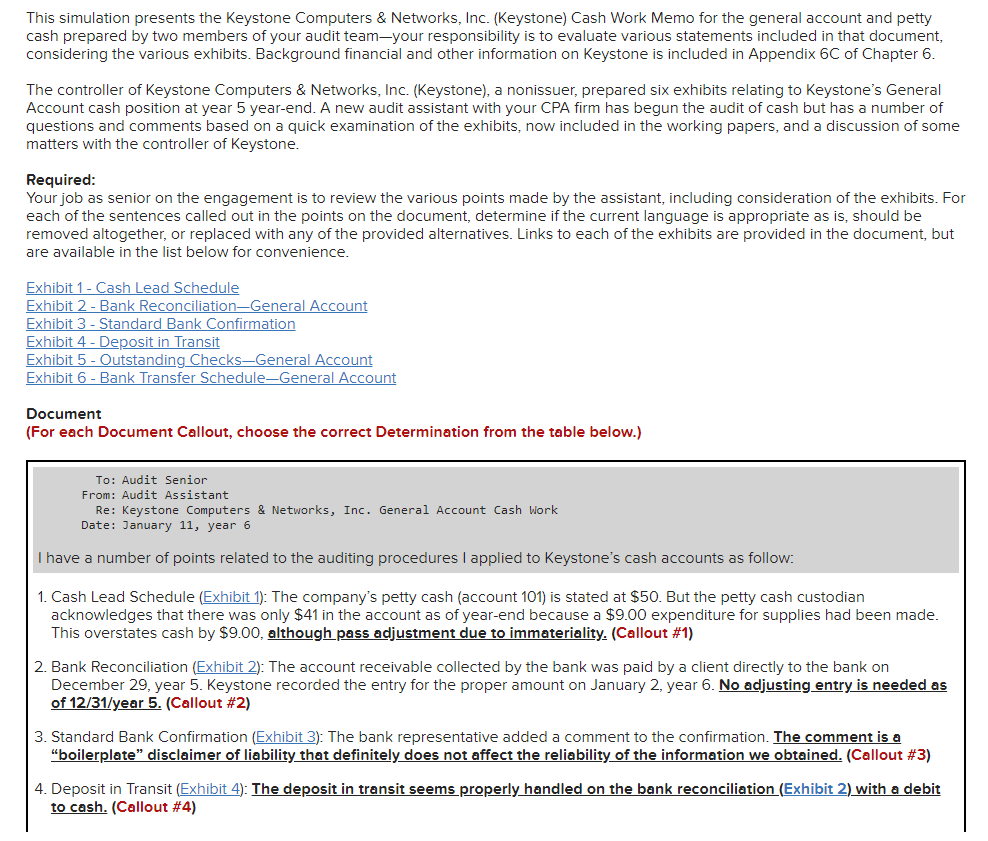

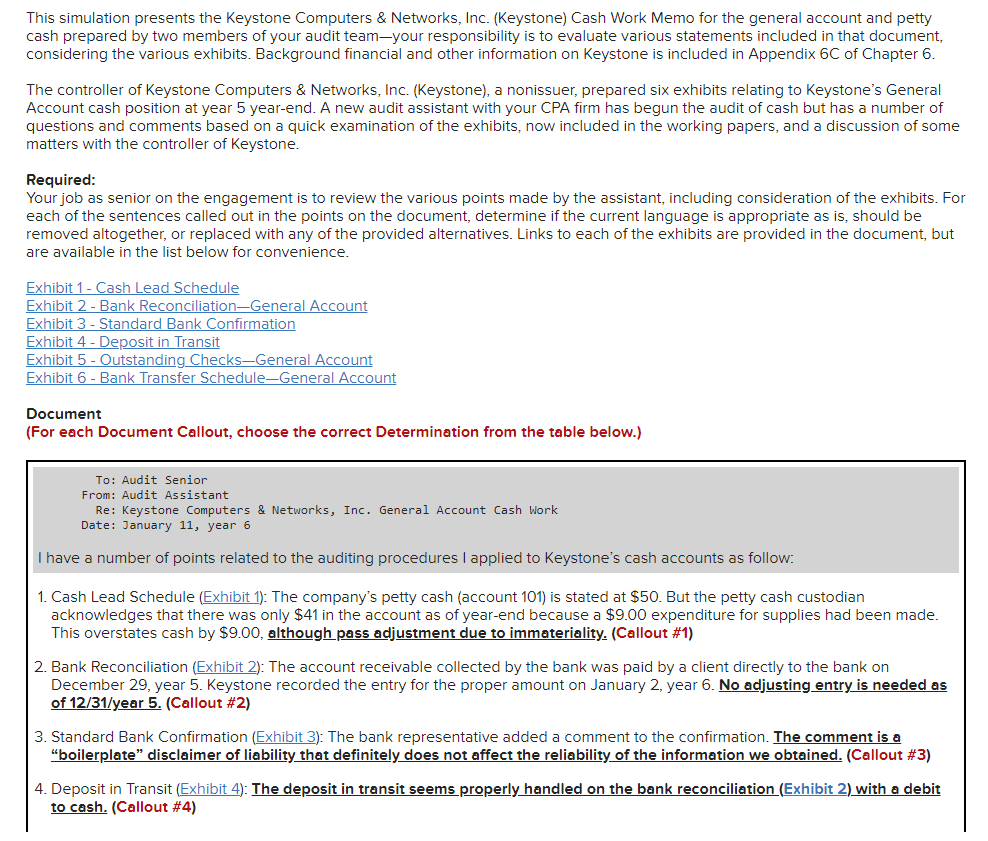

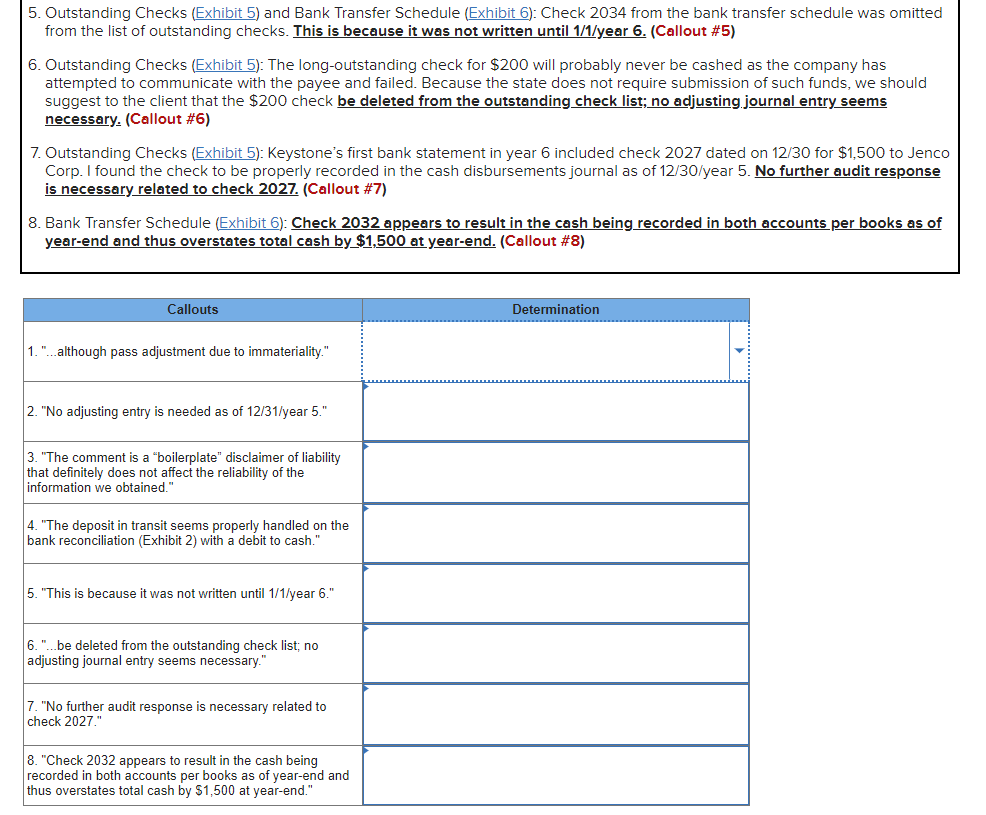

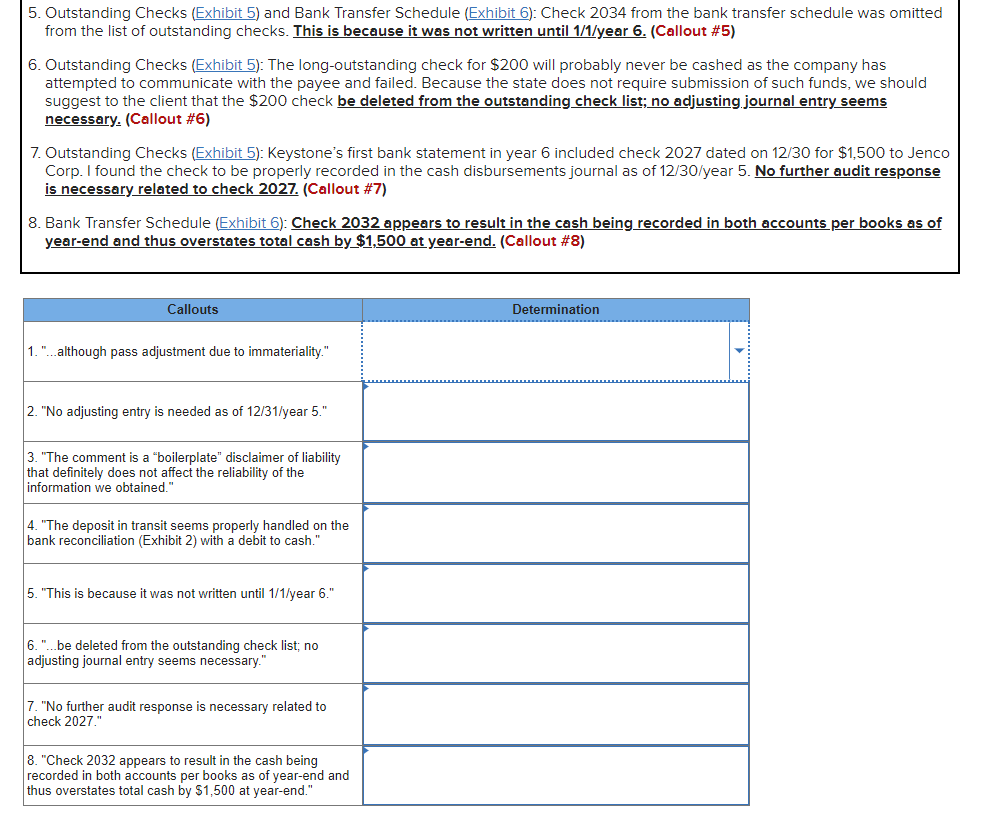

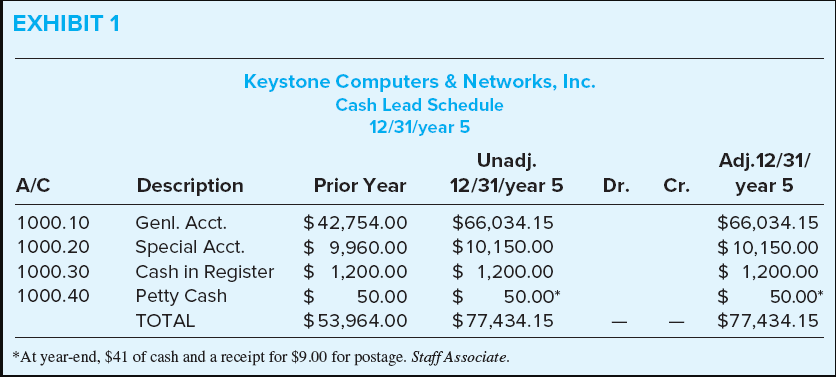

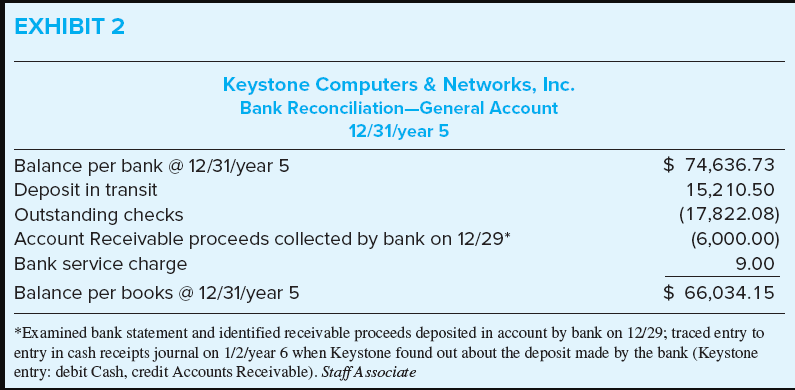

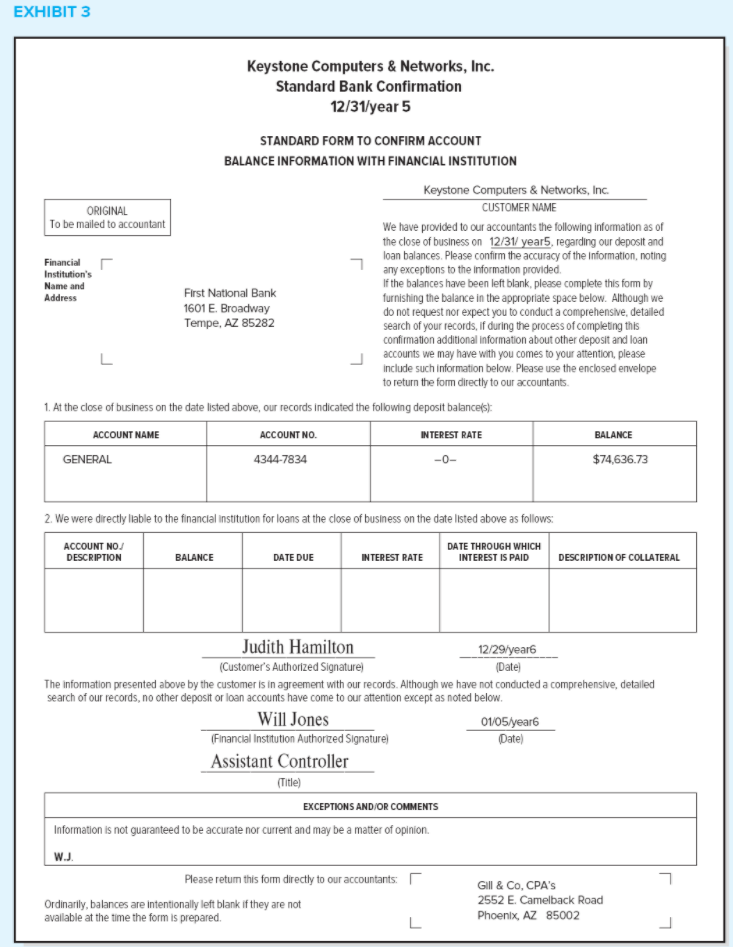

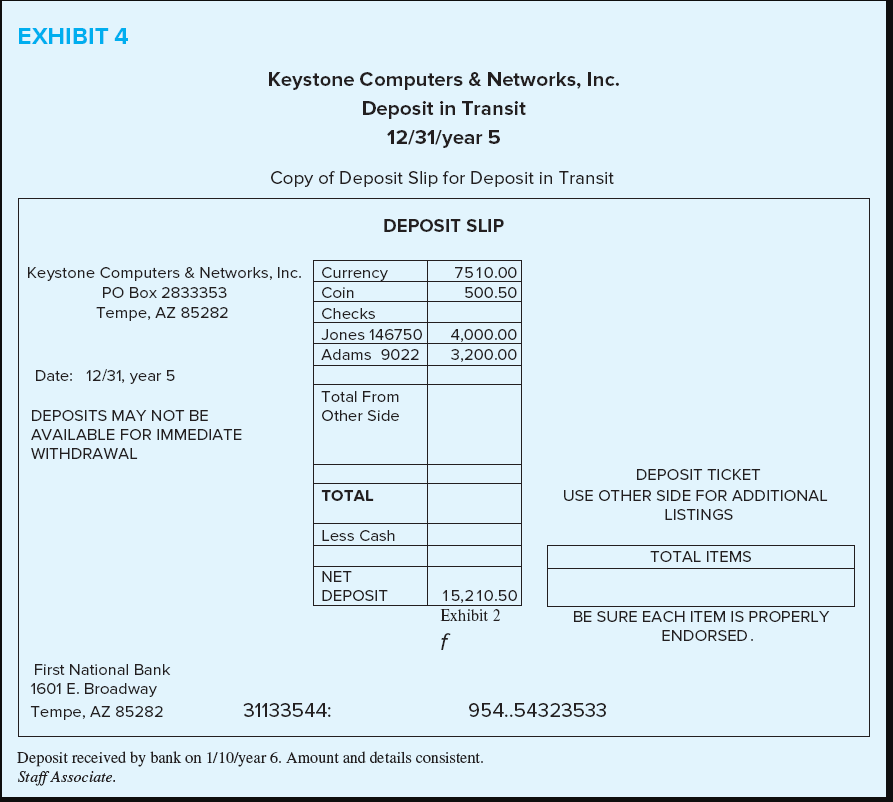

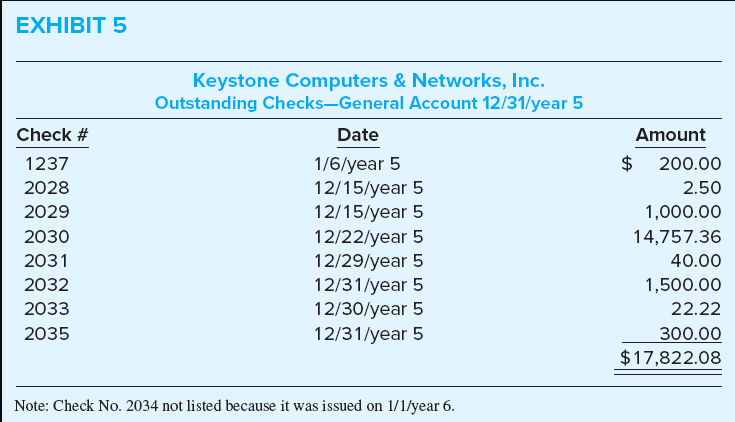

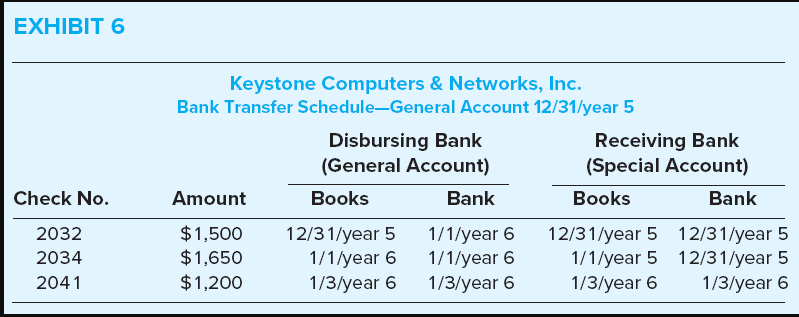

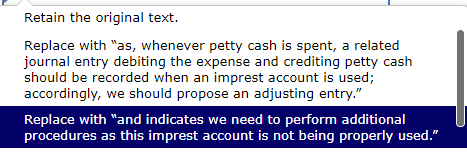

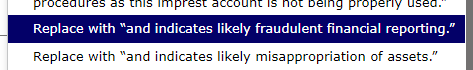

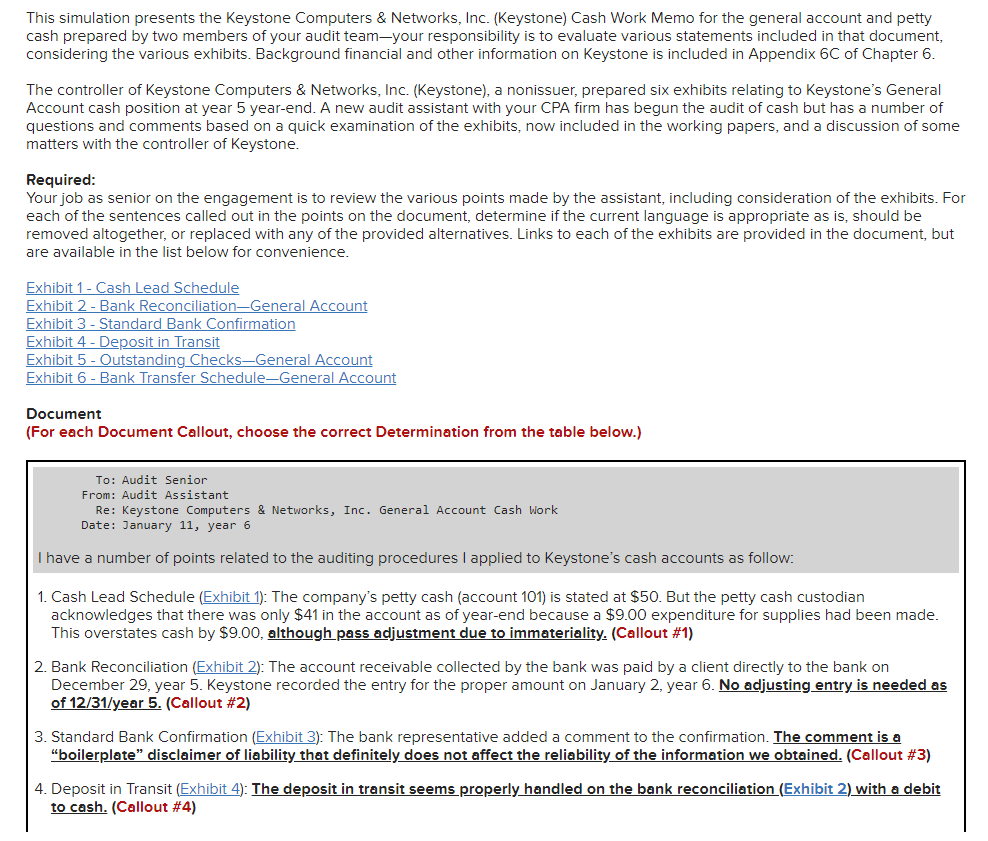

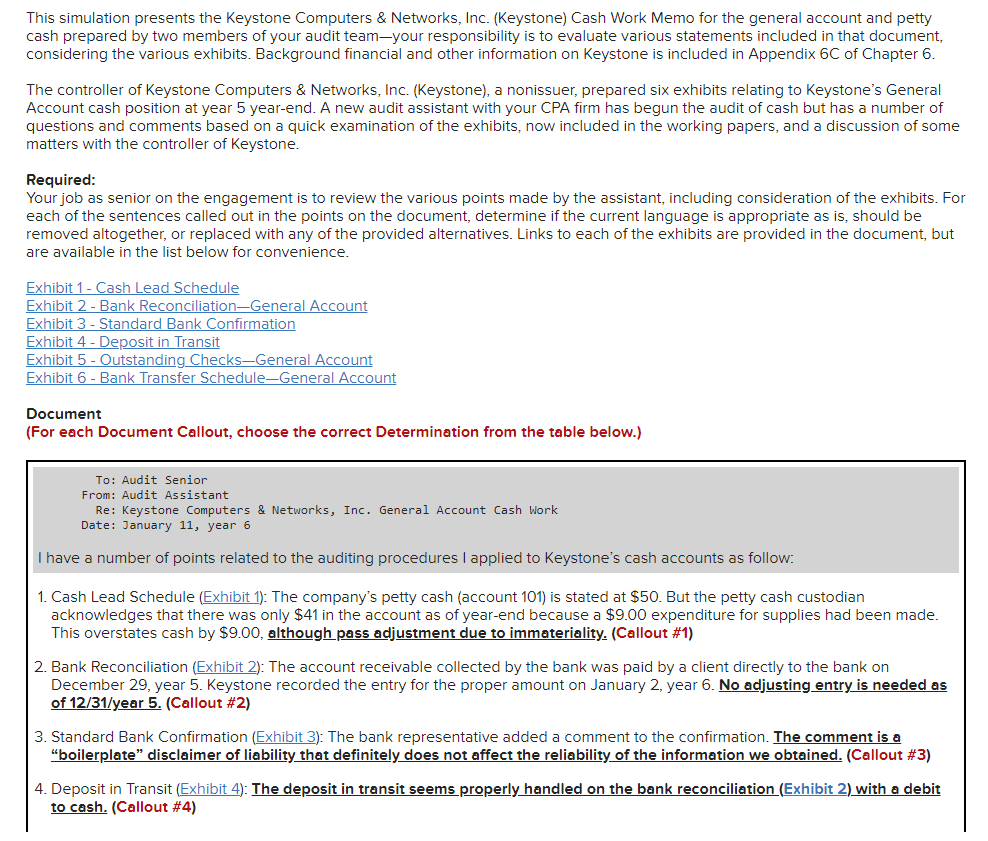

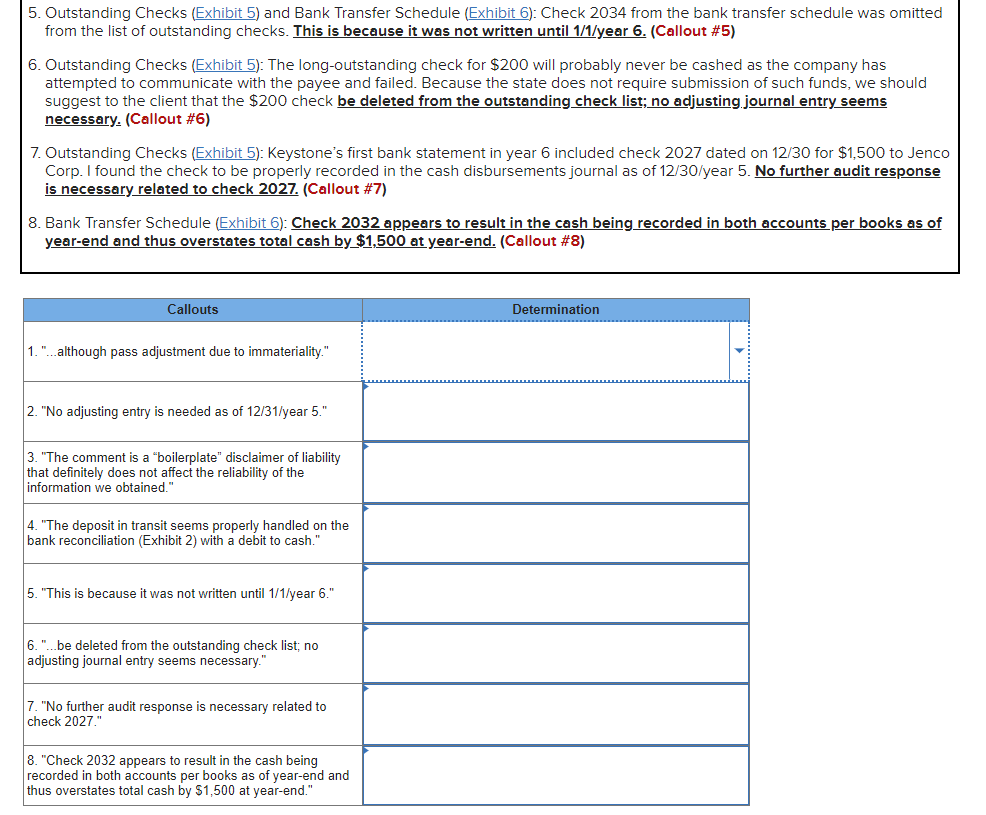

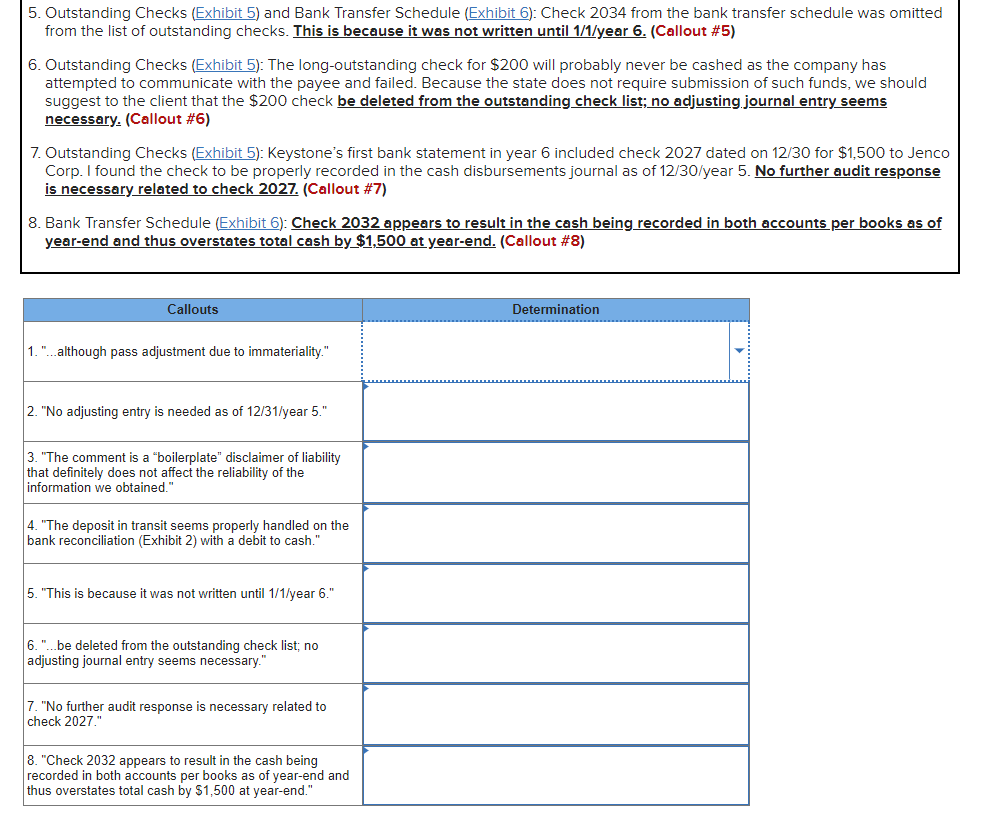

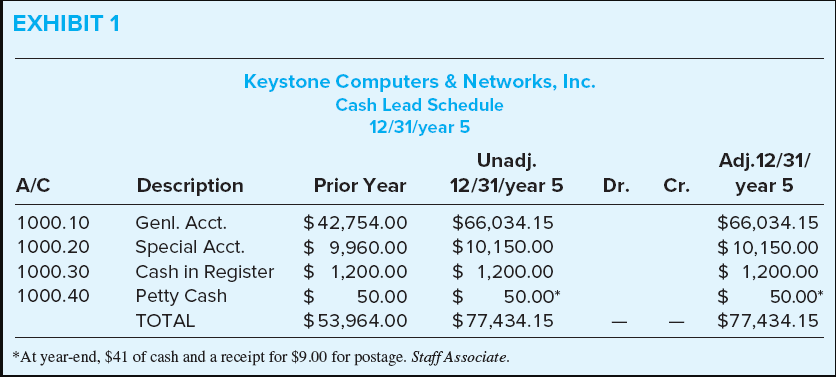

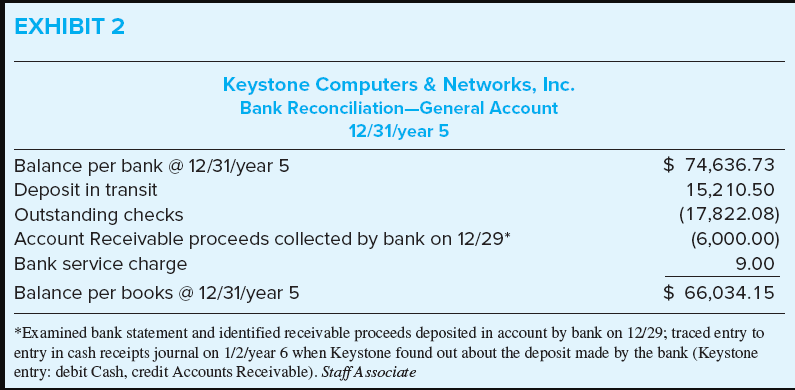

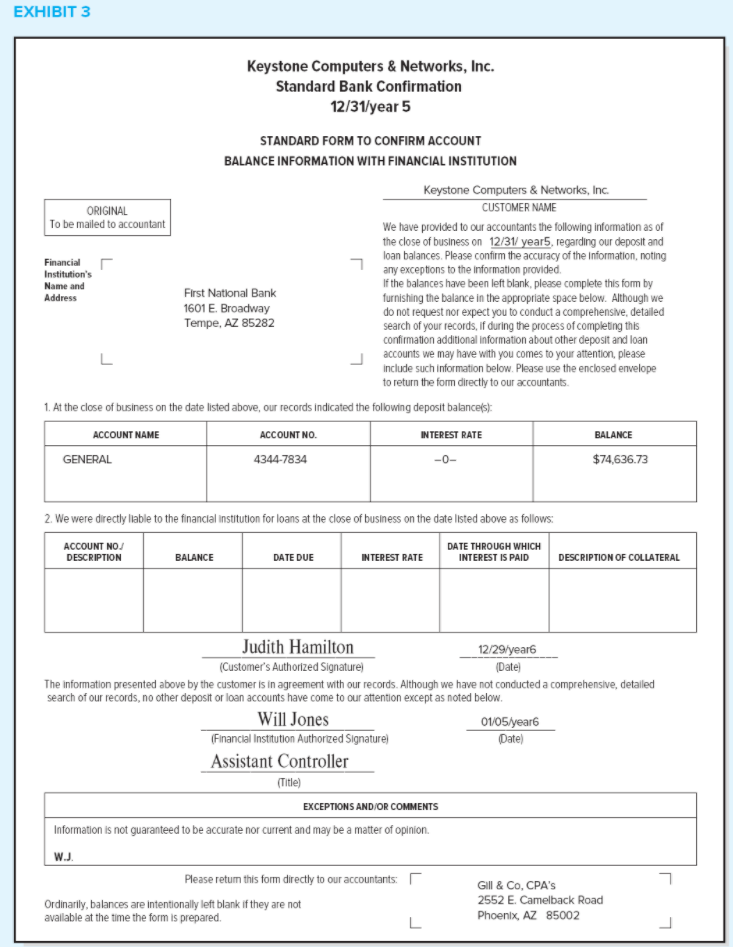

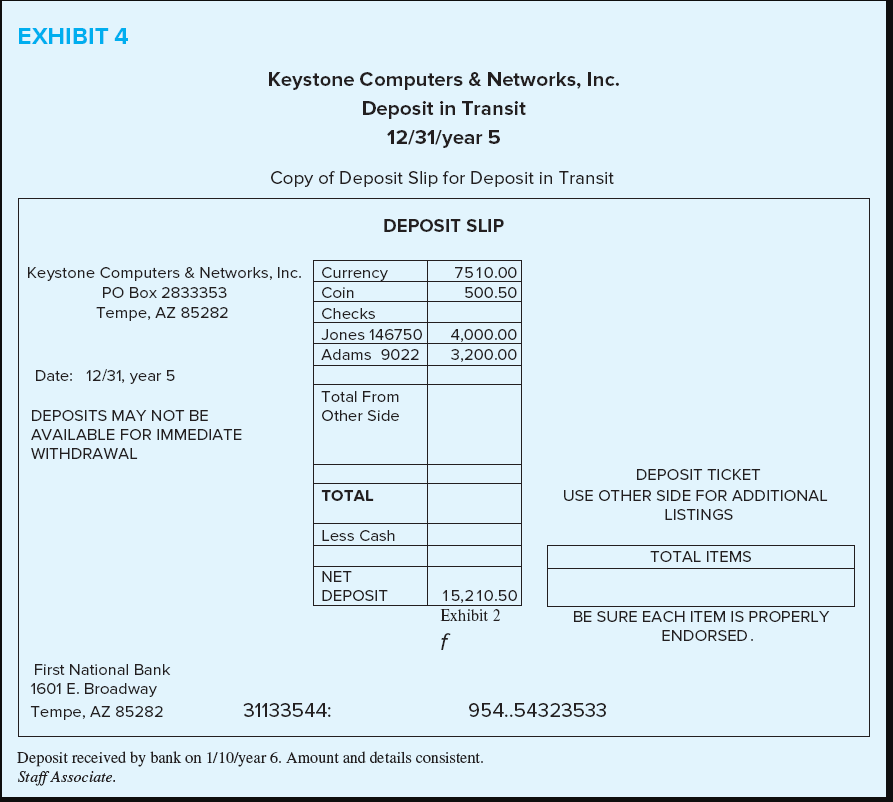

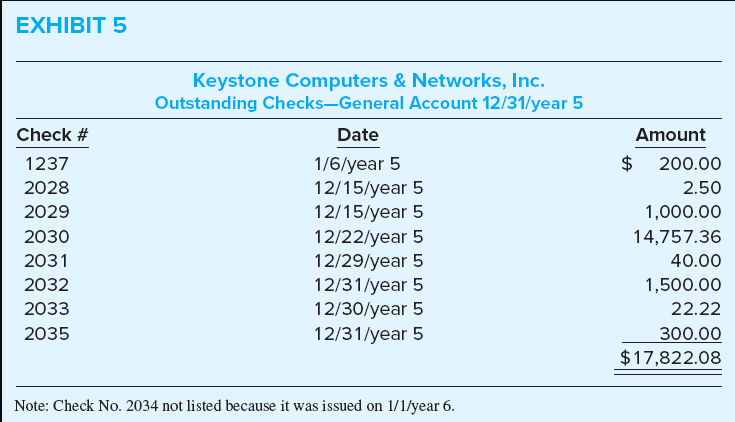

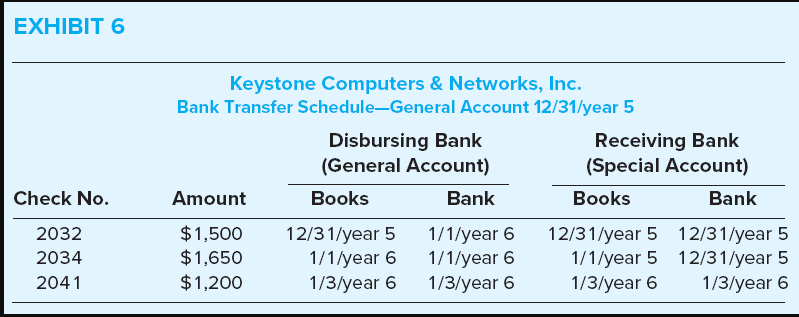

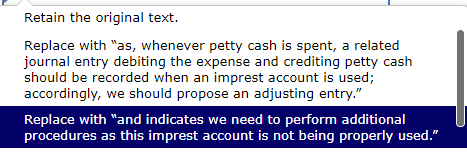

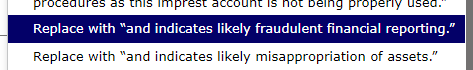

This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation=General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a sboilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation=General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a sboilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) Callouts Determination 1."...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6."...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) Callouts Determination 1."...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6."...