Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This was the same course I placed the previouordrr for but I got 30% and as a result failed, thanks to you. This is a

This was the same course I placed the previouordrr for but I got 30% and as a result failed, thanks to you.

This is a resit and you do not want me fail again, do you?

Please give me your very best

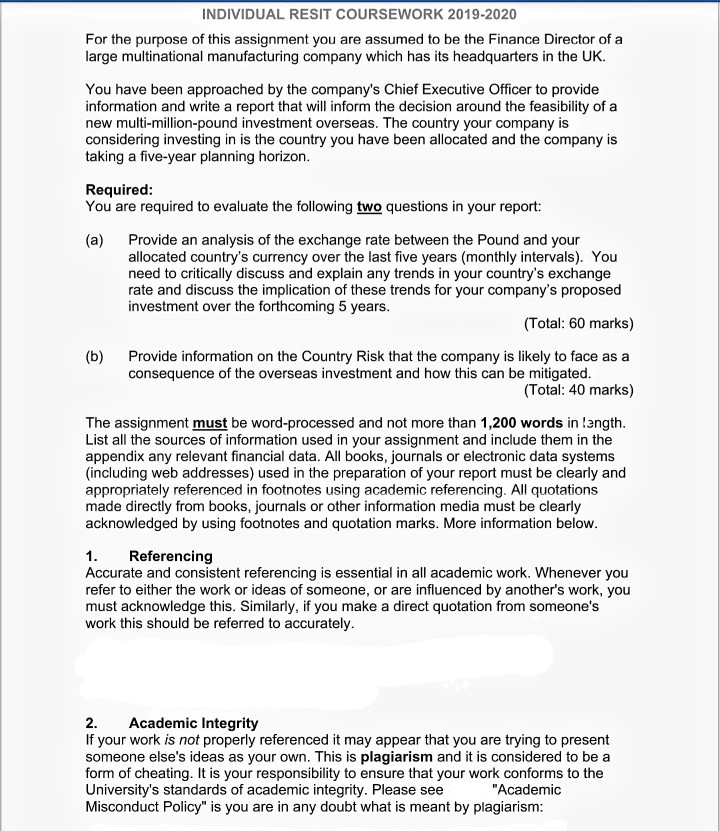

INDIVIDUAL RESIT COURSEWORK 2019-2020 For the purpose of this assignment you are assumed to be the Finance Director of a large multinational manufacturing company which has its headquarters in the UK. You have been approached by the company's Chief Executive Officer to provide information and write a report that will inform the decision around the feasibility of a new multi-million-pound investment overseas. The country your company is considering investing in is the country you have been allocated and the company is taking a five-year planning horizon. Required: You are required to evaluate the following two questions in your report: (a) Provide an analysis of the exchange rate between the Pound and your allocated country's currency over the last five years (monthly intervals). You need to critically discuss and explain any trends in your country's exchange rate and discuss the implication of these trends for your company's proposed investment over the forthcoming 5 years. (Total: 60 marks) (b) Provide information on the Country Risk that the company is likely to face as a consequence of the overseas investment and how this can be mitigated. (Total: 40 marks) The assignment must be word-processed and not more than 1,200 words in length. List all the sources of information used in your assignment and include them in the appendix any relevant financial data. All books, journals or electronic data systems (including web addresses) used in the preparation of your report must be clearly and appropriately referenced in footnotes using academic referencing. All quotations made directly from books, journals or other information media must be clearly acknowledged by using footnotes and quotation marks. More information below. 1. Referencing Accurate and consistent referencing is essential in all academic work. Whenever you refer to either the work or ideas of someone, or are influenced by another's work, you must acknowledge this. Similarly, if you make a direct quotation from someone's work this should be referred to accurately. 2. Academic Integrity If your work is not properly referenced it may appear that you are trying to present someone else's ideas as your own. This is plagiarism and it is considered to be a form of cheating. It is your responsibility to ensure that your work conforms to the University's standards of academic integrity. Please see "Academic Misconduct Policy" is you are in any doubt what is meant by plagiarism: INDIVIDUAL RESIT COURSEWORK 2019-2020 For the purpose of this assignment you are assumed to be the Finance Director of a large multinational manufacturing company which has its headquarters in the UK. You have been approached by the company's Chief Executive Officer to provide information and write a report that will inform the decision around the feasibility of a new multi-million-pound investment overseas. The country your company is considering investing in is the country you have been allocated and the company is taking a five-year planning horizon. Required: You are required to evaluate the following two questions in your report: (a) Provide an analysis of the exchange rate between the Pound and your allocated country's currency over the last five years (monthly intervals). You need to critically discuss and explain any trends in your country's exchange rate and discuss the implication of these trends for your company's proposed investment over the forthcoming 5 years. (Total: 60 marks) (b) Provide information on the Country Risk that the company is likely to face as a consequence of the overseas investment and how this can be mitigated. (Total: 40 marks) The assignment must be word-processed and not more than 1,200 words in length. List all the sources of information used in your assignment and include them in the appendix any relevant financial data. All books, journals or electronic data systems (including web addresses) used in the preparation of your report must be clearly and appropriately referenced in footnotes using academic referencing. All quotations made directly from books, journals or other information media must be clearly acknowledged by using footnotes and quotation marks. More information below. 1. Referencing Accurate and consistent referencing is essential in all academic work. Whenever you refer to either the work or ideas of someone, or are influenced by another's work, you must acknowledge this. Similarly, if you make a direct quotation from someone's work this should be referred to accurately. 2. Academic Integrity If your work is not properly referenced it may appear that you are trying to present someone else's ideas as your own. This is plagiarism and it is considered to be a form of cheating. It is your responsibility to ensure that your work conforms to the University's standards of academic integrity. Please see "Academic Misconduct Policy" is you are in any doubt what is meant by plagiarismStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started