Answered step by step

Verified Expert Solution

Question

1 Approved Answer

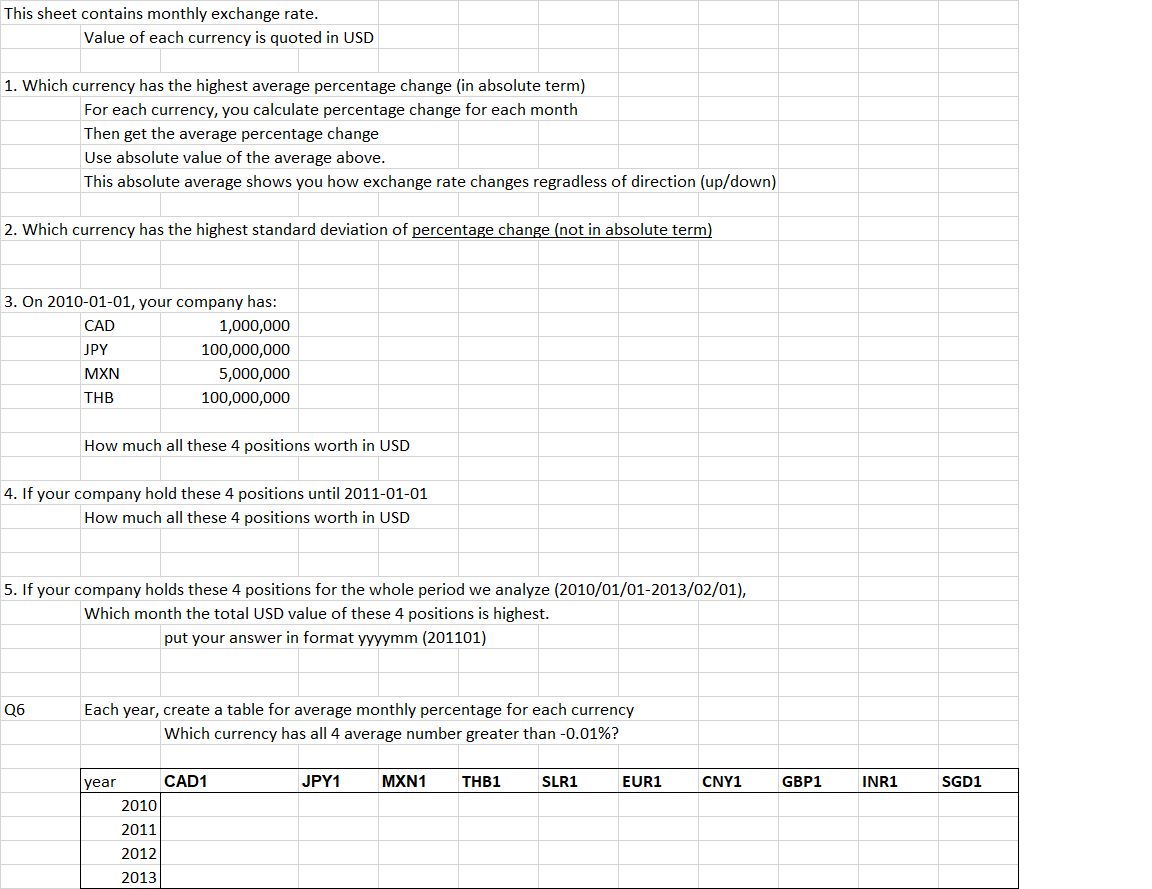

This sheet contains monthly exchange rate. Value of each currency is quoted in USD 1. Which currency has the highest average percentage change (in

