Answered step by step

Verified Expert Solution

Question

1 Approved Answer

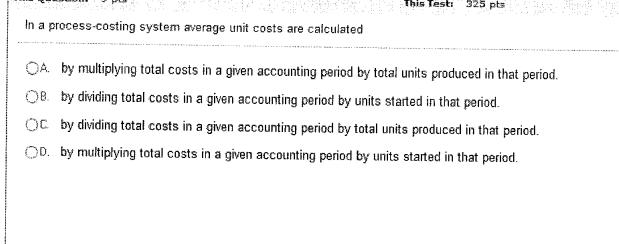

This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by

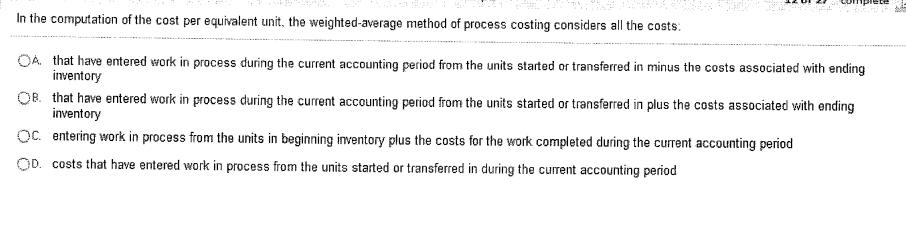

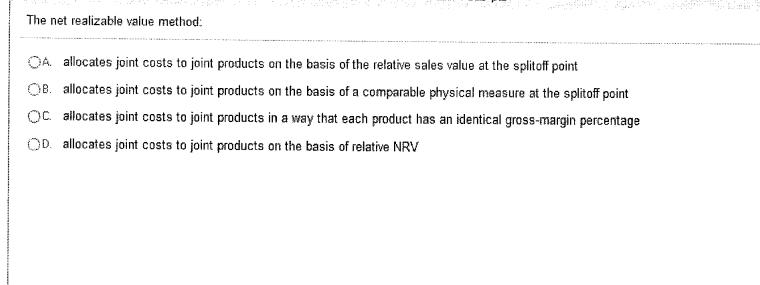

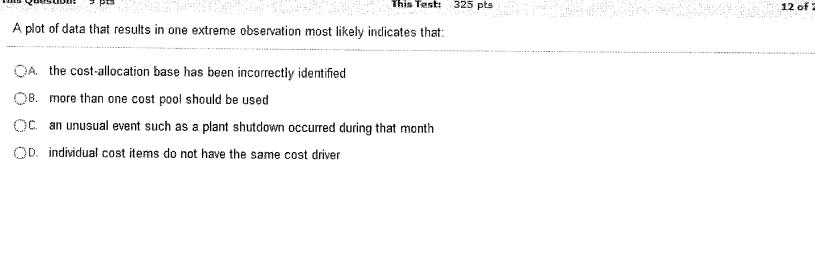

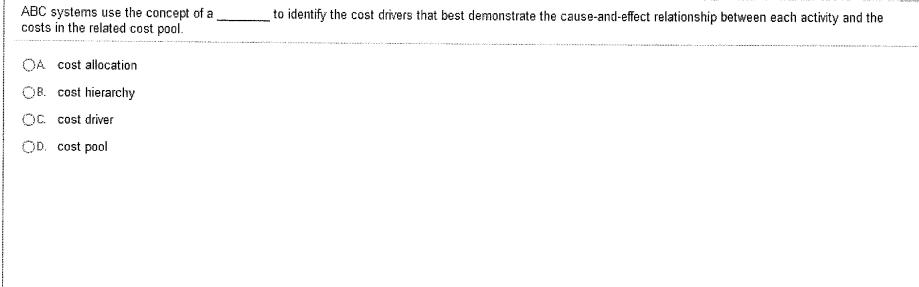

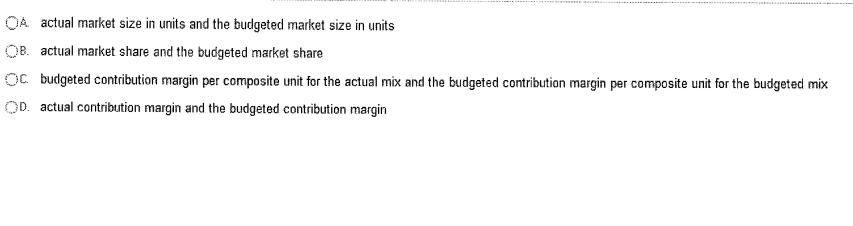

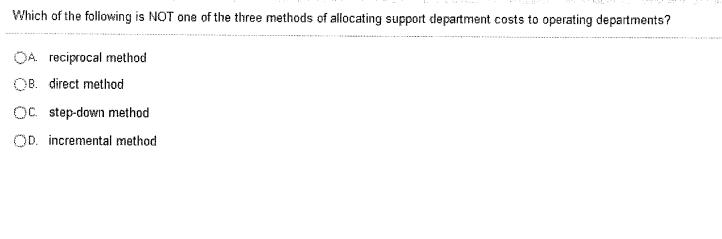

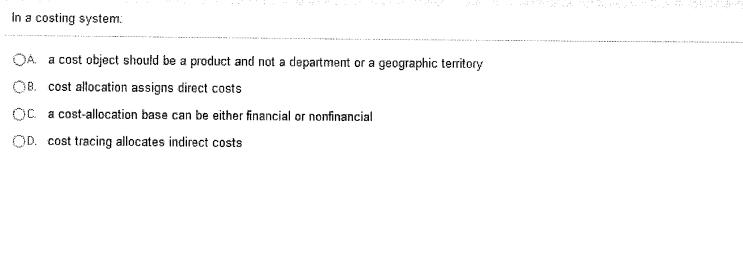

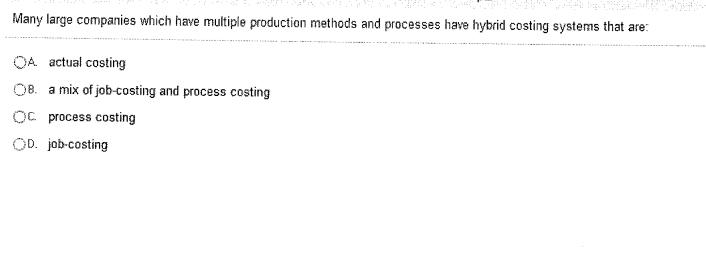

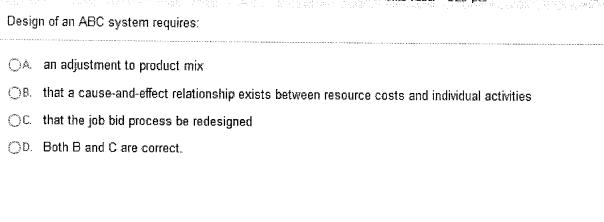

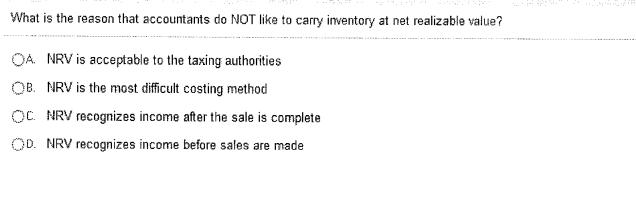

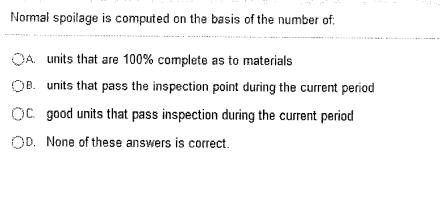

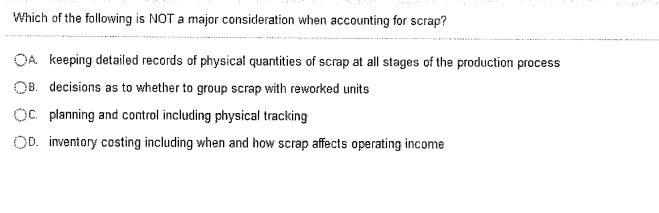

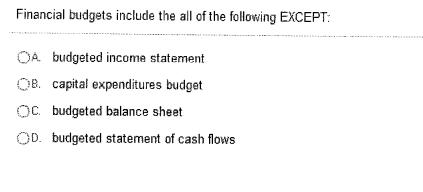

This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by total units produced in that period. OB by dividing total costs in a given accounting period by units started in that period. OC by dividing total costs in a given accounting period by total units produced in that period. OD. by multiplying total costs in a given accounting period by units started in that period. In the computation of the cost per equivalent unit, the weighted-average method of process costing considers all the costs: OA that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory OB. that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory OC. entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period OD. costs that have entered work in process from the units started or transferred in during the current accounting period ete The net realizable value method: OA allocates joint costs to joint products on the basis of the relative sales value at the splitoff point OB. allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point OC allocates joint costs to joint products in a way that each product has an identical gross-margin percentage OD allocates joint costs to joint products on the basis of relative NRV This Test: A plot of data that results in one extreme observation most likely indicates that: OA. the cost-allocation base has been incorrectly identified OB. more than one cost pool should be used OC an unusual event such as a plant shutdown occurred during that month OD. individual cost items do not have the same cost driver 325 pts 12 of ABC systems use the concept of a costs in the related cost pool. OA cost allocation OB. cost hierarchy OC. cost driver OD. cost pool to identify the cost drivers that best demonstrate the cause-and-effect relationship between each activity and the *********** OA actual market size in units and the budgeted market size in units OB. actual market share and the budgeted market share OC budgeted contribution margin per composite unit for the actual mix and the budgeted contribution margin per composite unit for the budgeted mix OD. actual contribution margin and the budgeted contribution margin Which of the following is NOT one of the three methods of allocating support department costs to operating departments? OA. reciprocal method OB. direct method OC step-down method OD. incremental method In a costing system: OA a cost object should be a product and not a department or a geographic territory OB. cost allocation assigns direct costs OC a cost-allocation base can be either financial or nonfinancial OD. cost tracing allocates indirect costs Many large companies which have multiple production methods and processes have hybrid costing systems that are: OA actual costing OB. a mix of job-costing and process costing O process costing OD. job-costing Design of an ABC system requires: OA an adjustment to product mix OB. that a cause-and-effect relationship exists