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." EXHIBIT 1 Adj. 12/31/ A/C Cr. year 5 Keystone Computers & Networks, Inc. Cash Lead Schedule 12/31/year 5 Unadj. Description Prior Year 12/31/year 5 Dr. Genl. Acct. $ 42,754.00 $66,034.15 Special Acct. $ 9,960.00 $10,150.00 Cash in Register $ 1,200.00 $ 1,200.00 Petty Cash $ 50.00 $ 50.00* TOTAL $ 53,964.00 $77,434.15 1000. 10 1000.20 1000.30 1000.40 $66,034.15 $ 10,150.00 $ 1,200.00 $ 50.00* - $77,434.15 *At year-end, $41 of cash and a receipt for $9.00 for postage. Staff Associate. EXHIBIT 2 Keystone Computers & Networks, Inc. Bank Reconciliation-General Account 12/31/year 5 Balance per bank @ 12/31/year 5 $ 74,636.73 Deposit in transit 15,210.50 Outstanding checks (17,822.08) Account Receivable proceeds collected by bank on 12/29* (6,000.00) Bank service charge 9.00 Balance per books @ 12/31/year 5 $ 66,034.15 *Examined bank statement and identified receivable proceeds deposited in account by bank on 12/29; traced entry to entry in cash receipts journal on 1/2/year 6 when Keystone found out about the deposit made by the bank (Keystone entry: debit Cash, credit Accounts Receivable). Staff Associate EXHIBIT 3 Keystone Computers & Networks, Inc. Standard Bank Confirmation 12/31/year 5 STANDARD FORM TO CONFIRM ACCOUNT BALANCE INFORMATION WITH FINANCIAL INSTITUTION Keystone Computers & Networks, Inc. ORIGINAL CUSTOMER NAME To be mailed to accountant We have provided to our accountants the following information as of the close of business on 12/31/ years, regarding our deposit and Financial 7 loan balances. Please confirm the accuracy of the information, noting Institution's any