Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thomas R. Mallory, age 42 is single and has no dependents. He is employed as a CPA by Acme Systems Company. Additionally, he owns

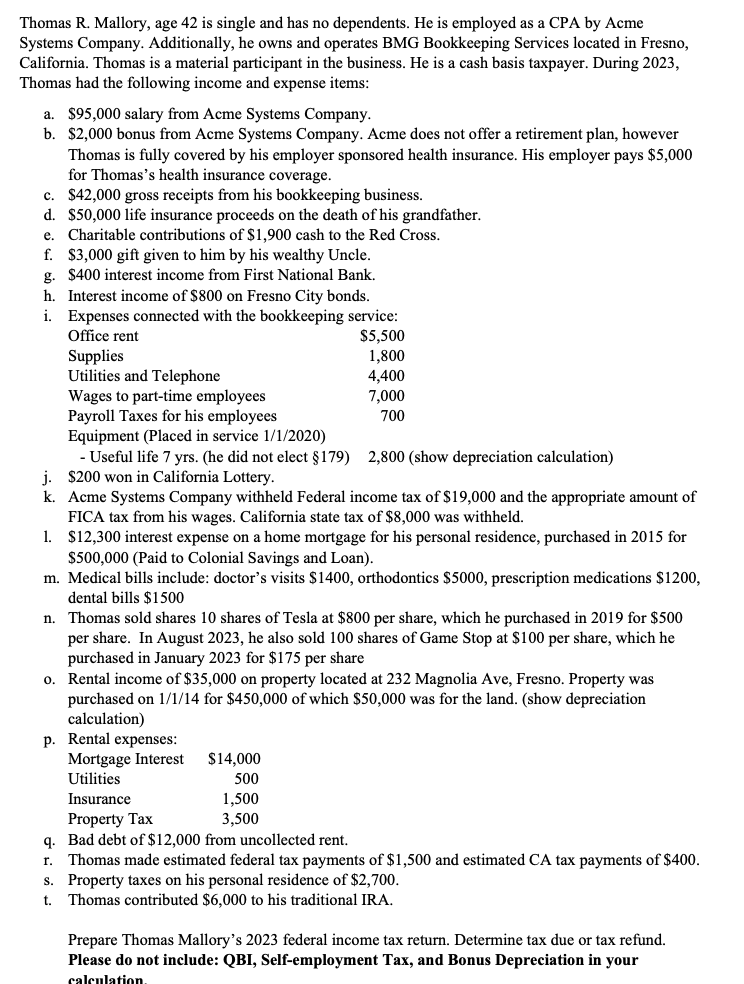

Thomas R. Mallory, age 42 is single and has no dependents. He is employed as a CPA by Acme Systems Company. Additionally, he owns and operates BMG Bookkeeping Services located in Fresno, California. Thomas is a material participant in the business. He is a cash basis taxpayer. During 2023, Thomas had the following income and expense items: a. $95,000 salary from Acme Systems Company. b. $2,000 bonus from Acme Systems Company. Acme does not offer a retirement plan, however Thomas is fully covered by his employer sponsored health insurance. His employer pays $5,000 for Thomas's health insurance coverage. c. $42,000 gross receipts from his bookkeeping business. d. $50,000 life insurance proceeds on the death of his grandfather. e. Charitable contributions of $1,900 cash to the Red Cross. f. $3,000 gift given to him by his wealthy Uncle. g. $400 interest income from First National Bank. h. Interest income of $800 on Fresno City bonds. i. Expenses connected with the bookkeeping service: Office rent Supplies Utilities and Telephone Wages to part-time employees Payroll Taxes for his employees Equipment (Placed in service 1/1/2020) $5,500 1,800 4,400 7,000 700 - Useful life 7 yrs. (he did not elect $179) 2,800 (show depreciation calculation) j. $200 won in California Lottery. k. Acme Systems Company withheld Federal income tax of $19,000 and the appropriate amount of FICA tax from his wages. California state tax of $8,000 was withheld. 1. $12,300 interest expense on a home mortgage for his personal residence, purchased in 2015 for $500,000 (Paid to Colonial Savings and Loan). m. Medical bills include: doctor's visits $1400, orthodontics $5000, prescription medications $1200, dental bills $1500 n. Thomas sold shares 10 shares of Tesla at $800 per share, which he purchased in 2019 for $500 per share. In August 2023, he also sold 100 shares of Game Stop at $100 per share, which he purchased in January 2023 for $175 per share o. Rental income of $35,000 on property located at 232 Magnolia Ave, Fresno. Property was purchased on 1/1/14 for $450,000 of which $50,000 was for the land. (show depreciation calculation) p. Rental expenses: Mortgage Interest Utilities Insurance Property Tax $14,000 500 1,500 3,500 q. Bad debt of $12,000 from uncollected rent. r. Thomas made estimated federal tax payments of $1,500 and estimated CA tax payments of $400. s. Property taxes on his personal residence of $2,700. t. Thomas contributed $6,000 to his traditional IRA. Prepare Thomas Mallory's 2023 federal income tax return. Determine tax due or tax refund. Please do not include: QBI, Self-employment Tax, and Bonus Depreciation in your calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Thomas R Mallory 2023 Federal Income Tax Return Filing Status Single Income Wages and Salary Acme Systems Company 95000 Bonus 2000 Note Not taxable du...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started