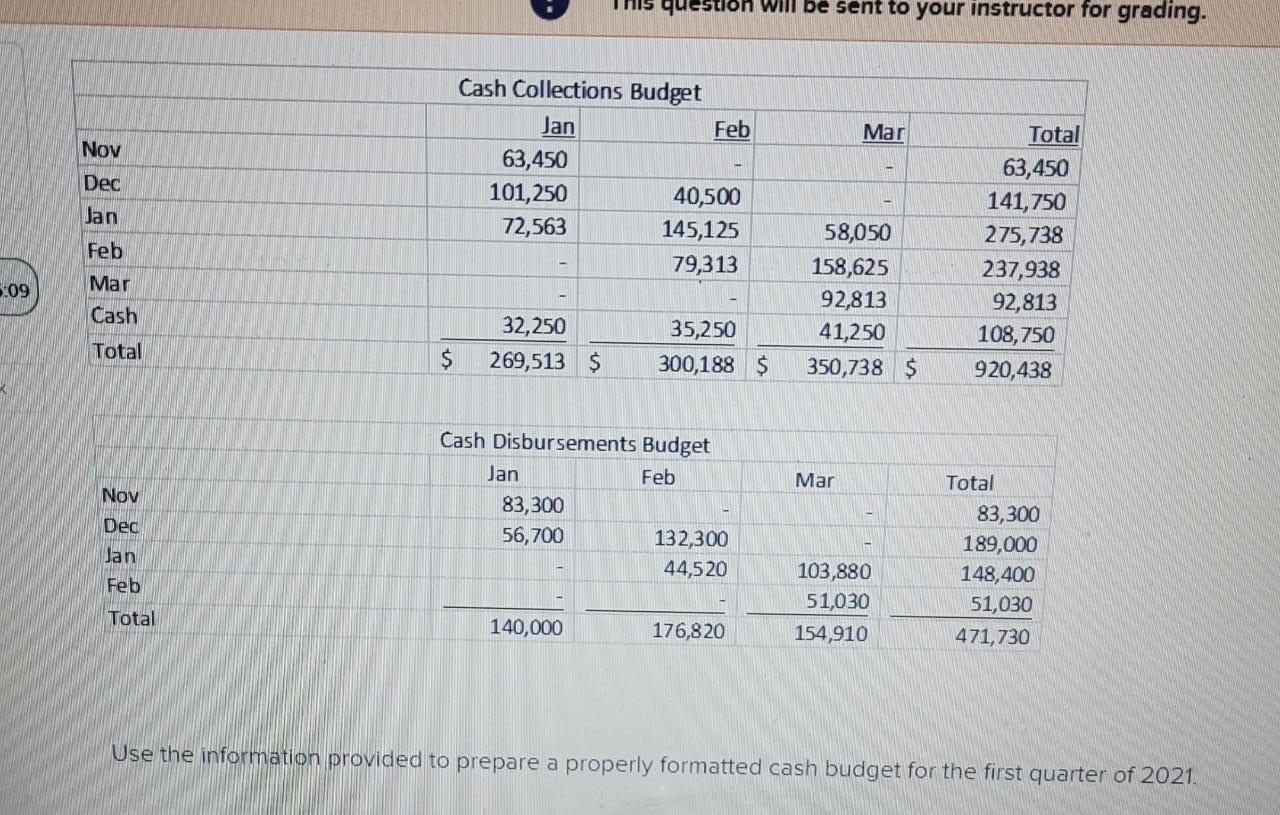

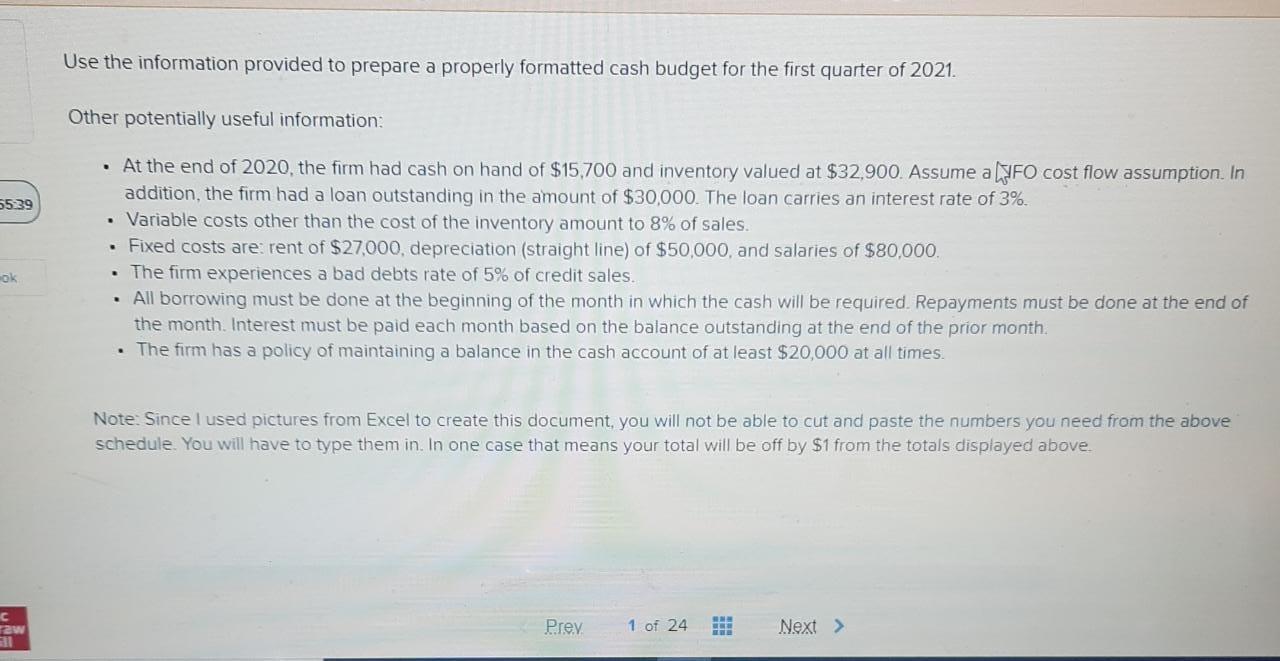

This question will be sent to your instructor for grading. Problem 1. Big Company prepares a budget each quarter. For the first quarter in 2021, the four schedules that follow Sales Budget Feb Unit Sales Jan 4,300 Mar SP 75 4,700 75 352,500 $ Total 14,500 75 1,087,500 --56:31 Sales 5,500 75 412,500 $ $ 322,500 $ DOK Unit Sales Unit Required BI Units 2 B Purchased Cost Purchases Purchases Budget Jan Feb 4,300 4,700 940 1,100 5,240 5,800 1,000 940 4,240 4,860 35 35 148,400 $ 170,100 $ Mar 5,500 1,000 6,500 1,100 5,400 35 189,000 $ Total 14,500 1,000 15,500 1,000 14,500 35 507,500 $ Cash Collections Budget Jan Feb 63,450 101,250 40,500 Mar NOV Total 63,450 141,750 Dec Prey 1 of 24 Next here to search 0 This question will be sent to your instructor for grading. Mar Nov Dec Jan Feb Mar Cash Cash Collections Budget Jan Feb 63,450 101,250 40,500 72,563 145,125 79,313 Total 63,450 141,750 275,738 237,938 92,813 108,750 920,438 58,050 158,625 92,813 41,250 350,738 $ 3:09 Total 32,250 269,513 $ 35,250 300,188 $ $ Mar Nov Dec Jan Feb Cash Disbursements Budget Jan Feb 83,300 56,700 132,300 44,520 103,880 51,030 154,910 Total 83,300 189,000 148,400 51,030 471,730 Total 140,000 176,820 Use the information provided to prepare a properly formatted cash budget for the first quarter of 2021. Use the information provided to prepare a properly formatted cash budget for the first quarter of 2021. Other potentially useful information: 55:39 At the end of 2020, the firm had cash on hand of $15,700 and inventory valued at $32,900. Assume a UFO cost flow assumption. In addition, the firm had a loan outstanding in the amount of $30,000. The loan