exceptions to the information provided Name and If the balances have been left blank, please complete this form by Address First National Bank furnishing the balance in the appropriate space below. Although we 1601 E. Broadway do not request nor expect you to conduct a comprehensive, detailed Tempe, AZ 85282 search of your records, if during the process of completing this confirmation additional information about other deposit and loan L accounts we may have with you comes to your attention, please include such information below. Please use the enclosed envelope to return the form directly to our accountants. 1. At the close of business on the date listed above, our records indicated the following deposit balance(s): ACCOUNT NAME ACCOUNT NO INTEREST RATE BALANCE GENERAL 4344-7834 -O- $74,636.73 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows: ACCOUNT NO DATE THROUGH WHICH DESCRIPTION BALANCE DATE DUE INTEREST RATE INTEREST IS PAID DESCRIPTION OF COLLATERAL (Date) Judith Hamilton 12/29/year (Customer's Authorized Signature) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive, detailed search of our records, no other deposit or loan accounts have come to our attention except as noted below. Will Jones 01/05/year (Financial Institution Authorized Signature) Assistant Controller (Title) EXCEPTIONS AND/OR COMMENTS Information is not guaranteed to be accurate nor current and may be a matter of opinion. Datel W.J. 7 Please retum this form directly to our accountants: Ordinarily, balances are intentionally left blank if they are not available at the time the form is