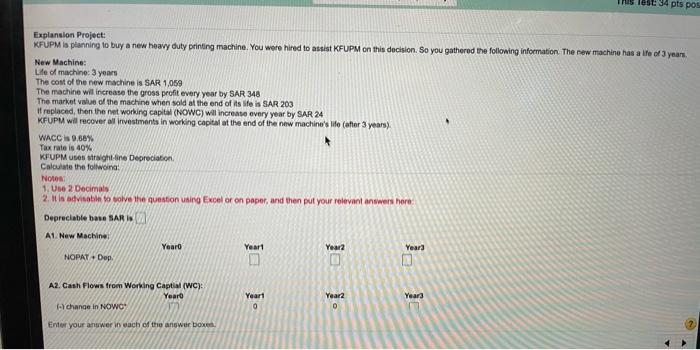

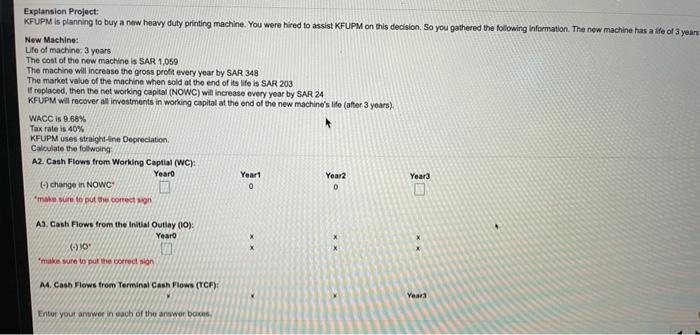

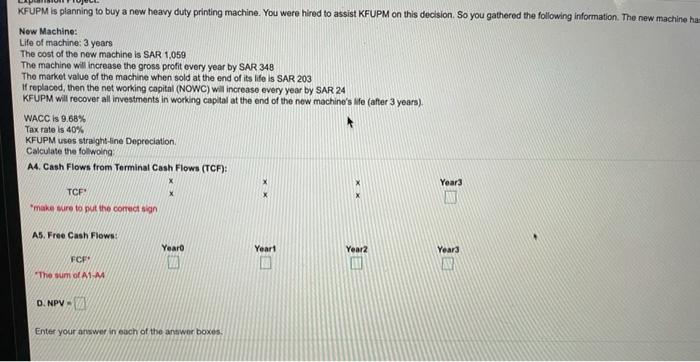

This Test 34 pts pos Explansion Project: KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a le of years, New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,069 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 if replaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). WACC 9.68% Tax rate is 40% KFUPM sos straight-ane Depreciation Calculate the follwing: Notes 1. Use 2 Decimals 2. It is advisable to solve the question using Excel or on paper, and then put your relevant answers here Depreciable base SARI A1 New Machine Yearo Yeart Year2 Year OPT bp. A2. Cash Flows from Working Captial (WC) Yearo - change in NOWCY Yeart Years Year 0 Enter your answer in each of the answer boxen. Explansion Project: KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a life of 3 years New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,059 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 freplaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years) WACC is 9.68% Tax rate is 40% KFUPM uses straight-line Depreciation Calculate the follwing A2. Cash Flows from Working Captial (WC): Yearo Yeart Year2 Year3 change in NOWC 0 0 O make sure to put the correct on A3 Cash Flows from the initial Outlay (10) Yearo (-10 12 make sure to put the correction M. Cash Flows from Terminal Cash Flows (TCF): Yaara Enter your arwer in each of the answer III KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine ha New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,059 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 If replaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's Me (after 3 years) WACC IS 9.68% Tax rate is 40% KFUPM USOs straight-line Depreciation Calculate the folloing A4 Cash Flows from Terminal Cash Flows (TCF): Year3 TCE make wire to put the correct sign A5. Free Cash Flows: Year Yeart Year2 Years E FCF "The sum of AIM D.NPVN Enter your answer in each of the answer boxes This Test 34 pts pos Explansion Project: KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a le of years, New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,069 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 if replaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). WACC 9.68% Tax rate is 40% KFUPM sos straight-ane Depreciation Calculate the follwing: Notes 1. Use 2 Decimals 2. It is advisable to solve the question using Excel or on paper, and then put your relevant answers here Depreciable base SARI A1 New Machine Yearo Yeart Year2 Year OPT bp. A2. Cash Flows from Working Captial (WC) Yearo - change in NOWCY Yeart Years Year 0 Enter your answer in each of the answer boxen. Explansion Project: KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a life of 3 years New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,059 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 freplaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years) WACC is 9.68% Tax rate is 40% KFUPM uses straight-line Depreciation Calculate the follwing A2. Cash Flows from Working Captial (WC): Yearo Yeart Year2 Year3 change in NOWC 0 0 O make sure to put the correct on A3 Cash Flows from the initial Outlay (10) Yearo (-10 12 make sure to put the correction M. Cash Flows from Terminal Cash Flows (TCF): Yaara Enter your arwer in each of the answer III KFUPM is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine ha New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,059 The machine will increase the gross profit every year by SAR 348 The market value of the machine when sold at the end of its life is SAR 203 If replaced, then the networking capital (NOWC) will increase every year by SAR 24 KFUPM will recover all investments in working capital at the end of the new machine's Me (after 3 years) WACC IS 9.68% Tax rate is 40% KFUPM USOs straight-line Depreciation Calculate the folloing A4 Cash Flows from Terminal Cash Flows (TCF): Year3 TCE make wire to put the correct sign A5. Free Cash Flows: Year Yeart Year2 Years E FCF "The sum of AIM D.NPVN Enter your answer in each of the answer boxes