Answered step by step

Verified Expert Solution

Question

1 Approved Answer

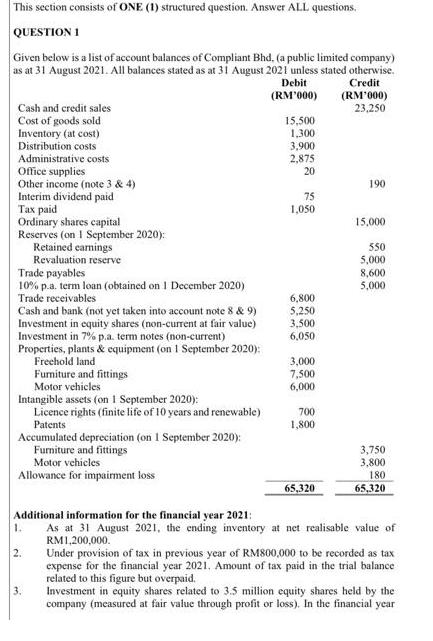

This section consists of ONE (1) structured question. Answer ALL questions. QUESTION 1 Given below is a list of account balances of Compliant Bhd.

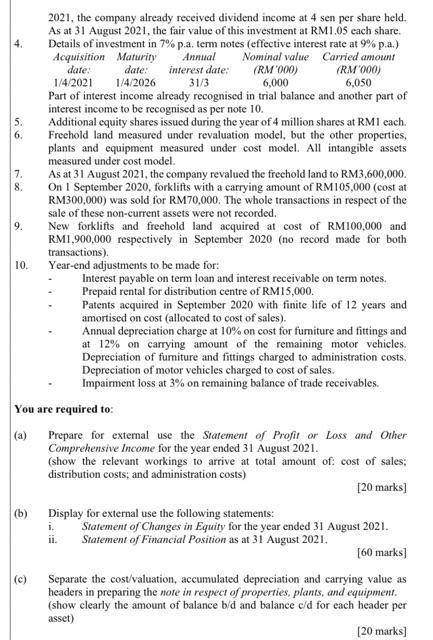

This section consists of ONE (1) structured question. Answer ALL questions. QUESTION 1 Given below is a list of account balances of Compliant Bhd. (a public limited company) as at 31 August 2021. All balances stated as at 31 August 2021 unless stated otherwise. Debit (RM'000) Credit (RM'000) 23,250 Cash and credit sales Cost of goods sold Inventory (at cost) Distribution costs Administrative costs Office supplies Other income (note 3 & 4) Interim dividend paid Tax paid Ordinary shares capital Reserves (on 1 September 2020): Trade payables 10% p.a. term loan (obtained on 1 December 2020) Trade receivables Cash and bank (not yet taken into account note 8 & 9) Investment in equity shares (non-current at fair value) Investment in 7% p.a. term notes (non-current) Properties, plants & equipment (on 1 September 2020): Freehold land Retained earnings Revaluation reserve Intangible assets (on 1 September 2020): Licence rights (finite life of 10 years and renewable) Patents Furniture and fittings Motor vehicles Accumulated depreciation (on 1 September 2020): Furniture and fittings Motor vehicles Allowance for impairment loss 2. 3. 15,500 1,300 3,900 2,875 20 75 1,050 6,800 5,250 3,500 6,050 3,000 7,500 6,000 700 1,800 65,320 190 15,000. 550 5,000 8,600 5,000 Additional information for the financial year 2021: 1. As at 31 August 2021, the ending inventory at net realisable value of RM1,200,000. 3,750 3,800 180 65,320 Under provision of tax in previous year of RM800,000 to be recorded as tax expense for the financial year 2021. Amount of tax paid in the trial balance related to this figure but overpaid. Investment in equity shares related to 3.5 million equity shares held by the company (measured at fair value through profit or loss). In the financial year 6. 7. 8. 9. 10. (b) 2021, the company already received dividend income at 4 sen per share held. As at 31 August 2021, the fair value of this investment at RM1.05 each share. Details of investment in 7% p.a. term notes (effective interest rate at 9% p.a.) Acquisition Maturity Nominal value Carried amount (RM'000) 6,000 Annual date: interest date: (RM'000) date: 1/4/2021 1/4/2026 31/3 6,050 Part of interest income already recognised in trial balance and another part of interest income to be recognised as per note 10. Additional equity shares issued during the year of 4 million shares at RMI each. Freehold land measured under revaluation model, but the other properties, plants and equipment measured under cost model. All intangible assets measured under cost model. (c) As at 31 August 2021, the company revalued the freehold land to RM3,600,000. On 1 September 2020, forklifts with a carrying amount of RM105,000 (cost at RM300,000) was sold for RM70,000. The whole transactions in respect of the sale of these non-current assets were not recorded. New forklifts and freehold land acquired at cost of RM100,000 and RM1,900,000 respectively in September 2020 (no record made for both transactions). Year-end adjustments to be made for: You are required to: Prepare for external use the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 August 2021. (show the relevant workings to arrive at total amount of: cost of sales; distribution costs; and administration costs) [20 marks] Interest payable on term loan and interest receivable on term notes. Prepaid rental for distribution centre of RM15,000. Patents acquired in September 2020 with finite life of 12 years and amortised on cost (allocated to cost of sales). Annual depreciation charge at 10% on cost for furniture and fittings and at 12% on carrying amount of the remaining motor vehicles. Depreciation of furniture and fittings charged to administration costs. Depreciation of motor vehicles charged to cost of sales. Impairment loss at 3% on remaining balance of trade receivables. Display for external use the following statements: i. ii. Statement of Changes in Equity for the year ended 31 August 2021. Statement of Financial Position as at 31 August 2021. [60 marks] Separate the cost/valuation, accumulated depreciation and carrying value as headers in preparing the note in respect of properties, plants, and equipment. (show clearly the amount of balance b/d and balance c/d for each header per asset) [20 marks]

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 August 2021 Reven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started