prepared. Gill & Co, CPA's 2552 E. Camelback Road Phoenix, AZ 85002 L L EXHIBIT 4 Keystone Computers & Networks, Inc. Deposit in Transit 12/31/year 5 Copy of Deposit Slip for Deposit in Transit DEPOSIT SLIP 7510.00 500.50 4,000.00 3,200.00 Keystone Computers & Networks, Inc. Currency PO Box 2833353 Coin Tempe, AZ 85282 Checks Jones 146750 Adams 9022 Date: 12/31, year 5 Total From DEPOSITS MAY NOT BE Other Side AVAILABLE FOR IMMEDIATE WITHDRAWAL TOTAL DEPOSIT TICKET USE OTHER SIDE FOR ADDITIONAL LISTINGS Less Cash TOTAL ITEMS NET DEPOSIT 15,2 10.50 Exhibit 2 f BE SURE EACH ITEM IS PROPERLY ENDORSED. First National Bank 1601 E. Broadway Tempe, AZ 85282 31133544 954..54323533 Deposit received by bank on 1/10/year 6. Amount and details consistent. Staff Associate. EXHIBIT 5 Check # 1237 2028 2029 2030 2031 2032 2033 2035 Keystone Computers & Networks, Inc. Outstanding ChecksGeneral Account 12/31/year 5 Date 1/6/year 5 12/15/year 5 12/15/year 5 12/22/year 5 12/29/year 5 12/31/year 5 12/30/year 5 12/31/year 5 Amount $ 200.00 2.50 1,000.00 14,757.36 40.00 1,500.00 22.22 300.00 $17,822.08 Note: Check No. 2034 not listed because it was issued on 1/1/year 6. EXHIBIT 6 Keystone Computers & Networks, Inc. Bank Transfer Schedule-General Account 12/31/year 5 Disbursing Bank Receiving Bank (General Account) (Special Account) Amount Books Bank Books Bank $1,500 12/31/year 5 1/1/year 6 12/31/year 5 12/31/year 5 $1,650 1/1/year 6 1/1/year 6 1/1/year 5 12/31/year 5 $1,200 1/3/year 6 1/3/year 6 1/3/year 6 1/3/year 6 Check No. 2032 2034 2041 Retain the original text. Replace with "as, whenever petty