Answered step by step

Verified Expert Solution

Question

1 Approved Answer

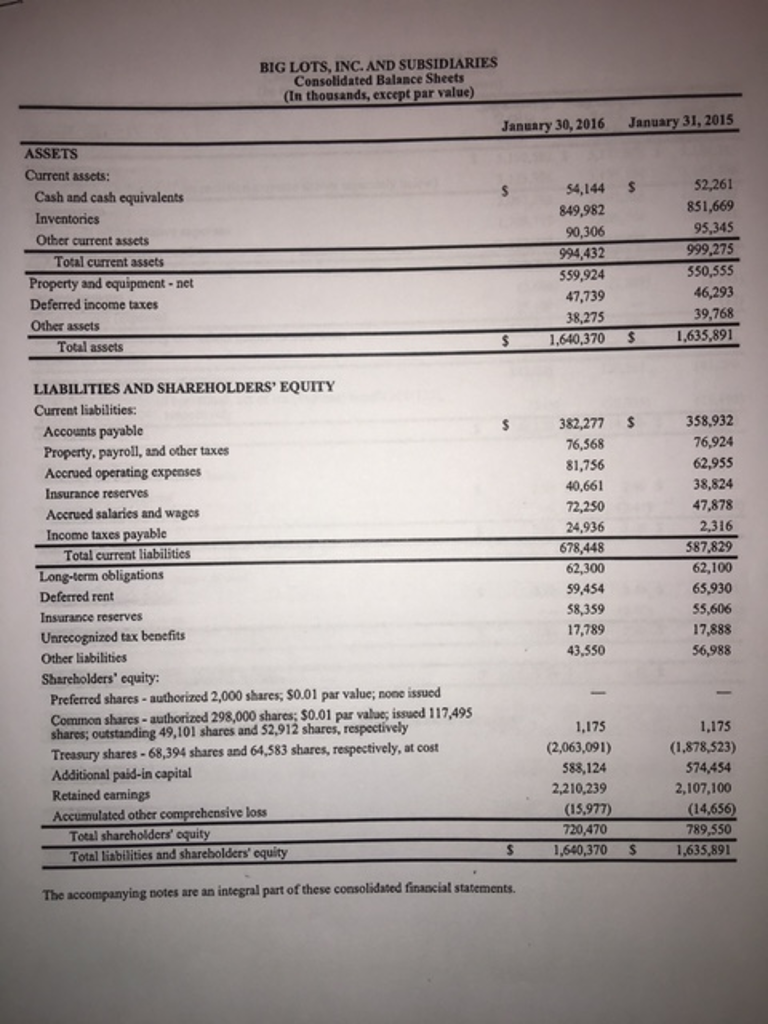

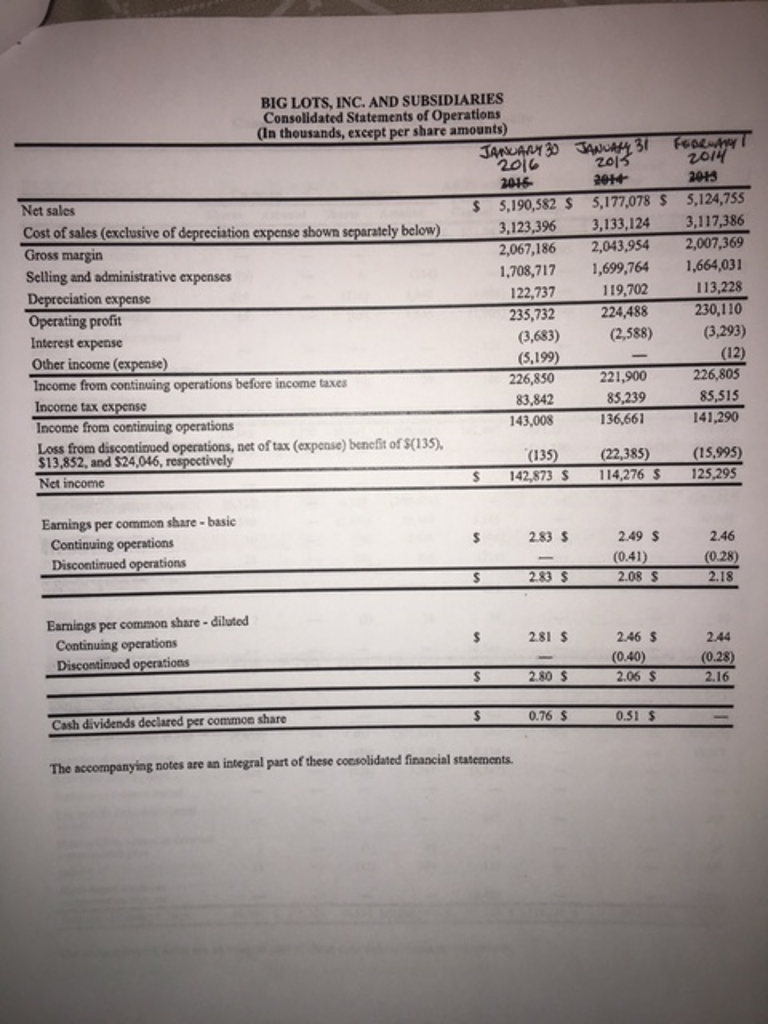

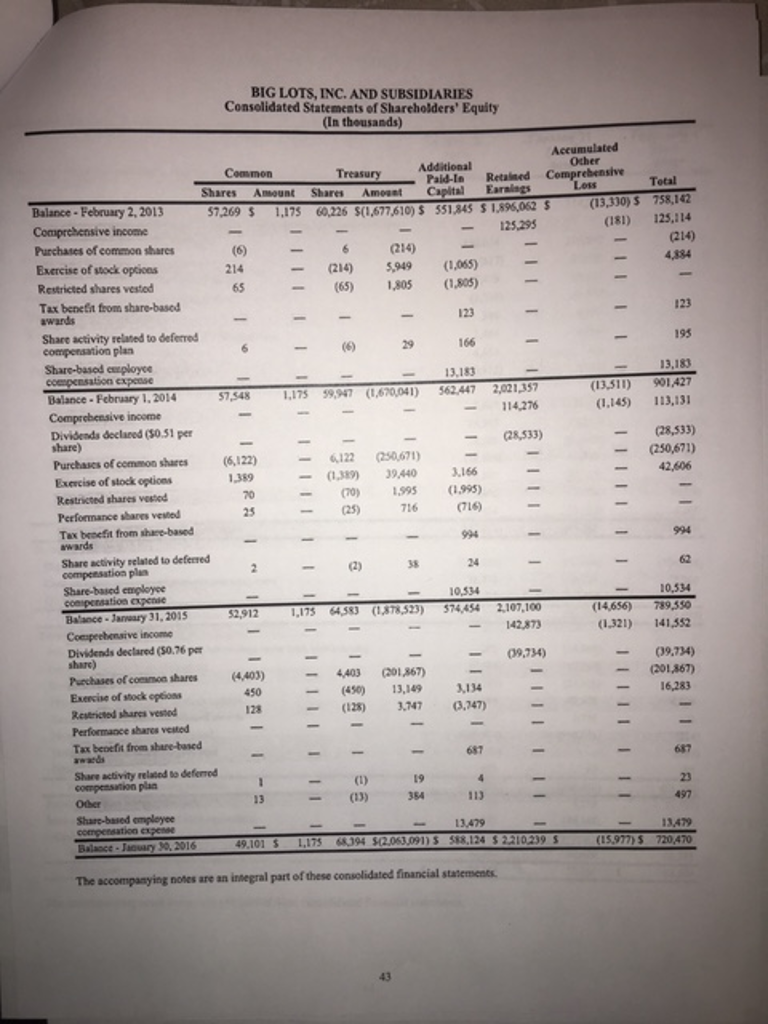

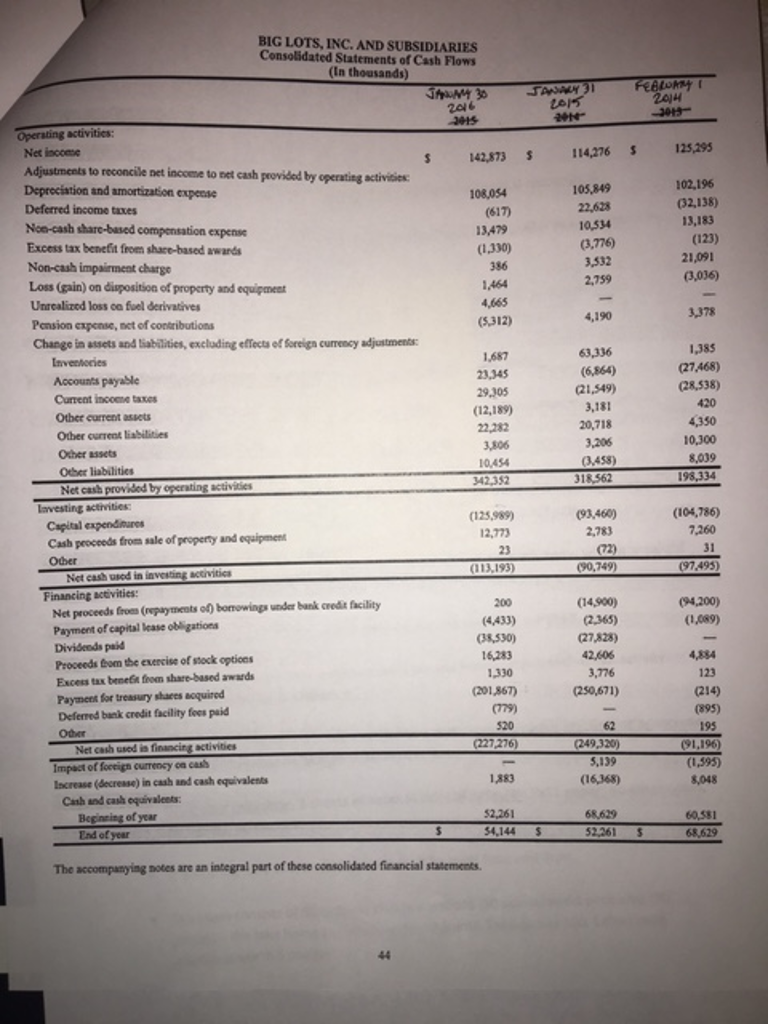

THIS QUESTIONS HAS BEEN UPDATED: 1. Calculate ROE for January 30, 2016 and January 31, 2015. Round to 1 decimal place. ( Total stockholders equity

THIS QUESTIONS HAS BEEN UPDATED:

1. Calculate ROE for January 30, 2016 and January 31, 2015. Round to 1 decimal place. (Total stockholders equity at 2/01/14 amounted to $901,427 in thousands)

2. Calculate the price to earnings ratio for 2016 and 2015. Market price per share was $38.78 at 01/30/16 and $41.91 at 01/31/15. Round to 1 decimal place.

3. Calculate the gross profit ratios for 2016, 2015, and 2014. Round to 1 decimal place.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started