Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This year. State A raised revenues by increasing its general sales tax rate from 5 percent to 6 percent. Because of the increase, the volume

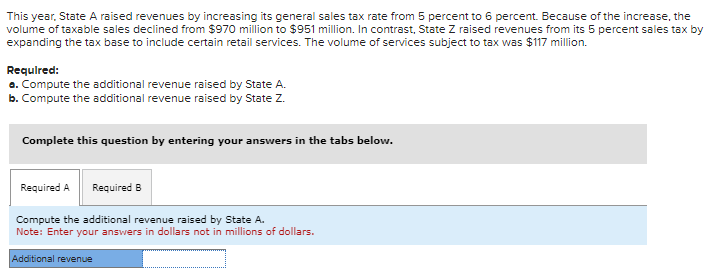

This year. State A raised revenues by increasing its general sales tax rate from 5 percent to 6 percent. Because of the increase, the volume of taxable sales declined from $970 million to $951 million. In contrast, State Z raised revenues from its 5 percent sales tax by expanding the tax base to include certain retail services. The volume of services subject to tax was $117 million. Required: o. Compute the additional revenue raised by State A. b. Compute the additional revenue raised by State Z. Complete this question by entering your answers in the tabs below. Compute the additional revenue raised by State A. Note: Enter your answers in dollars not in millions of dollars. Complete this question by entering your answers in the tabs below. Compute the additional revenue raised by State Z. Note: Enter your answers in dollars not in millions of dollars

This year. State A raised revenues by increasing its general sales tax rate from 5 percent to 6 percent. Because of the increase, the volume of taxable sales declined from $970 million to $951 million. In contrast, State Z raised revenues from its 5 percent sales tax by expanding the tax base to include certain retail services. The volume of services subject to tax was $117 million. Required: o. Compute the additional revenue raised by State A. b. Compute the additional revenue raised by State Z. Complete this question by entering your answers in the tabs below. Compute the additional revenue raised by State A. Note: Enter your answers in dollars not in millions of dollars. Complete this question by entering your answers in the tabs below. Compute the additional revenue raised by State Z. Note: Enter your answers in dollars not in millions of dollars Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started