cash is spent, a related journal entry debiting the expense and crediting petty cash should be recorded when an imprest account is used; accordingly, we should propose an adjusting entry." Replace with "and indicates we need to perform additional procedures as this imprest account is not being properly used." procedu es as this imprest account is not being properly used. Replace with "and indicates likely fraudulent financial reporting." Replace with "and indicates likely misappropriation of assets." This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation=General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a sboilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation=General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a sboilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) Callouts Determination 1."...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6."...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) Callouts Determination 1."...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6."...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." EXHIBIT 1 Adj. 12/31/ A/C Cr. year 5 Keystone Computers & Networks, Inc. Cash Lead Schedule 12/31/year 5 Unadj. Description Prior Year 12/31/year 5 Dr. Genl. Acct. $ 42,754.00 $66,034.15 Special Acct. $ 9,960.00 $10,150.00 Cash in Register $ 1,200.00 $ 1,200.00 Petty Cash $ 50.00 $ 50.00* TOTAL $ 53,964.00 $77,434.15 1000. 10 1000.20 1000.30 1000.40 $66,034.15 $ 10,150.00 $ 1,200.00 $ 50.00* - $77,434.15 *At year-end, $41 of cash and a receipt for $9.00 for postage. Staff Associate. EXHIBIT 2 Keystone Computers & Networks, Inc. Bank Reconciliation-General Account 12/31/year 5 Balance per bank @ 12/31/year 5 $ 74,636.73 Deposit in transit 15,210.50 Outstanding checks (17,822.08) Account Receivable proceeds collected by bank on 12/29* (6,000.00) Bank service charge 9.00 Balance per books @ 12/31/year 5 $ 66,034.15 *Examined bank statement and identified receivable proceeds deposited in account by bank on 12/29; traced entry to entry in cash receipts journal on 1/2/year 6 when Keystone found out about the deposit made by the bank (Keystone entry: debit Cash, credit Accounts Receivable). Staff Associate EXHIBIT 3 Keystone Computers & Networks, Inc. Standard Bank Confirmation 12/31/year 5 STANDARD FORM TO CONFIRM ACCOUNT BALANCE INFORMATION WITH FINANCIAL INSTITUTION Keystone Computers & Networks, Inc. ORIGINAL CUSTOMER NAME To be mailed to accountant We have provided to our accountants the following information as of the close of business on 12/31/ years, regarding our deposit and Financial 7 loan balances. Please confirm the accuracy of the information, noting Institution's any exceptions to the information provided Name and If the balances have been left blank, please complete this form by Address First National Bank furnishing the balance in the appropriate space below. Although we 1601 E. Broadway do not request nor expect you to conduct a comprehensive, detailed Tempe, AZ 85282 search of your records, if during the process of completing this confirmation additional information about other deposit and loan L accounts we may have with you comes to your attention, please include such information below. Please use the enclosed envelope to return the form directly to our accountants. 