Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thomas Drake is a small business owner, operating a manufacturing plant in Chicago, Illinois (as an S- Corp.) He has heard about a new

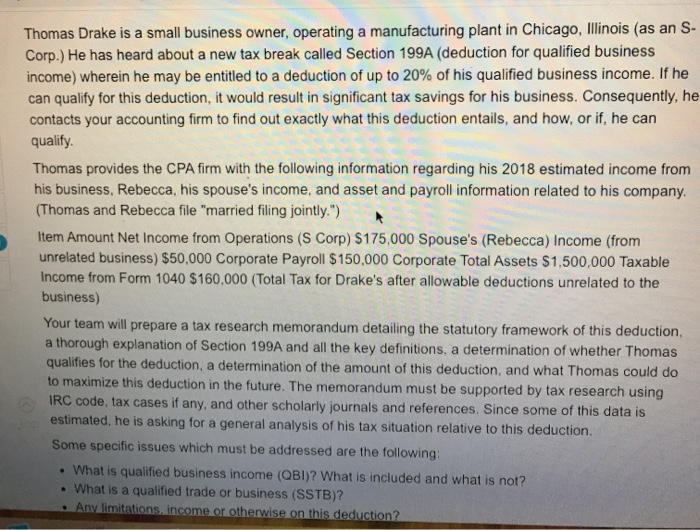

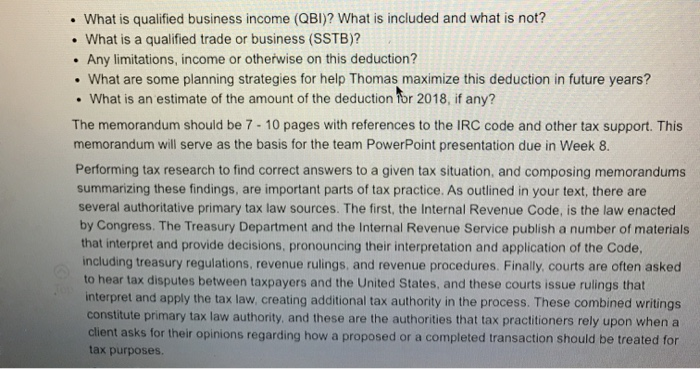

Thomas Drake is a small business owner, operating a manufacturing plant in Chicago, Illinois (as an S- Corp.) He has heard about a new tax break called Section 199A (deduction for qualified business income) wherein he may be entitled to a deduction of up to 20% of his qualified business income. If he can qualify for this deduction, it would result in significant tax savings for his business. Consequently, he contacts your accounting firm to find out exactly what this deduction entails, and how, or if, he can qualify. Thomas provides the CPA firm with the following information regarding his 2018 estimated income from his business, Rebecca, his spouse's income, and asset and payroll information related to his company. (Thomas and Rebecca file "married filing jointly.") Item Amount Net Income from Operations (S Corp) $175,000 Spouse's (Rebecca) Income (from unrelated business) $50,000 Corporate Payroll $150,000 Corporate Total Assets $1,500,000 Taxable Income from Form 1040 $160,000 (Total Tax for Drake's after allowable deductions unrelated to the business) Your team will prepare a tax research memorandum detailing the statutory framework of this deduction, a thorough explanation of Section 199A and all the key definitions, a determination of whether Thomas qualifies for the deduction, a determination of the amount of this deduction, and what Thomas could do to maximize this deduction in the future. The memorandum must be supported by tax research using IRC code, tax cases if any, and other scholarly journals and references. Since some of this data is estimated, he is asking for a general analysis of his tax situation relative to this deduction. Some specific issues which must be addressed are the following: What is qualified business income (QBI)? What is included and what is not? . What is a qualified trade or business (SSTB)? Any limitations, income or otherwise on this deduction? . What is qualified business income (QBI)? What is included and what is not? What is a qualified trade or business (SSTB)? Any limitations, income or otherwise on this deduction? . What are some planning strategies for help Thomas maximize this deduction in future years? What is an estimate of the amount of the deduction for 2018, if any? The memorandum should be 7 - 10 pages with references to the IRC code and other tax support. This memorandum will serve as the basis for the team PowerPoint presentation due in Week 8. Performing tax research to find correct answers to a given tax situation, and composing memorandums summarizing these findings, are important parts of tax practice. As outlined in your text, there are several authoritative primary tax law sources. The first, the Internal Revenue Code, is the law enacted by Congress. The Treasury Department and the Internal Revenue Service publish a number of materials that interpret and provide decisions, pronouncing their interpretation and application of the Code, including treasury regulations, revenue rulings, and revenue procedures. Finally, courts are often asked to hear tax disputes between taxpayers and the United States, and these courts issue rulings that interpret and apply the tax law, creating additional tax authority in the process. These combined writings constitute primary tax law authority, and these are the authorities that tax practitioners rely upon when a client asks for their opinions regarding how a proposed or a completed transaction should be treated for tax purposes.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Qualified Business Income It basically refers to the net amount of all qualified incomes including gains incomes deductions and losses from any qualif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started