carries an interest rate of 3%. Variable costs other than the cost of the inventory amount to 8% of sales. Fixed costs are rent of $27,000, depreciation (straight line) of $50,000, and salaries of $80,000. The firm experiences a bad debts rate of 5% of credit sales. All borrowing must be done at the beginning of the month in which the cash will be required. Repayments must be done at the end of the month. Interest must be paid each month based on the balance outstanding at the end of the prior month. . The firm has a policy of maintaining a balance in the cash account of at least $20,000 at all times. ok Note: Since I used pictures from Excel to create this document, you will not be able to cut and paste the numbers you need from the above schedule. You will have to type them in. In one case that means your total will be off by $1 from the totals displayed above C 12W Prey 1 of 24 HHH Next > This question will be sent to your instructor for grading. Problem 1. Big Company prepares a budget each quarter. For the first quarter in 2021, the four schedules that follow Sales Budget Feb Unit Sales Jan 4,300 Mar SP 75 4,700 75 352,500 $ Total 14,500 75 1,087,500 --56:31 Sales 5,500 75 412,500 $ $ 322,500 $ DOK Unit Sales Unit Required BI Units 2 B Purchased Cost Purchases Purchases Budget Jan Feb 4,300 4,700 940 1,100 5,240 5,800 1,000 940 4,240 4,860 35 35 148,400 $ 170,100 $ Mar 5,500 1,000 6,500 1,100 5,400 35 189,000 $ Total 14,500 1,000 15,500 1,000 14,500 35 507,500 $ Cash Collections Budget Jan Feb 63,450 101,250 40,500 Mar NOV Total 63,450 141,750 Dec Prey 1 of 24 Next here to search 0 This question will be sent to your instructor for grading. Mar Nov Dec Jan Feb Mar Cash Cash Collections Budget