Answered step by step

Verified Expert Solution

Question

1 Approved Answer

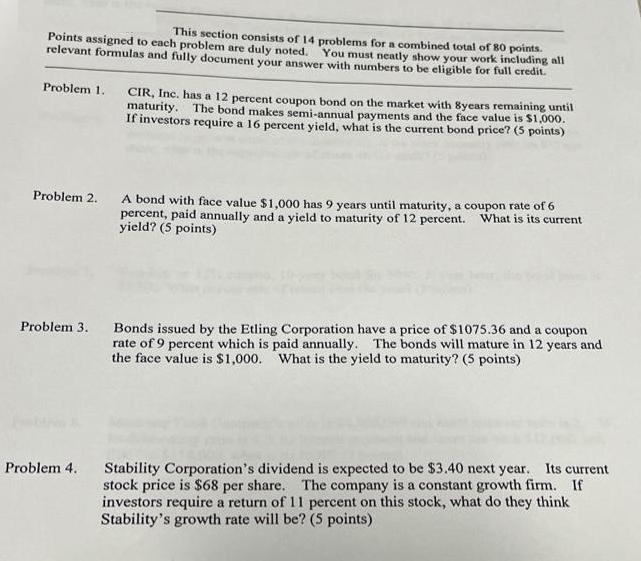

This section consists of 14 problems for a combined total of 80 points. Points assigned to each problem are duly noted, You must neatly

This section consists of 14 problems for a combined total of 80 points. Points assigned to each problem are duly noted, You must neatly show your work including all relevant formulas and fully document your answer with numbers to be eligible for full credit. Problem 1. CIR, Inc. has a 12 percent coupon bond on the market with 8years remaining until maturity. The bond makes semi-annual payments and the face value is $1,000. If investors require a 16 percent yield, what is the current bond price? (5 points) Problem 2. A bond with face value $1,000 has 9 years until maturity, a coupon rate of 6 percent, paid annually and a yield to maturity of 12 percent. yield? (5 points) What is its current Bonds issued by the Etling Corporation have a price of $1075.36 and a coupon rate of 9 percent which is paid annually. The bonds will mature in 12 years and the face value is $1,000. What is the yield to maturity? (5 points) Problem 3. Stability Corporation's dividend is expected to be $3.40 next year. Its current stock price is $68 per share. The company is a constant growth firm. If investors require a return of 11 percent on this stock, what do they think Stability's growth rate will be? (5 points) Problem 4. Problem 5. Plug and Play Inc. is in a declining industry at a rate of 12 percent per year indefinitely. If the discount rate is 10 percent and a $2.20 per share dividend are just paid, what price do you forecast for the stock next year? (5 points) Problem 6. Mercosur Inc. will pay a year-end dividend of $3.20 per share. Investors expect the dividend to grow at a rate of 6% indefinitely. If the stock currently sells for $32 per share, what is the expected rate of return on the stock? (5 points) You buy an 12% coupon, 10-yeay bond for $940. A year later, the bond price is $1,300. What is your rate of return over the year? (5 points) Problem 7. Mercosur Food Company's sales is $4,800,000 and asset turnover ratio is 2. If its debt-equity ratio is 4.0, its interest payment and taxes are each $12,000, and EBIT is $114,000, what is its ROE? (7 points) Problem 8.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Bonds are instrument issued by a company to aquire debt from public in return of some cupon amount on the face valve of bond Compute the current bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started