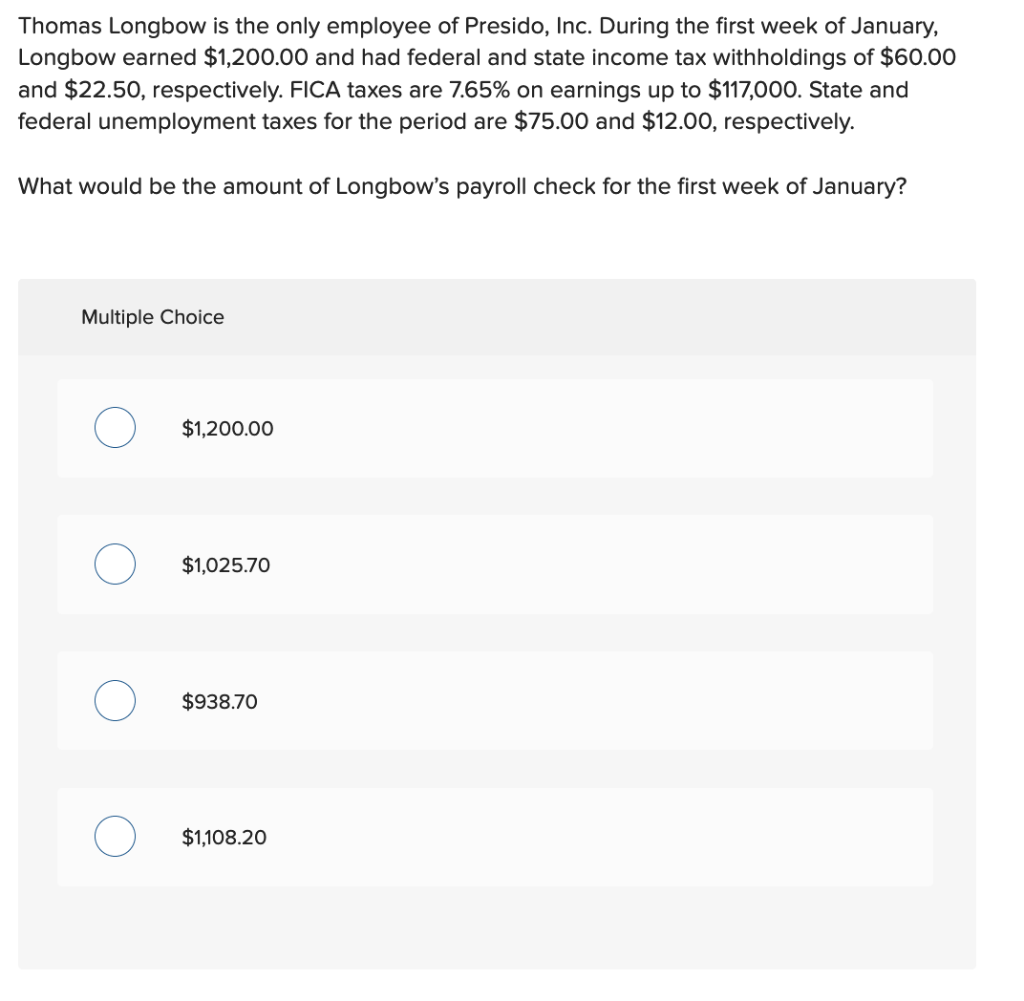

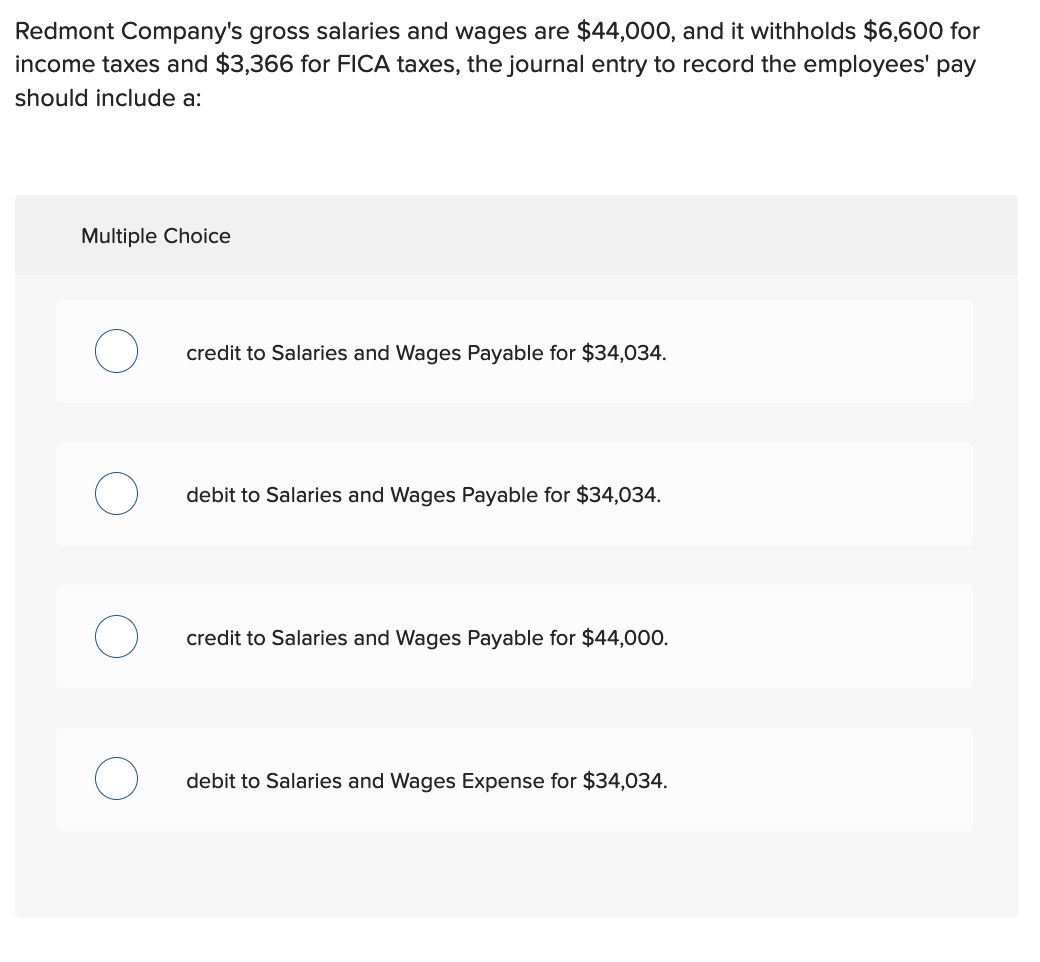

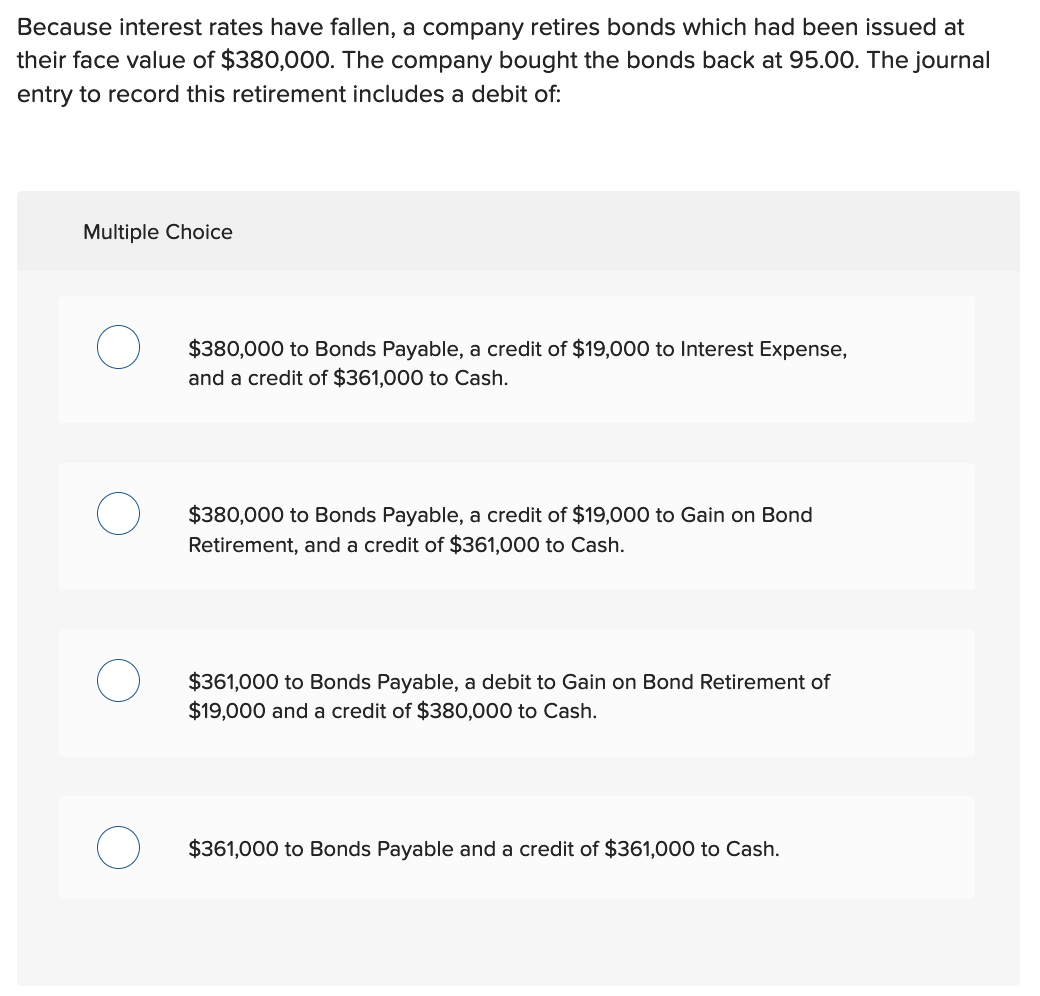

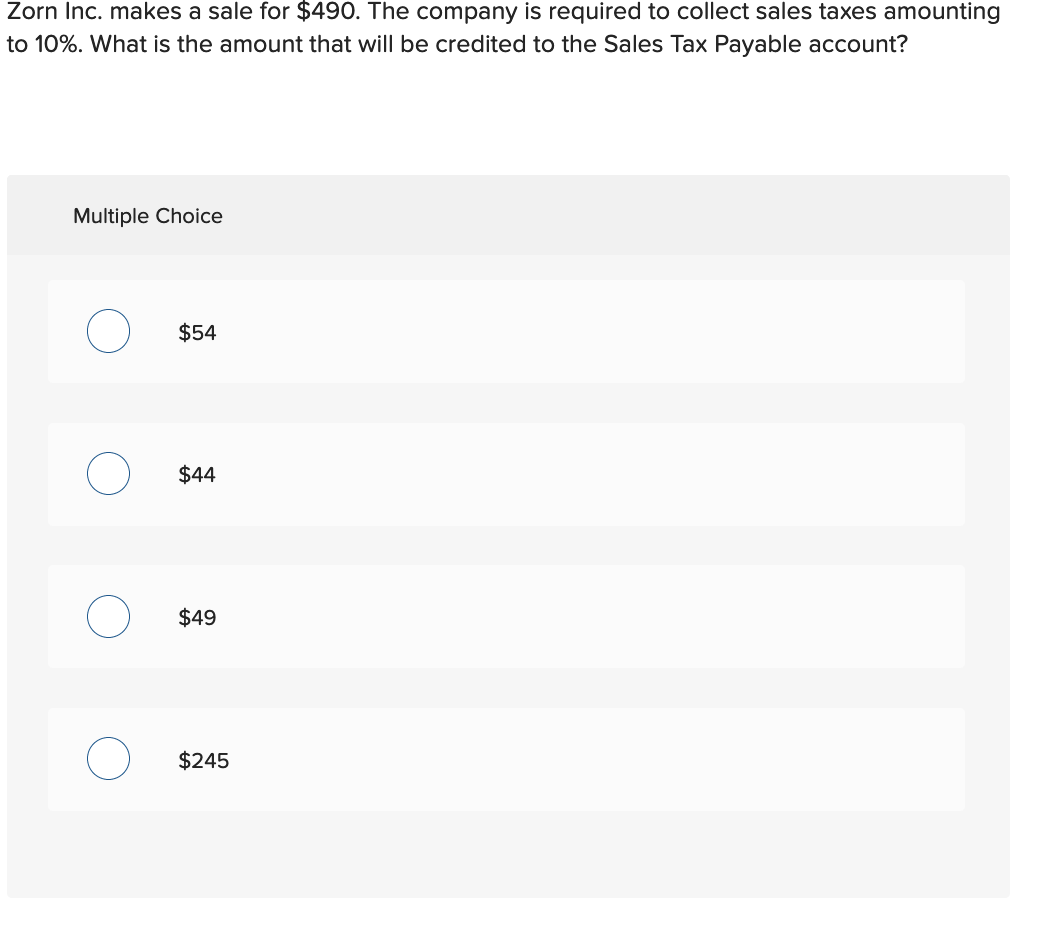

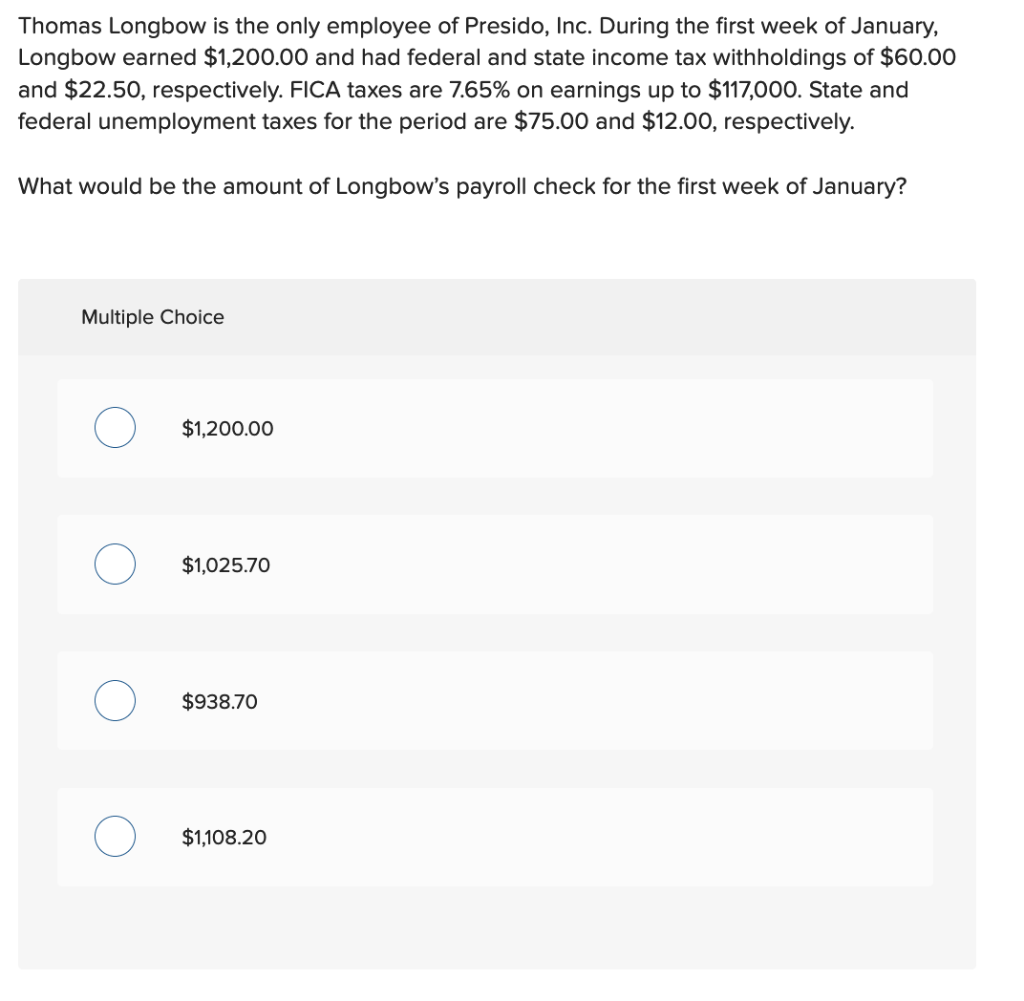

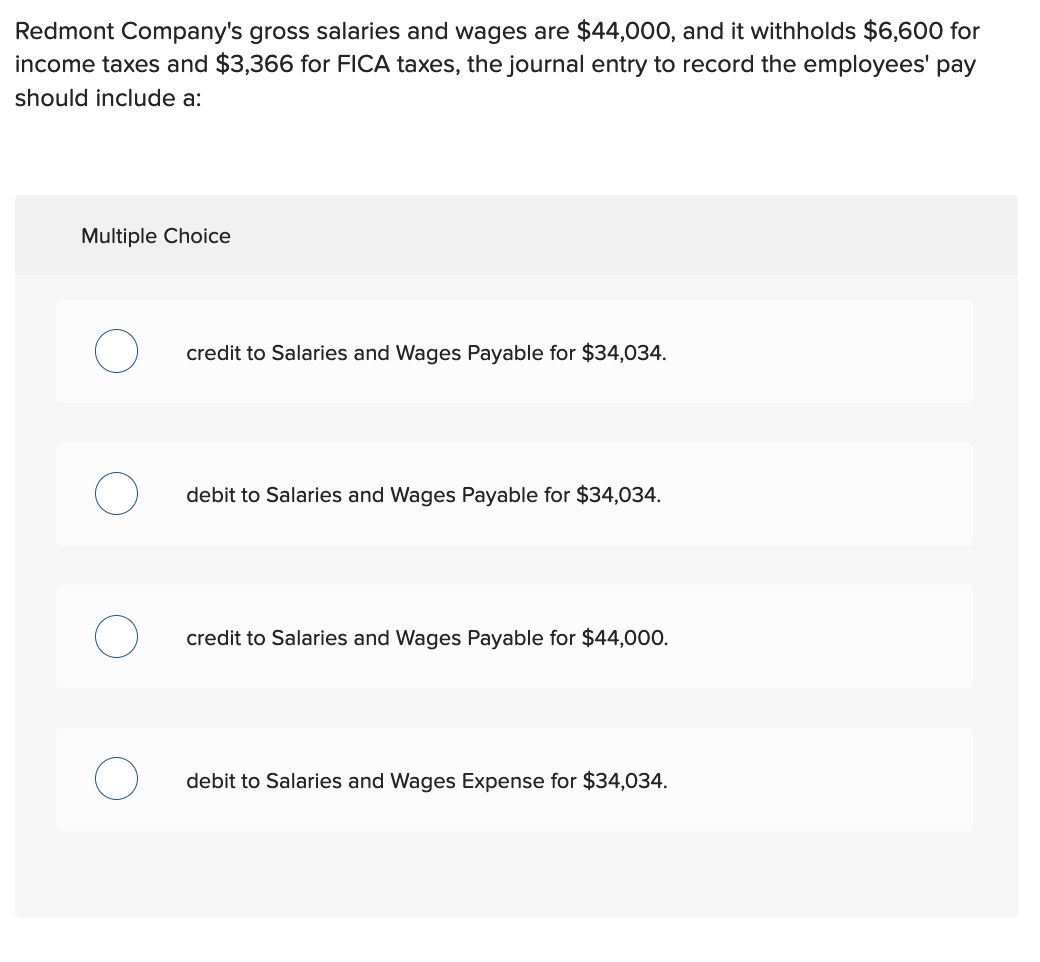

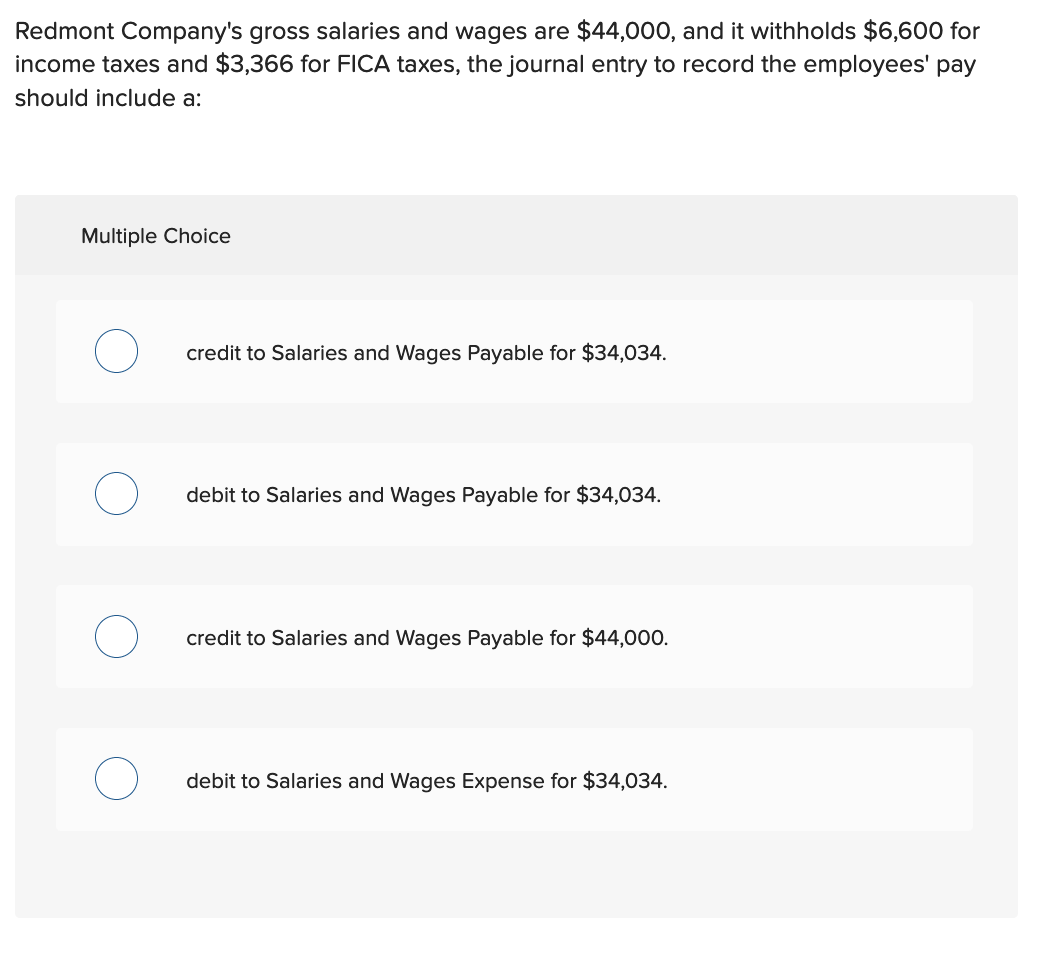

