Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This year, Gogo, Incorporated granted a nonqualified stock option to Mwana to buy 10,000 shares of Gogo stock for $8 per share for five

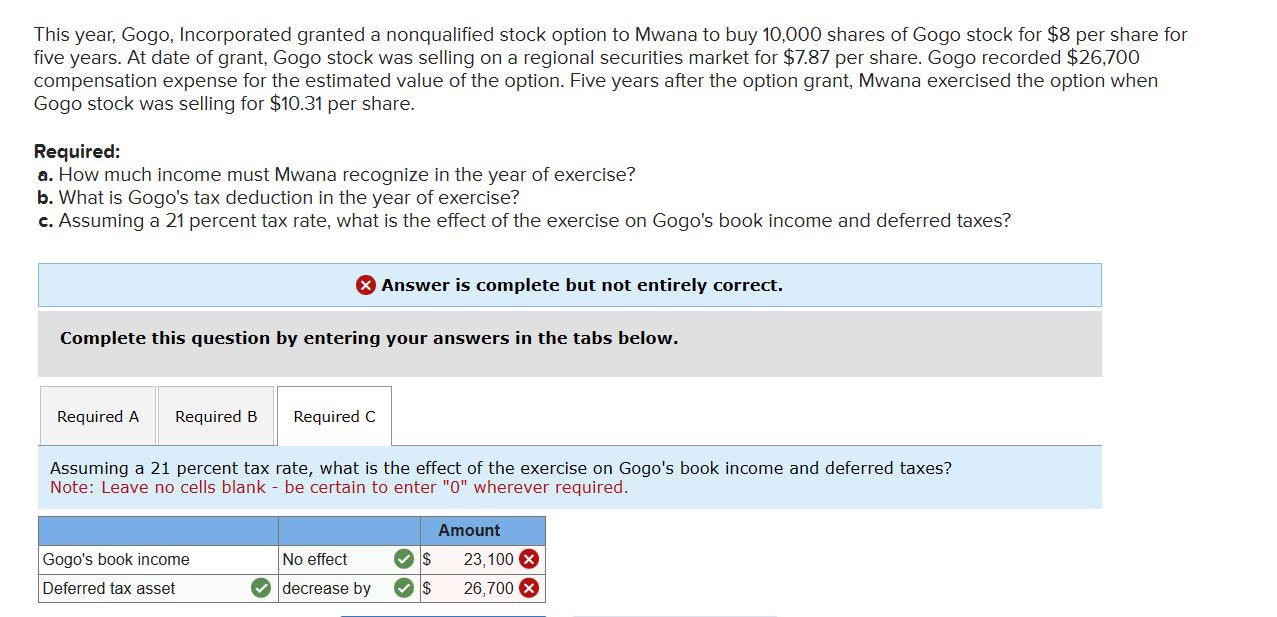

This year, Gogo, Incorporated granted a nonqualified stock option to Mwana to buy 10,000 shares of Gogo stock for $8 per share for five years. At date of grant, Gogo stock was selling on a regional securities market for $7.87 per share. Gogo recorded $26,700 compensation expense for the estimated value of the option. Five years after the option grant, Mwana exercised the option when Gogo stock was selling for $10.31 per share. Required: a. How much income must Mwana recognize in the year of exercise? b. What is Gogo's tax deduction in the year of exercise? c. Assuming a 21 percent tax rate, what is the effect of the exercise on Gogo's book income and deferred taxes? * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Assuming a 21 percent tax rate, what is the effect of the exercise on Gogo's book income and deferred taxes? Note: Leave no cells blank - be certain to enter "0" wherever required. Amount Gogo's book income Deferred tax asset No effect $ 23,100 decrease by $ 26,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Gogo Stock Option Exercise Tax Implications a Mwanas Income in Year of Exercise The difference betwe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started