Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thor Limited purchased a single plot of land on 1 January 2019 for R1 600 000 on credit and measures it using the revaluation

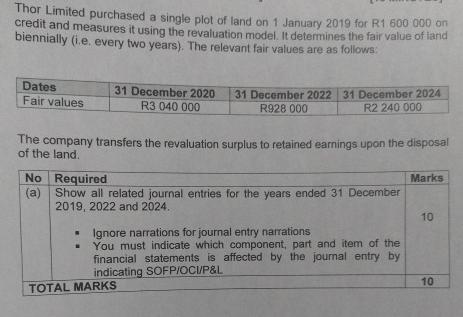

Thor Limited purchased a single plot of land on 1 January 2019 for R1 600 000 on credit and measures it using the revaluation model. It determines the fair value of land biennially (i.e. every two years). The relevant fair values are as follows: Dates Fair values 31 December 2020 R3 040 000 31 December 2022 31 December 2024 R928 000 R2 240 000 The company transfers the revaluation surplus to retained earnings upon the disposal of the land. No Required (a) Show all related journal entries for the years ended 31 December 2019, 2022 and 2024. Ignore narrations for journal entry narrations You must indicate which component, part and item of the financial statements is affected by the journal entry by indicating SOFP/OCI/P&L Marks 10 10 TOTAL MARKS

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

For the years ended 31 December 2019 2022 and 2024 the journal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started