between resource costs and individual activities OC. that the job bid process be redesigned OD. Both B and C are correct. What is the reason that accountants do NOT like to carry inventory at net realizable value? OA. NRV is acceptable to the taxing authorities QB. NRV is the most difficult costing method OC NRV recognizes income after the sale is complete OD. NRV recognizes income before sales are made Normal spoilage is computed on the basis of the number of: OA. units that are 100% complete as to materials OB. units that pass the inspection point during the current period OC good units that pass inspection during the current period OD. None of these answers is correct. Which of the following is NOT a major consideration when accounting for scrap? OA keeping detailed records of physical quantities of scrap at all stages of the production process OB. decisions as to whether to group scrap with reworked units Oc planning and control including physical tracking OD. inventory costing including when and how scrap affects operating income Financial budgets include the all of the following EXCEPT: OA budgeted income statement OB. capital expenditures budget OC budgeted balance sheet OD. budgeted statement of cash flows This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by total units produced in that period. OB by dividing total costs in a given accounting period by units started in that period. OC by dividing total costs in a given accounting period by total units produced in that period. OD. by multiplying total costs in a given accounting period by units started in that period. In the computation of the cost per equivalent unit, the weighted-average method of process costing considers all the costs: OA that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory OB. that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory OC. entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period OD. costs that have entered work in process from the units started or transferred in during the current accounting period ete The net realizable value method: OA allocates joint costs to joint products on the basis of the relative sales value at the splitoff point OB. allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point OC allocates joint costs to joint products in a way that each product has an identical gross-margin percentage OD allocates joint costs to joint products on the basis of relative NRV This Test: A plot of data that results in one extreme observation most likely indicates that: OA. the cost-allocation base has been incorrectly identified OB. more than one cost pool should be used OC an unusual event such as a plant shutdown occurred during that month OD. individual cost items do not have the same cost driver 325 pts 12 of ABC systems use the concept of a costs in the related cost pool. OA cost allocation OB. cost hierarchy OC. cost driver OD. cost pool to identify the cost drivers that best demonstrate the cause-and-effect relationship between each activity and the *********** OA actual market size in units and the budgeted market size in units OB. actual market share and the budgeted market share OC budgeted contribution margin per composite unit for the actual mix and the budgeted contribution margin per composite unit for the budgeted mix OD. actual contribution margin and the budgeted contribution margin Which of the following is NOT one of the three methods of allocating support department costs to operating departments? OA. reciprocal method OB. direct method OC step-down method OD. incremental method In a costing system: OA a cost object should be a product and not a