Thomas Plc generated $50 million in net income during the year on book equity of $300 million. The reported net income includes the 4% interest it earned on its cash balance of $100m.The company also reported $30 million of depreciation and $40 million of capital expenditures. Its non-cash working capital increased by $10 million, and debt increased by $10 million to $310 million. The cash balance at the end of the year was $115 million. If the cost of equity is 10%, and the tax rate is 25%, estimate a. Equity reinvestment rate.

b. Expected growth in net income for the company.

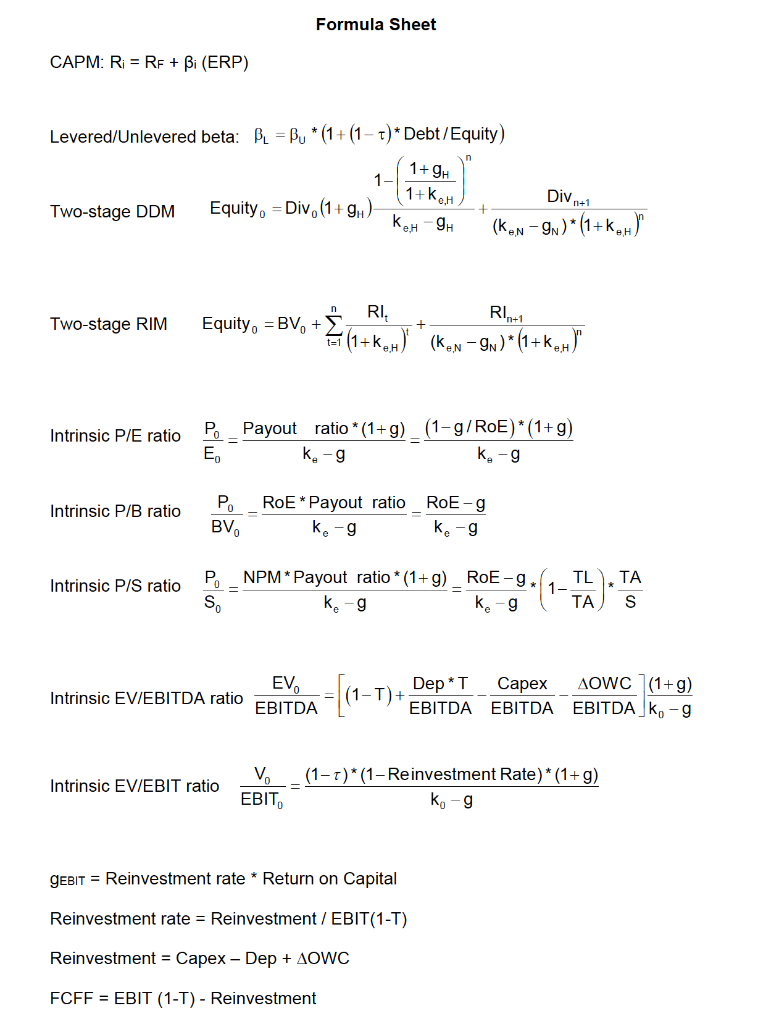

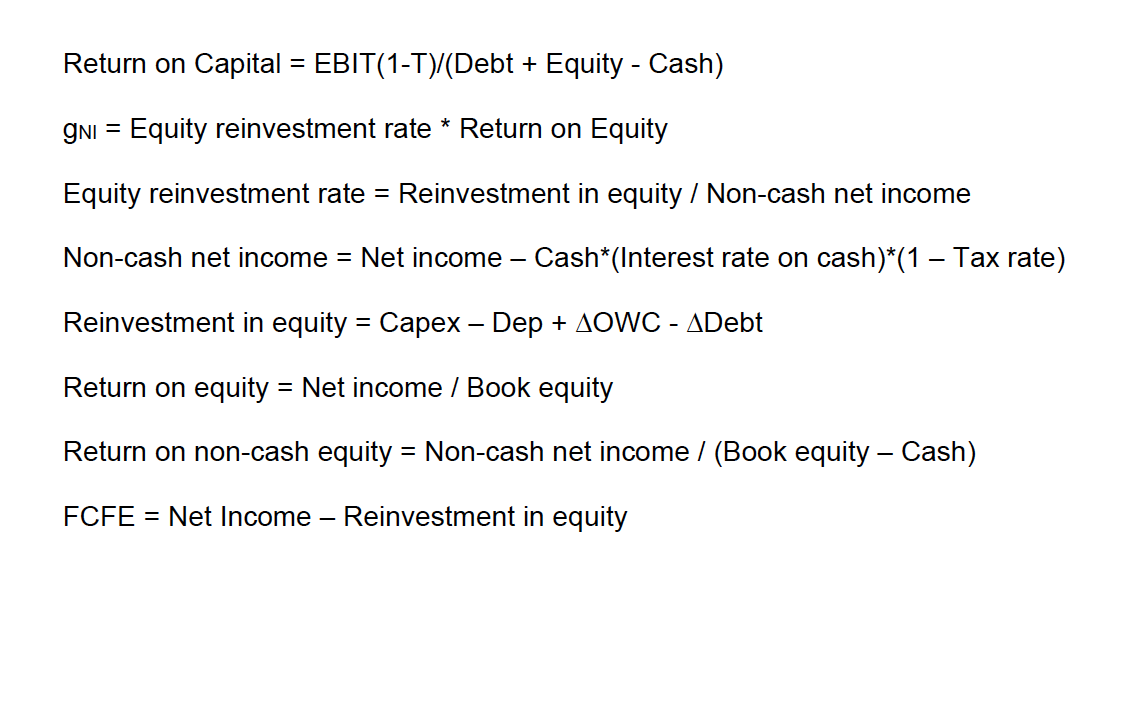

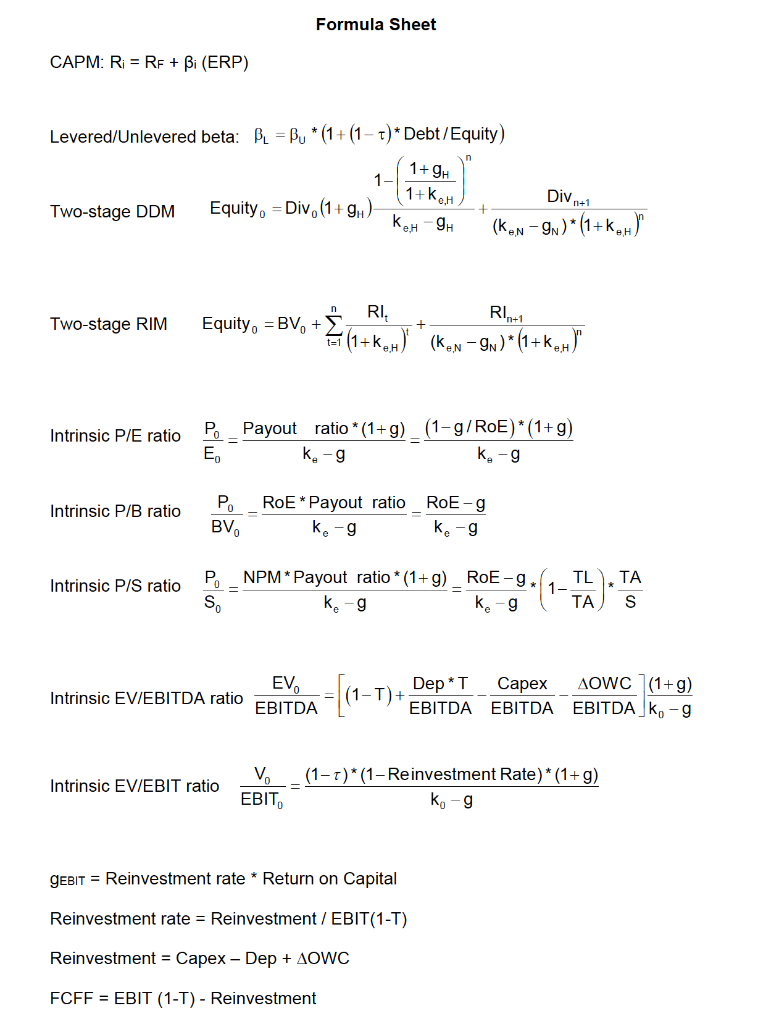

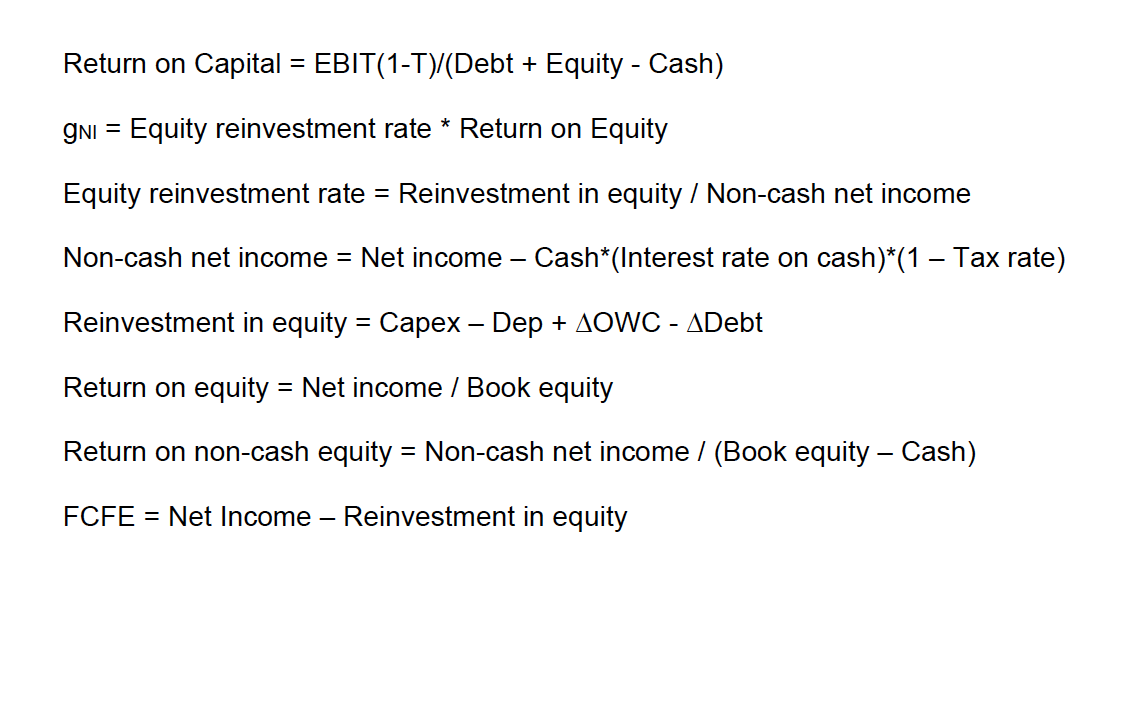

Formula Sheet CAPM: Ri = RF + Bi (ERP) Levered/Unlevered beta: BL = Bu * (1+ (1 - 1)* Debt/Equity) 1+9H 1- Div n+1 Two-stage DDM Equity. - Div. (1+gw) 1+keH keH - 9H (kon - 9n)*(1+kt) Two-stage RIM + Equity, =BV, + RIG RI = (1+key)" (kon -9N)*(1+keH)" Intrinsic P/E ratio PO E Payout ratio *(1+g) (1-g/RoE)*(1+g) k-g k-g