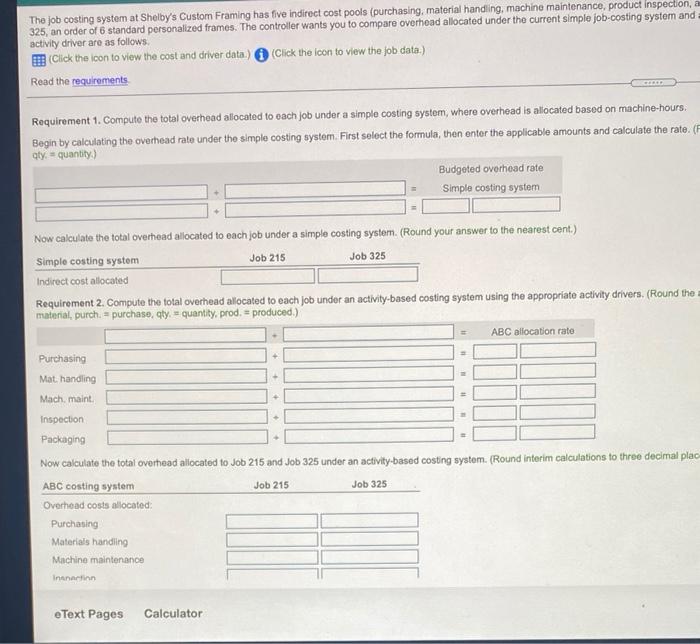

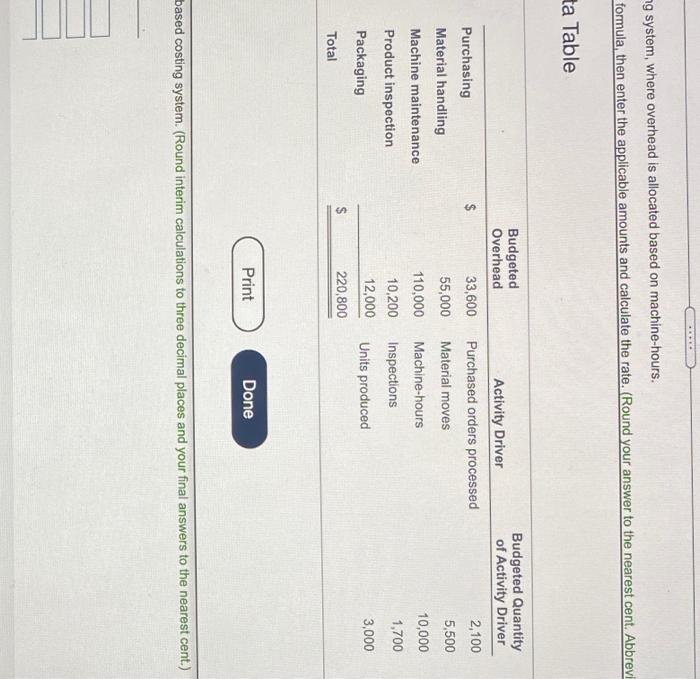

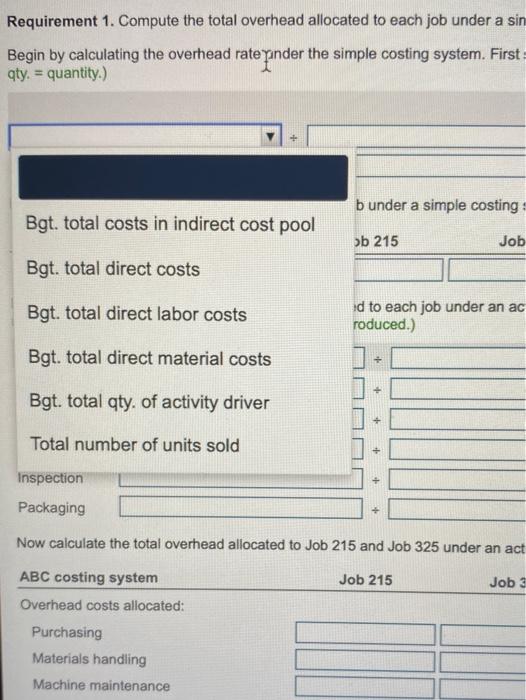

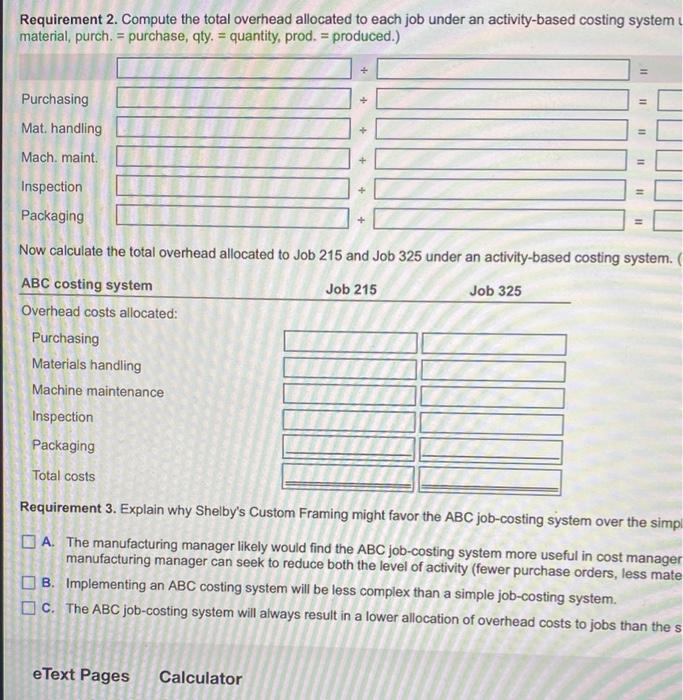

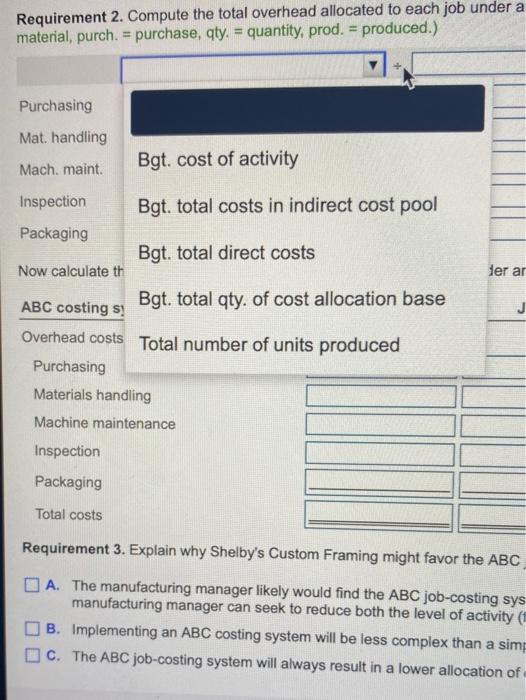

Tho job costing system at Shelby's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product Inspection, a 325, an order of 6 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and activity driver are as follows Click the icon to view the cost and driver data.) (Click the icon to view the job data) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours. Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate the rate. (F aty - quantity) Budgeted overhead rate Simple costing system Now calculate the total overhead allocated to each job under a simple costing system. (Round your answer to the nearest cent.) Simple costing system Job 215 Job 325 Indirect cost allocated Requirement 2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers, (Round the material, purch. = purchase, aty - quantity, prod. = produced.) ABC allocation rate Purchasing - Mat, handling - Mach, maint - Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an activity-based costing system. (Round interim calculations to three decimal plac ABC costing system Job 215 Job 325 Overhead costs allocated Purchasing Materials handling Machine maintenance Inanalinn eText Pages Calculator ng system, where overhead is allocated based on machine-hours. formula, then enter the applicable amounts and calculate the rate. (Round your answer to the nearest cent. Abbrevi ta Table Budgeted Overhead $ 33,600 Purchasing Material handling Machine maintenance Product inspection Packaging 55,000 Budgeted Quantity of Activity Driver 2,100 5,500 10,000 1,700 Activity Driver Purchased orders processed Material moves Machine-hours Inspections 110,000 10,200 12,000 Units produced 3,000 $ 220,800 Total Print Done based costing system. (Round interim calculations to three decimal places and your final answers to the nearest cent.) Requirement 1. Compute the total overhead allocated to each job under a sin Begin by calculating the overhead rate pinder the simple costing system. First: qty = quantity.) b under a simple costing Bgt. total costs in indirect cost pool ob 215 Job Bgt. total direct costs Bgt. total direct labor costs id to each job under an ac roduced.) Bgt. total direct material costs + + Bgt. total qty of activity driver + Total number of units sold Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an act Job 215 Job 3 ABC costing system Overhead costs allocated: Purchasing Materials handling Machine maintenance Requirement 2. Compute the total overhead allocated to each job under an activity-based costing system material, purch. = purchase, qty. = quantity, prod. = produced.) 11 11 11 11 11 Purchasing Mat handling Mach. maint Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an activity-based costing system.