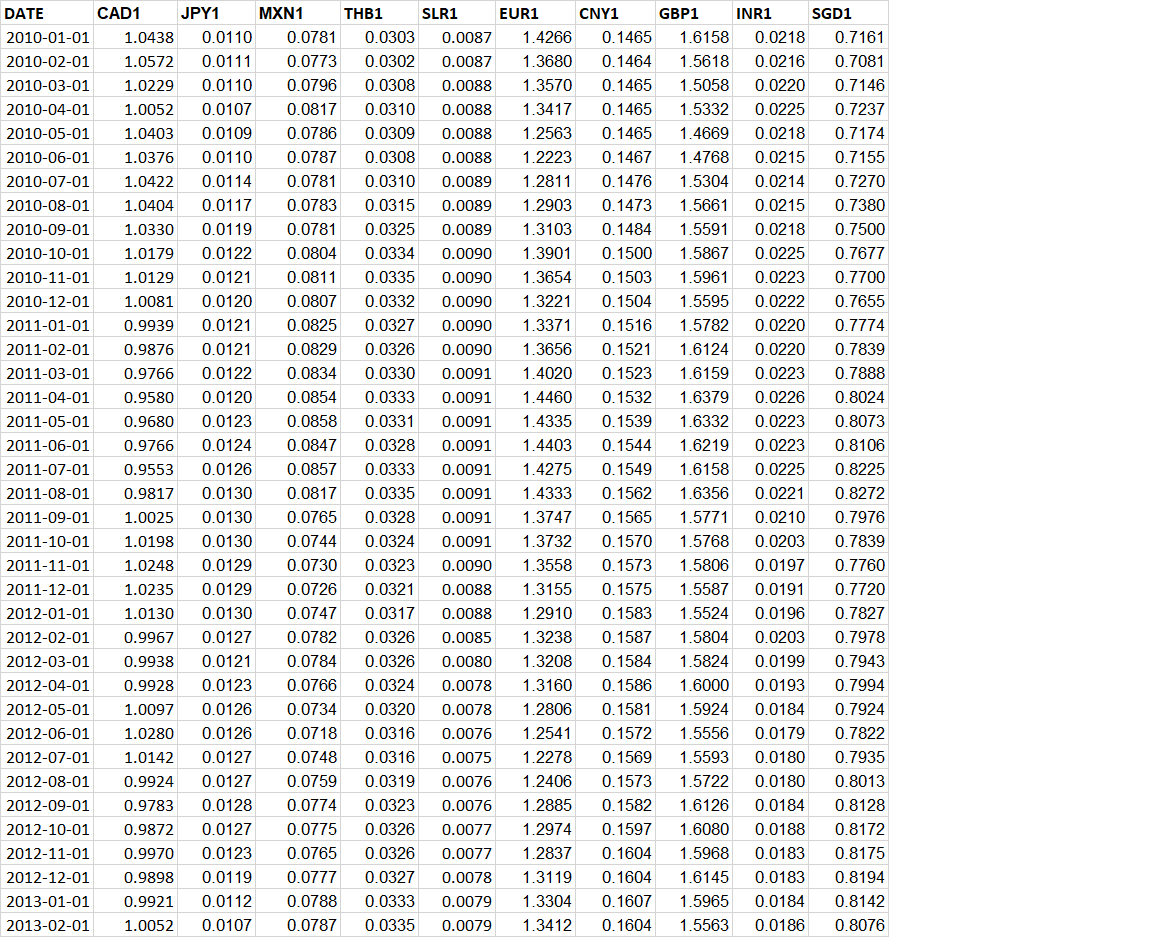

This sheet contains monthly exchange rate. Value of each currency is quoted in USD 1. Which currency has the highest average percentage change (in absolute term) For each currency, you calculate percentage change for each month Then get the average percentage change Use absolute value of the average above. This absolute average shows you how exchange rate changes regradless of direction (up/down) 2. Which currency has the highest standard deviation of percentage change (not in absolute term) 3. On 2010-01-01, your company has: CAD JPY MXN THB 1,000,000 100,000,000 5,000,000 100,000,000 How much all these 4 positions worth in USD 4. If your company hold these 4 positions until 2011-01-01 How much all these 4 positions worth in USD 5. If your company holds these 4 positions for the whole period we analyze (2010/01/01-2013/02/01), Which month the total USD value of these 4 positions is highest. put your answer in format yyyymm (201101) Q6 Each year, create a table for average monthly percentage for each currency Which currency has all 4 average number greater than -0.01%? year CAD1 2010 2011 2012 2013 JPY1 MXN1 THB1 SLR1 EUR1 CNY1 GBP1 INR1 SGD1 DATE CAD1 JPY1 MXN1 THB1 SLR1 EUR1 CNY1 GBP1 INR1 SGD1 2010-01-01 2010-02-01 2010-03-01 1.0438 0.0110 1.0572 0.0111 1.0229 0.0110 2010-04-01 1.0052 0.0107 0.0817 2010-05-01 1.0403 0.0109 0.0786 0.0773 0.0302 0.0796 0.0308 0.0310 0.0309 2010-06-01 1.0376 0.0110 0.0787 0.0308 2010-07-01 1.0422 0.0114 0.0781 2010-08-01 2010-09-01 2010-10-01 1.0404 0.0117 1.0330 0.0119 1.0179 0.0122 0.0783 2010-11-01 1.0129 0.0121 0.0811 0.0335 0.0090 2010-12-01 0.0807 0.0332 0.0090 2011-01-01 2011-02-01 2011-03-01 2011-04-01 2011-05-01 2011-06-01 2011-07-01 2011-08-01 0.9817 0.0130 2011-09-01 1.0025 0.0130 0.0765 0.0091 1.4275 0.0335 0.0091 1.4333 0.0328 0.0091 1.3747 0.0781 0.0303 0.0087 1.4266 0.1465 1.6158 0.0218 0.7161 0.0087 1.3680 0.1464 1.5618 0.0216 0.7081 0.0088 1.3570 0.1465 1.5058 0.0220 0.7146 0.0088 1.3417 0.1465 1.5332 0.0225 0.7237 0.0088 1.2563 0.1465 1.4669 0.0218 0.7174 0.0088 1.2223 0.1467 1.4768 0.0215 0.7155 0.0310 0.0089 1.2811 0.1476 1.5304 0.0214 0.7270 0.0315 0.0089 1.2903 