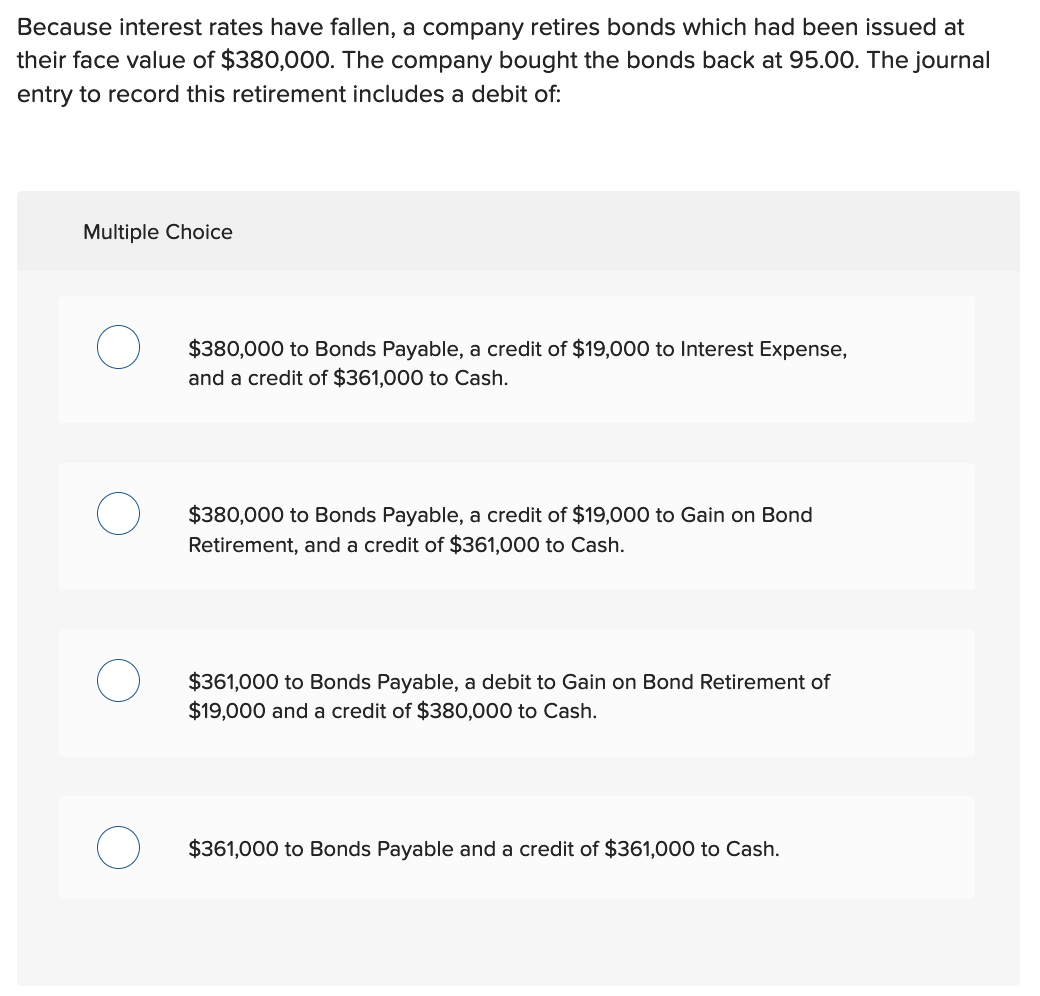

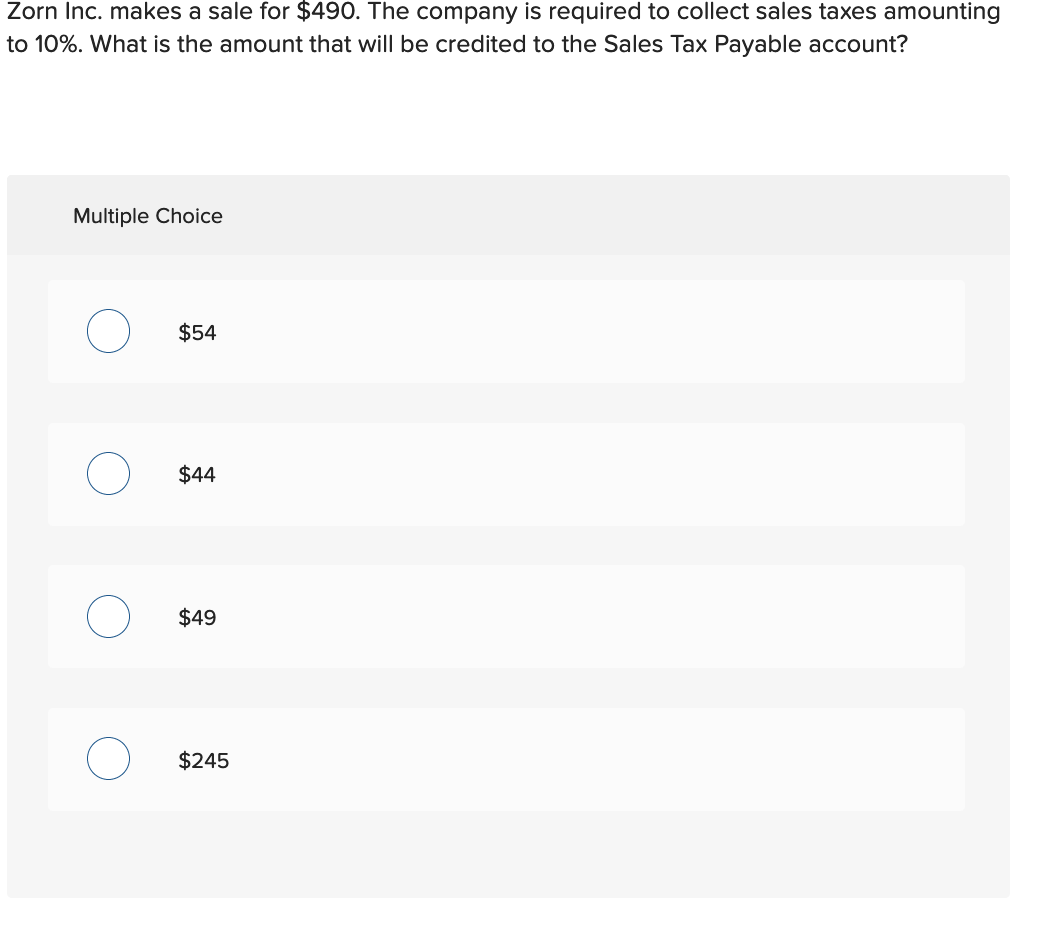

Thomas Longbow is the only employee of Presido, Inc. During the first week of January, Longbow earned $1,200.00 and had federal and state income tax withholdings of $60.00 and $22.50, respectively. FICA taxes are 7.65% on earnings up to $117,000. State