( ABC costing system Job 215 Job 325 Overhead costs allocated: Purchasing Materials handling Machine maintenance Inspection Packaging Total costs Requirement 3. Explain why Shelby's Custom Framing might favor the ABC job-costing system over the simp A. The manufacturing manager likely would find the ABC job-costing system more useful in cost manager manufacturing manager can seek to reduce both the level of activity (fewer purchase orders, less mate B. Implementing an ABC costing system will be less complex than a simple job-costing system. C. The ABC job-costing system will always result in a lower allocation of overhead costs to jobs than the s e Text Pages Calculator Requirement 2. Compute the total overhead allocated to each job under a material, purch. = purchase, qty = quantity, prod. = produced.) Purchasing Mat. handling Bgt. cost of activity Mach, maint. der ar Inspection Bgt. total costs in indirect cost pool Packaging Bgt. total direct costs Now calculate th ABC costing s Bgt. total qty. of cost allocation base Overhead costs Total number of units produced Purchasing Materials handling Machine maintenance Inspection Packaging Total costs Requirement 3. Explain why Shelby's Custom Framing might favor the ABC A. The manufacturing manager likely would find the ABC job-costing sys manufacturing manager can seek to reduce both the level of activity ( B. Implementing an ABC costing system will be less complex than a simp C. The ABC job-costing system will always result in a lower allocation of Tho job costing system at Shelby's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product Inspection, a 325, an order of 6 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and activity driver are as follows Click the icon to view the cost and driver data.) (Click the icon to view the job data) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours. Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate the rate. (F aty - quantity) Budgeted overhead rate Simple costing system Now calculate the total overhead allocated to each job under a simple costing system. (Round your answer to the nearest cent.) Simple costing system Job 215 Job 325 Indirect cost allocated Requirement 2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers, (Round the material, purch. = purchase, aty - quantity, prod. = produced.) ABC allocation rate Purchasing - Mat, handling - Mach, maint - Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an activity-based costing system. (Round interim calculations to three decimal plac ABC costing system Job 215 Job 325 Overhead costs allocated Purchasing Materials handling Machine maintenance Inanalinn eText Pages Calculator ng system, where overhead is allocated based on machine-hours. formula, then enter the applicable amounts and calculate the rate. (Round your answer to the nearest cent. Abbrevi ta Table Budgeted