department or a geographic territory OB. cost allocation assigns direct costs OC a cost-allocation base can be either financial or nonfinancial OD. cost tracing allocates indirect costs Many large companies which have multiple production methods and processes have hybrid costing systems that are: OA actual costing OB. a mix of job-costing and process costing O process costing OD. job-costing Design of an ABC system requires: OA an adjustment to product mix OB. that a cause-and-effect relationship exists between resource costs and individual activities OC. that the job bid process be redesigned OD. Both B and C are correct. What is the reason that accountants do NOT like to carry inventory at net realizable value? OA. NRV is acceptable to the taxing authorities QB. NRV is the most difficult costing method OC NRV recognizes income after the sale is complete OD. NRV recognizes income before sales are made Normal spoilage is computed on the basis of the number of: OA. units that are 100% complete as to materials OB. units that pass the inspection point during the current period OC good units that pass inspection during the current period OD. None of these answers is correct. Which of the following is NOT a major consideration when accounting for scrap? OA keeping detailed records of physical quantities of scrap at all stages of the production process OB. decisions as to whether to group scrap with reworked units Oc planning and control including physical tracking OD. inventory costing including when and how scrap affects operating income Financial budgets include the all of the following EXCEPT: OA budgeted income statement OB. capital expenditures budget OC budgeted balance sheet OD. budgeted statement of cash flows This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by total units produced in that period. OB by dividing total costs in a given accounting period by units started in that period. OC by dividing total costs in a given accounting period by total units produced in that period. OD. by multiplying total costs in a given accounting period by units started in that period. In the computation of the cost per equivalent unit, the weighted-average method of process costing considers all the costs: OA that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory OB. that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory OC. entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period OD. costs that have entered work in process from the units started or transferred in during the current accounting period ete The net realizable value method: OA allocates joint costs to joint products on the basis of the relative sales value at the splitoff point OB. allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point OC allocates joint costs to joint products in a way that each product has an identical gross-margin percentage OD allocates joint costs to joint products on the basis of relative NRV This Test: A plot of data that results in one extreme observation most likely indicates that: OA. the cost-allocation base has been incorrectly identified OB. more than one cost pool should be used OC an unusual event such as a plant shutdown occurred during that month OD. individual cost items do not have the same cost driver 325 pts 12 of ABC systems use the concept of a costs in the related cost pool. OA cost allocation OB. cost hierarchy OC. cost driver OD. cost pool to identify the cost drivers that best demonstrate the cause-and-effect relationship between each activity and the *********** OA actual market size in units and the budgeted market size in units OB. actual market share and the