Jan Feb 63,450 101,250 40,500 72,563 145,125 79,313 Total 63,450 141,750 275,738 237,938 92,813 108,750 920,438 58,050 158,625 92,813 41,250 350,738 $ 3:09 Total 32,250 269,513 $ 35,250 300,188 $ $ Mar Nov Dec Jan Feb Cash Disbursements Budget Jan Feb 83,300 56,700 132,300 44,520 103,880 51,030 154,910 Total 83,300 189,000 148,400 51,030 471,730 Total 140,000 176,820 Use the information provided to prepare a properly formatted cash budget for the first quarter of 2021. Use the information provided to prepare a properly formatted cash budget for the first quarter of 2021. Other potentially useful information: 55:39 At the end of 2020, the firm had cash on hand of $15,700 and inventory valued at $32,900. Assume a UFO cost flow assumption. In addition, the firm had a loan outstanding in the amount of $30,000. The loan carries an interest rate of 3%. Variable costs other than the cost of the inventory amount to 8% of sales. Fixed costs are rent of $27,000, depreciation (straight line) of $50,000, and salaries of $80,000. The firm experiences a bad debts rate of 5% of credit sales. All borrowing must be done at the beginning of the month in which the cash will be required. Repayments must be done at the end of the month. Interest must be paid each month based on the balance outstanding at the end of the prior month. . The firm has a policy of maintaining a balance in the cash account of at least $20,000 at all times. ok Note: Since I used pictures from Excel to create this document, you will not be able to cut and paste the numbers you need from the above schedule. You will have to type them in. In one case that means your total will be off by $1 from the totals displayed above C 12W Prey 1 of 24 HHH Next >