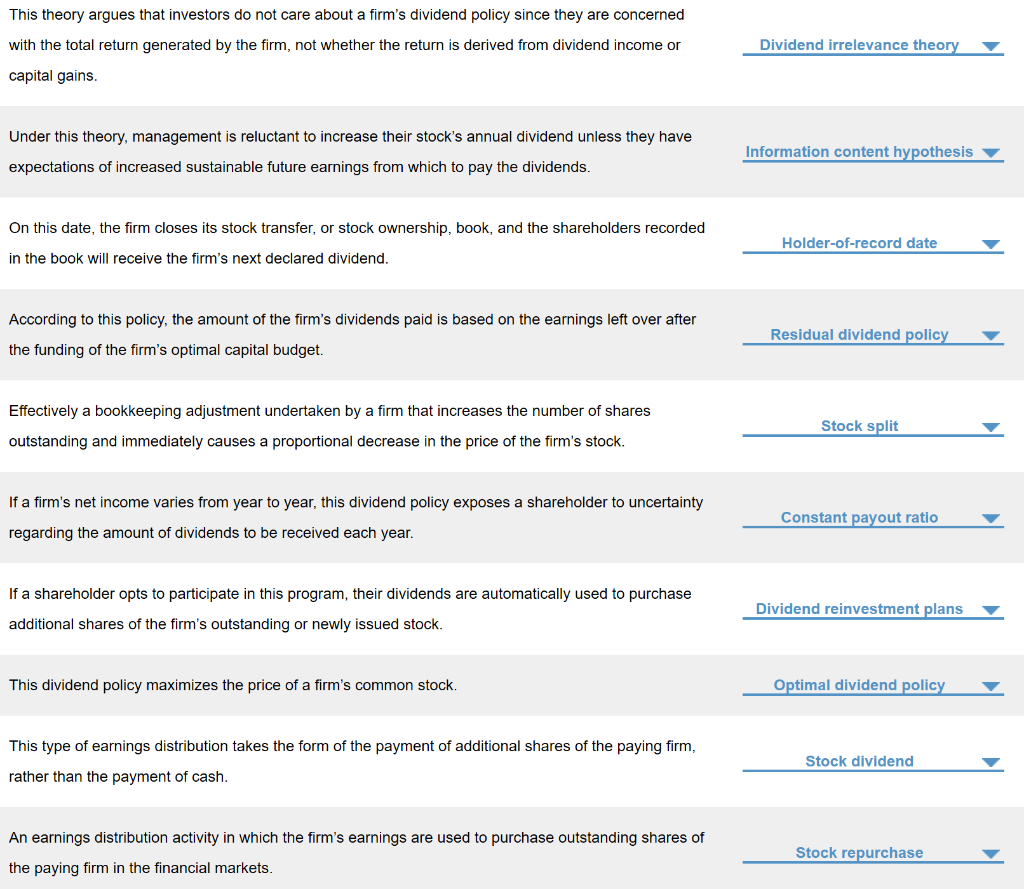

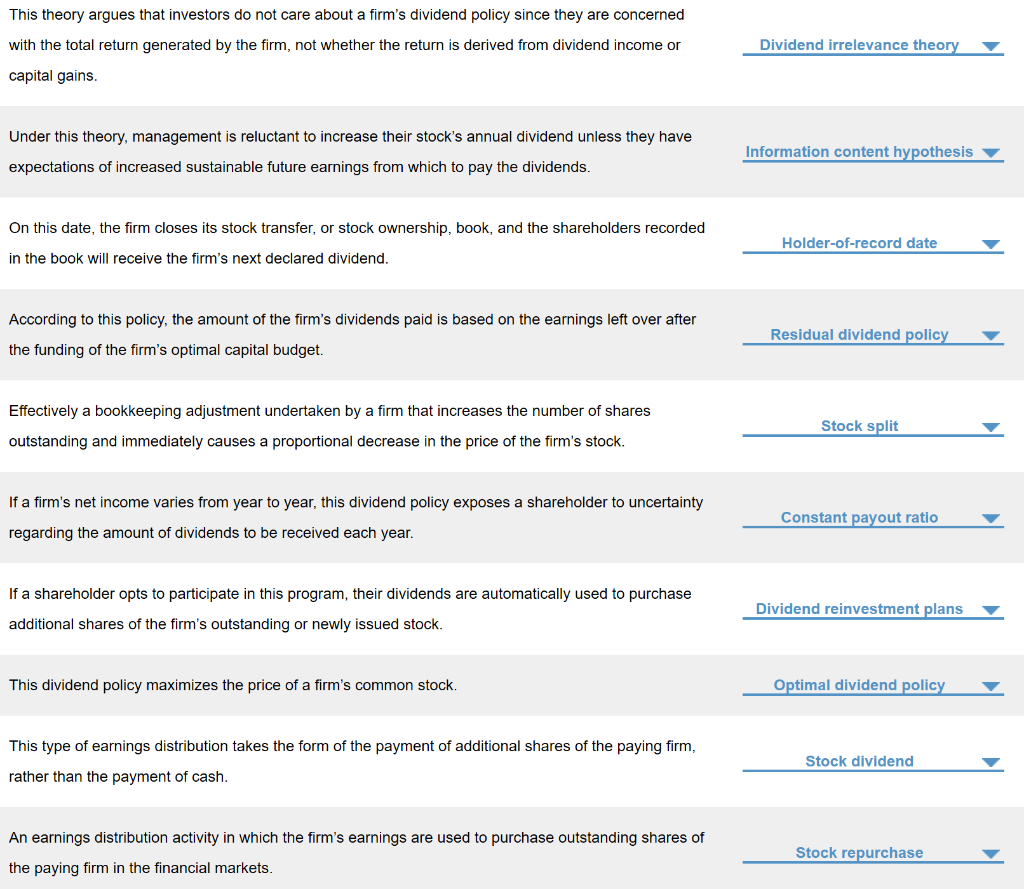

This theory argues that investors do not care about a firm's dividend policy since they are concerned with the total return generated by the firm, not whether the return is derived from dividend income or Dividend irrelevance theory capital gains. Under this theory, management is reluctant to increase their stock's annual dividend unless they have Information content hypothesis expectations of increased sustainable future earnings from which to pay the dividends. On this date, the firm closes its stock transfer, or stock ownership, book, and the shareholders recorded Holder-of-record date in the book will receive the firm's next declared dividend. According to this policy, the amount of the firm's dividends paid is based on the earnings left over after Residual dividend policy the funding of the firm's optimal capital budget. Effectively a bookkeeping adjustment undertaken by a firm that increases the number of shares outstanding and immediately causes a proportional decrease in the price of the firm's stock. Stock split If a firm's net income varies from year to year, this dividend policy exposes a shareholder to uncertainty Constant payout ratio regarding the amount of dividends to be received each year. If a shareholder opts to participate in this program, their dividends are automatically used to purchase additional shares of the firm's outstanding or newly issued stock. Dividend reinvestment plans This dividend policy maximizes the price of a firm's common stock. Optimal dividend policy This type of earnings distribution takes the form of the payment of additional shares of the paying firm, Stock dividend rather than the payment of cash. An earnings distribution activity in which the firm's earnings are used to purchase outstanding shares of the paying firm