1. At the close of business on the date listed above, our records indicated the following deposit balance(s): ACCOUNT NAME ACCOUNT NO INTEREST RATE BALANCE GENERAL 4344-7834 -O- $74,636.73 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows: ACCOUNT NO DATE THROUGH WHICH DESCRIPTION BALANCE DATE DUE INTEREST RATE INTEREST IS PAID DESCRIPTION OF COLLATERAL (Date) Judith Hamilton 12/29/year (Customer's Authorized Signature) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive, detailed search of our records, no other deposit or loan accounts have come to our attention except as noted below. Will Jones 01/05/year (Financial Institution Authorized Signature) Assistant Controller (Title) EXCEPTIONS AND/OR COMMENTS Information is not guaranteed to be accurate nor current and may be a matter of opinion. Datel W.J. 7 Please retum this form directly to our accountants: Ordinarily, balances are intentionally left blank if they are not available at the time the form is prepared. Gill & Co, CPA's 2552 E. Camelback Road Phoenix, AZ 85002 L L EXHIBIT 4 Keystone Computers & Networks, Inc. Deposit in Transit 12/31/year 5 Copy of Deposit Slip for Deposit in Transit DEPOSIT SLIP 7510.00 500.50 4,000.00 3,200.00 Keystone Computers & Networks, Inc. Currency PO Box 2833353 Coin Tempe, AZ 85282 Checks Jones 146750 Adams 9022 Date: 12/31, year 5 Total From DEPOSITS MAY NOT BE Other Side AVAILABLE FOR IMMEDIATE WITHDRAWAL TOTAL DEPOSIT TICKET USE OTHER SIDE FOR ADDITIONAL LISTINGS