0.1473 1.5661 0.0215 0.7380 0.0781 0.0325 0.0089 1.3103 0.1484 1.5591 0.0218 0.7500 0.0804 0.0334 0.0090 1.3901 0.1500 1.5867 0.0225 0.7677 1.3654 0.1503 1.5961 0.0223 0.7700 1.0081 0.0120 1.3221 0.1504 1.5595 0.0222 0.7655 0.9939 0.0121 0.0825 0.0327 0.0090 1.3371 0.1516 1.5782 0.0220 0.7774 0.9876 0.0121 0.0829 0.0326 0.0090 1.3656 0.1521 1.6124 0.0220 0.7839 0.9766 0.0122 0.0834 0.0330 0.0091 1.4020 0.1523 1.6159 0.0223 0.7888 0.9580 0.0120 0.0854 0.0333 0.0091 1.4460 0.1532 1.6379 0.0226 0.8024 0.9680 0.0123 0.0858 0.0331 0.0091 1.4335 0.1539 1.6332 0.0223 0.8073 0.9766 0.0124 0.0847 0.0328 0.0091 1.4403 0.1544 1.6219 0.0223 0.8106 0.9553 0.0126 0.0857 0.0333 1.6158 0.0225 0.8225 0.0817 0.1549 0.1562 0.1565 1.6356 1.5771 0.0210 0.0221 0.8272 0.7976 2011-10-01 1.0198 0.0130 0.0744 0.0324 0.0091 1.3732 0.1570 1.5768 0.0203 0.7839 2011-11-01 1.0248 0.0129 0.0730 0.0323 0.0090 1.3558 0.1573 1.5806 0.0197 0.7760 2011-12-01 1.0235 0.0129 0.0726 0.0321 0.0088 1.3155 0.1575 1.5587 0.0191 0.7720 2012-03-01 2012-04-01 2012-01-01 1.0130 0.0130 2012-02-01 0.9967 0.0127 0.9938 0.0121 0.9928 0.0123 0.0747 0.0317 0.0088 1.2910 0.1583 1.5524 0.0196 0.7827 0.0782 0.0326 0.0085 1.3238 0.0784 0.0326 0.0080 1.3208 0.0766 0.0324 0.0078 1.3160 2012-05-01 1.0097 0.0126 0.0734 0.0320 0.0078 1.2806 2012-06-01 2012-07-01 2012-08-01 2012-09-01 1.0280 0.0126 1.2541 1.0142 0.0127 0.0075 1.2278 0.9924 0.0127 0.0759 0.0319 0.0076 1.2406 0.9783 0.0128 0.0774 0.0323 0.0076 1.2885 2012-10-01 0.9872 0.0127 0.0775 0.0326 0.0077 1.2974 2012-11-01 0.9970 0.0123 0.0765 0.0326 0.0077 1.2837 2012-12-01 0.9898 0.0119 0.0777 0.0327 0.0078 1.3119 2013-01-01 0.9921 0.0112 0.0788 0.0333 0.0079 1.3304 2013-02-01 1.0052 0.0107 0.0787 0.0335 0.0079 1.3412 0.0718 0.0316 0.0076 0.0748 0.0316 0.1587 0.1584 1.5824 0.0199 0.7943 0.1586 1.6000 0.0193 0.7994 0.1581 1.5924 0.0184 0.7924 0.1572 1.5556 0.0179 0.7822 0.1569 1.5593 0.0180 0.7935 0.1573 1.5722 0.0180 0.8013 0.1582 1.6126 0.0184 0.8128 0.1597 1.6080 0.0188 0.8172 0.1604 1.5968 0.0183 0.8175 0.1604 1.6145 0.0183 0.8194 0.1607 1.5965 0.0184 0.8142 0.1604 1.5563 0.0186 0.8076 1.5804 0.0203 0.7978

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started