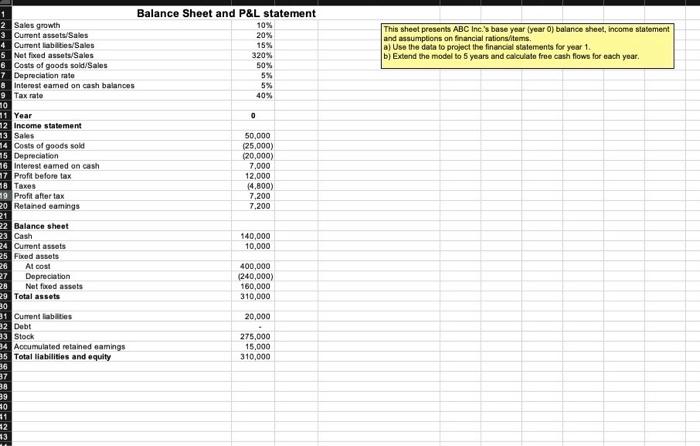

This sheet presents ABC Inc.'s base year(year ) balance sheet, income statement and assumptions on financial rations/tems. a) Use the data to project the financial statements for year 1. b) Extend the model to 5 years and calculate free cash flows for each year. 0 1 Balance Sheet and P&L statement 2 Sales growth 10% 3 Current assets/Sales 20% 4 Current liabilities/Sales 15% 5 Not fixed assets/Sales 320% 6 Costs of goods sold/Sales 50% 7 Depreciation rate 5% & Interest eamed on cash balances 5% 9 Tax rate 40% 10 11 Year 0 12 Income statement 13 Sales 50,000 14 Costs of goods sold (25,000) 15 Depreciation (20.000) 16 Interest eamed on cash 7.000 17 Profit before tax 12,000 18 Taxes (4.800) 19 Profit after tax 7,200 20 Retained earings 7.200 21 22 Balance sheet 23 Cash 140,000 24 Current assets 10,000 25 Fixed assets 26 Al cost 400,000 27 Depreciation (240,000) 28 Net foed assets 160,000 29 Total assets 310,000 30 31 Current liabilities 20,000 32 Debt 33 Stock 275,000 34 Accumulated retained eamings 15,000 35 Total liabilities and equity 310.000 36 37 38 39 10 11 12 13 This sheet presents ABC Inc.'s base year(year ) balance sheet, income statement and assumptions on financial rations/tems. a) Use the data to project the financial statements for year 1. b) Extend the model to 5 years and calculate free cash flows for each year. 0 1 Balance Sheet and P&L statement 2 Sales growth 10% 3 Current assets/Sales 20% 4 Current liabilities/Sales 15% 5 Not fixed assets/Sales 320% 6 Costs of goods sold/Sales 50% 7 Depreciation rate 5% & Interest eamed on cash balances 5% 9 Tax rate 40% 10 11 Year 0 12 Income statement 13 Sales 50,000 14 Costs of goods sold (25,000) 15 Depreciation (20.000) 16 Interest eamed on cash 7.000 17 Profit before tax 12,000 18 Taxes (4.800) 19 Profit after tax 7,200 20 Retained earings 7.200 21 22 Balance sheet 23 Cash 140,000 24 Current assets 10,000 25 Fixed assets 26 Al cost 400,000 27 Depreciation (240,000) 28 Net foed assets 160,000 29 Total assets 310,000 30 31 Current liabilities 20,000 32 Debt 33 Stock 275,000 34 Accumulated retained eamings 15,000 35 Total liabilities and equity 310.000 36 37 38 39 10 11 12 13