Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this should be better Japanese Yen Forward. Use the following spot and forward bid ask rates for the Japanese yenu.8. dolar(WS) exchange rate from September

this should be better

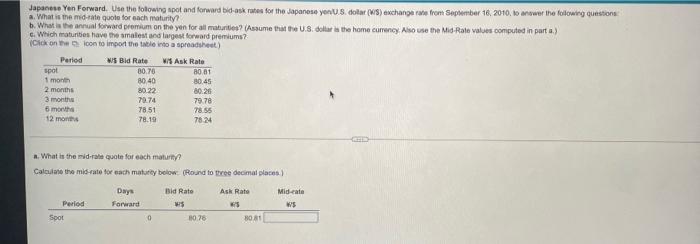

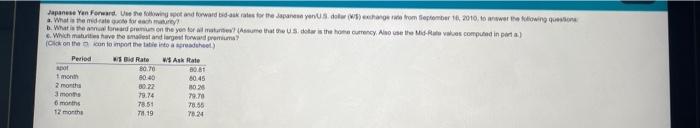

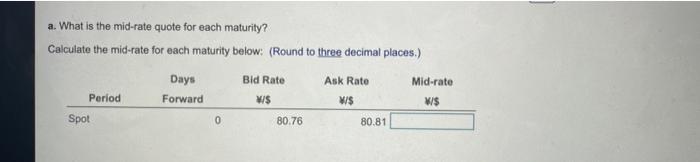

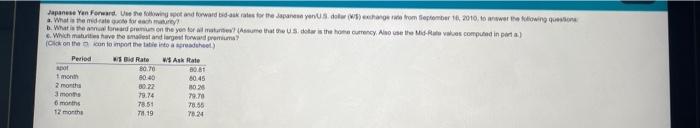

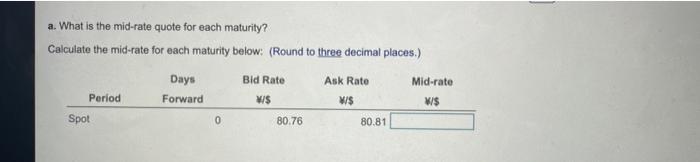

Japanese Yen Forward. Use the following spot and forward bid ask rates for the Japanese yenu.8. dolar(WS) exchange rate from September 16, 2010, to newer the following question a. What is the mid-rate quote for each maturity? b. What is the annual forward premium on the yen for all maturities? Assume that the U.S. dollar in the home comency Aso use the Mid Rate values computed in part a.) c. Which maturities have the smallest and largest forward premiums? Click on the conto import the table into a spreadsheet) Period ws Bid Rate w/ Ask Rate spot 30.70 80.61 1 month 80 40 80.45 2 months 80.22 80.26 3 months 70.74 79.78 6 months 78.51 78.55 12 months 78.19 7824 What is the mid-rate quote for each matur? Calculate the mistato for each maturity below (Round to three decimal places) Days Bid Rate Ask Rate Mid-cate Period Forward ws w's Spot 0 10.76 NO se Yen Fort. Une te wet and towed a rates for the us down from fember 162010, to www telowing question a. Whatsamrategiche What is the word pronun on the yen for at resume that the US is the home currency Abo use the MS-Rute values computed in porta) 6. Which is have the standigeat forward premium Oick on the contemport the table to read the Period WS Rate WS Ask Rate spot 80.70 30.81 1 month 80.40 80.45 2 month 80.22 B025 mo 79.74 79.70 6 months 7850 78.55 12 months 78 19 79.24 a. What is the mid-rate quote for each maturity? Calculate the mid-rate for each maturity below: (Round to three decimal places.) Bid Rate Ask Rate Mid-rate Days Forward M/S WS W/$ Period Spot 0 80.76 80.81 Japanese Yen Forward. Use the following spot and forward bid ask rates for the Japanese yenu.8. dolar(WS) exchange rate from September 16, 2010, to newer the following question a. What is the mid-rate quote for each maturity? b. What is the annual forward premium on the yen for all maturities? Assume that the U.S. dollar in the home comency Aso use the Mid Rate values computed in part a.) c. Which maturities have the smallest and largest forward premiums? Click on the conto import the table into a spreadsheet) Period ws Bid Rate w/ Ask Rate spot 30.70 80.61 1 month 80 40 80.45 2 months 80.22 80.26 3 months 70.74 79.78 6 months 78.51 78.55 12 months 78.19 7824 What is the mid-rate quote for each matur? Calculate the mistato for each maturity below (Round to three decimal places) Days Bid Rate Ask Rate Mid-cate Period Forward ws w's Spot 0 10.76 NO se Yen Fort. Une te wet and towed a rates for the us down from fember 162010, to www telowing question a. Whatsamrategiche What is the word pronun on the yen for at resume that the US is the home currency Abo use the MS-Rute values computed in porta) 6. Which is have the standigeat forward premium Oick on the contemport the table to read the Period WS Rate WS Ask Rate spot 80.70 30.81 1 month 80.40 80.45 2 month 80.22 B025 mo 79.74 79.70 6 months 7850 78.55 12 months 78 19 79.24 a. What is the mid-rate quote for each maturity? Calculate the mid-rate for each maturity below: (Round to three decimal places.) Bid Rate Ask Rate Mid-rate Days Forward M/S WS W/$ Period Spot 0 80.76 80.81

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started