and federal unemployment taxes for the period are $75.00 and $12.00, respectively. What would be the amount of Longbow's payroll check for the first week of January? Multiple Choice 0 $1,200.00 $1,200.00 0 $1,025.70 0 $938.70 0 $1,108.20 Redmont Company's gross salaries and wages are $44,000, and it withholds $6,600 for income taxes and $3,366 for FICA taxes, the journal entry to record the employees' pay should include a: Multiple Choice credit to Salaries and Wages Payable for $34,034. debit to Salaries and Wages Payable for $34,034. credit to Salaries and Wages Payable for $44,000. debit to Salaries and Wages Expense for $34,034. Redmont Company's gross salaries and wages are $44,000, and it withholds $6,600 for income taxes and $3,366 for FICA taxes, the journal entry to record the employees' pay should include a: Multiple Choice credit to Salaries and Wages Payable for $34,034. debit to Salaries and Wages Payable for $34,034. credit to Salaries and Wages Payable for $44,000. debit to Salaries and Wages Expense for $34,034. Because interest rates have fallen, a company retires bonds which had been issued at their face value of $380,000. The company bought the bonds back at 95.00. The journal entry to record this retirement includes a debit of: Multiple Choice $380,000 to Bonds Payable, a credit of $19,000 to Interest Expense, and a credit of $361,000 to Cash. $380,000 to Bonds Payable, a credit of $19,000 to Gain on Bond Retirement, and a credit of $361,000 to Cash. $361,000 to Bonds Payable, a debit to Gain on Bond Retirement of $19,000 and a credit of $380,000 to Cash. $361,000 to Bonds Payable and a credit of $361,000 to Cash. Zorn Inc. makes a sale for $490. The company is required to collect sales taxes amounting to 10%. What is the amount that will be credited to the Sales Tax Payable account? Multiple Choice $54 $44 $49 $245