Intrinsic P/B ratio P BV RoE * Payout ratio ke-g RoE-9 ke-g Intrinsic P/S ratio TL TA PO S. NPM* Payout ratio * (1+g)_ RoE-9. ke- ke-9 1- TA EV Intrinsic EV/EBITDA ratio =[ Dep *T Capex AOWC)(1+g) 1-T + EBITDA EBITDA EBITDA K-9 EBITDA Intrinsic EV/EBIT ratio V. EBIT, (1-T)*(1-Reinvestment Rate) * (1+g) ko-g GEBIT = Reinvestment rate * Return on Capital Reinvestment rate = Reinvestment / EBIT(1-T) Reinvestment = Capex - Dep + AOWC FCFF = EBIT (1-T) - Reinvestment Return on Capital = EBIT(1-T)/(Debt + Equity - Cash) gni = Equity reinvestment rate * Return on Equity Equity reinvestment rate = Reinvestment in equity / Non-cash net income Non-cash net income = Net income Cash*(Interest rate on cash)*(1 Tax rate) Reinvestment in equity = Capex Dep + AOWC - ADebt Return on equity = Net income / Book equity Return on non-cash equity = Non-cash net income / (Book equity Cash) FCFE = Net Income Reinvestment in equity Formula Sheet CAPM: Ri = RF + Bi (ERP) Levered/Unlevered beta: BL = Bu * (1+ (1 - 1)* Debt/Equity) 1+9H 1- Div n+1 Two-stage DDM Equity. - Div. (1+gw) 1+keH keH - 9H (kon - 9n)*(1+kt) Two-stage RIM + Equity, =BV, + RIG RI = (1+key)" (kon -9N)*(1+keH)" Intrinsic P/E ratio PO E Payout ratio *(1+g) (1-g/RoE)*(1+g) k-g k-g Intrinsic P/B ratio P BV RoE * Payout ratio ke-g RoE-9 ke-g Intrinsic P/S ratio TL TA PO S. NPM* Payout ratio * (1+g)_ RoE-9. ke- ke-9 1- TA EV Intrinsic EV/EBITDA ratio =[ Dep *T Capex AOWC)(1+g) 1-T + EBITDA EBITDA EBITDA K-9 EBITDA Intrinsic EV/EBIT ratio V. EBIT, (1-T)*(1-Reinvestment Rate) * (1+g) ko-g GEBIT = Reinvestment rate * Return on Capital Reinvestment rate = Reinvestment / EBIT(1-T) Reinvestment = Capex - Dep + AOWC FCFF = EBIT (1-T) - Reinvestment Return on Capital = EBIT(1-T)/(Debt + Equity - Cash) gni = Equity reinvestment rate * Return on Equity Equity reinvestment rate = Reinvestment in equity / Non-cash net income Non-cash net income = Net income Cash*(Interest rate on cash)*(1 Tax rate) Reinvestment in equity = Capex Dep + AOWC - ADebt Return on equity = Net income / Book equity Return on non-cash equity = Non-cash net income / (Book equity Cash) FCFE = Net Income Reinvestment in equity