Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this will be my last chegg interaction. thanks for the help with getting me through the semester. please help me with these last 2 questions.

this will be my last chegg interaction. thanks for the help with getting me through the semester. please help me with these last 2 questions. the second question has a part 2. thank you

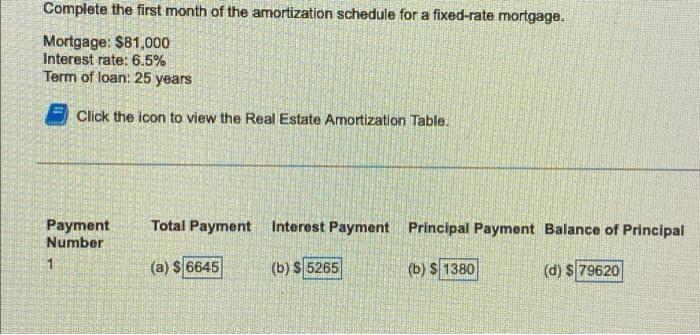

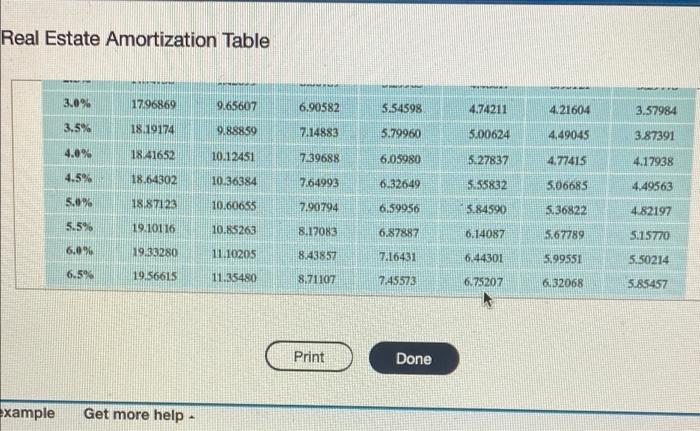

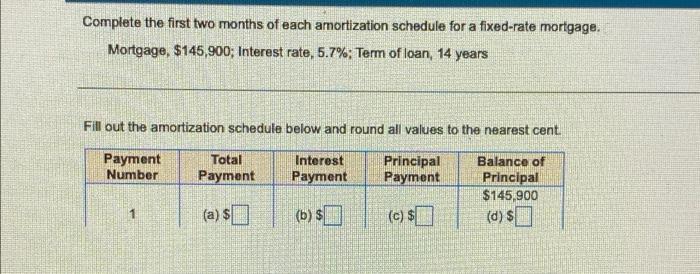

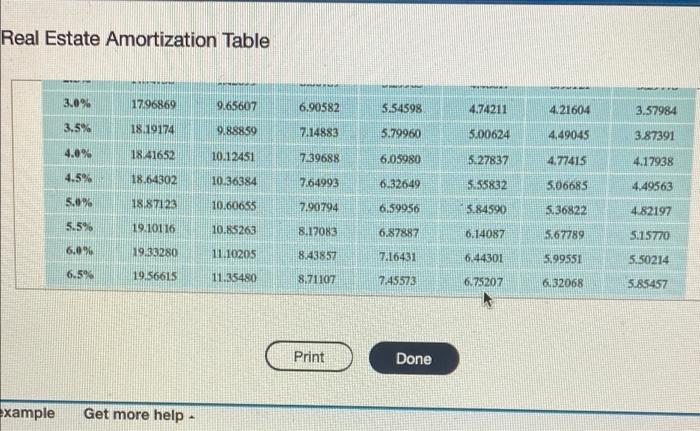

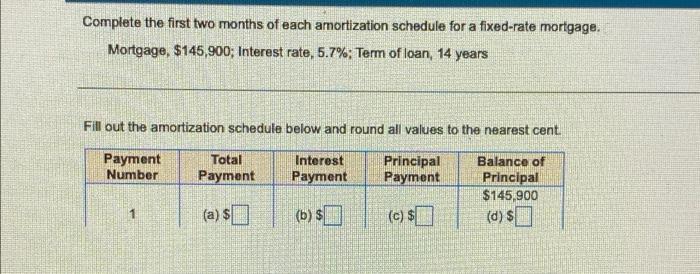

Complete the first month of the amortization schedule for a fixed-rate mortgage. Mortgage: $81,000 Interest rate: 6.5% Term of loan: 25 years Click the icon to view the Real Estate Amortization Table. Total Payment Interest Payment Principal Payment Balance of Principal Payment Number 1 (a) S 6645 (b) S 5265 (b) S 1380 (d) $ 79620 Real Estate Amortization Table 3.0% 17.96869 9.65607 6.90582 5.54598 4.74211 4.21604 3.57984 3.5% 18.19174 9:88859 7.14883 5.79960 5.00624 4,49045 3.87391 4.0% 18.41652 10.12451 7.39688 6,05980 4.77415 4.17938 5.27837 5.55832 4.5% 18.64302 10.36384 7.64993 6.32649 5.06685 4.49563 5.0% 1887123 10.60655 290794 6.59956 5.84590 5.36822 5.5% 19.10116 10.85263 8.17083 6.87887 6.14087 5.67789 4.82197 5.15770 5.50214 6.0% 19.33280 11.10205 8.43857 7.16431 6.44301 5.99551 6.5% 19.56615 11.35480 8.71107 7.49573 6.75207 6.32068 5.85457 Print Done Example Get more help Complete the first two months of each amortization schedule for a fixed-rate mortgage. Mortgage, $145,900; Interest rate, 5.7%, Term of loan, 14 years Fill out the amortization schedule below and round all values to the nearest cent. Payment Number Total Payment Interest Payment Principal Payment Balance of Principal $145,900 (d) $ (a) $ (b) $ (c) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started