budgeted market share OC budgeted contribution margin per composite unit for the actual mix and the budgeted contribution margin per composite unit for the budgeted mix OD. actual contribution margin and the budgeted contribution margin Which of the following is NOT one of the three methods of allocating support department costs to operating departments? OA. reciprocal method OB. direct method OC step-down method OD. incremental method In a costing system: OA a cost object should be a product and not a department or a geographic territory OB. cost allocation assigns direct costs OC a cost-allocation base can be either financial or nonfinancial OD. cost tracing allocates indirect costs Many large companies which have multiple production methods and processes have hybrid costing systems that are: OA actual costing OB. a mix of job-costing and process costing O process costing OD. job-costing Design of an ABC system requires: OA an adjustment to product mix OB. that a cause-and-effect relationship exists between resource costs and individual activities OC. that the job bid process be redesigned OD. Both B and C are correct. What is the reason that accountants do NOT like to carry inventory at net realizable value? OA. NRV is acceptable to the taxing authorities QB. NRV is the most difficult costing method OC NRV recognizes income after the sale is complete OD. NRV recognizes income before sales are made Normal spoilage is computed on the basis of the number of: OA. units that are 100% complete as to materials OB. units that pass the inspection point during the current period OC good units that pass inspection during the current period OD. None of these answers is correct. Which of the following is NOT a major consideration when accounting for scrap? OA keeping detailed records of physical quantities of scrap at all stages of the production process OB. decisions as to whether to group scrap with reworked units Oc planning and control including physical tracking OD. inventory costing including when and how scrap affects operating income Financial budgets include the all of the following EXCEPT: OA budgeted income statement OB. capital expenditures budget OC budgeted balance sheet OD. budgeted statement of cash flows This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by total units produced in that period. OB by dividing total costs in a given accounting period by units started in that period. OC by dividing total costs in a given accounting period by total units produced in that period. OD. by multiplying total costs in a given accounting period by units started in that period. In the computation of the cost per equivalent unit, the weighted-average method of process costing considers all the costs: OA that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory OB. that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory OC. entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period OD. costs that have entered work in process from the units started or transferred in during the current accounting period ete The net realizable value method: OA allocates joint costs to joint products on the basis of the relative sales value at the splitoff point OB. allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point OC allocates joint costs to joint products in a way that each product has an identical gross-margin percentage OD allocates joint costs to joint products on the basis of relative NRV This Test: A plot of data that results in one extreme observation most likely indicates that: OA. the cost-allocation base has been incorrectly identified OB. more than one cost pool should be used