Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This section consists of four compulsory questions with multiple parts. Candidates are required to attempt all parts of each question. Question 1 ( 2 1

This section consists of four compulsory questions with multiple parts. Candidates are required to attempt all parts of each question.

Question marks

Caribcel Group is a telecommunications giant with its headquarters in Kingston. Caribcel operates currently operates in Jamaica, Haiti, Dominica and Trinidad and Tobago. JamSys Limited JSL is the largest subsidiary of Caribcel Group and provides information technology services to business customers in the region. You are a new audit manager with Caribcel group and are responsible for the audit of the subsidiary JSL Recently, the finance director of JamSys Limited Tom Thomas, contacted you, saying: 'I was alerted yesterday to a fraud being conducted by members of our sales team. It appears that several sales representatives have been claiming reimbursement for fictitious travel and client entertaining expenses and inflating actual expenses incurred. It has been alleged that the sales representatives have claimed on expenses for items such as gifts for clients and office supplies which were never actually purchased, claimed for businessclass airline tickets but in reality had purchased economy tickets to Montego Bay, claimed for nonexistent business mileage from Kingston to Montego Bay and used the company credit card to purchase items for personal use. I am very worried about the scale of this fraud, as travel and client entertainment is one of our biggest expenses, which is why we are seeking the assistance of the internal audit division to conduct an audit. We plan to take action to prosecute these employees in an attempt to recoup our losses if evidence shows that a fraud has indeed occurred. We know that two years ago your division did an audit and found that the control environment is generally good so this fraud should not have occurred. However, we would like to meet to have further discussions on the matter.

Required:

a Write a memorandum to Mr Thomas explaining three components of a good control environment. Use the Committee of Sponsoring Organisation COSO guideline to frame your answer.

marks

b What are four fraud red flags that may have been present in JamSys Limited indicating the likelihood of this alleged fraud?

marks

c Describe three matters that should be discussed in the meeting with Tom Thomas about planning the audit into the alleged fraudulent activity.

marks

d State three types of evidence that you need to examine for this audit

marks

Question marks

Joshua Brown is the Chief Audit Executive CAE at ABC Bank Limited. He prepared a report on the areas reviewed in which highlighted numerous risks and discrepancies at ABC Bank Limited. The issues include poor risk management and inadequate portfolio diversification, as the management focused on single industries and invested in areas that they had no competencies. He also highlighted inadequate investment assessment and the lack of monitoring of assets. The bank's high operating cost was also making it difficult to meet them to short term obligations. Other issues include poor quality of management and strategic planning, a failure to exercise due diligence and care when extending credit and an unusually high appetite for risk.

Required:

Recommend five solutions that ABC Bank Limited should implement to address the risks and issues highlighted in the CAE's report.