Overhead $ 33,600 Purchasing Material handling Machine maintenance Product inspection Packaging 55,000 Budgeted Quantity of Activity Driver 2,100 5,500 10,000 1,700 Activity Driver Purchased orders processed Material moves Machine-hours Inspections 110,000 10,200 12,000 Units produced 3,000 $ 220,800 Total Print Done based costing system. (Round interim calculations to three decimal places and your final answers to the nearest cent.) Requirement 1. Compute the total overhead allocated to each job under a sin Begin by calculating the overhead rate pinder the simple costing system. First: qty = quantity.) b under a simple costing Bgt. total costs in indirect cost pool ob 215 Job Bgt. total direct costs Bgt. total direct labor costs id to each job under an ac roduced.) Bgt. total direct material costs + + Bgt. total qty of activity driver + Total number of units sold Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an act Job 215 Job 3 ABC costing system Overhead costs allocated: Purchasing Materials handling Machine maintenance Requirement 2. Compute the total overhead allocated to each job under an activity-based costing system material, purch. = purchase, qty. = quantity, prod. = produced.) 11 11 11 11 11 Purchasing Mat handling Mach. maint Inspection Packaging Now calculate the total overhead allocated to Job 215 and Job 325 under an activity-based costing system.( ABC costing system Job 215 Job 325 Overhead costs allocated: Purchasing Materials handling Machine maintenance Inspection Packaging Total costs Requirement 3. Explain why Shelby's Custom Framing might favor the ABC job-costing system over the simp A. The manufacturing manager likely would find the ABC job-costing system more useful in cost manager manufacturing manager can seek to reduce both the level of activity (fewer purchase orders, less mate B. Implementing an ABC costing system will be less complex than a simple job-costing system. C. The ABC job-costing system will always result in a lower allocation of overhead costs to jobs than the s e Text Pages Calculator Requirement 2. Compute the total overhead allocated to each job under a material, purch. = purchase, qty = quantity, prod. = produced.) Purchasing Mat. handling Bgt. cost of activity Mach, maint. der ar Inspection Bgt. total costs in indirect cost pool Packaging Bgt. total direct costs Now calculate th ABC costing s Bgt. total qty. of cost allocation base Overhead costs Total number of units produced Purchasing Materials handling Machine maintenance Inspection Packaging Total costs Requirement 3. Explain why Shelby's Custom Framing might favor the ABC A. The manufacturing manager likely would find the ABC job-costing sys manufacturing manager can seek to reduce both the level of activity ( B. Implementing an ABC costing system will be less complex than a simp C. The ABC job-costing system will always result in a lower allocation of