in the financial markets. Stock repurchase This theory argues that investors do not care about a firm's dividend policy since they are concerned with the total return generated by the firm, not whether the return is derived from dividend income or Dividend irrelevance theory capital gains. Under this theory, management is reluctant to increase their stock's annual dividend unless they have Information content hypothesis expectations of increased sustainable future earnings from which to pay the dividends. On this date, the firm closes its stock transfer, or stock ownership, book, and the shareholders recorded Holder-of-record date in the book will receive the firm's next declared dividend. According to this policy, the amount of the firm's dividends paid is based on the earnings left over after Residual dividend policy the funding of the firm's optimal capital budget. Effectively a bookkeeping adjustment undertaken by a firm that increases the number of shares outstanding and immediately causes a proportional decrease in the price of the firm's stock. Stock split If a firm's net income varies from year to year, this dividend policy exposes a shareholder to uncertainty Constant payout ratio regarding the amount of dividends to be received each year. If a shareholder opts to participate in this program, their dividends are automatically used to purchase additional shares of the firm's outstanding or newly issued stock. Dividend reinvestment plans This dividend policy maximizes the price of a firm's common stock. Optimal dividend policy This type of earnings distribution takes the form of the payment of additional shares of the paying firm, Stock dividend rather than the payment of cash. An earnings distribution activity in which the firm's earnings are used to purchase outstanding shares of the paying firm in the financial markets. Stock repurchase