marks

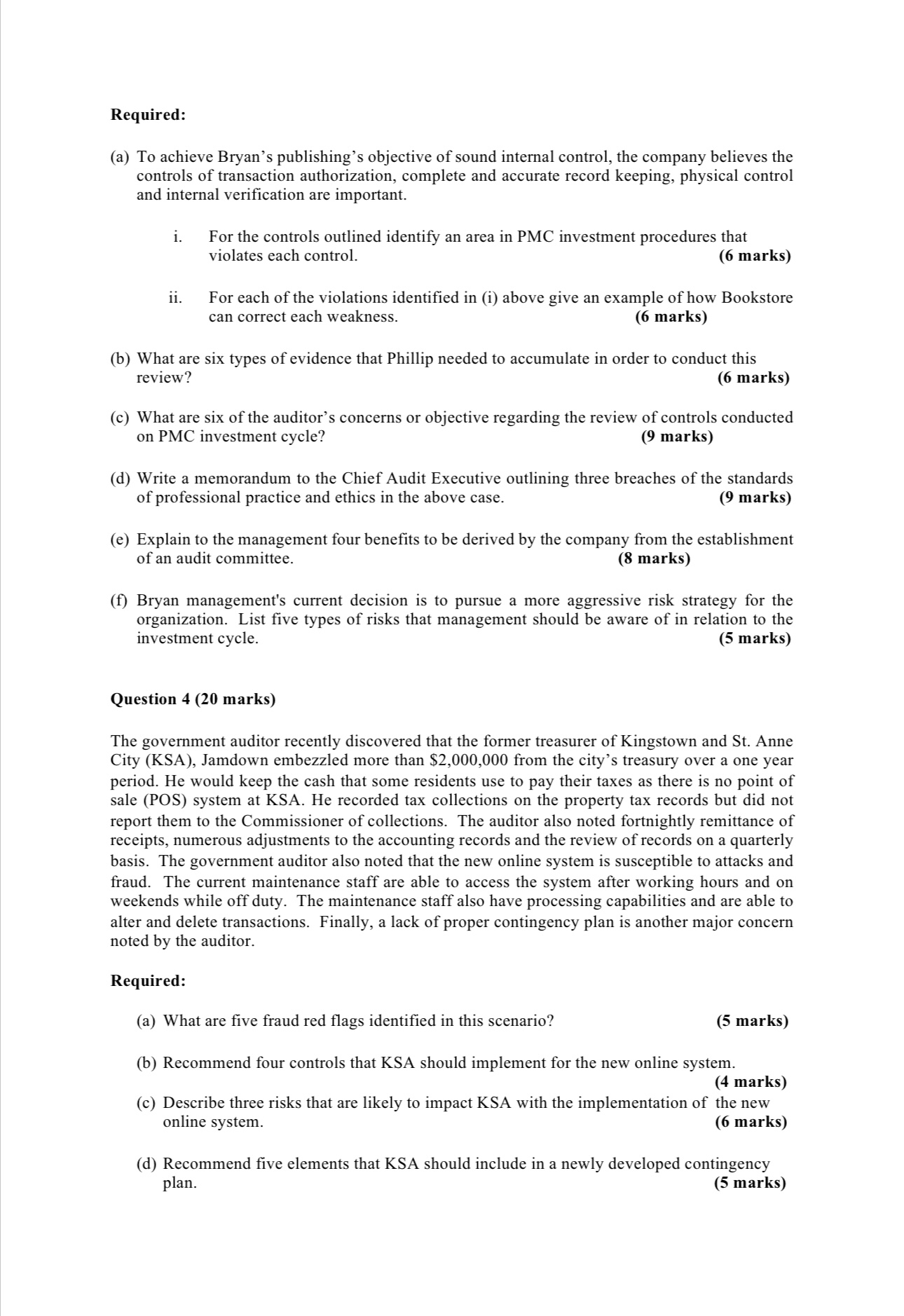

Question marks

Background to the Internal Audit Activity

Print and Media Company Limited PMC is a subsidiary of Bryan's Publishing and specializes in the publication and distribution of business text books. PMC employs on average employees and sales for financial year December exceeded $ million. Bryan periodically sends a member of its Internal Audit Department to audit the operations of its subsidiaries. Phillip Smith is an Internal Audit Manager working with Bryan's Publishing. He previously worked at Campbell's Press Limited for over three years as an Internal Auditor. Phillip decided to join PMC because the auditors were better compensated. Auditors are entitled to a of their annual salary for favourable performance appraisals when compared to the provided to other staff members. Phillip's first assignment was to conduct a review on PMC Investment cycle as management is contemplating a more aggressive risk appetite in this area. In conducting his review Phillip primarily worked with Roger Russell the treasurer of PMC The following information was contained in Phillip's report.

Authorisation Policy and Transactions

Throughout the year, PMC has made short term and longterm investments in securities; all securities are registered in the company's name. According to PMCs bylaws, long term investment activities must be approved by its Board of Directors, while shortterm investment activity may be approved by the presi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started