Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thomas Equipment Co. (TEC) manufactures equipment with a new process that allows it to achieve a high standard of quality; so in the past

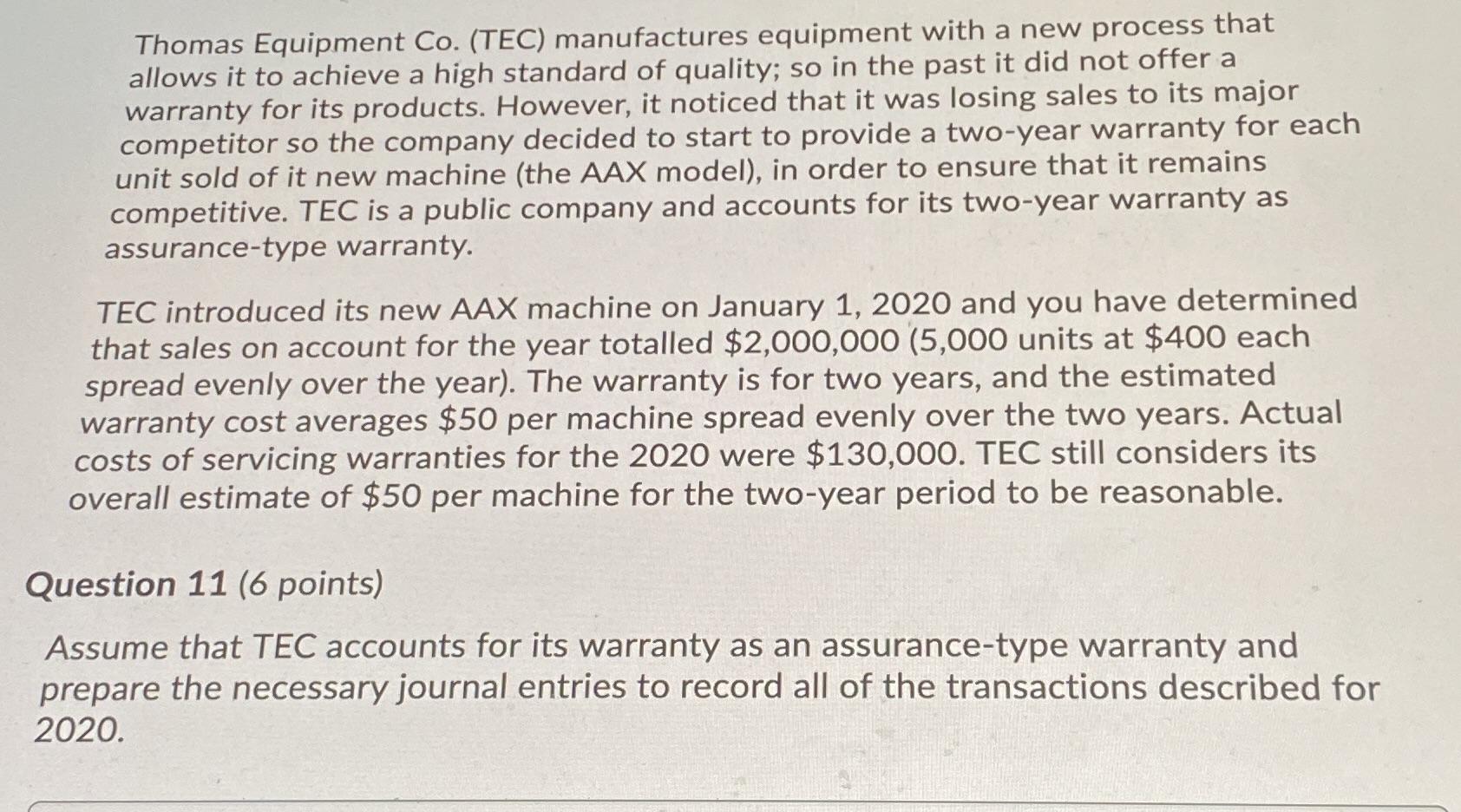

Thomas Equipment Co. (TEC) manufactures equipment with a new process that allows it to achieve a high standard of quality; so in the past it did not offer a warranty for its products. However, it noticed that it was losing sales to its major competitor so the company decided to start to provide a two-year warranty for each unit sold of it new machine (the AAX model), in order to ensure that it remains competitive. TEC is a public company and accounts for its two-year warranty as assurance-type warranty. TEC introduced its new AAX machine on January 1, 2020 and you have determined that sales on account for the year totalled $2,000,000 (5,000 units at $400 each spread evenly over the year). The warranty is for two years, and the estimated warranty cost averages $50 per machine spread evenly over the two years. Actual costs of servicing warranties for the 2020 were $130,000. TEC still considers its overall estimate of $50 per machine for the two-year period to be reasonable. Question 11 (6 points) Assume that TEC accounts for its warranty as an assurance-type warranty and prepare the necessary journal entries to record all of the transactions described for 2020.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To record the transactions for 2020 TEC would need to make the following journal entries 1To record ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started