OC an unusual event such as a plant shutdown occurred during that month OD. individual cost items do not have the same cost driver 325 pts 12 of ABC systems use the concept of a costs in the related cost pool. OA cost allocation OB. cost hierarchy OC. cost driver OD. cost pool to identify the cost drivers that best demonstrate the cause-and-effect relationship between each activity and the *********** OA actual market size in units and the budgeted market size in units OB. actual market share and the budgeted market share OC budgeted contribution margin per composite unit for the actual mix and the budgeted contribution margin per composite unit for the budgeted mix OD. actual contribution margin and the budgeted contribution margin Which of the following is NOT one of the three methods of allocating support department costs to operating departments? OA. reciprocal method OB. direct method OC step-down method OD. incremental method In a costing system: OA a cost object should be a product and not a department or a geographic territory OB. cost allocation assigns direct costs OC a cost-allocation base can be either financial or nonfinancial OD. cost tracing allocates indirect costs Many large companies which have multiple production methods and processes have hybrid costing systems that are: OA actual costing OB. a mix of job-costing and process costing O process costing OD. job-costing Design of an ABC system requires: OA an adjustment to product mix OB. that a cause-and-effect relationship exists between resource costs and individual activities OC. that the job bid process be redesigned OD. Both B and C are correct. What is the reason that accountants do NOT like to carry inventory at net realizable value? OA. NRV is acceptable to the taxing authorities QB. NRV is the most difficult costing method OC NRV recognizes income after the sale is complete OD. NRV recognizes income before sales are made Normal spoilage is computed on the basis of the number of: OA. units that are 100% complete as to materials OB. units that pass the inspection point during the current period OC good units that pass inspection during the current period OD. None of these answers is correct. Which of the following is NOT a major consideration when accounting for scrap? OA keeping detailed records of physical quantities of scrap at all stages of the production process OB. decisions as to whether to group scrap with reworked units Oc planning and control including physical tracking OD. inventory costing including when and how scrap affects operating income Financial budgets include the all of the following EXCEPT: OA budgeted income statement OB. capital expenditures budget OC budgeted balance sheet OD. budgeted statement of cash flows This Test: 325 pts In a process-costing system average unit costs are calculated OA by multiplying total costs in a given accounting period by total units produced in that period. OB by dividing total costs in a given accounting period by units started in that period. OC by dividing total costs in a given accounting period by total units produced in that period. OD. by multiplying total costs in a given accounting period by units started in that period. In the computation of the cost per equivalent unit, the weighted-average method of process costing considers all the costs: OA that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory OB. that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory OC. entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period OD. costs that have entered work in process from the units started or transferred in during the current accounting period