Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thomas who is a US investor, is contemplating investing some money in the UK, and is uncertain if the international Fisher effect (IFE) holds. Assume

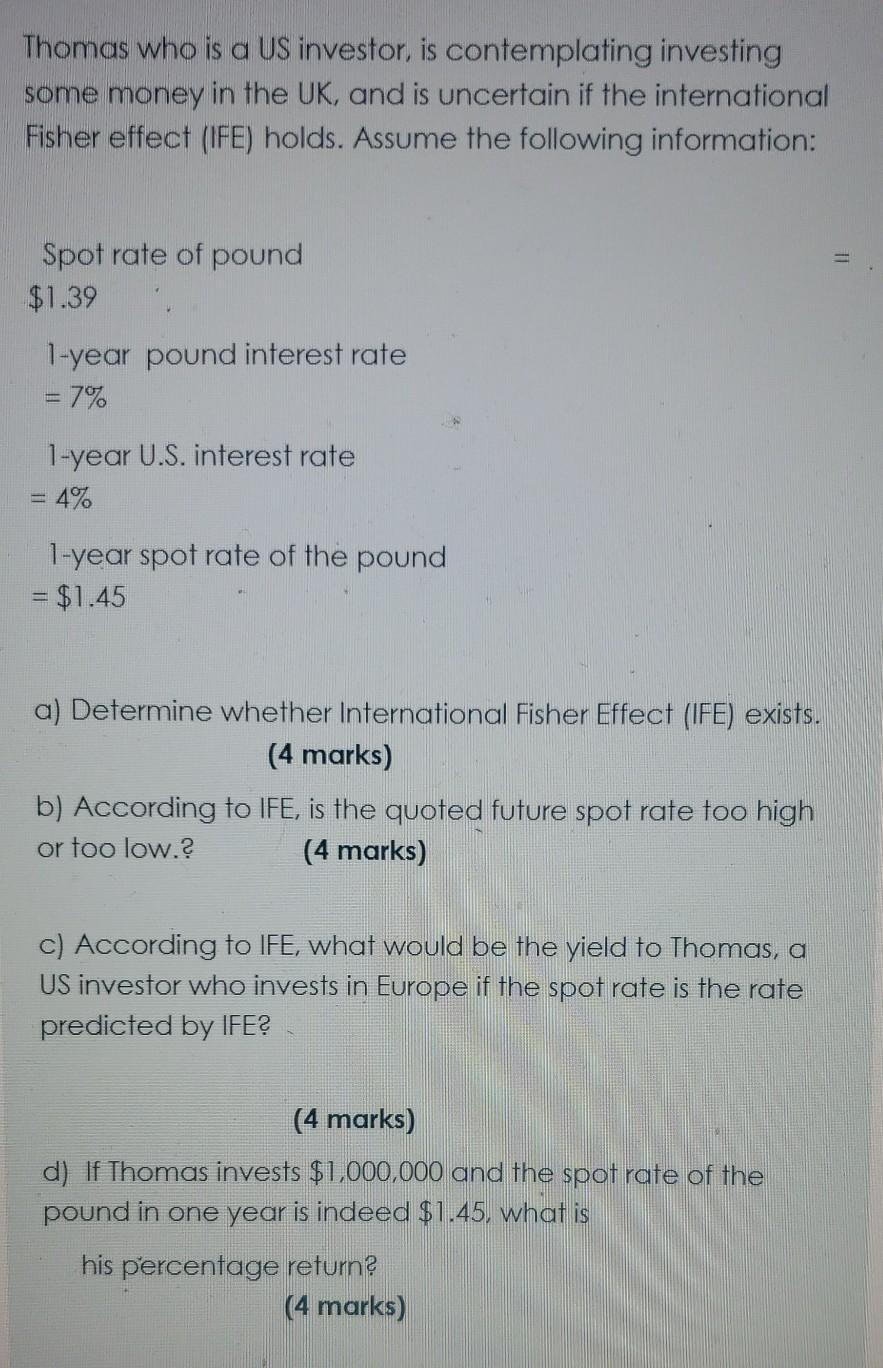

Thomas who is a US investor, is contemplating investing some money in the UK, and is uncertain if the international Fisher effect (IFE) holds. Assume the following information: Spot rate of pound $1.39 1-year pound interest rate = 7% 1-year U.S. interest rate = 4% 1-year spot rate of the pound = $1.45 a) Determine whether International Fisher Effect (IFE) exists. (4 marks) b) According to IFE, is the quoted future spot rate too high or too low.? (4 marks) c) According to IFE, what would be the yield to Thomas, a US investor who invests in Europe if the spot rate is the rate predicted by IFE? (4 marks) d) If Thomas invests $1,000,000 and the spot rate of the pound in one year is indeed $1.45, what is his percentage return? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started