Less Cash TOTAL ITEMS NET DEPOSIT 15,2 10.50 Exhibit 2 f BE SURE EACH ITEM IS PROPERLY ENDORSED. First National Bank 1601 E. Broadway Tempe, AZ 85282 31133544 954..54323533 Deposit received by bank on 1/10/year 6. Amount and details consistent. Staff Associate. EXHIBIT 5 Check # 1237 2028 2029 2030 2031 2032 2033 2035 Keystone Computers & Networks, Inc. Outstanding ChecksGeneral Account 12/31/year 5 Date 1/6/year 5 12/15/year 5 12/15/year 5 12/22/year 5 12/29/year 5 12/31/year 5 12/30/year 5 12/31/year 5 Amount $ 200.00 2.50 1,000.00 14,757.36 40.00 1,500.00 22.22 300.00 $17,822.08 Note: Check No. 2034 not listed because it was issued on 1/1/year 6. EXHIBIT 6 Keystone Computers & Networks, Inc. Bank Transfer Schedule-General Account 12/31/year 5 Disbursing Bank Receiving Bank (General Account) (Special Account) Amount Books Bank Books Bank $1,500 12/31/year 5 1/1/year 6 12/31/year 5 12/31/year 5 $1,650 1/1/year 6 1/1/year 6 1/1/year 5 12/31/year 5 $1,200 1/3/year 6 1/3/year 6 1/3/year 6 1/3/year 6 Check No. 2032 2034 2041 Retain the original text. Replace with "as, whenever petty cash is spent, a related journal entry debiting the expense and crediting petty cash should be recorded when an imprest account is used; accordingly, we should propose an adjusting entry." Replace with "and indicates we need to perform additional procedures as this imprest account is not being properly used." procedu es as this imprest account is not being properly used. Replace with "and indicates likely fraudulent financial reporting." Replace with "and indicates likely misappropriation of assets