ete The net realizable value method: OA allocates joint costs to joint products on the basis of the relative sales value at the splitoff point OB. allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point OC allocates joint costs to joint products in a way that each product has an identical gross-margin percentage OD allocates joint costs to joint products on the basis of relative NRV This Test: A plot of data that results in one extreme observation most likely indicates that: OA. the cost-allocation base has been incorrectly identified OB. more than one cost pool should be used OC an unusual event such as a plant shutdown occurred during that month OD. individual cost items do not have the same cost driver 325 pts 12 of ABC systems use the concept of a costs in the related cost pool. OA cost allocation OB. cost hierarchy OC. cost driver OD. cost pool to identify the cost drivers that best demonstrate the cause-and-effect relationship between each activity and the *********** OA actual market size in units and the budgeted market size in units OB. actual market share and the budgeted market share OC budgeted contribution margin per composite unit for the actual mix and the budgeted contribution margin per composite unit for the budgeted mix OD. actual contribution margin and the budgeted contribution margin Which of the following is NOT one of the three methods of allocating support department costs to operating departments? OA. reciprocal method OB. direct method OC step-down method OD. incremental method In a costing system: OA a cost object should be a product and not a department or a geographic territory OB. cost allocation assigns direct costs OC a cost-allocation base can be either financial or nonfinancial OD. cost tracing allocates indirect costs Many large companies which have multiple production methods and processes have hybrid costing systems that are: OA actual costing OB. a mix of job-costing and process costing O process costing OD. job-costing Design of an ABC system requires: OA an adjustment to product mix OB. that a cause-and-effect relationship exists between resource costs and individual activities OC. that the job bid process be redesigned OD. Both B and C are correct. What is the reason that accountants do NOT like to carry inventory at net realizable value? OA. NRV is acceptable to the taxing authorities QB. NRV is the most difficult costing method OC NRV recognizes income after the sale is complete OD. NRV recognizes income before sales are made Normal spoilage is computed on the basis of the number of: OA. units that are 100% complete as to materials OB. units that pass the inspection point during the current period OC good units that pass inspection during the current period OD. None of these answers is correct. Which of the following is NOT a major consideration when accounting for scrap? OA keeping detailed records of physical quantities of scrap at all stages of the production process OB. decisions as to whether to group scrap with reworked units Oc planning and control including physical tracking OD. inventory costing including when and how scrap affects operating income Financial budgets include the all of the following EXCEPT: OA budgeted income statement OB. capital expenditures budget OC budgeted balance sheet OD. budgeted statement of cash flows

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer A by dividing total cost in a given accounting period by total unit produced in that period Explanation in process costing system average unit cost is computed by dividing total cost by the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started